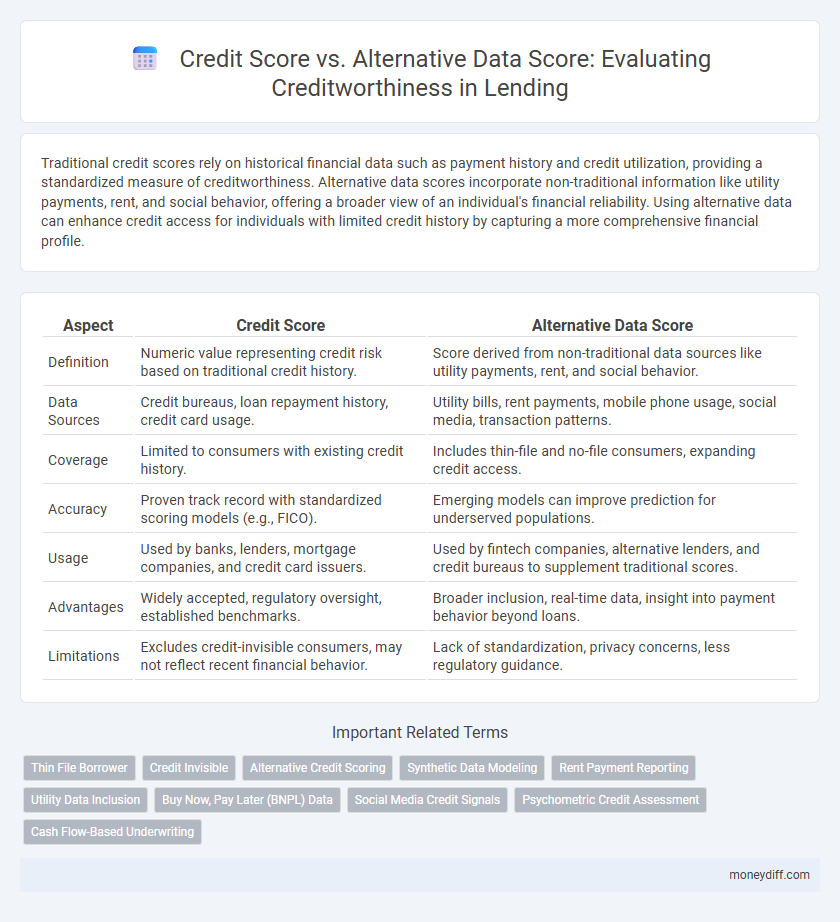

Traditional credit scores rely on historical financial data such as payment history and credit utilization, providing a standardized measure of creditworthiness. Alternative data scores incorporate non-traditional information like utility payments, rent, and social behavior, offering a broader view of an individual's financial reliability. Using alternative data can enhance credit access for individuals with limited credit history by capturing a more comprehensive financial profile.

Table of Comparison

| Aspect | Credit Score | Alternative Data Score |

|---|---|---|

| Definition | Numeric value representing credit risk based on traditional credit history. | Score derived from non-traditional data sources like utility payments, rent, and social behavior. |

| Data Sources | Credit bureaus, loan repayment history, credit card usage. | Utility bills, rent payments, mobile phone usage, social media, transaction patterns. |

| Coverage | Limited to consumers with existing credit history. | Includes thin-file and no-file consumers, expanding credit access. |

| Accuracy | Proven track record with standardized scoring models (e.g., FICO). | Emerging models can improve prediction for underserved populations. |

| Usage | Used by banks, lenders, mortgage companies, and credit card issuers. | Used by fintech companies, alternative lenders, and credit bureaus to supplement traditional scores. |

| Advantages | Widely accepted, regulatory oversight, established benchmarks. | Broader inclusion, real-time data, insight into payment behavior beyond loans. |

| Limitations | Excludes credit-invisible consumers, may not reflect recent financial behavior. | Lack of standardization, privacy concerns, less regulatory guidance. |

Credit Score vs Alternative Data Score: Understanding the Basics

Credit scores are traditional metrics derived from credit history, payment timeliness, and debt levels, widely used by lenders to assess creditworthiness. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and social behavior to provide a broader view of an individual's financial reliability. Understanding the differences between these scoring methods helps in evaluating credit risk more inclusively, especially for individuals with limited or no credit history.

Traditional Credit Scoring Models Explained

Traditional credit scoring models primarily rely on credit bureau data such as payment history, credit utilization, length of credit history, and types of credit accounts to calculate a credit score. These models use algorithms to analyze past borrowing behavior and predict future credit risk, commonly represented by scores like FICO or VantageScore. Limitations include exclusion of individuals with limited credit history, prompting the rise of alternative data scoring methods that incorporate non-traditional information for assessing creditworthiness.

What Is Alternative Data in Credit Assessment?

Alternative data in credit assessment refers to non-traditional information sources used to evaluate an individual's creditworthiness beyond conventional credit scores. This includes utility payments, rental history, phone bills, and social media activities, which provide a broader financial behavior picture for lenders. Incorporating alternative data improves credit access for consumers with thin or no credit files by supplementing traditional credit scoring models.

Key Differences Between Credit Scores and Alternative Data Scores

Credit scores primarily rely on traditional credit file information such as payment history, debt levels, and credit inquiries, whereas alternative data scores incorporate non-traditional data points like utility payments, rental history, and social behavior. Credit scores typically use standardized models like FICO or VantageScore, while alternative data scoring algorithms vary widely and aim to extend credit access to those with limited credit history. The key difference lies in data sources and inclusivity, with alternative data providing a broader view of creditworthiness beyond conventional financial records.

Advantages of Using Credit Scores for Lenders

Credit scores provide lenders with a standardized, easily accessible metric that efficiently predicts a borrower's likelihood to repay debt based on historical financial behavior. This traditional scoring method benefits from widespread acceptance, regulatory scrutiny, and extensive data ecosystems, enhancing risk assessment accuracy and consistency across diverse borrower profiles. By leveraging credit scores, lenders can streamline decision-making, reduce default rates, and improve portfolio performance through well-established risk models.

Benefits of Leveraging Alternative Data Scores

Leveraging alternative data scores enhances creditworthiness assessment by including non-traditional information such as utility payments, rental history, and social behavior, leading to a more comprehensive financial profile. This approach increases credit access for thin-file or no-credit consumers, reducing reliance on conventional credit scores that may overlook key financial behaviors. Incorporating alternative data also improves predictive accuracy and risk management for lenders, resulting in better-informed credit decisions and increased financial inclusion.

Limitations of Traditional Credit Scoring Methods

Traditional credit scoring methods primarily rely on historical credit data such as payment history, credit utilization, and length of credit accounts, which often excludes individuals with limited or no credit history. These models can overlook key financial behaviors including rent, utility payments, and employment stability that alternative data scoring incorporates to provide a more comprehensive assessment. Consequently, traditional credit scores may inaccurately represent the creditworthiness of thin-file or underserved consumers, limiting their access to credit opportunities.

How Alternative Data Scores Impact Financial Inclusion

Alternative data scores utilize non-traditional information such as utility payments, rental history, and mobile phone usage to assess creditworthiness, expanding access to credit for individuals lacking conventional credit history. This inclusive approach enables lenders to better evaluate risk for underserved populations, reducing reliance on traditional credit scores that may exclude significant portions of the population. Consequently, alternative data scoring enhances financial inclusion by providing more equitable credit opportunities and fostering economic empowerment.

Regulatory Considerations for Credit and Alternative Scoring

Regulatory considerations for credit score and alternative data score emphasize compliance with the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA) to prevent discrimination and ensure consumer transparency. Alternative scoring models must demonstrate accuracy, fairness, and privacy protection while avoiding adverse impact on protected classes under the Consumer Financial Protection Bureau (CFPB) guidelines. Regulators increasingly scrutinize data sources, requiring lenders to validate alternative data effectiveness and maintain detailed documentation to withstand audits and regulatory reviews.

The Future of Creditworthiness: Integrating Credit and Alternative Data

Creditworthiness evaluation is evolving through the integration of traditional credit scores and alternative data, such as utility payments, rental history, and social media behavior, offering a more comprehensive risk assessment. Leveraging machine learning algorithms on combined datasets enhances predictive accuracy and financial inclusion for underserved populations lacking extensive credit histories. This hybrid approach signals a future where credit decisions are more personalized, equitable, and reflective of an individual's real-time financial behavior.

Related Important Terms

Thin File Borrower

Thin file borrowers often face challenges with traditional credit scores due to limited credit history, making alternative data scores that incorporate utility payments, rental history, and other non-traditional financial behaviors essential for assessing creditworthiness. Utilizing alternative data enables lenders to more accurately evaluate risk and extend credit to individuals who might otherwise be excluded from mainstream financial services.

Credit Invisible

Credit scores traditionally rely on credit history, excluding millions classified as credit invisible who lack sufficient data for evaluation. Alternative data scores incorporate non-traditional information such as utility payments and rental history, improving creditworthiness assessment for these credit invisible individuals.

Alternative Credit Scoring

Alternative credit scoring leverages non-traditional data sources such as utility payments, rental history, and social media behavior to assess creditworthiness, providing a more inclusive evaluation for individuals with limited or no credit history. This approach enhances accuracy by incorporating behavioral patterns and real-time financial activities, often resulting in higher approval rates for underserved consumers compared to traditional credit scores.

Synthetic Data Modeling

Synthetic data modeling enhances creditworthiness analysis by generating realistic alternative data sets, improving credit scoring accuracy beyond traditional credit scores. This approach allows lenders to assess borrowers with limited credit history by integrating behavioral, transactional, and social data, resulting in a more inclusive and predictive credit evaluation.

Rent Payment Reporting

Rent payment reporting enhances creditworthiness assessment by incorporating consistent rental history into alternative data scores, providing a more comprehensive view than traditional credit scores alone. This method benefits individuals with thin credit files, increasing their chances of credit approval and favorable terms by reflecting timely rent payments.

Utility Data Inclusion

Credit scores traditionally rely on financial history and payment behavior, whereas alternative data scores incorporate utility data such as electricity, water, and phone bills, offering a more comprehensive view of creditworthiness. Including utility data enhances risk assessment accuracy, particularly benefiting individuals with limited or no conventional credit records.

Buy Now, Pay Later (BNPL) Data

Buy Now, Pay Later (BNPL) data enhances creditworthiness assessments by providing alternative indicators beyond traditional credit scores, capturing real-time payment behavior and consumer spending patterns. Integrating BNPL transactions into alternative data scores improves risk prediction accuracy and broadens credit access for individuals with limited credit history.

Social Media Credit Signals

Credit scores primarily rely on traditional financial data such as payment history and credit utilization, while alternative data scores incorporate unconventional sources including social media credit signals like online behavior, network connections, and sentiment analysis. Social media credit signals provide real-time insights into a borrower's lifestyle and reliability, enhancing creditworthiness assessments for individuals with limited credit history.

Psychometric Credit Assessment

Psychometric credit assessment enhances creditworthiness evaluation by analyzing behavioral traits and personality factors, offering deeper insights beyond traditional credit scores. Integrating alternative data scores with psychometric analysis improves accuracy in predicting credit risk, especially for individuals lacking extensive credit history.

Cash Flow-Based Underwriting

Cash flow-based underwriting leverages real-time payment data and income streams, providing a more dynamic assessment than traditional credit scores that rely on historical credit reports. Alternative data scores incorporate utility payments, rent history, and bank transactions to better predict creditworthiness for individuals with limited credit history.

Credit Score vs Alternative Data Score for creditworthiness. Infographic

moneydiff.com

moneydiff.com