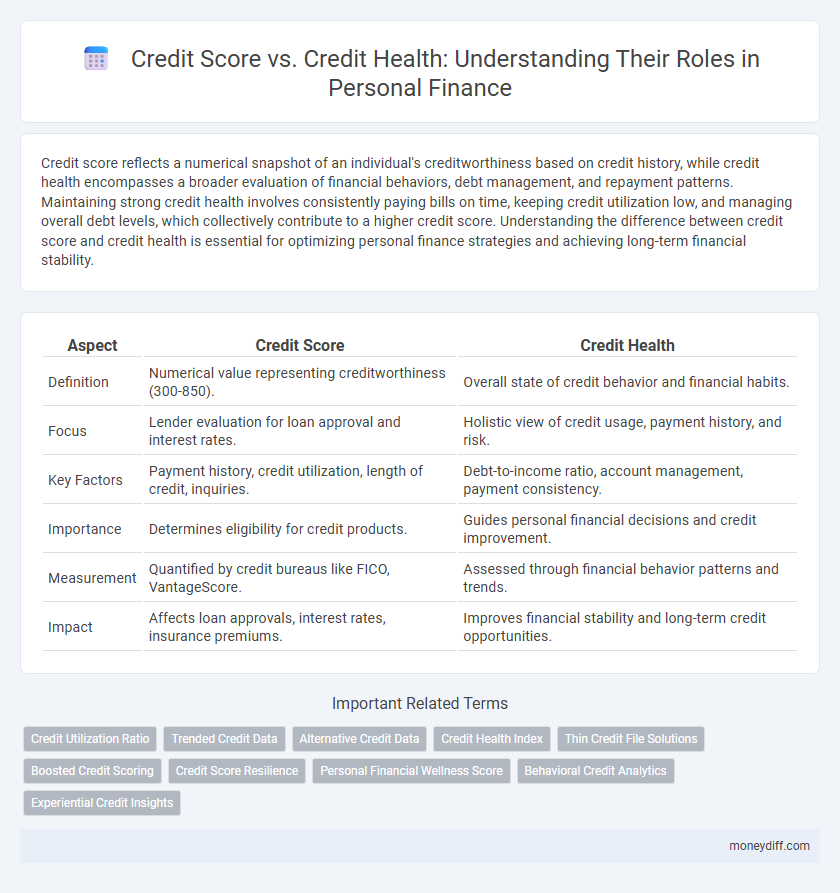

Credit score reflects a numerical snapshot of an individual's creditworthiness based on credit history, while credit health encompasses a broader evaluation of financial behaviors, debt management, and repayment patterns. Maintaining strong credit health involves consistently paying bills on time, keeping credit utilization low, and managing overall debt levels, which collectively contribute to a higher credit score. Understanding the difference between credit score and credit health is essential for optimizing personal finance strategies and achieving long-term financial stability.

Table of Comparison

| Aspect | Credit Score | Credit Health |

|---|---|---|

| Definition | Numerical value representing creditworthiness (300-850). | Overall state of credit behavior and financial habits. |

| Focus | Lender evaluation for loan approval and interest rates. | Holistic view of credit usage, payment history, and risk. |

| Key Factors | Payment history, credit utilization, length of credit, inquiries. | Debt-to-income ratio, account management, payment consistency. |

| Importance | Determines eligibility for credit products. | Guides personal financial decisions and credit improvement. |

| Measurement | Quantified by credit bureaus like FICO, VantageScore. | Assessed through financial behavior patterns and trends. |

| Impact | Affects loan approvals, interest rates, insurance premiums. | Improves financial stability and long-term credit opportunities. |

Understanding Credit Score and Credit Health

Understanding your credit score involves analyzing numerical ratings ranging from 300 to 850, which reflect your creditworthiness based on payment history, credit utilization, length of credit history, types of credit, and recent inquiries. Credit health extends beyond the score to include overall financial behavior, such as consistent on-time payments, maintaining low balances relative to credit limits, and managing debts responsibly to ensure sustainable financial stability. Monitoring both credit score and credit health provides a comprehensive view of personal finance, facilitating better loan terms and financial opportunities.

Key Differences Between Credit Score and Credit Health

Credit score is a numerical representation of an individual's creditworthiness based on credit history, payment patterns, and outstanding debt, typically ranging from 300 to 850. Credit health encompasses broader financial behavior, including credit utilization, payment punctuality, credit mix, and account age, reflecting long-term financial habits. Understanding these differences aids in managing personal finance by focusing on improving credit score milestones while maintaining overall credit health for sustainable financial stability.

Factors That Impact Your Credit Score

Payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries are primary factors impacting your credit score. Maintaining low credit card balances and timely payments positively influence credit health by demonstrating responsible credit management. Monitoring these elements regularly helps improve financial credibility and access to better loan terms.

Components of Credit Health Explained

Credit health encompasses multiple factors beyond the credit score, including payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. A strong payment history and low credit utilization demonstrate responsible credit management, directly influencing overall credit health. Monitoring these components regularly helps maintain a robust credit profile, improving creditworthiness and access to favorable lending terms.

Why Credit Health Matters Beyond Your Score

Credit health encompasses more than just a credit score by evaluating factors like payment history, debt levels, credit utilization, and financial habits, providing a comprehensive view of personal financial stability. Maintaining good credit health ensures long-term access to favorable loan terms, lower interest rates, and increased financial flexibility, which a single credit score number alone cannot guarantee. Lenders, renters, and insurers increasingly assess credit health to understand risk more accurately, highlighting its critical role in overall personal finance management.

Credit Score Myths and Realities

Many people mistakenly believe that a high credit score alone guarantees excellent credit health, but true credit health encompasses timely payments, low credit utilization, and a diverse credit mix. Contrary to popular myth, credit scores fluctuate based on multiple factors including recent credit inquiries and total debt levels, not solely on payment history. Understanding these realities helps individuals manage personal finance more effectively by focusing on overall credit behaviors rather than just a numeric score.

How to Monitor and Improve Credit Health

Regularly checking your credit report from major bureaus like Experian, Equifax, and TransUnion helps monitor your credit health by identifying errors and tracking account activity. Improving credit health involves timely bill payments, reducing credit card balances to below 30% of available credit, and limiting new credit inquiries. Using credit monitoring tools and maintaining a diverse mix of credit types can positively impact both your credit score and overall credit health.

The Role of Credit Score in Loan Approvals

Credit scores play a critical role in loan approvals by providing lenders with a quantifiable measure of an individual's creditworthiness based on credit history, payment punctuality, and debt levels. While credit health encompasses overall financial behavior, including credit utilization and account diversity, the credit score often serves as the primary factor influencing interest rates and borrowing limits. High credit scores typically increase approval chances and secure favorable loan terms, directly impacting personal finance management.

Building Strong Credit Health for Long-Term Financial Stability

Building strong credit health requires more than just maintaining a high credit score; it involves consistently managing debt, timely payments, and a balanced credit utilization ratio. Long-term financial stability is achieved by monitoring credit reports regularly to identify and correct errors, as well as diversifying credit types responsibly. Prioritizing credit health fosters better loan terms, higher credit limits, and overall financial resilience.

Credit Score vs Credit Health: Which Should You Prioritize?

Credit score is a numerical snapshot reflecting your creditworthiness based on payment history, debt levels, and credit inquiries, while credit health encompasses a broader view, including your debt management, credit utilization, and financial habits. Prioritizing credit health ensures sustainable financial stability by promoting responsible credit use and timely payments, which naturally improves your credit score over time. Focusing solely on credit score may lead to short-term gains, but maintaining overall credit health supports long-term personal finance goals.

Related Important Terms

Credit Utilization Ratio

Credit utilization ratio plays a crucial role in determining credit health, representing the percentage of available credit currently in use, with an ideal range below 30% to maintain a strong credit score. Monitoring and managing this ratio effectively helps improve credit health by lowering debt levels relative to credit limits, positively impacting personal finance stability.

Trended Credit Data

Trended credit data provides a dynamic view of credit health by tracking payment patterns and balances over time, offering deeper insights than a static credit score alone. This detailed credit behavior analysis helps lenders assess risk more accurately and allows consumers to improve their financial strategies effectively.

Alternative Credit Data

Alternative credit data enhances understanding of credit health by incorporating payment history for utilities, rent, and subscriptions, offering a more comprehensive view than traditional credit scores. This expanded data set improves accuracy in assessing personal finance risk and access to credit for individuals with thin or no credit files.

Credit Health Index

The Credit Health Index provides a comprehensive assessment of personal finance by evaluating factors beyond just the credit score, such as payment punctuality, credit utilization, and debt-to-income ratio. This holistic approach offers a more accurate reflection of an individual's overall creditworthiness and financial stability.

Thin Credit File Solutions

A thin credit file often results in a low credit score due to limited credit history, making Thin Credit File Solutions essential for building a stronger credit profile. These solutions, such as credit builder loans and authorized user tradelines, improve credit health by increasing account diversity and payment history, thereby enhancing personal finance opportunities.

Boosted Credit Scoring

Boosted credit scoring integrates advanced algorithms to analyze credit utilization, payment history, and debt-to-income ratios, offering a more accurate reflection of overall credit health beyond traditional credit scores. This approach enhances personal finance management by providing deeper insights into financial behaviors and enabling targeted strategies to improve creditworthiness and borrowing potential.

Credit Score Resilience

Credit score resilience measures how well your credit score withstands financial stress, reflecting consistent payment history, low credit utilization, and diverse credit types, which collectively support long-term credit health. Maintaining resilience enhances access to favorable loan terms and financial opportunities, distinguishing stable credit from transient credit score fluctuations.

Personal Financial Wellness Score

A Personal Financial Wellness Score evaluates comprehensive credit health by incorporating factors beyond the traditional credit score, such as debt management, savings habits, and payment consistency, providing a more holistic view of financial stability. This metric enables individuals to better understand their overall financial well-being and make informed decisions to improve long-term personal finance outcomes.

Behavioral Credit Analytics

Behavioral Credit Analytics evaluates credit health by analyzing patterns in payment behavior, credit utilization, and borrowing trends beyond the static credit score. This approach provides a dynamic and comprehensive view of an individual's financial responsibility, enabling more accurate risk assessment and personalized credit management strategies.

Experiential Credit Insights

Experiential credit insights reveal that credit health offers a broader assessment of personal finance by encompassing payment history, credit utilization, and debt management beyond just the credit score number. Monitoring credit health provides a dynamic view of financial behavior, enabling more effective strategies to improve long-term creditworthiness and access to favorable lending terms.

Credit score vs Credit health for personal finance. Infographic

moneydiff.com

moneydiff.com