Credit unions offer member-focused lending with lower interest rates and personalized service, making them ideal for individuals seeking affordable credit within a defined community. Community Development Financial Institutions (CDFIs) specialize in providing financial services to underserved markets, often supporting small businesses and low-income borrowers with flexible lending criteria and community-oriented programs. Both institutions promote financial inclusion, but CDFIs typically have a broader mission to stimulate economic development in distressed areas beyond standard credit union membership.

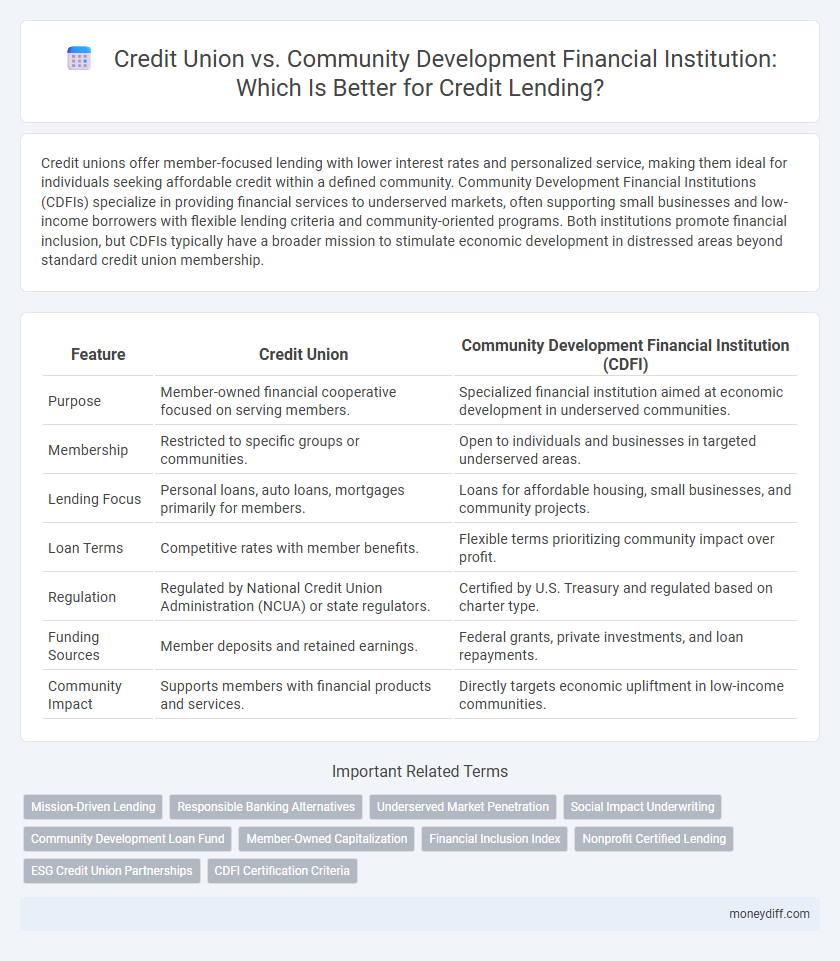

Table of Comparison

| Feature | Credit Union | Community Development Financial Institution (CDFI) |

|---|---|---|

| Purpose | Member-owned financial cooperative focused on serving members. | Specialized financial institution aimed at economic development in underserved communities. |

| Membership | Restricted to specific groups or communities. | Open to individuals and businesses in targeted underserved areas. |

| Lending Focus | Personal loans, auto loans, mortgages primarily for members. | Loans for affordable housing, small businesses, and community projects. |

| Loan Terms | Competitive rates with member benefits. | Flexible terms prioritizing community impact over profit. |

| Regulation | Regulated by National Credit Union Administration (NCUA) or state regulators. | Certified by U.S. Treasury and regulated based on charter type. |

| Funding Sources | Member deposits and retained earnings. | Federal grants, private investments, and loan repayments. |

| Community Impact | Supports members with financial products and services. | Directly targets economic upliftment in low-income communities. |

Understanding Credit Unions and CDFIs

Credit Unions are member-owned financial cooperatives offering affordable loans and personalized services, emphasizing community trust and shared financial goals. Community Development Financial Institutions (CDFIs) specialize in providing credit and financial services to underserved and low-income communities, often supported by government programs to promote economic development. Both institutions focus on improving access to credit but differ in structure, target market, and funding sources.

Mission and Core Objectives: Credit Unions vs. CDFIs

Credit unions primarily focus on serving their members by providing affordable financial services and promoting savings, often emphasizing member ownership and local community welfare. Community Development Financial Institutions (CDFIs) aim to deliver financial products and services to underserved or economically disadvantaged communities, prioritizing economic development and poverty alleviation. While both institutions support community lending, credit unions emphasize member benefits, whereas CDFIs concentrate on catalyzing broader community revitalization and inclusion.

Membership Requirements and Accessibility

Credit unions require membership based on common bonds such as employment, community, or association, limiting access to individuals within specific groups. Community Development Financial Institutions (CDFIs) prioritize serving underserved or low-income populations without strict membership criteria, offering broader accessibility. This inclusive approach enables CDFIs to extend lending services to a wider range of borrowers who may not qualify for credit union membership.

Loan Products and Lending Criteria Comparison

Credit unions typically offer a range of loan products such as personal loans, auto loans, and mortgages with competitive interest rates tailored to their members, emphasizing lower fees and flexible terms. Community Development Financial Institutions (CDFIs) focus on providing specialized lending products aimed at underserved markets, including small business loans, affordable housing loans, and microloans, with criteria designed to support economic development and credit building. While credit unions require membership eligibility and often prioritize creditworthiness, CDFIs apply more lenient lending criteria, considering alternative credit data and emphasizing community impact over strict financial metrics.

Interest Rates and Fees: Which Is More Affordable?

Credit unions typically offer lower interest rates and fewer fees compared to Community Development Financial Institutions (CDFIs) due to their nonprofit status and member-focused mission. CDFIs may have slightly higher rates to cover the costs of serving higher-risk or underserved borrowers but often provide flexible terms and fee waivers to enhance affordability. Evaluating specific loan products and borrower qualifications is essential to determine the most cost-effective option between these two lending sources.

Community Impact and Local Investment

Credit unions prioritize member ownership and often reinvest earnings locally, fostering community-based financial support and personalized lending solutions. Community Development Financial Institutions (CDFIs) specialize in providing capital to underserved populations, driving economic revitalization and social impact through targeted investments in affordable housing, small businesses, and community services. Both institutions enhance local economic development, but CDFIs have a distinct mandate to address systemic financial inequities and promote inclusive growth.

Financial Education and Support Services

Credit unions and community development financial institutions (CDFIs) both emphasize financial education and support services to empower underserved borrowers, with credit unions often offering personalized financial counseling tailored to member needs. CDFIs provide comprehensive financial literacy programs alongside lending, targeting economically disadvantaged communities to foster long-term financial stability. Both institutions leverage these educational efforts to enhance borrower success and community impact through responsible credit use and financial management.

Technology and Convenience for Borrowers

Credit unions and community development financial institutions (CDFIs) both aim to serve underserved borrowers, but credit unions often leverage more advanced technology platforms to streamline loan applications and repayments, enhancing convenience. CDFIs prioritize personalized service and flexible underwriting, sometimes with less technological integration, focusing instead on community impact and tailored financial solutions. Borrowers seeking fast, tech-driven access may prefer credit unions, while those valuing mission-driven lending with community support might opt for CDFIs.

Regulatory Oversight and Consumer Protections

Credit unions operate under strict regulatory oversight from the National Credit Union Administration (NCUA), ensuring strong consumer protections through federally insured deposits and member-focused governance. Community Development Financial Institutions (CDFIs), while regulated depending on their charter, often have flexible lending criteria to serve underserved communities, but may not provide the same uniform federal insurance levels as credit unions. Both entities aim to support financial inclusion; however, credit unions typically offer greater regulatory safeguards and standardized consumer protections due to their federal oversight.

Choosing the Right Lending Partner for Your Needs

Credit unions offer personalized lending with competitive interest rates and member-focused benefits, making them ideal for individuals seeking trust and lower fees. Community Development Financial Institutions (CDFIs) specialize in providing loans to underserved markets and small businesses, supporting economic growth in low-income areas with flexible qualification criteria. Assessing your credit needs, eligibility, and desired impact on the community helps determine whether a credit union or CDFI is the best lending partner.

Related Important Terms

Mission-Driven Lending

Credit unions and community development financial institutions (CDFIs) both emphasize mission-driven lending, but credit unions primarily serve their member base with affordable loans and financial services, promoting local economic stability. CDFIs target underserved communities by providing flexible, impactful credit solutions to individuals and businesses often excluded from traditional financial systems, fostering broader community development.

Responsible Banking Alternatives

Credit unions and community development financial institutions (CDFIs) both offer responsible banking alternatives by providing affordable loans with favorable terms to underserved communities. Credit unions operate as member-owned cooperatives emphasizing financial education and member benefits, while CDFIs focus on economic revitalization through targeted lending to low-income individuals and small businesses, ensuring equitable access to credit.

Underserved Market Penetration

Credit unions and community development financial institutions (CDFIs) both target underserved markets but differ in approach and scale; credit unions often serve specific member groups with tailored financial products, while CDFIs focus on broader community revitalization through flexible lending and technical assistance. CDFIs typically have greater capacity to reach deeply underserved populations due to specialized funding and regulatory support aimed at economic development in low-income areas.

Social Impact Underwriting

Credit unions prioritize member-owned, democratic lending models that emphasize personal relationships and financial education, fostering strong community ties and social impact underwriting focused on individual well-being. Community Development Financial Institutions (CDFIs) deploy targeted capital to underserved markets, leveraging data-driven underwriting processes that measure social outcomes such as job creation, affordable housing, and economic revitalization to maximize community development impact.

Community Development Loan Fund

Community Development Loan Funds (CDLFs) specialize in providing flexible, affordable credit to underserved communities, emphasizing economic revitalization and social impact, whereas credit unions primarily serve their member base with member-focused financial products. CDLFs often offer targeted lending solutions such as microloans and community investment loans that support small businesses and affordable housing projects in low-income areas.

Member-Owned Capitalization

Credit unions operate on a member-owned capitalization model where members' deposits fund loans, ensuring collective financial growth and decision-making power. Community Development Financial Institutions (CDFIs) receive capitalization primarily through grants, government funding, and private investments, focusing on underserved communities without direct member ownership influence.

Financial Inclusion Index

Credit unions and community development financial institutions (CDFIs) both enhance financial inclusion, with CDFIs often scoring higher on the Financial Inclusion Index due to their targeted lending to underserved communities. These institutions provide affordable credit options and financial services that drive equitable access and economic empowerment in marginalized populations.

Nonprofit Certified Lending

Credit unions and Community Development Financial Institutions (CDFIs) both prioritize nonprofit certified lending to serve underserved communities, but credit unions operate as member-owned cooperatives offering favorable interest rates, while CDFIs focus on fostering economic development through targeted loans and technical assistance. Nonprofit certified lending through CDFIs often addresses gaps in credit access by supporting small businesses and affordable housing projects with flexible underwriting criteria tailored to community needs.

ESG Credit Union Partnerships

Credit unions specializing in ESG credit union partnerships leverage their member-focused governance to provide socially responsible lending options, emphasizing environmental and social criteria in loan approvals. Community Development Financial Institutions (CDFIs) prioritize serving underserved communities through tailored financial products, often collaborating with ESG credit unions to expand access to sustainable financing and promote economic inclusion.

CDFI Certification Criteria

Credit unions and Community Development Financial Institutions (CDFIs) both provide essential lending services, but CDFI certification requires meeting specific criteria including a primary mission of promoting community development, serving underserved populations, and demonstrating accountability to target communities, which credit unions may not always fulfill. CDFI certification also mandates a targeted service area and proven financing activities supporting economic revitalization, distinguishing CDFIs from traditional credit unions in their focused impact and regulatory oversight.

Credit union vs community development financial institution for lending Infographic

moneydiff.com

moneydiff.com