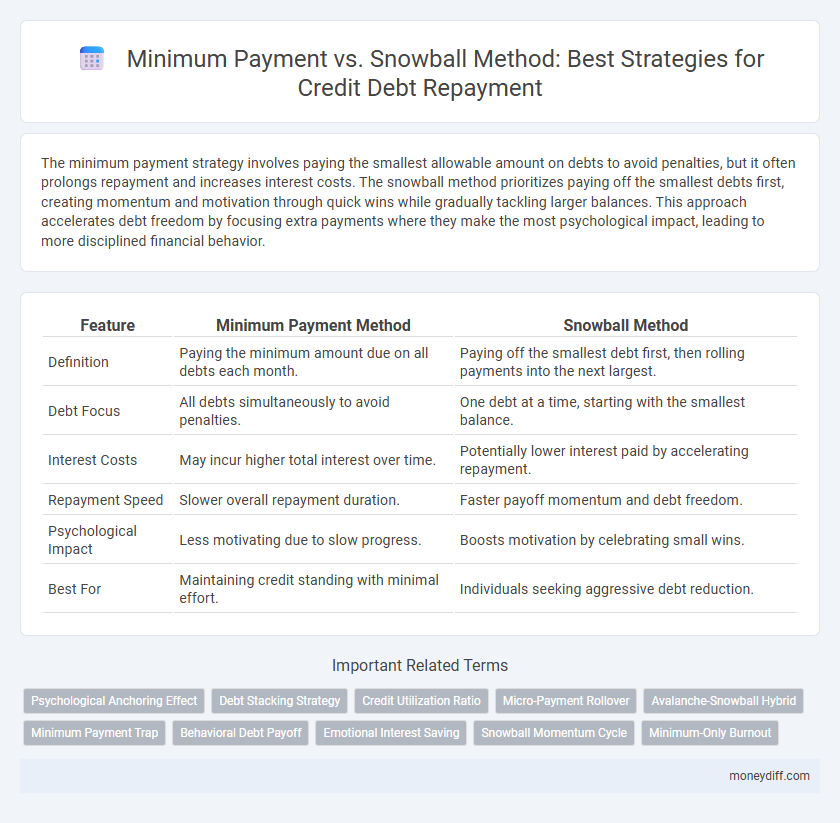

The minimum payment strategy involves paying the smallest allowable amount on debts to avoid penalties, but it often prolongs repayment and increases interest costs. The snowball method prioritizes paying off the smallest debts first, creating momentum and motivation through quick wins while gradually tackling larger balances. This approach accelerates debt freedom by focusing extra payments where they make the most psychological impact, leading to more disciplined financial behavior.

Table of Comparison

| Feature | Minimum Payment Method | Snowball Method |

|---|---|---|

| Definition | Paying the minimum amount due on all debts each month. | Paying off the smallest debt first, then rolling payments into the next largest. |

| Debt Focus | All debts simultaneously to avoid penalties. | One debt at a time, starting with the smallest balance. |

| Interest Costs | May incur higher total interest over time. | Potentially lower interest paid by accelerating repayment. |

| Repayment Speed | Slower overall repayment duration. | Faster payoff momentum and debt freedom. |

| Psychological Impact | Less motivating due to slow progress. | Boosts motivation by celebrating small wins. |

| Best For | Maintaining credit standing with minimal effort. | Individuals seeking aggressive debt reduction. |

Minimum Payment vs. Snowball Method: An Overview

The Minimum Payment method involves paying the lowest required amount on multiple debts, which prolongs repayment and increases total interest paid. The Snowball Method focuses on paying off the smallest debt first, gaining momentum and motivation as each balance is eliminated, leading to faster overall debt reduction. Studies show the Snowball Method can enhance psychological commitment, improving long-term financial discipline compared to the Minimum Payment approach.

Understanding Minimum Payments: What You Need to Know

Minimum payments on credit accounts cover only a small portion of the principal balance, primarily paying interest and mandatory fees, which prolongs debt repayment and increases total interest paid over time. Understanding how minimum payments impact your credit utilization ratio and overall debt timeline is crucial for effective financial planning. Opting to pay only the minimum can negatively affect your credit score and delay becoming debt-free, making alternative strategies like the snowball method more advantageous for accelerating debt reduction.

How the Snowball Method Works for Debt Repayment

The Snowball Method for debt repayment prioritizes paying off the smallest debts first while making minimum payments on larger balances, creating momentum as each smaller debt is eliminated. This psychological boost encourages continued discipline and accelerates overall debt reduction. By tackling debts in order of size rather than interest rate, it helps build confidence and motivation to stay on track.

Pros and Cons of Minimum Payment Strategy

The minimum payment strategy ensures debt holders maintain good credit standing by consistently meeting lender requirements, reducing the risk of penalties or increased interest rates. However, this approach may prolong the overall debt repayment period and increase total interest paid, as only the smallest required amount is paid each month. It lacks the momentum and psychological benefits of accelerated repayment methods like the snowball method, potentially undermining motivation to become debt-free faster.

Advantages of the Snowball Method for Paying Off Debt

The Snowball Method for debt repayment accelerates financial freedom by focusing on paying off the smallest debts first, which boosts motivation through quick wins. This strategy enhances debt payoff momentum and improves psychological commitment, increasing the likelihood of consistent payments. Compared to minimum payments, the Snowball Method reduces the total number of debts faster, facilitating a clearer path to full debt elimination.

Impact on Credit Score: Minimum Payment vs. Snowball Method

Making minimum payments on debts can maintain credit accounts in good standing but often prolongs repayment and accrues more interest, which may limit significant improvements in credit score over time. The Snowball Method targets smaller debts first, accelerating debt elimination and often leading to quicker increases in credit score due to reduced credit utilization and improved payment history. Choosing the Snowball Method frequently results in more substantial credit score benefits compared to only making minimum payments.

Interest Costs: Comparing Long-Term Outcomes

The snowball method accelerates debt repayment by targeting smaller balances first, reducing overall interest costs faster than minimum payments, which prolong debt and increase total interest paid. Making only minimum payments extends the repayment period, causing interest to accumulate substantially over time, often doubling or tripling the original debt. Prioritizing the snowball approach leads to quicker freedom from debt and considerable savings on interest expenses in the long run.

Psychological Benefits of the Snowball Approach

The Snowball Method offers significant psychological benefits by fostering a sense of achievement through the rapid payoff of smaller debts, which can build motivation and confidence. Paying off debts in ascending order creates visible progress that reinforces positive financial behavior and reduces stress. This incremental success often encourages consistent repayment habits, improving overall debt management and financial wellness.

Minimum Payment Risks: Why It May Prolong Your Debt

Making only the minimum payment on credit card debt results in slower principal reduction, causing extended interest accumulation and longer repayment periods. This approach increases the total amount paid over time, as monthly payments primarily cover interest rather than reducing the balance. The snowball method mitigates these risks by focusing on paying off smaller debts first, accelerating debt elimination and minimizing overall interest costs.

Choosing the Right Debt Repayment Method for Your Financial Goals

Choosing the right debt repayment method depends on your financial goals and psychological motivation. The Minimum Payment approach maintains credit score stability by meeting lender requirements but extends debt duration and increases overall interest paid. The Snowball Method accelerates debt freedom by targeting smaller balances first, building momentum and confidence while potentially saving interest costs if you allocate extra funds effectively.

Related Important Terms

Psychological Anchoring Effect

The psychological anchoring effect causes individuals to fixate on the minimum payment amount, often underestimating the total debt and prolonging repayment periods. In contrast, the snowball method leverages momentum by prioritizing small debt eliminations first, enhancing motivation and accelerating financial progress.

Debt Stacking Strategy

The Debt Stacking Strategy prioritizes paying off debts with the highest interest rates first, maximizing interest savings compared to the Minimum Payment approach, which only covers the smallest allowed amount on all debts. This method accelerates debt reduction, improves credit scores faster, and reduces overall financial costs by attacking expensive debt aggressively before moving to lower-interest balances.

Credit Utilization Ratio

Focusing on the credit utilization ratio, the snowball method prioritizes paying off smaller debts first, which can quickly reduce the number of active accounts and lower overall credit utilization, potentially improving credit scores faster. In contrast, making minimum payments often leaves balances high across multiple accounts, maintaining a higher utilization ratio that can negatively impact credit ratings.

Micro-Payment Rollover

The Micro-Payment Rollover technique enhances the Snowball Method by continuously applying freed-up funds from minimum payments on paid-off debts to the next smallest balance, accelerating overall debt reduction. This approach maximizes payment efficiency compared to making only minimum payments, significantly shortening the repayment timeline and reducing total interest paid.

Avalanche-Snowball Hybrid

Combining the Avalanche-Snowball Hybrid method strategically targets high-interest debts first while maintaining motivation by quickly clearing smaller balances, optimizing both interest savings and psychological rewards. This hybrid approach accelerates debt repayment by balancing financial efficiency with behavioral incentives, resulting in a more sustainable and effective credit management plan.

Minimum Payment Trap

Relying solely on minimum payments often results in prolonged debt due to accumulating interest and slower principal reduction, creating a costly minimum payment trap. The Snowball Method accelerates debt payoff by targeting smaller balances first, building momentum and reducing overall interest expenses.

Behavioral Debt Payoff

The snowball method leverages behavioral psychology by prioritizing smaller debts for quick wins, boosting motivation and commitment to continued repayment. Minimum payments prolong debt payoff and may foster complacency, whereas the snowball strategy drives momentum through visible progress, encouraging sustained financial discipline.

Emotional Interest Saving

Choosing the Snowball Method for debt repayment can significantly boost emotional interest savings by providing quick psychological wins through paying off smaller debts first, reducing stress and enhancing motivation. In contrast, making only minimum payments prolongs debt duration, increases interest costs, and often leads to feelings of financial frustration and helplessness.

Snowball Momentum Cycle

The Snowball Momentum Cycle accelerates debt repayment by focusing on paying off the smallest balances first, creating a psychological boost that fuels continued progress. This method contrasts with minimum payments, which can prolong debt by keeping balances high and reducing motivation to pay more than the required amount.

Minimum-Only Burnout

Relying solely on minimum payments prolongs debt payoff by accumulating more interest, leading to minimum-only burnout where balances barely decrease despite consistent payments. The snowball method accelerates debt elimination by targeting smaller balances first, avoiding the stagnation caused by minimum-only strategies.

Minimum Payment vs Snowball Method for debt repayment. Infographic

moneydiff.com

moneydiff.com