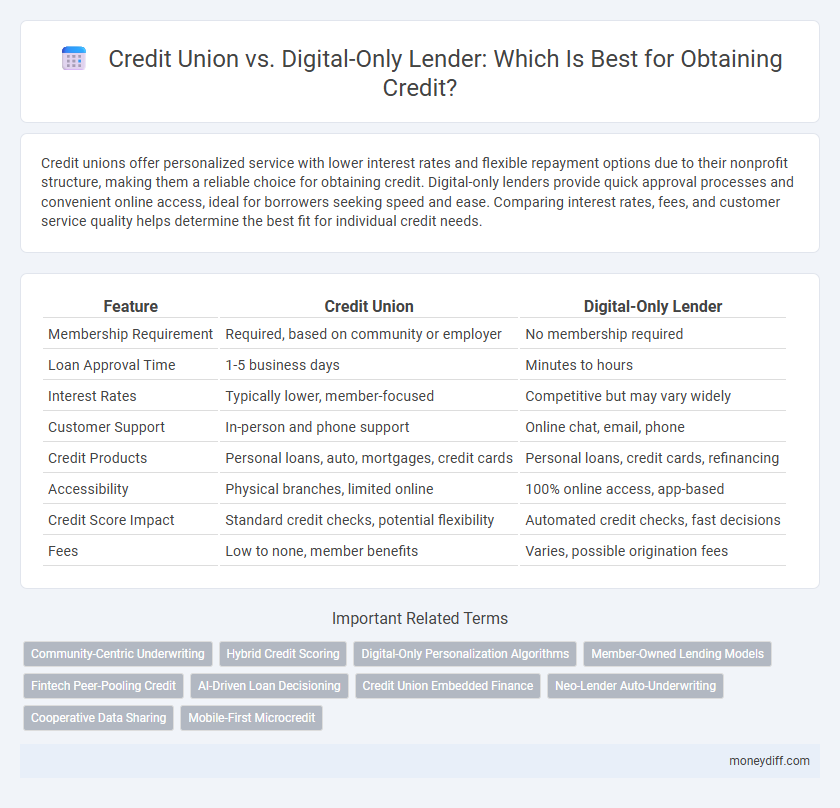

Credit unions offer personalized service with lower interest rates and flexible repayment options due to their nonprofit structure, making them a reliable choice for obtaining credit. Digital-only lenders provide quick approval processes and convenient online access, ideal for borrowers seeking speed and ease. Comparing interest rates, fees, and customer service quality helps determine the best fit for individual credit needs.

Table of Comparison

| Feature | Credit Union | Digital-Only Lender |

|---|---|---|

| Membership Requirement | Required, based on community or employer | No membership required |

| Loan Approval Time | 1-5 business days | Minutes to hours |

| Interest Rates | Typically lower, member-focused | Competitive but may vary widely |

| Customer Support | In-person and phone support | Online chat, email, phone |

| Credit Products | Personal loans, auto, mortgages, credit cards | Personal loans, credit cards, refinancing |

| Accessibility | Physical branches, limited online | 100% online access, app-based |

| Credit Score Impact | Standard credit checks, potential flexibility | Automated credit checks, fast decisions |

| Fees | Low to none, member benefits | Varies, possible origination fees |

Understanding Credit Unions and Digital-Only Lenders

Credit unions are member-owned financial cooperatives that offer personalized credit services with favorable interest rates and community-focused benefits. Digital-only lenders operate exclusively online, providing quick access to credit through automated processes and streamlined approvals without physical branch visits. Understanding these differences helps borrowers choose between traditional, relationship-driven credit unions and convenient, fast digital-only lending platforms.

Membership Requirements: Credit Unions vs Digital Lenders

Credit unions require membership based on specific criteria such as geographic location, employment, or affiliation with certain organizations, which can limit access but often results in personalized service and lower interest rates. Digital-only lenders offer broader accessibility without membership restrictions, enabling quick credit approval through online platforms but may have higher rates and less personalized support. Understanding these membership requirements helps borrowers weigh the trade-offs between community-focused credit unions and convenience-driven digital lenders.

Loan Application Process Compared

Credit unions typically require in-person visits and extensive documentation for loan applications, offering personalized service and potentially lower interest rates due to their nonprofit status. Digital-only lenders provide fast, fully online applications with instant pre-approval using automated algorithms, prioritizing convenience and speed over personalized underwriting. While credit unions emphasize member relationships and manual review, digital lenders leverage technology to streamline credit decisions and reduce processing times.

Credit Approval Criteria Differences

Credit unions evaluate credit approval based on comprehensive member profiles, emphasizing community ties and credit history within the cooperative framework. Digital-only lenders rely heavily on automated algorithms analyzing credit scores, income verification, and alternative data for faster, data-driven decisions. This results in credit unions often offering more personalized terms, while digital lenders prioritize speed and accessibility through streamlined criteria.

Interest Rates and Fee Structures

Credit unions typically offer lower interest rates and fewer fees compared to digital-only lenders, as they operate on a non-profit basis and prioritize member benefits. Digital-only lenders often have higher interest rates and more variable fee structures due to streamlined online processes and risk-based pricing models. Borrowers seeking cost-effective credit solutions may find credit unions more advantageous, while those valuing speed and convenience might consider digital-only lenders despite potentially higher costs.

Customer Service Experience

Credit unions typically offer personalized customer service with in-branch support and financial counseling, enhancing borrower satisfaction through face-to-face interaction. Digital-only lenders provide fast, convenient, and 24/7 online access but may lack personalized assistance and local presence, sometimes resulting in impersonal customer experiences. Members of credit unions often benefit from tailored advice and community-focused service, which can improve trust and loan management.

Access to Financial Products and Services

Credit unions typically offer a wider range of financial products and personalized services, including loans, savings accounts, and financial counseling, catering to members with diverse credit needs. Digital-only lenders provide quick access to credit through streamlined online platforms, often featuring competitive rates and automated approval processes but may lack the in-depth advisory support found at credit unions. The choice between the two depends on the importance of personalized service versus convenience and speed in accessing financial products.

Security and Privacy Measures

Credit unions employ stringent security protocols including federal insurance through the National Credit Union Administration (NCUA) and robust encryption methods to safeguard member data during credit transactions. Digital-only lenders implement advanced cybersecurity technologies such as multi-factor authentication, biometric verification, and end-to-end encryption to protect personal and financial information online. Both credit unions and digital-only lenders prioritize privacy, but credit unions benefit from regulatory oversight that enforces strict data protection standards tailored to member confidentiality.

Speed of Disbursement and Flexibility

Credit unions typically offer a moderate speed of disbursement with personalized service, making them suitable for borrowers seeking flexible repayment options tailored to individual needs. Digital-only lenders provide rapid disbursement, often within 24 to 48 hours, leveraging automated processes to accelerate loan approval and funding. However, digital lenders may have less flexibility in terms of repayment plans and personalized customer service compared to credit unions.

Which Option Is Better for Your Credit Needs?

Credit unions typically offer lower interest rates, personalized service, and member-focused benefits, making them ideal for individuals seeking trustworthy, community-based lending options. Digital-only lenders provide fast approval processes, convenient online access, and flexible credit options, catering to borrowers who prioritize speed and technology-driven solutions. Evaluating your credit needs, such as interest rates, repayment flexibility, and customer service preferences, will help determine whether a credit union or digital-only lender is the better choice for your financial goals.

Related Important Terms

Community-Centric Underwriting

Credit unions emphasize community-centric underwriting by assessing applicants' local ties and financial behaviors within their specific membership groups, offering personalized credit solutions. Digital-only lenders rely on algorithm-driven models and big data analytics, often prioritizing speed and scalability over localized, community-based credit evaluation.

Hybrid Credit Scoring

Hybrid credit scoring combines traditional credit data with alternative financial behavior metrics, enabling credit unions and digital-only lenders to better assess borrower risk and expand credit access. Credit unions leverage hybrid models to offer personalized credit options with community trust, while digital-only lenders utilize advanced algorithms to deliver fast approval and competitive rates.

Digital-Only Personalization Algorithms

Digital-only lenders utilize advanced personalization algorithms that analyze extensive consumer data to tailor credit offers, resulting in faster approval processes and customized interest rates compared to traditional credit unions. These algorithms continuously adapt to user behavior and financial patterns, enabling more accurate risk assessments and personalized credit solutions that enhance borrower experience and accessibility.

Member-Owned Lending Models

Credit unions operate on a member-owned lending model, which often results in lower interest rates and personalized service due to their nonprofit status, aligning the financial interests of borrowers with the cooperative's overall success. Digital-only lenders, while offering convenience and fast approval processes, typically function as investor-owned entities prioritizing profitability, which may lead to higher rates and less flexible repayment options.

Fintech Peer-Pooling Credit

Fintech peer-pooling credit platforms leverage blockchain technology and decentralized networks to offer faster approval times and lower interest rates compared to traditional credit unions, which rely on member deposits and localized funding. Digital-only lenders prioritize algorithmic risk assessment and real-time data analytics, enhancing credit access efficiency but often lacking the personalized support and community trust inherent in credit unions.

AI-Driven Loan Decisioning

Credit unions leverage AI-driven loan decisioning to provide personalized credit solutions with lower interest rates and member-focused benefits, while digital-only lenders use advanced AI algorithms to offer faster approvals and streamlined application processes, prioritizing convenience and speed. Both utilize machine learning models to assess credit risk accurately, but credit unions often integrate AI insights with human judgment for tailored financial advice.

Credit Union Embedded Finance

Credit unions, leveraging embedded finance, offer personalized credit solutions with lower interest rates and community-focused benefits compared to digital-only lenders, whose streamlined online platforms provide quick access but often with higher fees. Embedded finance in credit unions integrates lending services into everyday financial activities, enhancing member engagement and delivering tailored credit products that align with members' financial health.

Neo-Lender Auto-Underwriting

Neo-lender auto-underwriting streamlines credit approval by leveraging AI algorithms that analyze borrower data instantly, often resulting in faster loan decisions compared to traditional credit unions. Digital-only lenders use advanced machine learning models to improve risk assessment efficiency, reducing reliance on manual underwriting and enabling more competitive interest rates for consumers.

Cooperative Data Sharing

Credit unions leverage cooperative data sharing among member institutions to enhance creditworthiness assessments, often leading to more personalized lending decisions and favorable terms. In contrast, digital-only lenders typically rely on algorithm-driven models and alternative data sources, which may lack the depth of shared cooperative insights found in credit union networks.

Mobile-First Microcredit

Mobile-first microcredit offered by digital-only lenders provides fast, convenient loan access through user-friendly apps with instant approvals, ideal for individuals seeking quick small amounts. Credit unions, while offering potentially lower interest rates and personalized service, typically involve more rigorous application processes and less emphasis on mobile-first technology.

Credit Union vs Digital-Only Lender for obtaining credit. Infographic

moneydiff.com

moneydiff.com