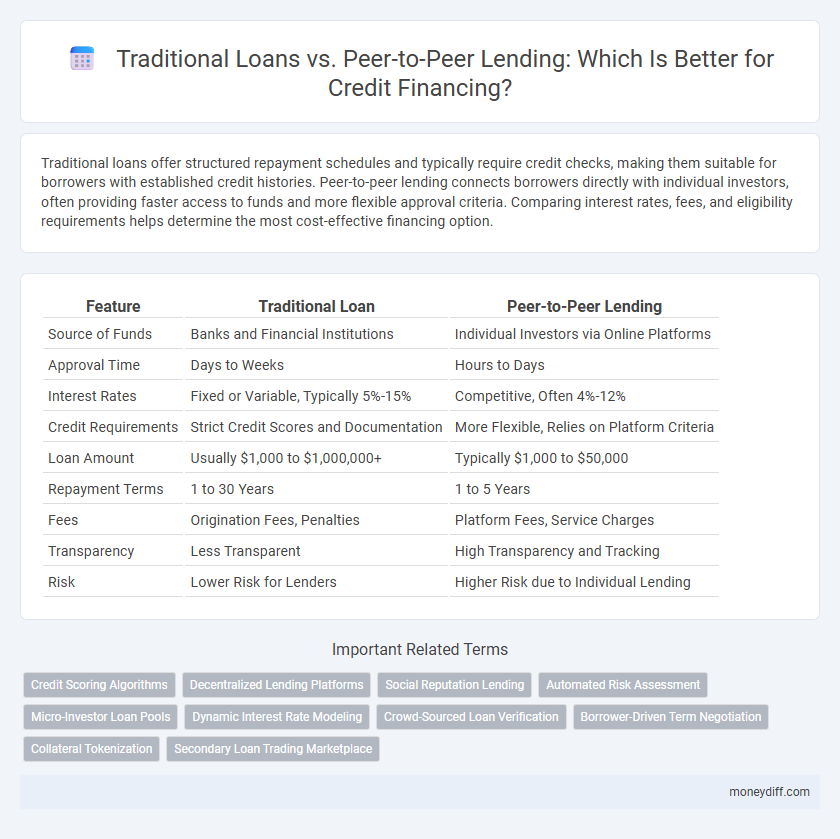

Traditional loans offer structured repayment schedules and typically require credit checks, making them suitable for borrowers with established credit histories. Peer-to-peer lending connects borrowers directly with individual investors, often providing faster access to funds and more flexible approval criteria. Comparing interest rates, fees, and eligibility requirements helps determine the most cost-effective financing option.

Table of Comparison

| Feature | Traditional Loan | Peer-to-Peer Lending |

|---|---|---|

| Source of Funds | Banks and Financial Institutions | Individual Investors via Online Platforms |

| Approval Time | Days to Weeks | Hours to Days |

| Interest Rates | Fixed or Variable, Typically 5%-15% | Competitive, Often 4%-12% |

| Credit Requirements | Strict Credit Scores and Documentation | More Flexible, Relies on Platform Criteria |

| Loan Amount | Usually $1,000 to $1,000,000+ | Typically $1,000 to $50,000 |

| Repayment Terms | 1 to 30 Years | 1 to 5 Years |

| Fees | Origination Fees, Penalties | Platform Fees, Service Charges |

| Transparency | Less Transparent | High Transparency and Tracking |

| Risk | Lower Risk for Lenders | Higher Risk due to Individual Lending |

Understanding Traditional Loans and Peer-to-Peer Lending

Traditional loans involve borrowing funds from banks or financial institutions with fixed interest rates and structured repayment schedules, often requiring extensive credit checks and collateral. Peer-to-peer lending connects borrowers directly with individual investors through online platforms, offering potentially lower interest rates and more flexible terms but with varied risk levels. Understanding these differences helps borrowers evaluate financing options based on creditworthiness, cost efficiency, and repayment flexibility.

Key Differences Between Traditional Loans and P2P Lending

Traditional loans are typically issued by banks or credit unions with strict eligibility criteria, fixed interest rates, and longer approval times, often requiring extensive documentation and collateral. Peer-to-peer (P2P) lending connects borrowers directly with individual investors through online platforms, offering faster approval, competitive interest rates, and more flexible qualification standards. Key differences include the source of funds, approval process speed, risk evaluation methods, and potential for personalized loan terms.

Eligibility and Approval Criteria Compared

Traditional loans typically require stringent credit scores, verified income, and a stable employment history for approval, making eligibility more restrictive. Peer-to-peer lending platforms often use alternative data points like social behavior and less rigid credit assessments, offering broader access to individuals with varying financial backgrounds. Approval speed on P2P platforms is generally faster due to automated processes, contrasting with the longer evaluation periods needed by traditional financial institutions.

Interest Rates: Traditional Loans vs P2P Platforms

Interest rates on traditional loans typically range from 6% to 36%, determined by credit scores, loan terms, and lender policies, often including additional fees and stricter qualifications. Peer-to-peer (P2P) lending platforms offer variable interest rates usually between 5% to 30%, influenced by borrower risk profiles and platform-specific algorithms, providing potentially lower costs due to fewer intermediaries. P2P lending can present more competitive rates, especially for borrowers with moderate credit, while traditional loans may offer more predictable terms and regulatory protections.

Application Process: Bank Loans versus P2P Lending

Traditional bank loans require extensive paperwork, credit checks, and longer approval times, often taking weeks to secure financing. Peer-to-peer (P2P) lending platforms streamline the application process through online interfaces, enabling faster approval often within days by connecting borrowers directly with individual investors. The digital nature of P2P lending reduces bureaucratic hurdles and increases accessibility for borrowers with varied credit profiles.

Speed of Funding: Which Option is Faster?

Peer-to-peer lending typically offers faster funding than traditional loans, with approval and disbursement often completed within days compared to the weeks required by banks. Traditional loans involve extensive credit checks, documentation, and bank processing times, causing delays. The streamlined, digital nature of peer-to-peer platforms significantly accelerates the approval cycle, making it the quicker financing option.

Loan Amounts and Repayment Terms

Traditional loans typically offer higher loan amounts, often ranging from $5,000 to $500,000, with fixed repayment terms between one to thirty years depending on the lender and creditworthiness. Peer-to-peer lending platforms provide loans usually between $1,000 and $40,000, with more flexible repayment terms that commonly span three to five years. Borrowers seeking larger sums and longer-term stability often favor traditional loans, whereas those preferring quicker approvals and customizable payment schedules may opt for peer-to-peer lending.

Risks and Security Considerations

Traditional loans typically involve strict regulatory oversight and established collateral requirements, providing borrowers with clearer legal protections but often exposing them to higher default penalties. Peer-to-peer lending platforms, while offering greater accessibility and speed, carry increased risks of borrower default and limited regulatory safeguards, potentially resulting in greater financial loss for investors. Security considerations for P2P lending include platform insolvency risks and data privacy vulnerabilities, necessitating thorough platform vetting and diversification to mitigate exposure.

Impact on Credit Score and Credit Building

Traditional loans often require strict credit score criteria and timely repayments directly influence credit history, promoting steady credit building. Peer-to-peer lending platforms may offer more lenient credit requirements, but inconsistent reporting to credit bureaus can limit their impact on credit scores. Choosing between these financing options affects long-term credit development based on reporting practices and repayment discipline.

Choosing the Right Financing Option for Your Needs

Traditional loans offer structured repayment plans and typically require strong credit scores, making them suitable for borrowers seeking stability and predictable terms. Peer-to-peer lending provides access to diverse individual investors with flexible criteria, often benefiting those with limited credit history or needing faster approval. Evaluating factors like interest rates, eligibility, funding speed, and loan purpose is crucial to selecting the optimal financing method for your specific credit needs.

Related Important Terms

Credit Scoring Algorithms

Traditional loan approval relies heavily on established credit scoring algorithms such as FICO, which assess creditworthiness based on credit history, payment patterns, and debt levels, often leading to rigid eligibility criteria. Peer-to-peer lending platforms utilize alternative credit scoring models incorporating social data, transaction history, and machine learning techniques to offer more flexible and inclusive financing options.

Decentralized Lending Platforms

Decentralized lending platforms leverage blockchain technology to facilitate peer-to-peer lending, bypassing traditional banks and reducing intermediary costs. These platforms offer greater transparency, faster loan approvals, and lower interest rates compared to traditional loans, empowering borrowers with more accessible and flexible financing options.

Social Reputation Lending

Traditional loans rely on credit scores and collateral, while peer-to-peer lending leverages social reputation and community trust to assess borrower credibility. This innovative approach reduces reliance on conventional financial metrics, enabling more inclusive access to funds through social reputation lending platforms.

Automated Risk Assessment

Automated risk assessment in traditional loans relies on established credit scoring models and extensive financial histories to determine borrower eligibility and interest rates. Peer-to-peer lending platforms utilize machine learning algorithms and real-time data analysis to evaluate risk dynamically, often enabling faster approvals and tailored loan terms.

Micro-Investor Loan Pools

Traditional loans typically involve financial institutions offering fixed interest rates and rigid qualification criteria, whereas peer-to-peer lending leverages micro-investor loan pools to diversify risk and provide competitive rates with greater accessibility. Micro-investor loan pools aggregate smaller investments from multiple individuals, enabling borrowers to secure funds rapidly while investors gain portfolio diversification and potential higher returns.

Dynamic Interest Rate Modeling

Dynamic interest rate modeling in traditional loans relies heavily on centralized risk assessments and fixed guidelines, often resulting in less flexible rates that may not reflect individual borrower risk accurately. Peer-to-peer lending platforms use algorithm-driven dynamic pricing models that adjust interest rates in real-time based on borrower credit profiles and market demand, enabling more personalized and competitive financing options.

Crowd-Sourced Loan Verification

Traditional loans rely on established financial institutions with rigorous credit scoring systems for loan approval, ensuring stringent verification but often resulting in slower processing times. Peer-to-peer lending leverages crowd-sourced loan verification, where multiple investors assess and validate borrower information collectively, enhancing transparency and speeding up funding while potentially increasing risk diversification.

Borrower-Driven Term Negotiation

Borrowers in peer-to-peer lending platforms often negotiate loan terms directly with investors, allowing for more flexible interest rates and repayment schedules compared to traditional loans with fixed terms set by banks. This borrower-driven negotiation can lead to personalized financing solutions that better align with individual credit profiles and funding needs.

Collateral Tokenization

Traditional loans rely on physical collateral or credit scores to secure financing, often resulting in lengthy approval processes and limited asset flexibility. Peer-to-peer lending leverages collateral tokenization, transforming assets into digital tokens that facilitate faster, transparent transactions and broaden access to lenders, enhancing liquidity and reducing risk.

Secondary Loan Trading Marketplace

Secondary loan trading marketplaces enable investors to buy and sell existing loans, enhancing liquidity and risk management in both traditional loan portfolios and peer-to-peer lending platforms. These marketplaces increase transparency, facilitate pricing discovery, and provide access to diverse credit assets, making them a crucial factor in optimizing financing strategies across both lending models.

Traditional Loan vs Peer-to-Peer Lending for financing. Infographic

moneydiff.com

moneydiff.com