Credit cards offer flexible repayment options and rewards but can lead to high-interest debt if balances are not paid in full. Buy Now Pay Later (BNPL) services provide interest-free installments over a set period, making budgeting easier for short-term purchases. Consumers should evaluate fees, credit impact, and spending habits to choose the best payment method for their financial situation.

Table of Comparison

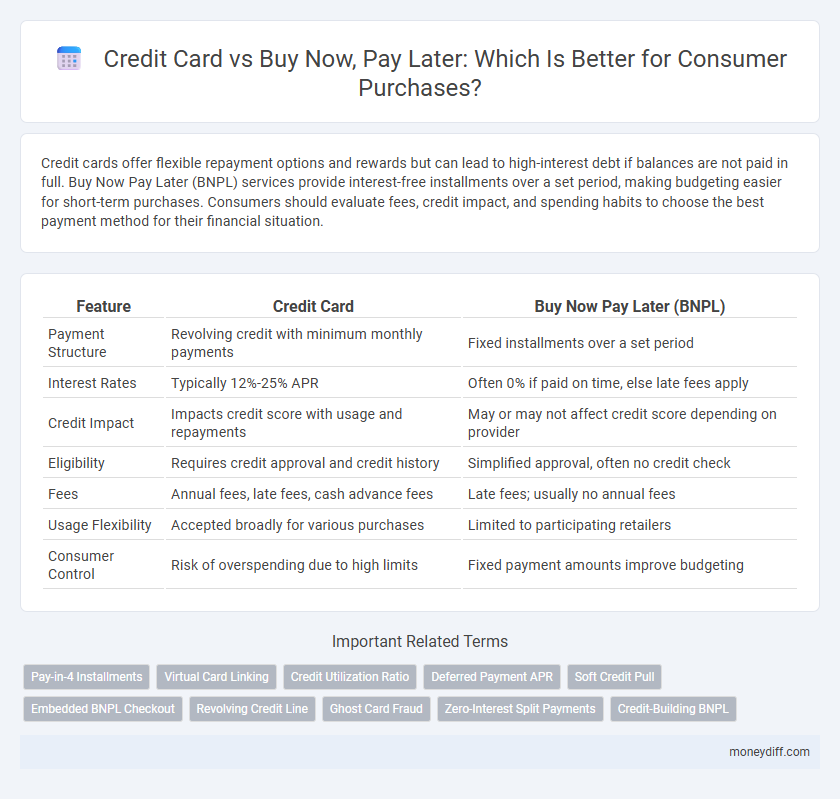

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Payment Structure | Revolving credit with minimum monthly payments | Fixed installments over a set period |

| Interest Rates | Typically 12%-25% APR | Often 0% if paid on time, else late fees apply |

| Credit Impact | Impacts credit score with usage and repayments | May or may not affect credit score depending on provider |

| Eligibility | Requires credit approval and credit history | Simplified approval, often no credit check |

| Fees | Annual fees, late fees, cash advance fees | Late fees; usually no annual fees |

| Usage Flexibility | Accepted broadly for various purchases | Limited to participating retailers |

| Consumer Control | Risk of overspending due to high limits | Fixed payment amounts improve budgeting |

Understanding Credit Cards and Buy Now Pay Later

Credit cards offer revolving credit with interest charges and rewards programs, allowing consumers to borrow up to a preset limit and make monthly payments. Buy Now Pay Later (BNPL) services split purchases into interest-free installments, providing short-term financing without affecting credit scores if paid on time. Understanding the terms, fees, and impact on credit reports is essential to managing credit card debt versus BNPL affordability and risk.

How Credit Cards Work for Consumer Purchases

Credit cards allow consumers to make purchases by borrowing funds up to a pre-approved credit limit, with the obligation to repay the amount either in full or over time with interest. Each transaction is recorded on a monthly statement, giving users detailed insights into their spending patterns and payment due dates. Interest rates, fees, and rewards programs vary by card issuer, impacting the overall cost and benefits of using credit cards for purchases.

Buy Now Pay Later: A Quick Overview

Buy Now Pay Later (BNPL) offers consumers a flexible payment option by splitting purchases into interest-free installments, often over a few weeks or months. BNPL services typically require minimal credit checks, making them accessible to a broader range of shoppers compared to traditional credit cards. Merchants benefit from increased conversion rates and higher average order values, while consumers can manage cash flow without incurring high-interest debt.

Comparing Interest Rates and Fees

Credit cards typically charge interest rates ranging from 15% to 25% APR if balances are not paid in full, with fees including annual fees, late payment fees, and cash advance fees. Buy Now Pay Later (BNPL) services often feature zero or low interest rates for short-term repayment plans but may impose late fees and higher penalties for missed payments. Comparing the two, credit cards offer revolving credit with ongoing interest accumulation, while BNPL provides fixed repayment schedules with potentially fewer upfront costs but higher risk of fees if terms are breached.

Credit Score Impact: Credit Cards vs Buy Now Pay Later

Credit cards typically impact credit scores by reporting usage and payment history to credit bureaus, influencing factors like credit utilization and payment timeliness. Buy Now Pay Later (BNPL) services may not always report to credit bureaus, resulting in limited or no impact on credit scores unless payments are missed, which can then negatively affect credit. Consumers aiming to build or maintain credit should monitor how each option reports to bureaus, as credit cards offer more consistent opportunities for credit score improvement.

Repayment Flexibility and Terms

Credit cards offer revolving credit with minimum monthly payments and variable interest rates, providing borrowers the flexibility to pay over time but potentially incurring high interest costs. Buy Now Pay Later (BNPL) solutions typically feature fixed repayment schedules with no interest if paid within the agreed period, making budgeting easier but less flexible for extending payments beyond the term. Consumers prioritizing predictable monthly installments may prefer BNPL, while those needing ongoing access to credit with adjustable repayment amounts often favor credit cards.

Security and Consumer Protection Features

Credit cards offer robust security features such as fraud detection, zero liability policies, and encryption technologies that protect consumers from unauthorized transactions. Buy Now Pay Later (BNPL) services may lack comprehensive consumer protection measures, often offering limited dispute resolution and weaker fraud safeguards. Cardholders benefit from regulatory protections under frameworks like the Truth in Lending Act, enhancing accountability and reducing financial risk compared to many BNPL providers.

Eligibility Requirements and Application Process

Credit card eligibility typically requires a good credit score, stable income, and a thorough credit check, with the application process involving detailed financial documentation and a longer approval time. Buy Now Pay Later (BNPL) services often have more lenient eligibility criteria, sometimes requiring only basic identity verification and no hard credit check, allowing for a faster, simpler application process. Consumers with limited credit history or lower credit scores may find BNPL more accessible, while credit cards offer more extensive credit-building opportunities.

Budgeting and Spending Control Challenges

Credit cards and Buy Now Pay Later (BNPL) services both offer flexible payment options, but they present distinct budgeting and spending control challenges for consumers. Credit cards often encourage overspending due to revolving credit limits and accruing interest on unpaid balances, complicating monthly budgeting. BNPL services split payments into installments without immediate interest, yet they can lead to fragmented tracking of expenses and unexpected financial strain if multiple purchases overlap across different platforms.

Choosing the Right Option for Your Financial Needs

Credit cards offer flexibility with revolving credit limits, rewards programs, and fraud protection, making them ideal for managing ongoing expenses and building credit history. Buy Now Pay Later (BNPL) services provide interest-free installment plans for short-term purchases but may lead to overspending without careful budgeting. Assess your spending habits, financial goals, and ability to repay promptly to choose the option that aligns with your consumer needs and credit profile.

Related Important Terms

Pay-in-4 Installments

Pay-in-4 installment plans offer consumers the flexibility to split purchases into four equal, interest-free payments over six weeks, enhancing budget management without accumulating credit card debt. Unlike traditional credit cards, these plans reduce the risk of overspending and help shoppers avoid high-interest charges typically associated with revolving credit balances.

Virtual Card Linking

Virtual card linking enhances Buy Now Pay Later (BNPL) services by enabling seamless integration with multiple merchant platforms, offering consumers real-time transaction control and improved security compared to traditional credit cards. This technology reduces fraud risk and streamlines payment authentication, making BNPL a more flexible and consumer-friendly option for managing purchases.

Credit Utilization Ratio

Credit cards impact the credit utilization ratio directly, as outstanding balances are reported to credit bureaus and affect credit scores, whereas Buy Now Pay Later (BNPL) services often do not report to credit agencies, resulting in minimal or no effect on this ratio. Consumers using credit cards must manage their utilization below 30% to maintain a healthy credit score, while BNPL offers flexibility without immediate impact on credit utilization but can lead to increased debt if multiple plans are used simultaneously.

Deferred Payment APR

Credit cards typically feature an average deferred payment APR ranging from 15% to 25%, which applies if the balance is not paid in full by the due date. Buy Now Pay Later (BNPL) services often offer 0% deferred payment APR for short terms but may charge high interest rates or fees if payments are missed or extended beyond the promotional period.

Soft Credit Pull

Soft credit pulls for credit cards allow consumers to check pre-approval offers without impacting their credit score, providing a low-risk way to explore financing options. Buy Now Pay Later services typically do not perform soft or hard credit checks, enabling instant approval and purchase flexibility without affecting credit reports.

Embedded BNPL Checkout

Embedded BNPL checkout enhances consumer flexibility by integrating interest-free installment options directly at the point of sale, contrasting with traditional credit cards that often involve revolving debt and higher interest rates. This seamless integration reduces friction in the purchasing process, driving higher conversion rates while offering consumers transparent payment plans and improved budget management.

Revolving Credit Line

Revolving credit lines on credit cards offer consumers flexible repayment options with interest accruing on unpaid balances, enabling ongoing access to funds for purchases. Buy Now Pay Later services typically provide short-term installment payments without revolving balances, often limiting spending flexibility compared to credit cards.

Ghost Card Fraud

Credit cards offer robust fraud detection systems that proactively identify and prevent ghost card fraud, whereas Buy Now Pay Later (BNPL) services often lack comprehensive security measures, making consumers more vulnerable to unauthorized transactions. The advanced encryption and real-time monitoring of credit card networks significantly reduce the risk of ghost card theft compared to the relatively nascent and less regulated BNPL platforms.

Zero-Interest Split Payments

Zero-interest split payments through Buy Now Pay Later (BNPL) services let consumers divide purchases into manageable installments without accruing interest, unlike traditional credit cards that often charge high interest rates on carried balances. BNPL platforms improve cash flow management and budget predictability, offering an alternative that avoids credit card interest fees while maintaining purchase flexibility.

Credit-Building BNPL

Credit card usage contributes directly to credit score improvement through reported payment history and credit utilization ratios, while Buy Now Pay Later (BNPL) services traditionally lack consistent credit bureau reporting, limiting their impact on credit-building. Emerging BNPL providers are integrating credit reporting features to enhance consumer credit profiles, offering an alternative pathway for credit-building alongside conventional credit cards.

Credit Card vs Buy Now Pay Later for consumer purchases. Infographic

moneydiff.com

moneydiff.com