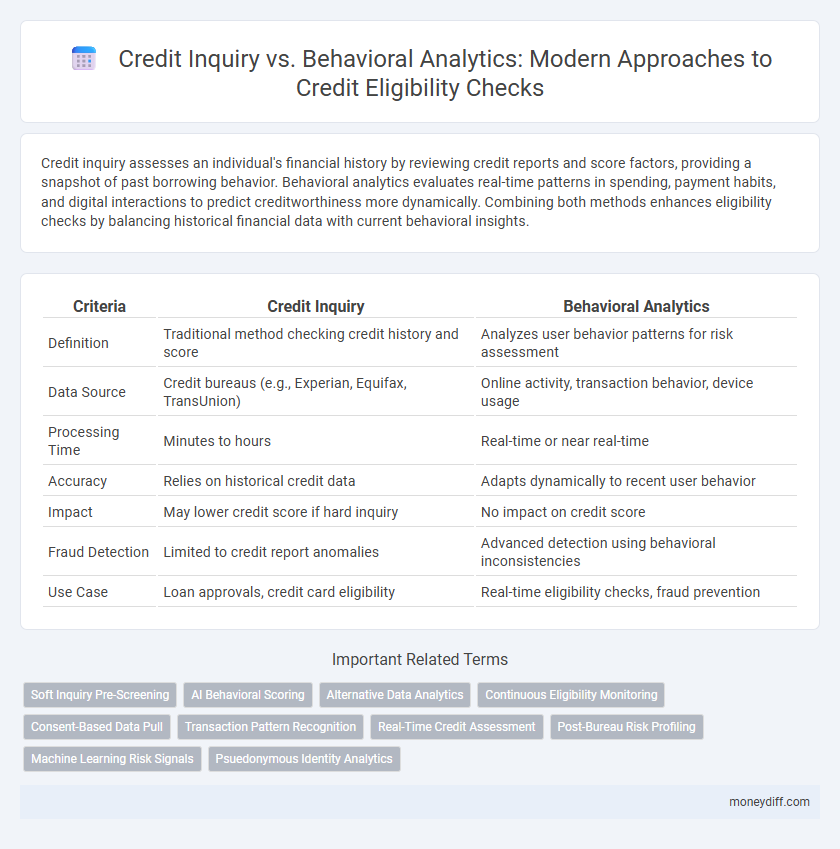

Credit inquiry assesses an individual's financial history by reviewing credit reports and score factors, providing a snapshot of past borrowing behavior. Behavioral analytics evaluates real-time patterns in spending, payment habits, and digital interactions to predict creditworthiness more dynamically. Combining both methods enhances eligibility checks by balancing historical financial data with current behavioral insights.

Table of Comparison

| Criteria | Credit Inquiry | Behavioral Analytics |

|---|---|---|

| Definition | Traditional method checking credit history and score | Analyzes user behavior patterns for risk assessment |

| Data Source | Credit bureaus (e.g., Experian, Equifax, TransUnion) | Online activity, transaction behavior, device usage |

| Processing Time | Minutes to hours | Real-time or near real-time |

| Accuracy | Relies on historical credit data | Adapts dynamically to recent user behavior |

| Impact | May lower credit score if hard inquiry | No impact on credit score |

| Fraud Detection | Limited to credit report anomalies | Advanced detection using behavioral inconsistencies |

| Use Case | Loan approvals, credit card eligibility | Real-time eligibility checks, fraud prevention |

Understanding Credit Inquiries in Eligibility Assessments

Credit inquiries provide direct data on an individual's credit history, offering precise insights into past borrowing and repayment behaviors essential for eligibility assessments. Behavioral analytics leverages patterns from broader data sources, such as spending habits and online activities, to predict creditworthiness beyond traditional credit reports. Combining credit inquiries with behavioral analytics enhances accuracy in eligibility checks by integrating objective credit data with contextual behavioral indicators.

Introduction to Behavioral Analytics in Credit Evaluation

Behavioral analytics in credit evaluation leverages data patterns from a borrower's transaction history, spending habits, and digital interactions to assess creditworthiness more accurately than traditional credit inquiries. Unlike credit inquiries that rely on static credit scores and credit reports, behavioral analytics provides real-time insights into financial behavior, enabling lenders to identify risk factors and predict repayment likelihood with greater precision. This advanced approach enhances eligibility checks by incorporating dynamic and granular data, improving decision-making in credit approvals and reducing default risks.

Credit Inquiry: Hard vs. Soft Checks Explained

Credit inquiries are categorized into hard and soft checks, each affecting eligibility assessments differently. Hard inquiries occur when a lender reviews your credit report for lending decisions, potentially lowering your credit score, while soft inquiries do not impact your score and include personal credit checks or pre-approved offers. Understanding the distinction between these inquiries is crucial for managing credit applications and maintaining a healthy credit profile.

How Behavioral Analytics Enhances Credit Decisioning

Behavioral analytics enhances credit decisioning by analyzing real-time consumer actions, such as spending patterns and digital device usage, to provide a dynamic and accurate assessment of creditworthiness beyond traditional credit inquiries. This method enables lenders to detect fraud, predict default risk, and identify creditworthy individuals with thin or no credit files through insights derived from non-traditional data sources. Integrating behavioral analytics into credit eligibility checks improves risk management and enables more inclusive lending practices by leveraging machine learning algorithms that interpret complex behavior signals.

Impact of Credit Inquiries on Credit Scores

Credit inquiries, particularly hard inquiries, directly impact credit scores by temporarily lowering them, which can affect eligibility for new credit. Behavioral analytics offers a deeper understanding of creditworthiness by analyzing spending patterns and payment behaviors without the immediate score impact typical of credit inquiries. Combining credit inquiry data with behavioral analytics provides a comprehensive approach for lenders to assess risk more accurately and improve credit eligibility decisions.

Privacy and Data Concerns: Inquiries vs. Behavioral Analytics

Credit inquiries typically involve accessing an individual's credit report with consent, ensuring compliance with regulations like the Fair Credit Reporting Act (FCRA) to protect consumer privacy. Behavioral analytics collect data on user actions and patterns, raising concerns about transparency and potential misuse without explicit consent. Balancing credit inquiry accuracy with the privacy risks inherent in behavioral data collection is critical to maintaining consumer trust and regulatory compliance.

Speed and Accuracy: Comparing Eligibility Check Methods

Credit inquiry methods provide rapid access to an applicant's credit history, ensuring quick eligibility decisions but sometimes lacking depth in behavioral insights. Behavioral analytics leverage real-time data such as spending patterns and social interactions, enhancing accuracy in predicting creditworthiness while requiring more processing time. Combining both approaches can optimize speed and accuracy, enabling more reliable and efficient credit eligibility assessments.

Consumer Experience: Traditional vs. Behavioral Approaches

Credit inquiry processes rely on hard data from credit bureaus, which can delay eligibility checks and limit consumer insights to past financial behavior. Behavioral analytics leverage real-time data such as spending patterns, digital footprints, and social interactions, offering a dynamic and personalized eligibility assessment that enhances consumer experience. This approach reduces friction and increases approval accuracy by capturing holistic financial behavior beyond standard credit scores.

Financial Inclusion: The Role of Behavioral Analytics

Behavioral analytics leverages real-time transaction data, digital footprints, and spending patterns to assess creditworthiness beyond traditional credit inquiry methods, enabling a more inclusive evaluation of underserved populations. This approach reduces reliance on limited credit histories and empowers lenders to extend credit to individuals with thin or no credit files, enhancing financial inclusion. By incorporating machine learning models that analyze behavioral data, financial institutions can identify creditworthy applicants more accurately and responsibly.

Future Trends: Integrating Inquiries and Behavioral Data for Eligibility

Credit inquiries provide historical data on borrowing habits, while behavioral analytics evaluate real-time consumer actions to assess creditworthiness. Future trends emphasize integrating these datasets using AI-driven algorithms to enhance predictive accuracy and reduce default risks. This fusion enables lenders to create dynamic eligibility models that adapt to evolving financial behaviors and market conditions.

Related Important Terms

Soft Inquiry Pre-Screening

Soft inquiries in credit pre-screening allow lenders to evaluate eligibility without impacting the applicant's credit score, using limited credit report data and behavioral analytics to enhance decision accuracy. Behavioral analytics combine patterns from transaction history, spending habits, and online behavior, providing deeper insights beyond traditional credit inquiries for more precise risk assessment.

AI Behavioral Scoring

AI behavioral scoring leverages machine learning algorithms to analyze real-time user interactions and behavioral patterns, offering a dynamic and predictive approach to credit eligibility assessment beyond traditional credit inquiry data. This method enhances accuracy in risk evaluation by incorporating non-traditional data, reducing reliance on static credit reports and enabling more inclusive credit decisions.

Alternative Data Analytics

Credit inquiry relies on traditional credit reports and payment history, while behavioral analytics leverages alternative data like online activity, social media patterns, and transaction behavior to assess eligibility more comprehensively. Alternative data analytics enhances risk evaluation by identifying creditworthy individuals overlooked by conventional credit inquiries, improving access to financial services.

Continuous Eligibility Monitoring

Continuous eligibility monitoring leverages behavioral analytics to provide real-time insights into a consumer's creditworthiness by analyzing spending patterns, income changes, and financial habits beyond static credit inquiries. This dynamic approach enhances risk assessment accuracy and enables proactive decision-making for credit issuers.

Consent-Based Data Pull

Credit inquiry relies on consent-based data pull to access an individual's credit history for eligibility assessment, ensuring compliance with privacy regulations. Behavioral analytics complements this by analyzing user behavior patterns without infringing on consent, providing deeper insights into creditworthiness while maintaining data privacy.

Transaction Pattern Recognition

Credit inquiry analyzes historical credit reports and payment histories to assess eligibility, while behavioral analytics leverages transaction pattern recognition to detect real-time spending habits and predict financial behavior. Integrating transaction pattern recognition enhances accuracy in eligibility checks by identifying anomalies and spending trends that traditional credit inquiries might overlook.

Real-Time Credit Assessment

Real-time credit assessment leverages credit inquiries to access traditional credit history, while behavioral analytics analyzes transactional patterns and spending behavior for dynamic eligibility evaluation. Combining both methods enhances accuracy by integrating static credit data with real-time behavioral insights, enabling more precise risk management and faster decision-making in credit approvals.

Post-Bureau Risk Profiling

Credit inquiry provides a snapshot of a borrower's credit history by accessing traditional credit bureau data, while behavioral analytics leverages real-time transaction patterns and digital footprints to offer a dynamic and predictive eligibility assessment. Post-bureau risk profiling enhances accuracy by integrating behavioral data with credit inquiries, reducing default rates and enabling more precise lending decisions.

Machine Learning Risk Signals

Credit inquiry captures traditional credit report data revealing past loans and repayment history, while behavioral analytics leverages machine learning risk signals to analyze real-time user interactions and spending patterns for more dynamic eligibility assessments. Machine learning models process diverse data points, such as transaction frequency and device usage, enhancing accuracy in predicting creditworthiness beyond static credit inquiries.

Psuedonymous Identity Analytics

Credit inquiry primarily involves evaluating an individual's financial history through traditional data sources, while behavioral analytics leverages pseudonymous identity analytics to assess eligibility by analyzing patterns and behaviors without directly revealing personal identifiers. This approach enhances privacy compliance and enables more accurate risk assessment by correlating anonymized behavioral signals with creditworthiness.

Credit Inquiry vs Behavioral Analytics for eligibility check. Infographic

moneydiff.com

moneydiff.com