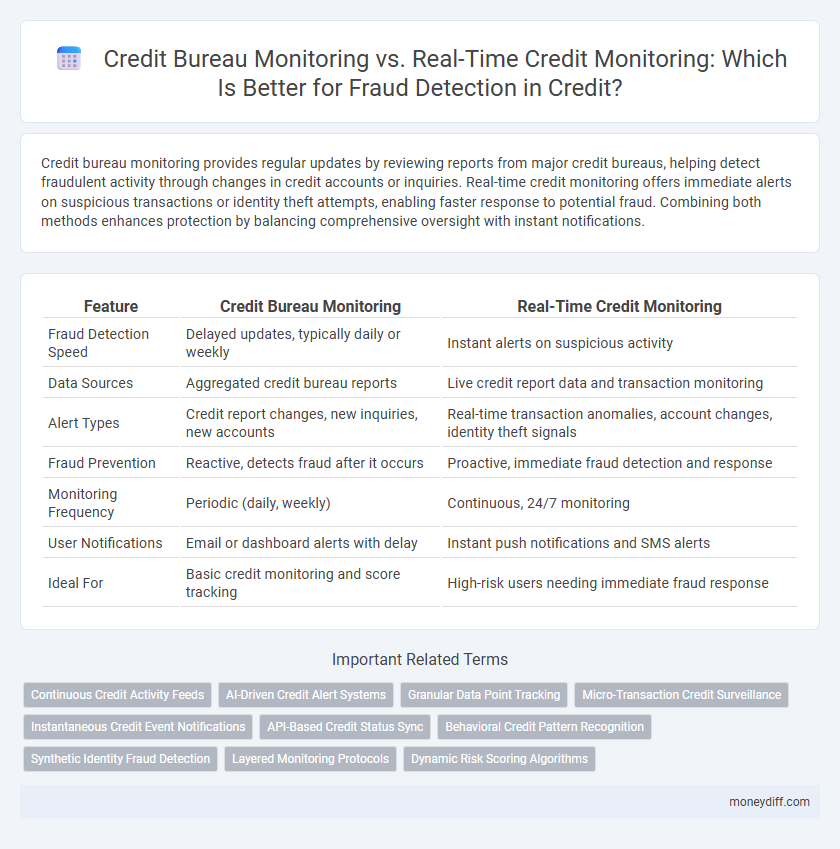

Credit bureau monitoring provides regular updates by reviewing reports from major credit bureaus, helping detect fraudulent activity through changes in credit accounts or inquiries. Real-time credit monitoring offers immediate alerts on suspicious transactions or identity theft attempts, enabling faster response to potential fraud. Combining both methods enhances protection by balancing comprehensive oversight with instant notifications.

Table of Comparison

| Feature | Credit Bureau Monitoring | Real-Time Credit Monitoring |

|---|---|---|

| Fraud Detection Speed | Delayed updates, typically daily or weekly | Instant alerts on suspicious activity |

| Data Sources | Aggregated credit bureau reports | Live credit report data and transaction monitoring |

| Alert Types | Credit report changes, new inquiries, new accounts | Real-time transaction anomalies, account changes, identity theft signals |

| Fraud Prevention | Reactive, detects fraud after it occurs | Proactive, immediate fraud detection and response |

| Monitoring Frequency | Periodic (daily, weekly) | Continuous, 24/7 monitoring |

| User Notifications | Email or dashboard alerts with delay | Instant push notifications and SMS alerts |

| Ideal For | Basic credit monitoring and score tracking | High-risk users needing immediate fraud response |

Understanding Credit Bureau Monitoring

Credit Bureau Monitoring involves regularly reviewing reports from major credit bureaus--Equifax, Experian, and TransUnion--to track changes in credit history and detect unusual activities. It provides alerts on new credit inquiries, accounts opened, or changes to personal information, helping identify potential identity theft or fraud early. This monitoring method relies on periodic updates rather than continuous real-time data, offering a comprehensive overview of credit health over time.

Real-Time Credit Monitoring: An Overview

Real-Time Credit Monitoring provides immediate alerts on changes to your credit report, enabling swift action against potential fraud or identity theft. Unlike traditional Credit Bureau Monitoring that updates reports periodically, real-time services continuously track credit activity across multiple bureaus. This proactive approach enhances fraud detection by flagging suspicious transactions or inquiries as they happen, minimizing financial risk.

Key Differences Between Credit Bureau and Real-Time Monitoring

Credit bureau monitoring provides periodic updates based on data aggregated from major credit reporting agencies, helping detect fraud through alerts on changes to credit reports such as new accounts or inquiries. Real-time credit monitoring offers instantaneous notifications by continuously scanning credit activity, enabling quicker response to unauthorized transactions or identity theft. The key difference lies in timing, with credit bureau monitoring offering batch updates and real-time monitoring delivering immediate alerts for faster fraud detection.

How Credit Bureau Monitoring Detects Fraud

Credit bureau monitoring detects fraud by regularly reviewing credit reports from major bureaus to identify unusual activities such as new account openings, hard inquiries, or changes in personal information. This process enables early detection of identity theft or fraudulent credit applications before significant damage occurs. By alerting consumers to these discrepancies, credit bureau monitoring helps maintain accurate credit profiles and prevent further unauthorized actions.

The Role of Real-Time Monitoring in Fraud Prevention

Real-time credit monitoring plays a crucial role in fraud prevention by instantly alerting consumers to suspicious activities such as unauthorized account openings or significant changes in credit reports. Unlike traditional credit bureau monitoring, which updates information periodically and may delay detection, real-time systems provide continuous surveillance and immediate notifications. This immediacy enables quicker responses to potential fraud, minimizing financial damage and enhancing credit security.

Speed and Accuracy: Comparing Detection Capabilities

Real-time credit monitoring offers superior speed and accuracy by instantly alerting users to suspicious activity as it occurs, while credit bureau monitoring relies on periodic updates that may delay fraud detection. The immediate data syncing in real-time systems enhances timely responses, reducing financial losses from identity theft or unauthorized transactions. Credit bureau monitoring provides comprehensive historical credit data but lacks the rapid alert mechanisms essential for proactive fraud prevention.

Pros and Cons of Credit Bureau Monitoring

Credit Bureau Monitoring provides a comprehensive overview of credit reports from major bureaus like Equifax, TransUnion, and Experian, allowing users to detect discrepancies and potential fraud based on periodic updates. Its main advantage lies in aggregating data from multiple sources for a broader perspective, but the drawback is the lag in data refresh intervals that can delay fraud detection. Unlike real-time monitoring, it may not immediately alert users to unauthorized transactions, potentially increasing the window of vulnerability.

Advantages and Limitations of Real-Time Monitoring

Real-time credit monitoring offers immediate alerts on suspicious activities, allowing for faster fraud detection compared to traditional credit bureau monitoring, which updates less frequently. This proactive approach helps consumers quickly address identity theft but may generate false alarms due to constant tracking of transactions. Limitations include higher costs and potential data privacy concerns since real-time systems continuously access personal financial information.

Choosing the Right Credit Monitoring Solution for Fraud Detection

Credit Bureau Monitoring provides periodic updates from major credit bureaus, offering a comprehensive overview of credit changes but may delay fraud alerts. Real-Time Credit Monitoring delivers instant notifications of suspicious activities, enabling quicker responses to potential identity theft. Choosing the right solution depends on the need for timely fraud detection versus broader credit report tracking.

Emerging Trends in Credit Monitoring Technologies

Emerging trends in credit monitoring technologies highlight the shift from traditional credit bureau monitoring to real-time credit monitoring for enhanced fraud detection. Real-time credit monitoring utilizes instant data feeds and AI algorithms to detect suspicious activities the moment they occur, providing faster alerts compared to periodic credit bureau reports. Advanced machine learning models and biometric authentication are increasingly integrated into these systems, improving accuracy in identifying identity theft and fraudulent credit inquiries.

Related Important Terms

Continuous Credit Activity Feeds

Continuous credit activity feeds enable real-time credit monitoring to detect fraud more swiftly than traditional credit bureau monitoring, which relies on periodic data updates. By leveraging live data streams, real-time credit monitoring offers instantaneous alerts on suspicious activities, enhancing proactive fraud prevention.

AI-Driven Credit Alert Systems

AI-driven credit alert systems enhance fraud detection by analyzing patterns across credit bureau monitoring data and real-time credit activity, enabling immediate identification of suspicious transactions. These systems leverage machine learning algorithms to provide proactive notifications, reducing financial damage and improving credit security for consumers.

Granular Data Point Tracking

Real-time credit monitoring provides granular data point tracking by continuously analyzing credit file changes, enabling immediate detection of suspicious activity such as new account openings or sudden balance shifts. Credit bureau monitoring typically delivers periodic updates that may miss subtle fraud indicators, making real-time solutions superior for proactive credit fraud detection and timely alerts.

Micro-Transaction Credit Surveillance

Credit Bureau Monitoring aggregates historical credit data from multiple sources to detect anomalies and suspicious patterns, while Real-Time Credit Monitoring provides immediate alerts on micro-transaction credit activities, enabling faster identification of potentially fraudulent small transactions. Micro-Transaction Credit Surveillance leverages real-time analytics and AI algorithms to monitor high volumes of low-value transactions, enhancing fraud detection accuracy and reducing financial losses.

Instantaneous Credit Event Notifications

Real-time credit monitoring provides instantaneous credit event notifications, enabling immediate alerts for suspicious activities such as new inquiries or account openings. Credit bureau monitoring, while comprehensive, often delivers delayed updates that may impede prompt fraud detection and prevention.

API-Based Credit Status Sync

API-based credit status sync enables real-time credit monitoring by continuously updating credit activity and fraud alerts, reducing the lag inherent in traditional credit bureau monitoring that relies on periodic data pulls. This seamless integration empowers lenders and consumers with instantaneous insights into credit changes, enhancing fraud detection and credit risk management accuracy.

Behavioral Credit Pattern Recognition

Credit bureau monitoring typically analyzes historical credit reports to identify patterns of potential fraud, relying on periodic data updates, while real-time credit monitoring employs behavioral credit pattern recognition to detect anomalies instantly by continuously tracking transactions and credit activities. Behavioral credit pattern recognition enhances fraud detection accuracy by leveraging machine learning algorithms to identify unusual activities that deviate from established credit usage trends, offering proactive protection against identity theft and fraudulent accounts.

Synthetic Identity Fraud Detection

Credit bureau monitoring provides regular updates on traditional credit activities, while real-time credit monitoring offers immediate alerts for suspicious activities, enhancing the detection of synthetic identity fraud by identifying discrepancies as they occur. Utilizing advanced algorithms and machine learning, real-time systems analyze multiple data points instantly, making them more effective in preventing synthetic identities from establishing fraudulent credit profiles.

Layered Monitoring Protocols

Layered monitoring protocols combine Credit Bureau Monitoring, which periodically reviews credit reports for significant changes, with Real-Time Credit Monitoring that instantly detects fraudulent transactions or inquiries. This dual approach enhances fraud detection accuracy by leveraging historical credit data analysis alongside immediate alerts to suspicious activity.

Dynamic Risk Scoring Algorithms

Dynamic risk scoring algorithms enhance real-time credit monitoring by continuously analyzing transactional data to detect fraudulent activity instantly, while traditional credit bureau monitoring relies on periodic updates that may delay fraud detection. These advanced algorithms leverage machine learning models to assess risk factors dynamically, providing more accurate and timely alerts compared to static credit report evaluations.

Credit Bureau Monitoring vs Real-Time Credit Monitoring for fraud detection. Infographic

moneydiff.com

moneydiff.com