Analyzing credit limit alongside spend behavior provides a comprehensive risk assessment by identifying patterns of overspending or consistent underutilization. Evaluating the alignment between assigned credit limits and actual spending habits helps detect potential financial stress or misuse. This approach enhances fraud detection and creditworthiness evaluation by integrating dynamic behavioral data with static credit thresholds.

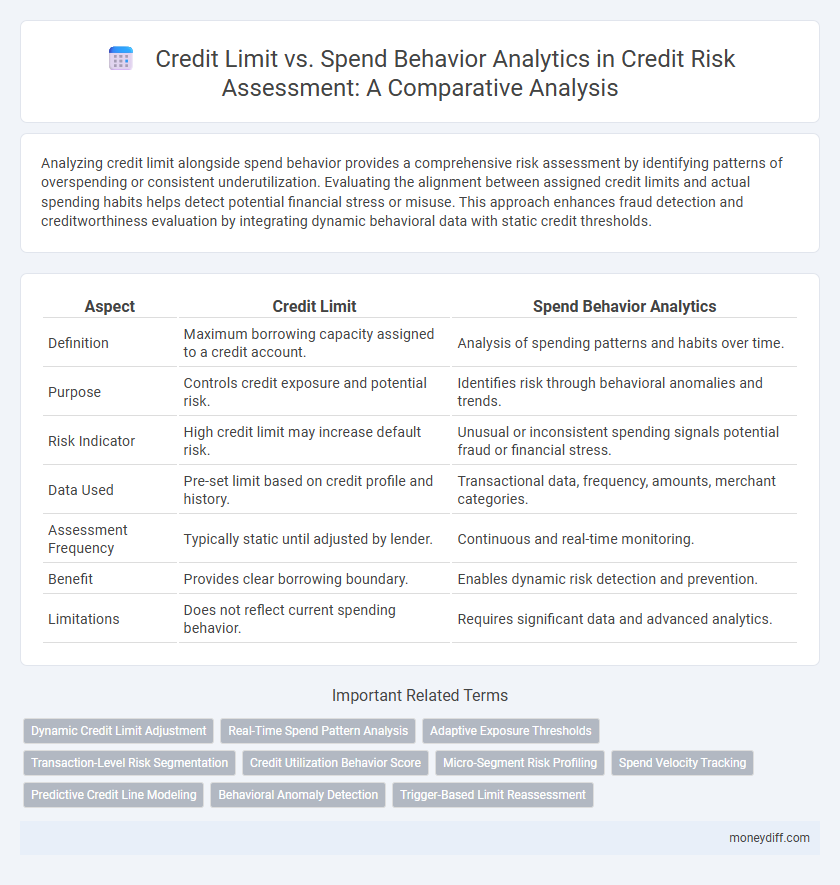

Table of Comparison

| Aspect | Credit Limit | Spend Behavior Analytics |

|---|---|---|

| Definition | Maximum borrowing capacity assigned to a credit account. | Analysis of spending patterns and habits over time. |

| Purpose | Controls credit exposure and potential risk. | Identifies risk through behavioral anomalies and trends. |

| Risk Indicator | High credit limit may increase default risk. | Unusual or inconsistent spending signals potential fraud or financial stress. |

| Data Used | Pre-set limit based on credit profile and history. | Transactional data, frequency, amounts, merchant categories. |

| Assessment Frequency | Typically static until adjusted by lender. | Continuous and real-time monitoring. |

| Benefit | Provides clear borrowing boundary. | Enables dynamic risk detection and prevention. |

| Limitations | Does not reflect current spending behavior. | Requires significant data and advanced analytics. |

Understanding Credit Limits in Risk Assessment

Understanding credit limits is crucial for accurate risk assessment, as they represent the maximum amount a borrower can utilize on a credit account. Analyzing spend behavior against these limits reveals patterns such as frequency of maximum usage, sudden spikes in expenditures, or consistent underutilization, which serve as key indicators of financial discipline and potential default risk. Integrating credit limit data with spend behavior analytics enhances predictive accuracy in credit scoring models, enabling lenders to tailor credit offerings and mitigate risk effectively.

The Impact of Spend Behavior on Credit Risk

Analyzing spend behavior provides critical insights into credit risk by revealing patterns of overspending or irregular transactions that indicate higher default probability. Credit limit adjustments based on detailed spend behavior analytics enable lenders to mitigate risk by aligning credit exposure with actual borrower risk profiles. Incorporating transaction frequency, average expenditures, and payment consistency enhances the accuracy of credit risk assessments and informs dynamic credit limit management strategies.

Comparing Credit Limits and Spend Patterns

Comparing credit limits and spend patterns enhances risk assessment by revealing discrepancies between approved credit lines and actual consumer behavior. Analyzing spend behavior analytics highlights whether users consistently stay within their credit limits or frequently approach or exceed them, signaling potential default risks. Integrating these insights enables lenders to tailor credit limits more accurately and implement proactive risk management strategies.

Key Metrics in Credit Limit Analysis

Credit limit analysis utilizes key metrics such as utilization rate, payment history, and average monthly spend to assess borrower risk effectively. Monitoring spend behavior analytics, including transaction frequency and spending patterns, helps identify potential overextension and credit misuse. Combining these data points enhances predictive accuracy for default risk and informs better credit limit adjustments.

Behavioral Analytics for Credit Management

Behavioral analytics in credit management leverages spend behavior data to refine credit limit assessments, detecting patterns that predict repayment risks and potential defaults more accurately. Analyzing transaction frequency, category spend, and payment punctuality helps financial institutions tailor credit limits to individual risk profiles, thereby minimizing exposure. Integrating behavioral insights enhances predictive models, facilitating proactive risk mitigation and personalized credit offerings.

Identifying Risk Through Spend Behavior

Analyzing spend behavior provides critical insights into customer risk by revealing patterns of overutilization relative to credit limits, indicating potential financial distress. Behavioral analytics track deviations such as frequent maxing out of credit limits or sudden spikes in spending, which correlate strongly with increased default probabilities. Integrating these data points with credit limit parameters enhances predictive risk models, enabling proactive credit management and reduced exposure to bad debt.

Machine Learning in Credit Risk Evaluation

Machine learning models analyze credit limit utilization patterns and spending behavior to enhance risk assessment accuracy in credit evaluation. By processing large datasets of transaction histories and credit usage, these algorithms identify hidden correlations and predict potential default risks more effectively than traditional methods. Integrating spend behavior analytics with credit limit data enables dynamic risk scoring, improving credit decision-making and minimizing financial losses.

Optimizing Credit Limits with Data-Driven Insights

Optimizing credit limits using spend behavior analytics enhances risk assessment accuracy by identifying patterns of high-risk transactions and payment consistency. Data-driven insights enable lenders to adjust credit limits proactively, minimizing default probability while maximizing customer credit utilization. Leveraging machine learning algorithms on transaction data refines credit scoring models, supporting more precise and dynamic credit limit management.

Challenges in Analyzing Credit and Spending Data

Analyzing credit limits and spend behavior presents challenges due to data variability, inconsistent transaction categorization, and dynamic consumer habits that complicate risk assessment models. Incomplete or delayed data can distort credit risk predictions and hinder timely decision-making. Accurate integration of real-time spend analytics with static credit limits remains a critical obstacle for effective credit risk management.

Future Trends in Credit Risk Analytics

Advanced credit risk analytics increasingly leverage credit limit utilizations and spend behavior patterns to predict default probabilities more accurately. Machine learning models analyze real-time transaction data and credit limit adjustments to identify potential risks before they manifest. Future trends emphasize integrating alternative data sources and behavioral insights to enhance the precision of credit risk assessments and optimize credit limit management.

Related Important Terms

Dynamic Credit Limit Adjustment

Dynamic credit limit adjustment leverages spend behavior analytics to continuously monitor transaction patterns, enabling real-time risk assessment and personalized credit limit updates. This approach reduces default rates by aligning credit exposure with evolving consumer financial behavior and spending capacity.

Real-Time Spend Pattern Analysis

Real-time spend pattern analysis uses credit limit data alongside transaction frequency and amount to identify deviations in customer behavior that signal potential credit risk. This dynamic approach enables lenders to adjust risk assessments instantly, improving fraud detection and reducing default rates.

Adaptive Exposure Thresholds

Adaptive exposure thresholds leverage real-time spend behavior analytics to dynamically adjust credit limits, enhancing risk assessment accuracy by identifying deviations from typical expenditure patterns. This approach minimizes default risk by tailoring credit exposure based on individual spending habits and market conditions.

Transaction-Level Risk Segmentation

Transaction-level risk segmentation leverages credit limit utilization patterns and detailed spend behavior analytics to identify high-risk clients with precision. Analyzing variations in transaction amounts, frequency, and merchant types enables dynamic risk assessments that enhance credit limit management and reduce default rates.

Credit Utilization Behavior Score

Credit Utilization Behavior Score provides a nuanced analysis of spend patterns relative to the assigned credit limit, enabling more precise risk assessment by identifying tendencies such as constant near-limit spending or strategic low utilization. This metric improves predictive accuracy for default risk by correlating credit limit usage with historical repayment behavior and identifying anomalous spend behaviors.

Micro-Segment Risk Profiling

Micro-segment risk profiling leverages credit limit data and spend behavior analytics to accurately assess borrower risk by identifying unique patterns within narrowly defined customer groups. This approach enhances predictive precision in credit risk management by correlating adjustable credit limits with real-time transaction behaviors at a granular level.

Spend Velocity Tracking

Spend velocity tracking analyzes the frequency and amount of transactions within a specific period to detect unusual spending patterns that may indicate risk. Integrating spend velocity metrics with credit limit data enhances risk assessment accuracy by identifying rapid expenditure spikes that exceed typical credit utilization thresholds.

Predictive Credit Line Modeling

Predictive credit line modeling leverages spend behavior analytics to dynamically adjust credit limits based on real-time transaction patterns, reducing default risk and optimizing credit utilization. By integrating machine learning algorithms with historical spending data, lenders enhance risk assessment accuracy and proactively manage credit exposure.

Behavioral Anomaly Detection

Credit limit adjustments based on spend behavior analytics enhance risk assessment by identifying deviations from typical spending patterns that signal potential credit misuse or fraud. Behavioral anomaly detection algorithms analyze transaction frequency, amount, and category shifts to provide early warnings of financial distress or fraudulent activity, enabling proactive credit risk management.

Trigger-Based Limit Reassessment

Trigger-based limit reassessment leverages real-time spend behavior analytics to dynamically adjust credit limits, enhancing risk assessment accuracy by identifying abnormal transaction patterns and potential fraud. Integrating expenditure anomalies and timely credit limit modifications minimizes default risk and optimizes portfolio performance.

Credit Limit vs Spend Behavior Analytics for risk assessment. Infographic

moneydiff.com

moneydiff.com