Installment loans require fixed monthly payments over a set period, offering predictable budgeting but less flexibility if income fluctuates. Income-linked repayment loans adjust monthly payments based on income, providing relief during lower-earning periods and reducing the risk of default. Choosing between these options depends on financial stability and the borrower's ability to manage consistent versus variable payments.

Table of Comparison

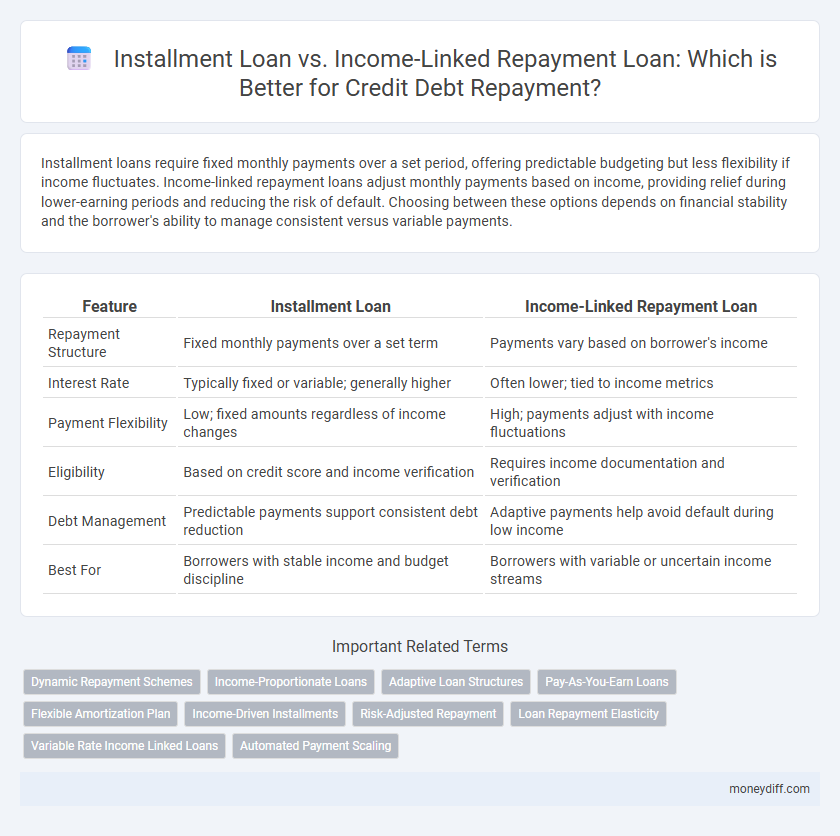

| Feature | Installment Loan | Income-Linked Repayment Loan |

|---|---|---|

| Repayment Structure | Fixed monthly payments over a set term | Payments vary based on borrower's income |

| Interest Rate | Typically fixed or variable; generally higher | Often lower; tied to income metrics |

| Payment Flexibility | Low; fixed amounts regardless of income changes | High; payments adjust with income fluctuations |

| Eligibility | Based on credit score and income verification | Requires income documentation and verification |

| Debt Management | Predictable payments support consistent debt reduction | Adaptive payments help avoid default during low income |

| Best For | Borrowers with stable income and budget discipline | Borrowers with variable or uncertain income streams |

Understanding Installment Loans: Key Features and Structure

Installment loans provide borrowers with a fixed loan amount repaid over a set period through regular, predetermined payments combining principal and interest. These loans feature consistent monthly payments, a fixed interest rate, and a structured repayment schedule, offering predictability and budget management ease. Key characteristics include the loan term length, credit score impact, and typically lower interest rates compared to revolving credit.

What Is an Income-Linked Repayment Loan?

An income-linked repayment loan adjusts monthly payments based on the borrower's current income, making debt management more flexible compared to fixed installment loans. Unlike traditional installment loans that require fixed monthly payments regardless of financial changes, income-linked loans reduce financial strain during periods of low income. This mechanism helps borrowers maintain repayment schedules without defaulting, promoting long-term credit stability.

Qualification Criteria: Installment vs Income-Linked Loans

Installment loans require borrowers to meet specific credit score thresholds, steady income verification, and often a low debt-to-income ratio for qualification. Income-linked repayment loans prioritize income documentation and employment status over credit scores, offering more flexible qualification criteria based on earnings relative to loan payments. Understanding these distinct qualification requirements helps borrowers select the optimal debt repayment solution tailored to their financial situation.

Flexibility in Monthly Payments: A Comparative View

Installment loans offer fixed monthly payments, providing predictability but limited flexibility for borrowers with fluctuating incomes. Income-linked repayment loans adjust monthly payments based on the borrower's earnings, enhancing payment flexibility and reducing financial stress during low-income periods. This adaptability can be crucial for debt management, especially for those with variable or seasonal income streams.

Impact on Borrower’s Financial Stability

Installment loans offer predictable monthly payments that help borrowers maintain consistent cash flow, reducing the risk of missed payments and credit score damage. Income-linked repayment loans adjust monthly payments based on the borrower's earnings, providing flexibility that aligns debt obligations with actual income fluctuations. Income-contingent plans can prevent financial distress during income drops, but may result in a longer repayment timeline and potentially higher total interest costs.

Interest Rates and Long-Term Costs

Installment loans typically feature fixed interest rates, offering predictable monthly payments but potentially higher long-term costs due to accumulated interest over the loan term. Income-linked repayment loans adjust payments based on the borrower's earnings, often resulting in lower initial interest rates and reduced financial strain, though total interest paid can vary depending on income fluctuations. Borrowers aiming to minimize interest expenses should compare the effective interest rates and projected repayment timelines of both loan types to determine the most cost-efficient option.

Pros and Cons of Installment Loans

Installment loans offer fixed monthly payments and a defined repayment schedule, making budgeting predictable for borrowers managing debt repayment. However, rigid payment terms may strain finances during periods of income fluctuation, increasing the risk of missed payments or default. These loans typically have higher interest rates compared to income-linked repayment loans, which adjust repayments based on earnings to provide more flexibility.

Pros and Cons of Income-Linked Repayment Loans

Income-linked repayment loans offer the advantage of flexible monthly payments that adjust according to the borrower's income, reducing the risk of default during financial hardships and providing a more manageable debt repayment plan. However, these loans may result in higher overall interest costs and extended repayment periods compared to fixed installment loans, potentially increasing the total financial burden. Borrowers should carefully evaluate their income stability and long-term repayment capacity before opting for income-linked repayment loans to ensure alignment with their financial goals.

Which Loan Type Fits Different Debt Repayment Scenarios?

Installment loans offer fixed monthly payments and predictable repayment schedules, making them ideal for borrowers with stable income who prefer consistent budgeting. Income-linked repayment loans adjust monthly payments based on the borrower's earnings, providing flexibility during periods of fluctuating income or financial hardship. Choosing between these loan types depends on income stability and repayment capacity, with installment loans suited for steady earners and income-linked options beneficial for borrowers with variable income streams.

Choosing the Right Loan for Your Money Management Goals

Installment loans offer fixed monthly payments over a set period, providing predictable budgeting for debt repayment, while income-linked repayment loans adjust payments based on your earnings, offering flexibility during income fluctuations. Choosing the right loan depends on your financial stability and cash flow consistency; fixed installment loans suit those with steady income, whereas income-linked repayment plans benefit borrowers expecting variable income or temporary financial hardship. Evaluating interest rates, repayment terms, and personal financial goals ensures optimal money management and debt reduction strategies.

Related Important Terms

Dynamic Repayment Schemes

Installment loans offer fixed monthly payments over a set term, providing predictable debt repayment schedules, while income-linked repayment loans adjust payments based on the borrower's earnings, enhancing flexibility and reducing the risk of default during income fluctuations. Dynamic repayment schemes like income-linked loans cater to variable financial situations, aligning debt obligations with real-time income changes and promoting sustainable debt management.

Income-Proportionate Loans

Income-proportionate loans adjust monthly payments based on a borrower's income, providing flexibility and reducing the risk of default compared to fixed installment loans with set payment amounts. These loans are especially beneficial for individuals with variable earnings, ensuring debt repayment remains manageable and aligned with financial capacity.

Adaptive Loan Structures

Installment loans offer fixed monthly payments, providing predictable budgeting for debt repayment, while income-linked repayment loans adjust payments based on earnings, ensuring flexibility during income fluctuations. Adaptive loan structures optimize financial management by aligning repayment obligations with borrowers' economic realities, reducing default risk and improving long-term credit stability.

Pay-As-You-Earn Loans

Pay-As-You-Earn (PAYE) loans adjust monthly repayments based on borrower income, offering flexible debt management compared to fixed installment loans with predetermined payment schedules. This income-linked approach reduces financial strain during low-earning periods, enhancing affordability and minimizing default risks in debt repayment strategies.

Flexible Amortization Plan

Installment loans provide fixed monthly payments with a predetermined amortization schedule, ensuring consistent repayment amounts over the loan term. Income-linked repayment loans offer a flexible amortization plan by adjusting monthly payments based on the borrower's income, helping to manage debt more effectively during financial fluctuations.

Income-Driven Installments

Income-driven installment loans adjust monthly payments based on the borrower's income and family size, providing flexibility and reducing the risk of default by aligning repayment with financial capacity. Unlike fixed installment loans, this approach ensures that loan burdens remain manageable during income fluctuations, promoting long-term debt sustainability.

Risk-Adjusted Repayment

Installment loans offer fixed repayment amounts that simplify budgeting but may strain borrowers with fluctuating income, increasing default risk in economic downturns. Income-linked repayment loans adjust payments based on earnings, reducing financial stress and lowering risk-adjusted repayment burdens by aligning debt service with borrower capacity.

Loan Repayment Elasticity

Installment loans offer fixed monthly payments, providing predictable debt repayment schedules but limited flexibility when income fluctuates, resulting in lower loan repayment elasticity. Income-linked repayment loans adjust payments based on borrower earnings, increasing repayment elasticity and reducing default risk during income volatility by aligning loan obligations with actual financial capacity.

Variable Rate Income Linked Loans

Variable Rate Income-Linked Loans adjust repayments based on the borrower's fluctuating income, offering flexibility compared to fixed installments in traditional installment loans. This dynamic structure helps manage debt more sustainably by aligning payment amounts with real-time earnings, reducing default risk during income variability.

Automated Payment Scaling

Installment loans offer fixed monthly payments that remain constant regardless of income fluctuations, providing predictable debt repayment schedules. Income-linked repayment loans utilize automated payment scaling, adjusting monthly amounts based on the borrower's income changes to ensure affordability and reduce default risk.

Installment Loan vs Income-Linked Repayment Loan for debt repayment. Infographic

moneydiff.com

moneydiff.com