Secured credit relies on traditional assets like real estate or vehicles as collateral, offering lenders tangible security and often lower interest rates. Crypto-backed credit uses digital assets such as Bitcoin or Ethereum, providing faster access to funds and flexible repayment options but with higher volatility risk. Understanding the stability and liquidity differences between secured and crypto-backed collateral is crucial for maximizing credit benefits while managing potential financial exposure.

Table of Comparison

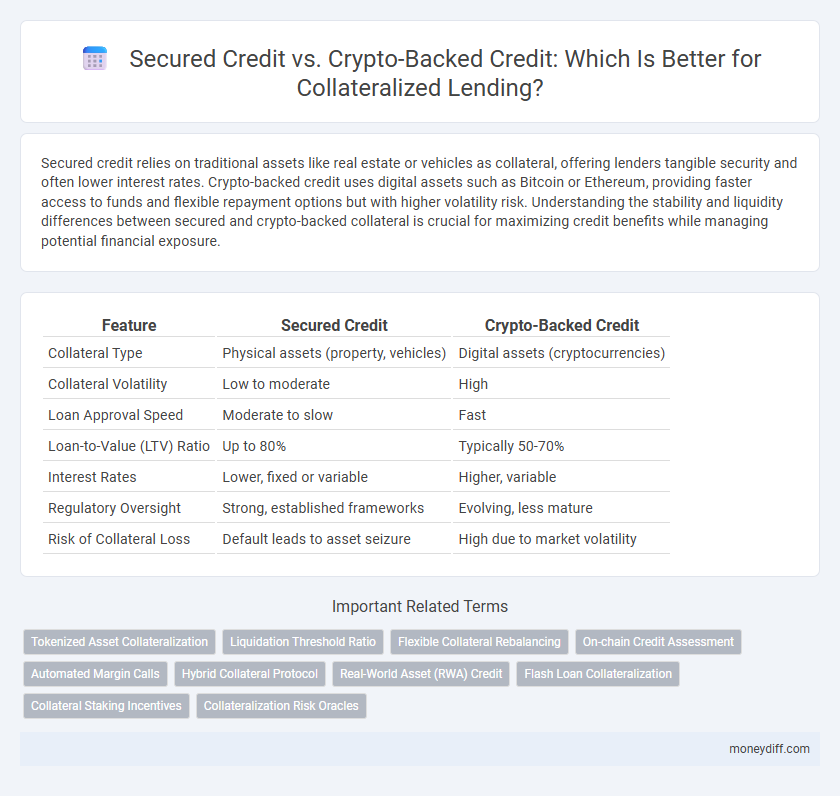

| Feature | Secured Credit | Crypto-Backed Credit |

|---|---|---|

| Collateral Type | Physical assets (property, vehicles) | Digital assets (cryptocurrencies) |

| Collateral Volatility | Low to moderate | High |

| Loan Approval Speed | Moderate to slow | Fast |

| Loan-to-Value (LTV) Ratio | Up to 80% | Typically 50-70% |

| Interest Rates | Lower, fixed or variable | Higher, variable |

| Regulatory Oversight | Strong, established frameworks | Evolving, less mature |

| Risk of Collateral Loss | Default leads to asset seizure | High due to market volatility |

Understanding Secured Credit: Traditional Collateral Explained

Secured credit relies on tangible assets like real estate, vehicles, or savings accounts as collateral, providing lenders with a lower risk profile and borrowers with potentially better interest rates. Traditional collateral involves legally binding agreements ensuring the lender's claim on the asset if the borrower defaults, enhancing creditworthiness. This method contrasts with crypto-backed credit, which uses volatile digital assets, making secured credit a preferred option for stability and predictable valuation.

What Is Crypto-Backed Credit?

Crypto-backed credit leverages digital assets like Bitcoin or Ethereum as collateral to secure loans, enabling borrowers to access liquidity without selling their holdings. Unlike traditional secured credit that relies on physical assets such as real estate or vehicles, crypto-backed credit offers faster approval processes and global accessibility. The volatility inherent in cryptocurrencies requires lenders to implement strict loan-to-value ratios and margin calls to manage risk effectively.

Key Differences Between Secured and Crypto-Backed Credit

Secured credit involves borrowing money using traditional assets such as real estate or vehicles as collateral, offering lenders tangible security and typically lower interest rates. Crypto-backed credit uses digital assets like Bitcoin or Ethereum as collateral, enabling faster approval and more flexible borrowing but with higher volatility risk due to fluctuating crypto values. Key differences include asset type, risk exposure, and lender requirements, impacting accessibility and loan terms for borrowers.

Advantages of Traditional Secured Credit

Traditional secured credit offers lower interest rates due to the tangible assets used as collateral, such as real estate or vehicles, which reduces lender risk. It provides established legal frameworks and predictable liquidation processes, enhancing borrower confidence and stability. This credit type also benefits from widespread acceptance and regulatory oversight, ensuring greater consumer protection and accessibility.

Benefits of Using Cryptocurrency as Collateral

Using cryptocurrency as collateral in credit transactions offers increased liquidity and faster access to funds compared to traditional secured credit that relies on physical assets. Crypto-backed credit provides enhanced transparency and reduced risk through blockchain technology, ensuring immutable records and real-time valuation of collateral. This form of credit also enables fractional collateralization, allowing borrowers to leverage smaller amounts of digital assets for larger loans, optimizing capital efficiency.

Risks Associated with Secured Credit Loans

Secured credit loans typically involve assets such as real estate or vehicles as collateral, which carry market volatility and the risk of asset depreciation impacting loan recovery. Borrowers face the danger of foreclosure or repossession if they default, potentially leading to significant financial loss and damaged credit scores. Unlike crypto-backed credit, which is subject to extreme cryptocurrency price fluctuations causing rapid collateral value shifts, secured credit risks are generally tied to more stable but still vulnerable traditional asset markets.

Volatility and Security Risks in Crypto-Backed Credit

Secured credit relies on traditional assets like real estate or vehicles, offering stable collateral with low volatility and predictable risk. Crypto-backed credit uses digital assets as collateral, which are highly volatile and can rapidly lose value, increasing the risk of margin calls or liquidation. Security risks in crypto-backed credit also stem from potential hacking, smart contract vulnerabilities, and regulatory uncertainties.

Eligibility and Approval Process: Secured vs Crypto-Backed Credit

Secured credit typically requires a tangible asset like a home or vehicle as collateral, with eligibility based heavily on credit history and income verification, leading to a standardized and often slower approval process. Crypto-backed credit uses digital assets such as Bitcoin or Ethereum as collateral, offering faster approval but demands understanding of cryptocurrency volatility and wallet management, which may limit eligibility to crypto holders. Institutions often implement automated risk assessment algorithms for crypto-backed loans, contrasting with the traditional underwriting procedures of secured credit.

Which Collateral Type Offers Better Interest Rates?

Secured credit typically offers lower interest rates due to the stability and lower risk associated with traditional collateral such as real estate or vehicles. Crypto-backed credit often incurs higher rates because of the volatility and regulatory uncertainties surrounding digital assets. Lenders price the risk of asset depreciation and liquidity challenges, making secured credit more favorable for borrowers seeking better interest rates.

Choosing the Right Collateral for Your Financial Needs

Secured credit relies on traditional assets like real estate or vehicles as collateral, offering stability and predictable valuation, while crypto-backed credit uses digital assets such as Bitcoin or Ethereum, providing faster access but subject to high market volatility. Selecting the right collateral depends on your risk tolerance; real estate offers lower risk but slower liquidation, whereas crypto-backed loans offer liquidity with increased price fluctuations. Evaluate your financial goals and market conditions to ensure collateral aligns with your repayment ability and long-term strategy.

Related Important Terms

Tokenized Asset Collateralization

Tokenized asset collateralization in crypto-backed credit leverages blockchain technology to convert digital assets into liquid collateral, enhancing transparency and reducing fraud risk compared to traditional secured credit which relies on physical or non-tokenized assets. This innovation allows fractional collateralization, increasing access to credit markets by enabling smaller investors to use tokenized assets as collateral more efficiently than conventional secured credit systems.

Liquidation Threshold Ratio

Secured credit typically features a stable liquidation threshold ratio set by traditional financial institutions, often around 70-80%, ensuring predictable collateral liquidation during default. Crypto-backed credit exhibits more volatile liquidation threshold ratios, ranging from 50% to 75%, due to rapid cryptocurrency price fluctuations impacting collateral value and liquidation risk.

Flexible Collateral Rebalancing

Secured credit allows flexible collateral rebalancing by adjusting asset types like real estate or vehicles to maintain loan-to-value ratios, enhancing risk management. Crypto-backed credit offers dynamic collateral rebalancing through automated smart contracts that adapt to volatile digital asset valuations, ensuring continuous loan security.

On-chain Credit Assessment

Secured credit relies on traditional collateral such as real estate or vehicles, while crypto-backed credit uses digital assets like cryptocurrencies held on blockchain as collateral, enabling real-time, transparent on-chain credit assessment. On-chain credit assessment leverages smart contracts and decentralized finance (DeFi) protocols to accurately evaluate borrower risk and collateral value through immutable blockchain data.

Automated Margin Calls

Secured credit relies on traditional assets like real estate or vehicles as collateral, enabling automated margin calls based on established credit risk models and real-time asset valuations. Crypto-backed credit utilizes volatile digital assets as collateral, triggering automated margin calls through smart contracts that execute instantly when collateral value drops below predefined thresholds.

Hybrid Collateral Protocol

Hybrid Collateral Protocol integrates traditional secured credit assets with crypto-backed credit, enhancing collateral efficiency and risk diversification by leveraging both tangible and digital assets. This innovative approach improves liquidity and credit accessibility while maintaining robust security through multi-layered collateralization.

Real-World Asset (RWA) Credit

Secured credit leveraging Real-World Assets (RWA) as collateral offers stability through tangible assets like property and vehicles, ensuring reliable valuation and lower risk for lenders. In contrast, crypto-backed credit depends on volatile digital assets, which can lead to rapid collateral value fluctuations, making RWAs a more secure and predictable option for credit facilities.

Flash Loan Collateralization

Secured credit relies on traditional assets such as real estate or vehicles as collateral, providing stability and regulatory clarity for lenders. Crypto-backed credit, particularly in flash loan collateralization, enables instant, permissionless borrowing by locking volatile digital assets momentarily without long-term asset exposure risk.

Collateral Staking Incentives

Secured credit traditionally requires physical or financial assets as collateral, often limiting liquidity and earning potential, while crypto-backed credit leverages digital assets that can be staked to generate additional rewards, enhancing collateral utility. Collateral staking incentives in crypto-backed credit enable borrowers to maintain asset ownership and earn passive income, reducing opportunity costs compared to conventional secured loans.

Collateralization Risk Oracles

Secured credit relies on tangible assets like real estate or vehicles as collateral, offering lower collateralization risk due to stable valuations verified by traditional appraisal methods. Crypto-backed credit depends on decentralized oracles to determine asset value, exposing it to higher collateralization risk from price volatility and oracle manipulation vulnerabilities.

Secured Credit vs Crypto-Backed Credit for Collateral Infographic

moneydiff.com

moneydiff.com