Credit scores rely on traditional financial data such as payment history and credit utilization, while alternative data scores incorporate non-traditional information like rental payments, utility bills, and social behavior to assess creditworthiness. Alternative data scores provide a more inclusive evaluation for individuals with limited credit history, enabling broader access to loans. Lenders increasingly leverage both credit scores and alternative data to make more informed, equitable loan approval decisions.

Table of Comparison

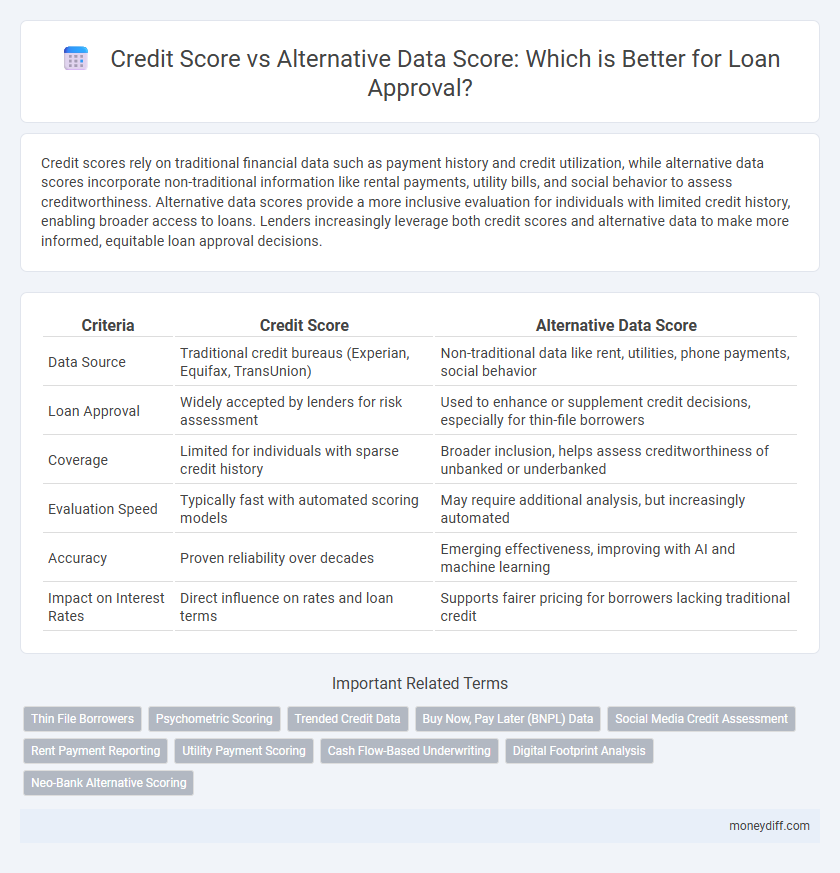

| Criteria | Credit Score | Alternative Data Score |

|---|---|---|

| Data Source | Traditional credit bureaus (Experian, Equifax, TransUnion) | Non-traditional data like rent, utilities, phone payments, social behavior |

| Loan Approval | Widely accepted by lenders for risk assessment | Used to enhance or supplement credit decisions, especially for thin-file borrowers |

| Coverage | Limited for individuals with sparse credit history | Broader inclusion, helps assess creditworthiness of unbanked or underbanked |

| Evaluation Speed | Typically fast with automated scoring models | May require additional analysis, but increasingly automated |

| Accuracy | Proven reliability over decades | Emerging effectiveness, improving with AI and machine learning |

| Impact on Interest Rates | Direct influence on rates and loan terms | Supports fairer pricing for borrowers lacking traditional credit |

Understanding Credit Scores: The Traditional Approach

Traditional credit scores rely heavily on payment history, credit utilization, and length of credit history to assess loan eligibility. These scores primarily use data from major credit bureaus, emphasizing factors like timely payments and outstanding debts. Understanding this approach highlights the limitations faced by individuals with thin credit files or limited credit history in securing loan approval.

What Is Alternative Data Scoring?

Alternative data scoring evaluates creditworthiness by analyzing non-traditional financial information such as rent payments, utility bills, mobile phone usage, and social media activity. This method provides lenders with a broader and more inclusive view of an applicant's financial behavior, especially for individuals with limited or no credit history. By incorporating alternative data, lenders can make more accurate loan approval decisions and extend credit to underserved populations.

Key Differences Between Credit Scores and Alternative Data Scores

Credit scores primarily rely on traditional financial data such as payment history, credit utilization, and length of credit history to assess loan eligibility. Alternative data scores incorporate non-traditional information like utility payments, rental history, and social behavior, offering a broader view of creditworthiness, especially for those with limited credit history. These key differences influence lender decisions by expanding access to credit for underserved populations while maintaining risk assessment accuracy.

How Lenders Use Credit Scores for Loan Approval

Lenders primarily rely on credit scores derived from traditional credit reports to evaluate a borrower's creditworthiness by analyzing payment history, credit utilization, and debt levels. These scores offer a standardized metric that simplifies risk assessment and loan approval decisions, enabling faster processing and consistent underwriting standards. While alternative data scores can supplement this information, credit scores remain the dominant factor for predicting loan repayment behavior.

The Rise of Alternative Data in Loan Decisions

Traditional credit scores rely heavily on factors like payment history, credit utilization, and loan accounts, often excluding individuals with limited credit history. Alternative data scores incorporate non-traditional metrics such as utility payments, rental history, and even social media behavior to provide a more comprehensive view of creditworthiness. The rise of alternative data in loan decisions expands financial inclusion by enabling lenders to assess risk more accurately for underserved populations.

Pros and Cons of Credit Scores vs Alternative Data Scores

Credit scores provide a standardized measure of creditworthiness based on traditional financial data such as payment history, credit utilization, and length of credit history, offering broad acceptance and comparability in loan approval. Alternative data scores incorporate non-traditional data sources like utility payments, rental history, and social behavior, enabling lenders to assess creditworthiness for individuals with limited credit history or thin files. However, credit scores may exclude significant portions of the population due to lack of credit records, while alternative data scores face challenges in data consistency, privacy concerns, and regulatory acceptance, affecting their reliability and scalability.

Impact on Borrowers: Who Benefits Most?

Credit scores primarily benefit borrowers with established credit histories by providing lenders a quick risk assessment, while alternative data scores expand access to credit for those with limited or no traditional credit records, such as young adults or immigrants. Alternative data incorporates non-traditional information like utility payments, rental history, and employment records, enabling more inclusive loan approval decisions and reducing financial exclusion. Consequently, underserved populations gain increased opportunities for credit, fostering financial inclusion and economic mobility.

The Role of Technology in Alternative Data Assessment

Technology enables lenders to analyze alternative data sources such as utility payments, rental history, and social behavior to enhance credit assessments beyond traditional credit scores. Machine learning algorithms process vast datasets to generate more inclusive and accurate alternative data scores, improving loan approval decisions for underserved borrowers. These innovations reduce credit invisibility and expand financial access by offering a holistic view of creditworthiness through technological advancements.

Credit Score Myths vs Alternative Data Realities

Traditional credit scores often exclude significant segments of the population due to reliance on mainstream financial behaviors, perpetuating myths that only conventional credit history predicts loan eligibility. Alternative data scores incorporate non-traditional indicators like utility payments, rental history, and digital transactions, providing a more comprehensive and inclusive view of creditworthiness. This approach reveals the reality that many creditworthy individuals are overlooked by standard scoring models, expanding access to credit for underbanked consumers.

The Future of Loan Approval: Integrating Credit and Alternative Data

Integrating traditional credit scores with alternative data scores enhances the accuracy and inclusivity of loan approval processes by capturing a broader range of financial behaviors. Utilizing alternative data such as utility payments, rental history, and online transactions helps lenders assess creditworthiness for individuals with limited or no traditional credit history. This combined approach supports more informed lending decisions and expands financial access to underserved populations.

Related Important Terms

Thin File Borrowers

Credit scores primarily rely on traditional financial data like payment history and credit utilization, often disadvantaging thin file borrowers with limited credit history. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and employment records, enabling more accurate loan approvals for individuals lacking extensive credit profiles.

Psychometric Scoring

Psychometric scoring leverages behavioral data and personality assessments to predict creditworthiness, offering a nuanced alternative to traditional credit scores that rely primarily on financial history. This approach enables lenders to assess loan applicants with limited or no formal credit history by analyzing traits such as honesty, risk tolerance, and financial discipline.

Trended Credit Data

Trended credit data offers a dynamic view of a borrower's credit behavior over time, enhancing loan approval accuracy beyond traditional credit scores by capturing spending patterns, payment consistency, and credit utilization trends. Integrating alternative data sources with trended credit data enables lenders to assess creditworthiness more comprehensively, reducing default risk and expanding access to credit for underrepresented or thin-file borrowers.

Buy Now, Pay Later (BNPL) Data

Credit scores primarily rely on traditional financial history, while alternative data scores incorporate Buy Now, Pay Later (BNPL) transaction records, offering lenders deeper insights into consumer payment behavior beyond conventional credit limits. Integrating BNPL data enhances loan approval accuracy by capturing timely repayment patterns, reducing default risk, and expanding credit access to those with limited or no credit history.

Social Media Credit Assessment

Social media credit assessment leverages alternative data such as online behavior, interactions, and digital footprints to provide a more comprehensive evaluation of creditworthiness beyond traditional credit scores. This method enhances loan approval processes by incorporating real-time, diverse data points that predict financial reliability for individuals with limited credit history.

Rent Payment Reporting

Credit scores typically rely on traditional financial data such as credit card and loan payment histories, whereas alternative data scores incorporate non-traditional metrics like rent payment reporting, providing a more comprehensive view of a borrower's creditworthiness. Rent payment reporting helps lenders assess the reliability of individuals with limited credit history by demonstrating consistent, timely payments in their financial behavior.

Utility Payment Scoring

Utility payment scoring leverages alternative data such as electricity, water, and phone bill payments to enhance credit evaluations, providing lenders with a more comprehensive view of borrower reliability beyond traditional credit scores. This approach improves loan approval accuracy, especially for individuals with limited credit histories, by incorporating consistent on-time utility payments as indicators of financial responsibility.

Cash Flow-Based Underwriting

Cash flow-based underwriting leverages alternative data scores that analyze real-time income and spending patterns, providing a more accurate credit risk assessment than traditional credit scores. This method improves loan approval rates for individuals with thin or no credit history by emphasizing cash flow stability over past credit behavior.

Digital Footprint Analysis

Digital footprint analysis enhances loan approval by incorporating alternative data scores alongside traditional credit scores, capturing online behaviors such as payment history on utilities, social media activity, and e-commerce transactions. This approach improves risk assessment accuracy for borrowers with limited credit history, providing lenders with a comprehensive view of creditworthiness beyond conventional credit bureau reports.

Neo-Bank Alternative Scoring

Neo-bank alternative scoring leverages non-traditional data such as utility payments, mobile phone usage, and social media activity to assess creditworthiness beyond conventional credit scores. This alternative data score enhances loan approval accuracy by providing a more inclusive financial profile for underbanked or thin-file borrowers.

Credit Score vs Alternative Data Score for Loan Approval Infographic

moneydiff.com

moneydiff.com