Revolving credit offers flexible access to funds up to a set limit, allowing borrowers to draw, repay, and redraw as needed for ongoing financing needs. Embedded credit integrates financing directly into a product or service, providing seamless credit access without separate applications or approvals. Choosing between revolving and embedded credit depends on the flexibility required and the convenience preferred for managing continuous cash flow.

Table of Comparison

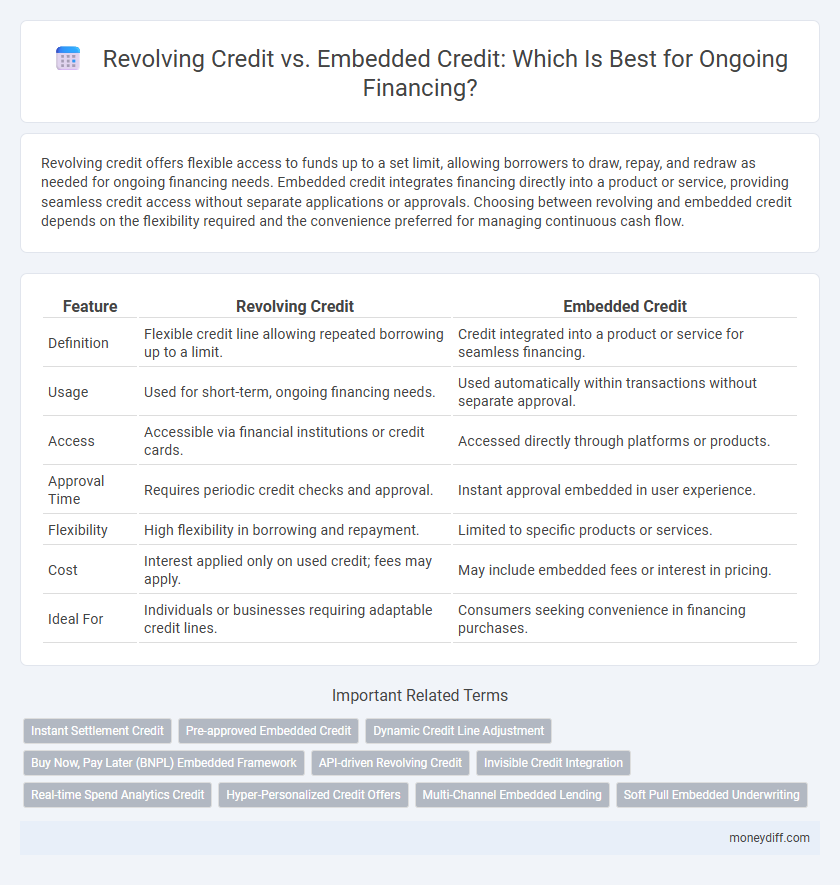

| Feature | Revolving Credit | Embedded Credit |

|---|---|---|

| Definition | Flexible credit line allowing repeated borrowing up to a limit. | Credit integrated into a product or service for seamless financing. |

| Usage | Used for short-term, ongoing financing needs. | Used automatically within transactions without separate approval. |

| Access | Accessible via financial institutions or credit cards. | Accessed directly through platforms or products. |

| Approval Time | Requires periodic credit checks and approval. | Instant approval embedded in user experience. |

| Flexibility | High flexibility in borrowing and repayment. | Limited to specific products or services. |

| Cost | Interest applied only on used credit; fees may apply. | May include embedded fees or interest in pricing. |

| Ideal For | Individuals or businesses requiring adaptable credit lines. | Consumers seeking convenience in financing purchases. |

Overview of Revolving Credit and Embedded Credit

Revolving credit provides borrowers with a flexible borrowing limit that resets as repayments are made, enabling continuous access to funds for short-term financing needs. Embedded credit is integrated within a primary financial product or service, offering seamless financing without separate credit applications, often linked to ongoing transactions. Both options facilitate liquidity management, with revolving credit suited for dynamic borrowing environments and embedded credit enhancing convenience through automatic credit availability.

Key Differences Between Revolving and Embedded Credit

Revolving credit provides borrowers with a flexible, pre-approved credit limit that can be used, repaid, and reused repeatedly, making it ideal for managing cash flow fluctuations. Embedded credit is integrated directly into a purchase transaction or financial product, offering financing without separate credit approval processes. The key differences lie in access flexibility, where revolving credit allows ongoing borrowing up to the limit, while embedded credit ties financing to a specific purchase or service, often simplifying approval but limiting reusability.

How Revolving Credit Works

Revolving credit allows borrowers to access a pre-approved credit limit repeatedly without reapplying, making it ideal for managing ongoing cash flow needs. Interest is charged only on the amount withdrawn, and as borrowers repay the balance, their credit availability replenishes automatically. This flexible financing option supports dynamic business operations by providing instant access to funds whenever required.

How Embedded Credit Works

Embedded credit integrates financing directly within the purchase of goods or services, allowing consumers to access credit seamlessly at the point of sale without separate loan applications. This method leverages real-time credit approval algorithms and automated payment systems to facilitate ongoing financing, making repayment convenient and often linked to the transaction itself. Unlike revolving credit, embedded credit minimizes consumer effort by embedding terms and conditions into the purchase process, streamlining access to continuous credit without the need for separate credit lines or manual management.

Pros and Cons of Revolving Credit

Revolving credit offers flexible access to funds up to a credit limit, allowing borrowers to reuse credit as they repay, which supports ongoing financing needs efficiently. Its pros include improved cash flow management and convenience, while cons involve potentially higher interest rates and the risk of accumulating debt if not managed properly. Compared to embedded credit, revolving credit provides greater adaptability but may come with fewer long-term cost savings or automatic integration into business operations.

Pros and Cons of Embedded Credit

Embedded credit offers seamless integration with ongoing financial operations, providing businesses with automatic access to funds without repeated credit approvals, which enhances cash flow management. However, it may limit borrowing flexibility due to predefined credit limits tied to specific accounts or transactions, potentially leading to higher costs if utilized beyond intended purposes. The convenience of embedded credit reduces administrative burden but requires careful monitoring to avoid unintended debt accumulation and maintain optimal financial health.

Suitability: Which Businesses Should Use Revolving Credit?

Revolving credit suits businesses with fluctuating cash flow needs, such as retailers and service providers that require ongoing access to funds for inventory purchases or operational expenses. This flexible financing option allows companies to borrow, repay, and re-borrow within a credit limit, making it ideal for managing short-term capital demands. Businesses with predictable expenses may find embedded credit better, but those needing adaptable, on-demand capital benefit most from revolving credit facilities.

Suitability: When to Choose Embedded Credit Solutions

Embedded credit solutions are highly suitable for businesses requiring seamless, ongoing financing integrated directly within their operational platforms, enhancing user experience and reducing friction. These solutions work well when continuous access to funds is necessary without frequent approval delays, especially in e-commerce, subscription services, or digital marketplaces. Choosing embedded credit is ideal for companies seeking to boost customer retention and drive transactions by embedding credit options within their existing customer journey.

Impact on Cash Flow: Revolving vs Embedded Credit

Revolving credit offers flexible borrowing and repayment, allowing businesses to manage cash flow fluctuations efficiently by drawing funds up to a credit limit as needed. Embedded credit is integrated within supplier agreements, automatically financing purchases without separate borrowing processes, which can stabilize cash outflows but limit flexibility. Choosing revolving credit enhances short-term liquidity management, while embedded credit supports predictable cash flow aligned with operational cycles.

Choosing the Right Financing Option for Your Needs

Revolving credit offers flexible, ongoing access to funds with a preset credit limit, ideal for businesses needing regular cash flow support and unpredictable expenses. Embedded credit, integrated within supplier agreements or service contracts, provides seamless financing tied directly to purchasing activities, enhancing efficiency and reducing administrative overhead. Assess your cash flow patterns, repayment capacity, and operational requirements to select the financing option that aligns best with your financial strategy and business growth objectives.

Related Important Terms

Instant Settlement Credit

Instant Settlement Credit enhances revolving credit by providing immediate access to funds without waiting periods, optimizing cash flow for ongoing financing needs. Embedded credit integrates financing directly into transactions, but lacks the instantaneous fund availability that Instant Settlement Credit guarantees, making it ideal for businesses requiring rapid liquidity.

Pre-approved Embedded Credit

Pre-approved embedded credit integrates financing directly into ongoing transactions, offering seamless access to funds without the need for repeated approval processes, unlike revolving credit which requires periodic re-evaluation and manual drawdowns. This embedded model enhances cash flow management by providing predetermined credit limits embedded within vendor or service agreements, optimizing operational efficiency and reducing administrative overhead.

Dynamic Credit Line Adjustment

Revolving credit offers dynamic credit line adjustment by allowing borrowers to increase or decrease their credit limits based on ongoing financial needs and repayment behavior. Embedded credit integrates financing within a service or product, enabling automatic credit limit recalibrations tailored to real-time usage patterns and risk profiles.

Buy Now, Pay Later (BNPL) Embedded Framework

Revolving credit offers flexible borrowing with a set credit limit and revolving balance, while embedded credit in Buy Now, Pay Later (BNPL) frameworks integrates financing directly at the point of sale, enabling seamless installment payments without traditional credit checks. BNPL embedded credit enhances customer experience by providing instant, interest-free financing options, driving higher conversion rates and repeat purchases in e-commerce environments.

API-driven Revolving Credit

API-driven revolving credit enables seamless, real-time access to flexible borrowing limits, enhancing cash flow management for businesses without requiring repeated credit assessments. Embedded credit, often integrated within payment platforms, provides user-friendly financing at the point of sale but lacks the dynamic scalability and customized controls offered by API-driven revolving credit solutions.

Invisible Credit Integration

Revolving credit offers flexible, ongoing access to funds with a defined credit limit, enabling businesses to manage cash flow effectively, while embedded credit seamlessly integrates financing options directly within purchasing platforms, providing an invisible, automated credit experience that enhances user convenience and operational efficiency. Invisible credit integration leverages technology to streamline credit offers without interrupting customer interactions, optimizing financial agility and driving continuous funding access.

Real-time Spend Analytics Credit

Revolving credit offers flexible borrowing limits with real-time spend analytics enabling instant tracking and adjustment of expenses, optimizing cash flow management for businesses. Embedded credit integrates financing directly into payment platforms, providing seamless access to credit while leveraging real-time spend data for enhanced credit decisioning and risk management.

Hyper-Personalized Credit Offers

Revolving credit offers flexible, reusable borrowing limits tailored to individual spending habits, enabling hyper-personalized credit solutions that adapt dynamically to users' financial behaviors. Embedded credit integrates seamless financing options within ecosystems or platforms, leveraging real-time consumer data to provide contextually relevant, hyper-personalized credit offers that enhance user engagement and ongoing consumer financing.

Multi-Channel Embedded Lending

Multi-channel embedded lending integrates revolving credit directly within diverse digital platforms, offering seamless, on-demand financing options tailored to consumer purchase behaviors and business cash flow needs. This approach enhances customer engagement and retention by providing flexible credit access without traditional application hurdles, contrasting with revolving credit's more standardized, standalone credit lines.

Soft Pull Embedded Underwriting

Revolving credit offers flexible borrowing up to a set limit with periodic repayments, while embedded credit integrates financing directly within a product or service, enabling seamless access through soft pull embedded underwriting that minimizes credit score impacts. Soft pull embedded underwriting leverages real-time data to assess creditworthiness discreetly, enhancing customer experience and approval rates for ongoing financing solutions.

Revolving Credit vs Embedded Credit for ongoing financing. Infographic

moneydiff.com

moneydiff.com