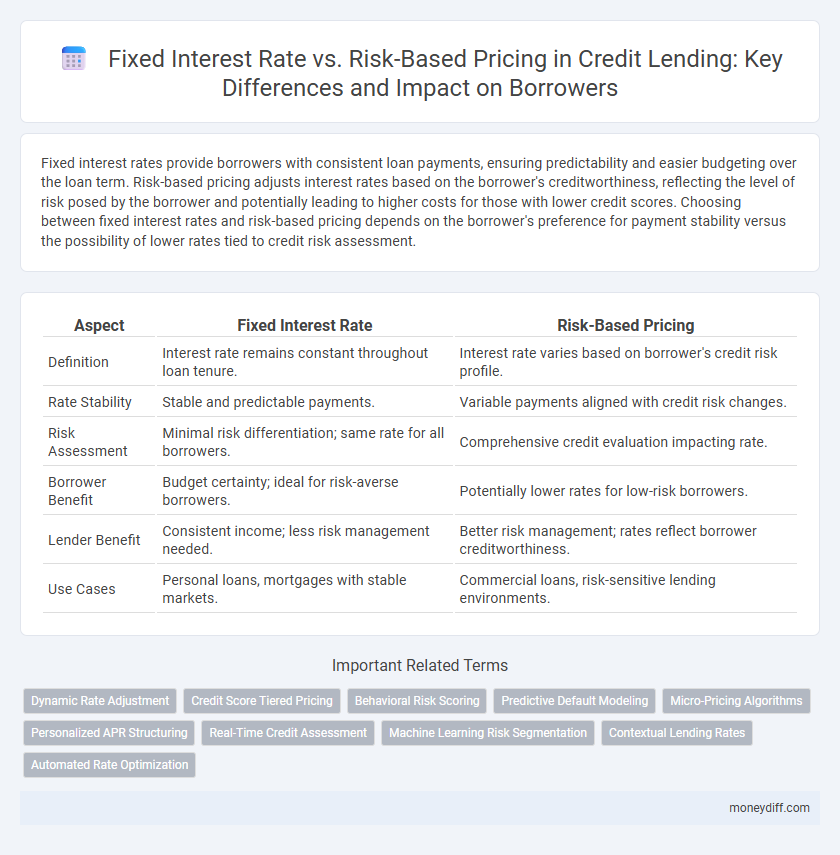

Fixed interest rates provide borrowers with consistent loan payments, ensuring predictability and easier budgeting over the loan term. Risk-based pricing adjusts interest rates based on the borrower's creditworthiness, reflecting the level of risk posed by the borrower and potentially leading to higher costs for those with lower credit scores. Choosing between fixed interest rates and risk-based pricing depends on the borrower's preference for payment stability versus the possibility of lower rates tied to credit risk assessment.

Table of Comparison

| Aspect | Fixed Interest Rate | Risk-Based Pricing |

|---|---|---|

| Definition | Interest rate remains constant throughout loan tenure. | Interest rate varies based on borrower's credit risk profile. |

| Rate Stability | Stable and predictable payments. | Variable payments aligned with credit risk changes. |

| Risk Assessment | Minimal risk differentiation; same rate for all borrowers. | Comprehensive credit evaluation impacting rate. |

| Borrower Benefit | Budget certainty; ideal for risk-averse borrowers. | Potentially lower rates for low-risk borrowers. |

| Lender Benefit | Consistent income; less risk management needed. | Better risk management; rates reflect borrower creditworthiness. |

| Use Cases | Personal loans, mortgages with stable markets. | Commercial loans, risk-sensitive lending environments. |

Understanding Fixed Interest Rates in Lending

Fixed interest rates in lending maintain a constant percentage over the loan term, providing predictable monthly payments and protection against rate fluctuations. This pricing method contrasts with risk-based pricing, where interest rates vary according to the borrower's creditworthiness and market risk factors. Choosing fixed rates offers financial stability, particularly beneficial for borrowers seeking consistent budgeting without exposure to interest rate volatility.

What is Risk-Based Pricing?

Risk-based pricing is a lending strategy where the interest rate charged on a loan is determined by the borrower's credit risk profile, including factors such as credit score, income stability, and debt-to-income ratio. Unlike fixed interest rates, which remain constant regardless of risk, risk-based pricing adjusts rates to reflect the probability of default, helping lenders mitigate potential losses. This approach promotes fair lending by aligning borrowing costs with individual creditworthiness and financial behavior.

Key Differences Between Fixed Interest Rates and Risk-Based Pricing

Fixed interest rates offer borrowers a consistent loan repayment amount by maintaining a stable percentage over the loan term, providing predictability and easier budgeting. Risk-based pricing adjusts interest rates according to the borrower's creditworthiness, income stability, and debt-to-income ratio, resulting in higher rates for riskier profiles and lower rates for low-risk individuals. This key difference impacts loan affordability, as fixed rates shield against market fluctuations while risk-based pricing aligns costs with individual risk levels.

Pros and Cons of Fixed Interest Rate Loans

Fixed interest rate loans offer predictable monthly payments, providing borrowers with financial stability and ease of budgeting by locking in a constant rate over the loan term. However, this stability can result in higher overall costs compared to risk-based pricing loans, especially if market interest rates decline, as fixed rates do not adjust to reflect changes in the borrower's credit risk or economic conditions. Fixed rate loans also limit lender flexibility, potentially leading to stricter qualification criteria and reduced access for higher-risk borrowers.

Advantages and Disadvantages of Risk-Based Pricing

Risk-based pricing enables lenders to tailor interest rates based on individual credit risk, enhancing loan accessibility for borrowers with diverse credit profiles and potentially decreasing default rates. This approach incentivizes responsible borrowing by rewarding low-risk clients with lower rates but can result in higher costs for those with poor credit, potentially limiting access for high-risk individuals. While it promotes efficiency in credit markets, risk-based pricing may also contribute to economic inequality if high-risk borrowers face consistently prohibitive rates.

How Credit Scores Influence Lending Rates

Credit scores play a crucial role in determining lending rates by influencing both fixed interest rates and risk-based pricing models. Borrowers with higher credit scores typically qualify for lower fixed interest rates, reflecting their lower risk profile and reliability in repaying debt. In risk-based pricing, lenders adjust interest rates dynamically based on credit scores, with poorer scores leading to higher rates to compensate for increased default risk.

Impact on Borrowers: Fixed vs. Risk-Based Pricing

Fixed interest rates provide borrowers with predictable monthly payments and budget stability, minimizing exposure to market volatility. Risk-based pricing tailors loan costs to individual credit profiles, often resulting in lower rates for low-risk borrowers but higher costs for those with poorer credit. This approach can incentivize credit improvement yet may impose financial strain on higher-risk borrowers due to fluctuating loan expenses.

Effects on Lenders: Risk Management Strategies

Fixed interest rates provide lenders with predictable cash flows, enhancing financial stability and simplifying risk management models. Risk-based pricing allows lenders to adjust rates according to borrower creditworthiness, improving risk-adjusted returns but introducing variability in revenue. Combining fixed rates with risk-based adjustments helps lenders balance stable income with effective risk segmentation strategies.

Choosing the Right Lending Option for Your Needs

Fixed interest rates provide predictable monthly payments, making budgeting easier for borrowers seeking financial stability over the loan term. Risk-based pricing adjusts interest rates based on the borrower's credit score, income, and repayment history, potentially offering lower rates to those with strong credit profiles but higher costs for riskier applicants. Selecting the right lending option depends on evaluating your creditworthiness, risk tolerance, and preference for payment certainty versus potential cost savings.

Future Trends in Lending: Fixed Rates vs. Risk-Based Models

Future trends in lending are increasingly shaped by the balance between fixed interest rates and risk-based pricing models. Fixed rates offer predictable repayment schedules, appealing to borrowers seeking stability amid market volatility, while risk-based pricing leverages advanced analytics and credit scoring to tailor rates according to individual borrower risk profiles, promoting personalized lending solutions. Innovations in machine learning and big data are expected to enhance risk assessment accuracy, making risk-based pricing more dynamic and potentially more prevalent than fixed-rate loans in the coming years.

Related Important Terms

Dynamic Rate Adjustment

Fixed interest rates provide borrowers with payment stability by maintaining a constant rate throughout the loan term, while risk-based pricing adjusts interest rates dynamically based on the borrower's credit risk profile, enabling lenders to better manage default risk and optimize returns. Dynamic rate adjustment leverages real-time data and credit scoring models to recalibrate rates, ensuring loan pricing remains aligned with evolving borrower behaviors and market conditions.

Credit Score Tiered Pricing

Fixed interest rates provide predictable monthly payments regardless of credit score, while risk-based pricing adjusts loan rates according to credit score tiers, aligning borrower risk with pricing. Credit score tiered pricing enables lenders to offer lower rates to high-credit borrowers and higher rates to those with lower credit scores, optimizing loan profitability and risk management.

Behavioral Risk Scoring

Behavioral risk scoring in lending evaluates borrower habits and payment patterns to dynamically adjust interest rates, contrasting with fixed interest rates that remain constant regardless of individual risk profiles. This approach enhances credit risk management by tailoring pricing models to actual borrower behavior, potentially reducing default rates while offering more competitive loan terms.

Predictive Default Modeling

Predictive default modeling enhances risk-based pricing by leveraging borrower credit data, payment history, and macroeconomic factors to tailor interest rates according to predicted default probabilities, improving lender profitability and borrower fairness. Fixed interest rates offer stability but lack sensitivity to individual credit risk, potentially leading to higher losses or missed profit opportunities compared to dynamic pricing driven by predictive analytics.

Micro-Pricing Algorithms

Fixed interest rates provide borrowers with predictable loan repayments, while risk-based pricing adjusts rates according to individual credit risk profiles using micro-pricing algorithms that analyze detailed borrower data points. These algorithms enhance lending precision by segmenting customers more accurately, enabling tailored interest rates that optimize risk management and profitability.

Personalized APR Structuring

Personalized APR structuring in lending leverages risk-based pricing to tailor interest rates according to individual credit profiles, enhancing precision beyond fixed interest rate models. This approach improves lender profitability and borrower fairness by aligning loan costs with credit risk factors such as payment history, income stability, and debt-to-income ratio.

Real-Time Credit Assessment

Fixed interest rates provide predictable loan repayments by maintaining consistent costs regardless of market fluctuations, while risk-based pricing adjusts interest rates dynamically based on real-time credit assessment using up-to-date borrower data and creditworthiness metrics. Real-time credit assessment leverages advanced analytics and machine learning to evaluate risk instantaneously, enabling more personalized and accurate lending decisions compared to the static nature of fixed interest rates.

Machine Learning Risk Segmentation

Machine learning risk segmentation enhances credit lending by accurately identifying borrower profiles, allowing lenders to tailor risk-based pricing rather than relying on fixed interest rates that overlook individual risk factors. This approach increases predictive accuracy, minimizes default rates, and optimizes interest revenue by aligning loan terms with dynamic risk assessments derived from extensive borrower data analysis.

Contextual Lending Rates

Fixed interest rates offer borrowers stability by maintaining a consistent repayment amount throughout the loan term, while risk-based pricing adjusts lending rates according to the borrower's creditworthiness, income stability, and market conditions. Contextual lending rates leverage advanced data analytics and credit scoring models to tailor interest rates, optimizing risk management and ensuring competitive loan offers aligned with individual borrower profiles.

Automated Rate Optimization

Automated rate optimization leverages advanced algorithms and machine learning to dynamically adjust loan interest rates, comparing fixed interest rates with risk-based pricing models to maximize profitability and borrower fairness. This technology enhances credit decision-making by analyzing borrower risk profiles in real-time, enabling lenders to offer personalized rates that balance competitive pricing with risk management.

Fixed Interest Rate vs Risk-Based Pricing for lending. Infographic

moneydiff.com

moneydiff.com