Hard credit inquiries occur when lenders review your credit report as part of a loan application, which can temporarily lower your credit score. Soft pull monitoring allows you to check your credit report without impacting your score and is used primarily for pre-approval offers or background checks. Understanding the difference between hard inquiries and soft pulls helps you manage your credit health and minimize the risk of score drops during multiple loan applications.

Table of Comparison

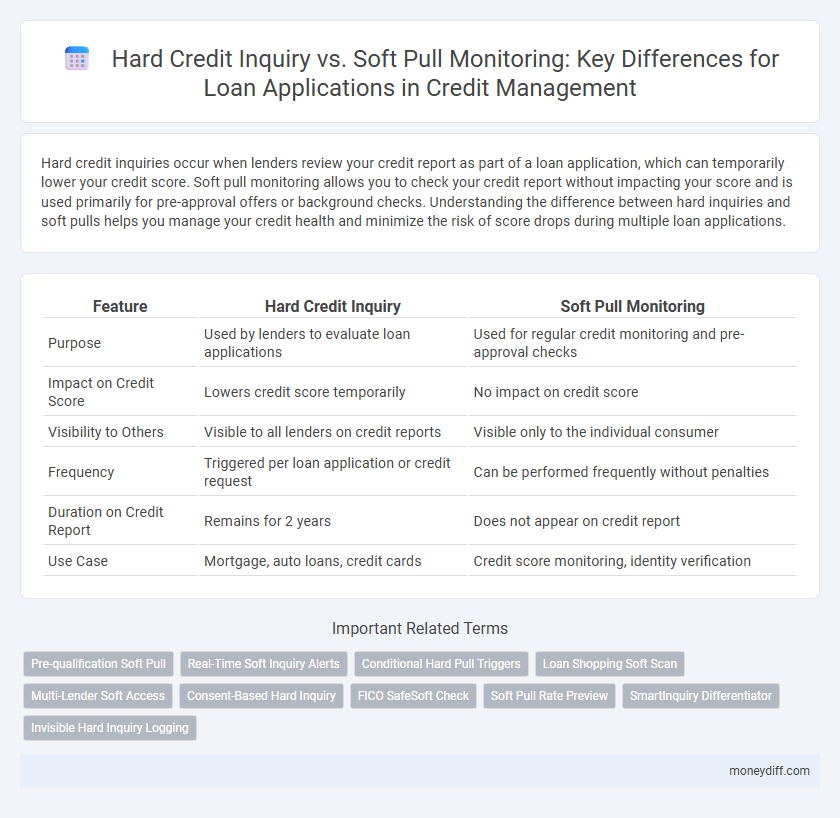

| Feature | Hard Credit Inquiry | Soft Pull Monitoring |

|---|---|---|

| Purpose | Used by lenders to evaluate loan applications | Used for regular credit monitoring and pre-approval checks |

| Impact on Credit Score | Lowers credit score temporarily | No impact on credit score |

| Visibility to Others | Visible to all lenders on credit reports | Visible only to the individual consumer |

| Frequency | Triggered per loan application or credit request | Can be performed frequently without penalties |

| Duration on Credit Report | Remains for 2 years | Does not appear on credit report |

| Use Case | Mortgage, auto loans, credit cards | Credit score monitoring, identity verification |

Understanding Hard Credit Inquiry: Definition and Impact

Hard credit inquiry occurs when a lender reviews your credit report as part of a loan application process, signaling active credit-seeking behavior. This type of inquiry can slightly lower your credit score temporarily, reflecting increased credit risk to potential lenders. Monitoring and understanding hard inquiries is essential for managing your credit health and improving loan approval chances.

What Is a Soft Pull Credit Check?

A soft pull credit check is a type of credit inquiry that does not affect your credit score and is typically used for pre-approval offers or background checks. Unlike hard inquiries, soft pulls do not indicate you are actively seeking credit and are visible only to you on your credit report. Monitoring soft pull credit checks helps consumers track who is accessing their credit information without impacting their creditworthiness during loan applications.

How Hard Inquiries Affect Your Credit Score

Hard credit inquiries occur when lenders check your credit report during a loan application, which can slightly lower your credit score for a short period. Multiple hard inquiries within a 14-45 day window for the same loan type are typically treated as a single inquiry, minimizing the impact on your score. Monitoring hard pulls is crucial because frequent hard inquiries can signal higher credit risk to lenders, potentially affecting your eligibility and interest rates.

Soft Pull Monitoring: Benefits and Limitations

Soft pull monitoring allows lenders to evaluate a borrower's creditworthiness without impacting their credit score, making it ideal for pre-qualifications and ongoing credit assessments. It provides real-time updates on credit status changes, helping both lenders and consumers manage risk proactively. However, soft pulls do not provide the full credit report details available in hard inquiries, limiting their use for final loan approval decisions.

Hard Credit Inquiry vs Soft Pull: Key Differences

Hard credit inquiries occur when a lender reviews your credit report as part of a loan application, impacting your credit score by signaling new debt risk. Soft pull monitoring, used for background checks or pre-approved offers, does not affect your credit score and provides a non-intrusive way to monitor credit activity. Understanding these differences helps borrowers manage credit applications strategically and minimize negative impacts on their credit profile.

When Lenders Use Hard Inquiries for Loan Applications

Lenders use hard credit inquiries during loan applications to assess a borrower's creditworthiness by accessing detailed credit reports from credit bureaus, which can impact credit scores. Hard inquiries typically occur when applying for mortgages, auto loans, or credit cards, signaling a new credit request that lenders evaluate for risk. Monitoring hard pulls helps lenders make informed decisions about approving loans and setting interest rates based on current credit behavior.

How Soft Pulls Facilitate Pre-Approval Processes

Soft pull credit inquiries allow lenders to assess a borrower's creditworthiness without impacting their credit score, enabling a more discreet and efficient pre-approval process. By utilizing soft pulls, financial institutions can quickly evaluate preliminary eligibility for loans, streamlining the application experience and reducing unnecessary hard inquiries. This facilitates quicker decisions and enhances customer satisfaction during credit assessments.

Credit Score Protection: Minimizing Hard Inquiry Effects

Hard credit inquiries directly impact your credit score by temporarily lowering it, whereas soft pull monitoring allows lenders to review your credit without affecting your score. Minimizing hard inquiries during loan applications protects your credit score, preserving your eligibility for better interest rates and loan terms. Using soft pull services helps track credit activity and avoid unnecessary hard pulls, ensuring optimal credit score maintenance.

Monitoring Your Credit: Best Practices for Loan Applicants

Monitoring your credit effectively involves understanding the difference between hard credit inquiries and soft pull monitoring, as hard inquiries occur when a lender checks your credit for loan approval and can temporarily lower your credit score. Soft pull monitoring allows you to track your credit report without impacting your score, providing ongoing insight into changes and areas needing improvement before applying for a loan. Regularly reviewing your credit through soft pulls helps you spot errors, manage your credit utilization, and improve your creditworthiness, increasing your chances of loan approval with favorable terms.

Frequently Asked Questions About Credit Checks and Loan Applications

Hard credit inquiries occur when lenders check your credit report to make lending decisions, impacting your credit score and appearing on your report for up to two years. Soft pull monitoring includes checks like pre-approvals or personal credit reviews that do not affect your credit score or appear on your report to lenders. Understanding the difference is crucial for managing credit health during loan applications and avoiding unnecessary score dips.

Related Important Terms

Pre-qualification Soft Pull

Pre-qualification soft pulls allow lenders to assess a borrower's creditworthiness without impacting their credit score, providing a non-invasive way to gauge loan eligibility. Hard credit inquiries, triggered by full loan applications, can lower credit scores and remain on reports for up to two years, making soft pull monitoring essential for minimizing score damage during the early loan consideration phase.

Real-Time Soft Inquiry Alerts

Real-time soft inquiry alerts provide borrowers immediate notifications when a lender or third party performs a non-impacting credit check, enabling proactive monitoring without affecting credit scores. This continuous oversight helps applicants detect unauthorized loan inquiries swiftly while maintaining a pristine credit profile, unlike hard credit inquiries, which temporarily lower credit scores and require careful management.

Conditional Hard Pull Triggers

Conditional hard pull triggers activate a hard credit inquiry only when specific criteria are met during the loan application process, minimizing unnecessary impacts on a borrower's credit score. This targeted approach ensures lenders access comprehensive credit data when essential while preserving credit health by avoiding indiscriminate hard pulls.

Loan Shopping Soft Scan

Loan shopping soft scans allow borrowers to check multiple loan offers without affecting their credit score, as soft credit inquiries do not impact credit reports or credit ratings. In contrast, hard credit inquiries occur when a lender reviews a full credit report during loan approval, potentially lowering the credit score temporarily.

Multi-Lender Soft Access

Multi-lender soft access allows borrowers to apply for loans without impacting their credit score by enabling lenders to perform soft credit inquiries, which provide essential data for pre-qualification without a hard inquiry's score impact. This method facilitates seamless loan comparison across multiple lenders while maintaining credit integrity, increasing approval chances and preserving credit health.

Consent-Based Hard Inquiry

Consent-based hard credit inquiries occur when lenders request detailed credit information with explicit borrower permission, directly impacting credit scores and loan eligibility decisions. Soft pull monitoring allows for credit assessments without affecting scores, used primarily for pre-approval or background checks, offering a less intrusive evaluation method.

FICO SafeSoft Check

Hard credit inquiries can lower your FICO score and are triggered when lenders review your credit report for loan approvals, while soft pull monitoring, such as FICO SafeSoft Check, allows consumers to track their credit without affecting their score. FICO SafeSoft Check provides real-time updates and insights, enabling borrowers to manage their credit health proactively during the loan application process.

Soft Pull Rate Preview

Soft Pull Rate Preview allows lenders to monitor credit inquiries without impacting an applicant's credit score, providing a non-intrusive assessment of creditworthiness during preliminary loan evaluations. Unlike hard credit inquiries, soft pulls are recorded on credit reports but do not lower credit scores, enabling frequent rate checks and improved customer experience.

SmartInquiry Differentiator

Hard credit inquiries impact credit scores by appearing on credit reports and are triggered during formal loan applications, while soft pull monitoring allows consumers and lenders to check credit without affecting scores; SmartInquiry leverages advanced algorithms to distinguish between these inquiries in real-time, providing precise tracking and risk assessment for smarter loan decision-making. Its innovative technology enhances credit monitoring by offering detailed insights into credit behaviors without unnecessary score reductions, optimizing both borrower experience and lender accuracy.

Invisible Hard Inquiry Logging

Hard credit inquiry logging occurs when lenders access your credit report for loan applications, impacting your credit score and remaining visible to other creditors for up to two years. Invisible hard inquiries, however, are unique in that they do not show up on your credit report but can still influence lending decisions through specialized monitoring systems used by certain financial institutions.

Hard Credit Inquiry vs Soft Pull Monitoring for loan applications. Infographic

moneydiff.com

moneydiff.com