Traditional credit checks provide a detailed credit report that includes all borrowing history and inquiries, offering lenders comprehensive insight into an applicant's financial behavior. Soft credit pulls, by contrast, allow for a basic overview of creditworthiness without affecting the applicant's credit score or revealing full credit details, making them ideal for initial screening. Lenders use soft credit pulls to minimize impact on applicants while reserving full credit checks for later stages of the approval process.

Table of Comparison

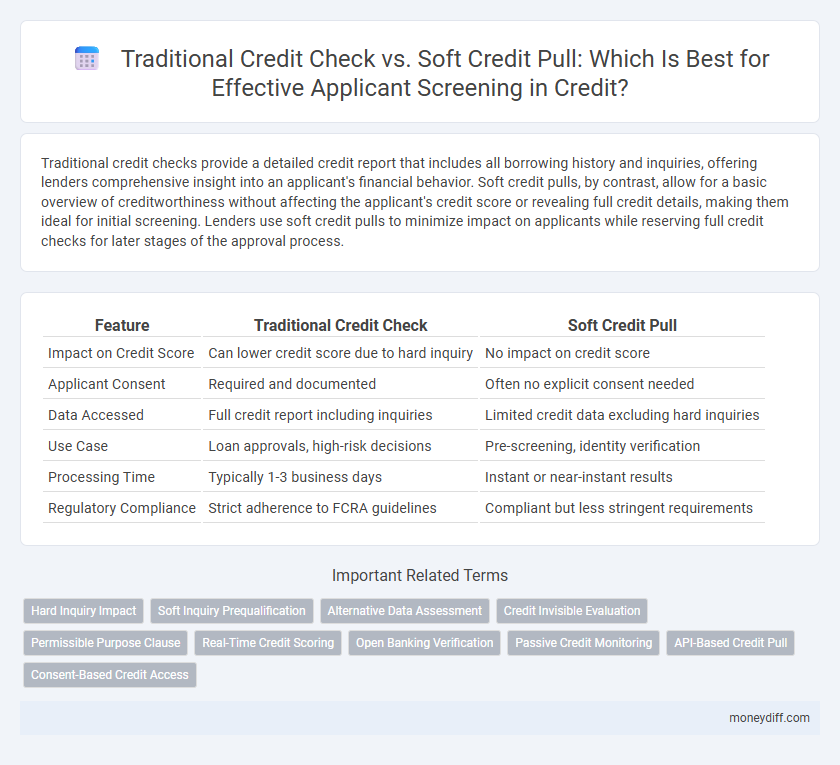

| Feature | Traditional Credit Check | Soft Credit Pull |

|---|---|---|

| Impact on Credit Score | Can lower credit score due to hard inquiry | No impact on credit score |

| Applicant Consent | Required and documented | Often no explicit consent needed |

| Data Accessed | Full credit report including inquiries | Limited credit data excluding hard inquiries |

| Use Case | Loan approvals, high-risk decisions | Pre-screening, identity verification |

| Processing Time | Typically 1-3 business days | Instant or near-instant results |

| Regulatory Compliance | Strict adherence to FCRA guidelines | Compliant but less stringent requirements |

Understanding Traditional Credit Checks

Traditional credit checks involve a hard inquiry on an applicant's credit report, impacting their credit score and providing lenders with a comprehensive view of credit history, including payment history, credit limits, and outstanding debts. These checks are crucial for assessing risk in loan approvals, credit card applications, and mortgage decisions. Unlike soft credit pulls, traditional checks require explicit permission and are recorded on credit reports, influencing future creditworthiness evaluations.

What Is a Soft Credit Pull?

A soft credit pull is a type of credit inquiry that does not affect an applicant's credit score and is used primarily for preliminary screening in lending decisions. Unlike traditional credit checks, soft pulls only provide limited information, such as credit score and basic account details, without revealing detailed credit history. This method enables lenders to assess creditworthiness efficiently while preserving the applicant's credit standing.

Key Differences Between Hard and Soft Credit Inquiries

Hard credit inquiries occur when lenders or landlords request a full credit report, impacting the applicant's credit score and staying on it for up to two years. Soft credit pulls involve reviewing limited credit information without affecting the credit score, commonly used for pre-approval or background checks. The main difference lies in the potential impact on credit and the depth of information accessed during the applicant screening process.

Impact on Applicant Credit Scores

Traditional credit checks, also known as hard inquiries, can negatively impact an applicant's credit score by lowering it slightly and remaining on the credit report for up to two years. Soft credit pulls, often used for pre-qualification or preliminary screening, do not affect credit scores and are not visible to other lenders. Choosing soft credit pulls for applicant screening preserves credit scores while still providing essential credit information for decision-making.

Data Accessed in Traditional vs Soft Credit Checks

Traditional credit checks access comprehensive credit reports including detailed account history, payment history, public records, and credit inquiries, providing lenders with in-depth financial behavior insights. Soft credit pulls retrieve limited information such as credit score and summary data without affecting credit ratings, mainly used for pre-approval or background screening. The difference in data scope impacts decision-making, with traditional checks offering full credit profiles and soft pulls offering high-level credit insights.

Privacy Considerations for Applicants

Traditional credit checks reveal detailed financial histories to lenders, raising significant privacy concerns for applicants. Soft credit pulls limit exposure by providing only limited information without impacting credit scores or notifying third parties, thereby enhancing applicant privacy. Choosing soft inquiries helps protect sensitive data while still enabling effective applicant screening.

Speed and Efficiency in Applicant Screening

Traditional credit checks often require extensive processing time and can negatively impact applicants' credit scores, slowing down the screening process. Soft credit pulls provide a rapid and non-intrusive alternative, enabling faster decision-making without affecting credit ratings. Utilizing soft credit inquiries enhances screening efficiency by delivering immediate insights while maintaining applicant trust.

Legal and Compliance Factors

Traditional credit checks involve hard inquiries that impact an applicant's credit score and require explicit consent, aligning with the Fair Credit Reporting Act (FCRA) regulations to ensure legal compliance. Soft credit pulls do not affect credit scores and can be used for pre-screening or marketing purposes without the need for formal authorization, but must still adhere to privacy laws and the FCRA's permissible use guidelines. Both methods demand strict adherence to consumer protection laws to prevent discrimination and unauthorized access during applicant screening.

Best Practices for Choosing Screening Methods

Selecting between traditional credit checks and soft credit pulls hinges on balancing thoroughness and applicant privacy during screening. Traditional credit checks provide comprehensive financial history, crucial for high-risk lending decisions, while soft pulls enable quick prequalification without impacting credit scores. Best practices recommend using soft pulls for initial applicant screening and reserving hard inquiries for final approval stages to maintain candidate goodwill and compliance with fair lending regulations.

How to Communicate Credit Screening Procedures to Applicants

Clearly explain the difference between traditional credit checks and soft credit pulls to applicants, emphasizing that traditional checks may impact their credit scores while soft pulls do not. Use straightforward language to describe why each method is used during the screening process, highlighting transparency and trust. Provide written notifications before conducting any credit check, ensuring applicants understand their rights and how their credit information will be used.

Related Important Terms

Hard Inquiry Impact

Traditional credit checks involve a hard inquiry on the applicant's credit report, which can temporarily lower their credit score by several points and remain visible to other lenders for up to two years. In contrast, soft credit pulls do not affect credit scores or appear on reports viewed by lenders, making them a less intrusive option for applicant screening.

Soft Inquiry Prequalification

Soft inquiry prequalification allows lenders to assess an applicant's creditworthiness without affecting their credit score, providing a non-invasive alternative to traditional credit checks. This method streamlines applicant screening by using soft credit pulls, which offer essential credit information while maintaining customer trust and minimizing application friction.

Alternative Data Assessment

Traditional credit checks rely heavily on credit scores and payment history from major credit bureaus, which can exclude applicants with limited or no credit history. Soft credit pulls leverage alternative data such as rent payments, utility bills, and employment records to provide a more comprehensive view of creditworthiness without impacting the applicant's credit score.

Credit Invisible Evaluation

Traditional credit checks provide comprehensive credit histories but often disadvantage credit-invisible individuals lacking extensive credit records, while soft credit pulls enable applicants to be screened without impacting their credit score, offering a more inclusive evaluation method. Soft pulls utilize limited data from alternative credit sources, making them ideal for assessing credit-invisible applicants in applicant screening processes.

Permissible Purpose Clause

The Permissible Purpose Clause strictly regulates when a lender can perform a traditional credit check, requiring explicit applicant consent for hard inquiries that impact credit scores. In contrast, soft credit pulls used for applicant screening do not affect credit reports and are allowed under broader permissible purposes, enabling pre-approval assessments without damaging credit standing.

Real-Time Credit Scoring

Real-time credit scoring enhances applicant screening by using soft credit pulls, which do not impact credit scores while providing immediate insights into creditworthiness. Traditional credit checks involve hard inquiries that can lower scores and delay decisions, making soft pulls a preferred option for faster, non-invasive credit evaluation.

Open Banking Verification

Traditional credit checks rely on hard inquiries that can temporarily lower an applicant's credit score, while soft credit pulls enable pre-screening without impacting credit ratings. Open Banking verification enhances applicant screening by securely accessing real-time financial data, providing more accurate insights into creditworthiness beyond conventional credit reports.

Passive Credit Monitoring

Traditional credit checks provide comprehensive financial data by accessing full credit reports, enabling lenders to evaluate creditworthiness thoroughly, whereas soft credit pulls offer limited information without impacting credit scores, suitable for passive credit monitoring to track applicants' financial behavior over time without trigger alerts. Passive credit monitoring through soft pulls helps institutions identify changes in risk profiles early, enhancing decision-making in applicant screening while preserving customer trust by avoiding hard inquiries.

API-Based Credit Pull

API-based credit pull streamlines applicant screening by providing real-time access to both traditional credit checks and soft credit pulls, enabling lenders to evaluate creditworthiness with greater accuracy and speed. This technology reduces processing time, minimizes data errors, and enhances compliance with regulatory standards by securely integrating credit data directly into applicant management systems.

Consent-Based Credit Access

Traditional credit checks require explicit applicant consent before accessing their full credit report, ensuring compliance with regulatory frameworks like the Fair Credit Reporting Act (FCRA). Soft credit pulls provide consent-based credit access by allowing lenders to review limited credit information without impacting the applicant's credit score, supporting a non-intrusive screening process.

Traditional Credit Check vs Soft Credit Pull for Applicant Screening Infographic

moneydiff.com

moneydiff.com