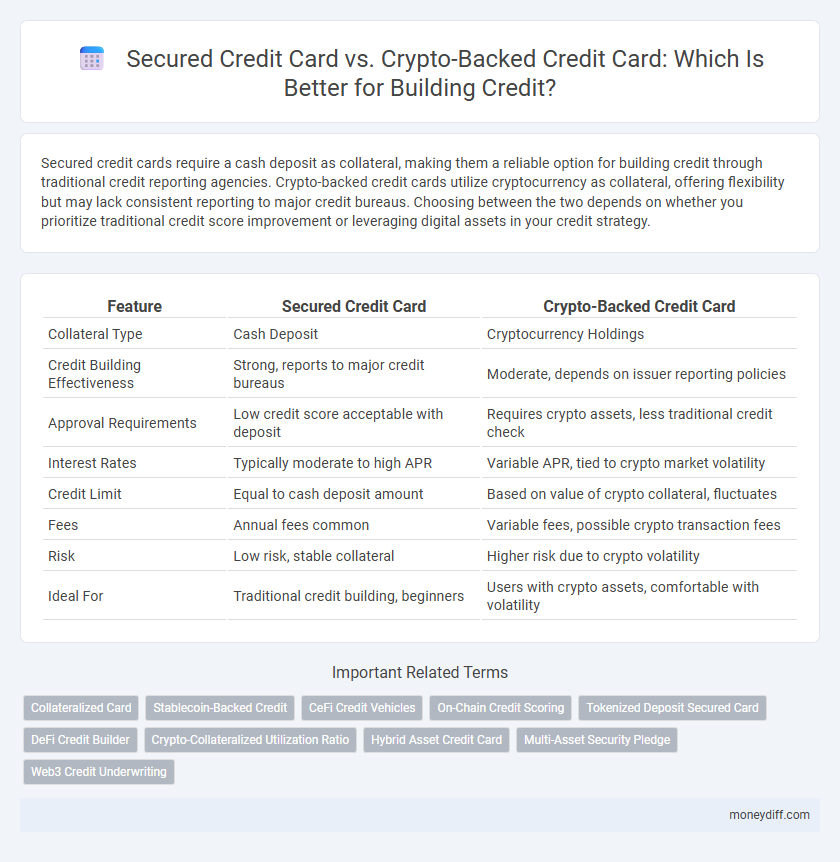

Secured credit cards require a cash deposit as collateral, making them a reliable option for building credit through traditional credit reporting agencies. Crypto-backed credit cards utilize cryptocurrency as collateral, offering flexibility but may lack consistent reporting to major credit bureaus. Choosing between the two depends on whether you prioritize traditional credit score improvement or leveraging digital assets in your credit strategy.

Table of Comparison

| Feature | Secured Credit Card | Crypto-Backed Credit Card |

|---|---|---|

| Collateral Type | Cash Deposit | Cryptocurrency Holdings |

| Credit Building Effectiveness | Strong, reports to major credit bureaus | Moderate, depends on issuer reporting policies |

| Approval Requirements | Low credit score acceptable with deposit | Requires crypto assets, less traditional credit check |

| Interest Rates | Typically moderate to high APR | Variable APR, tied to crypto market volatility |

| Credit Limit | Equal to cash deposit amount | Based on value of crypto collateral, fluctuates |

| Fees | Annual fees common | Variable fees, possible crypto transaction fees |

| Risk | Low risk, stable collateral | Higher risk due to crypto volatility |

| Ideal For | Traditional credit building, beginners | Users with crypto assets, comfortable with volatility |

Secured Credit Cards: Traditional Path to Building Credit

Secured credit cards provide a reliable method for establishing or rebuilding credit by requiring a refundable security deposit that typically matches the credit limit, minimizing risk for lenders. These cards report to major credit bureaus, allowing consistent, responsible use to reflect positively on credit reports and improve credit scores over time. Unlike crypto-backed credit cards, secured cards maintain stability through traditional banking networks and regulatory oversight, making them a preferred choice for consumers focused on long-term credit building.

Crypto-Backed Credit Cards: A New Era in Credit Building

Crypto-backed credit cards enable users to leverage cryptocurrency holdings as collateral, offering an innovative way to build credit without requiring traditional credit history. These cards report payment activity to major credit bureaus, facilitating credit score improvement while maintaining digital asset exposure. This emerging financial tool combines blockchain security with conventional credit-building strategies, appealing to tech-savvy consumers seeking alternative credit options.

Key Differences Between Secured and Crypto-Backed Credit Cards

Secured credit cards require a cash deposit as collateral, directly linked to the credit limit, making them a traditional and reliable way to build or rebuild credit history reported to major credit bureaus. Crypto-backed credit cards use cryptocurrency assets as collateral, allowing users to leverage their digital holdings without liquidating them, but they pose higher volatility risks and may have varying acceptance by credit bureaus. Secured cards often have lower fees and more predictable terms, whereas crypto-backed cards offer innovative features such as crypto rewards and integration with wallets but require a strong understanding of market fluctuations and regulatory conditions.

Approval Requirements: Secured vs Crypto-Backed Cards

Secured credit cards require a security deposit typically equal to the credit limit, making approval accessible for individuals with limited or poor credit history. Crypto-backed credit cards leverage cryptocurrency as collateral, often demanding ownership of a specific crypto amount and wallet verification, which can limit approval to crypto holders. Approval for secured cards tends to be more straightforward and universally available compared to the specialized criteria of crypto-backed cards that emphasize cryptocurrency asset verification.

Credit Reporting: How Each Card Impacts Your Credit Score

Secured credit cards typically report your payment history to major credit bureaus, directly impacting your credit score by building a positive credit history with responsible use. Crypto-backed credit cards may offer similar reporting, but coverage varies widely depending on the issuer, potentially limiting consistent credit bureau reporting. Regular, on-time payments on either card can improve your credit score, but secured cards provide more reliable and proven credit reporting benefits for credit building.

Fees and Interest Rates Comparison

Secured credit cards typically charge an annual fee ranging from $25 to $50 with interest rates between 15% and 25%, making them a straightforward option for building credit. Crypto-backed credit cards often feature lower or no annual fees but may impose higher interest rates or dynamic fees tied to cryptocurrency market volatility. Users should weigh the predictable cost structure of secured cards against the potential financial fluctuations and hidden costs of crypto-backed options when focusing on fees and interest variables.

Collateral: Cash Deposits vs Cryptocurrency Pledges

Secured credit cards require cash deposits as collateral, providing a stable foundation for credit risk assessment and easier approval for users with limited credit history. Crypto-backed credit cards use cryptocurrency pledges as collateral, offering potentially higher credit limits but exposing users to market volatility and liquidation risks. The choice between cash deposits and cryptocurrency pledges directly impacts credit-building strategies and financial security.

Accessibility: Who Should Choose Which Card?

Secured credit cards offer universal accessibility by requiring a cash deposit and are ideal for individuals new to credit or with low credit scores seeking a straightforward path to credit building. Crypto-backed credit cards leverage digital assets as collateral, appealing primarily to cryptocurrency holders comfortable with market volatility and looking to utilize their crypto for credit without selling it. Users unfamiliar with cryptocurrencies or lacking digital assets should choose secured cards for stable and predictable credit-building opportunities.

Risks Involved with Secured and Crypto-Backed Cards

Secured credit cards carry risks such as potential loss of the security deposit if payments are missed, alongside fees and interest rates that may be higher than traditional credit cards. Crypto-backed credit cards expose users to cryptocurrency market volatility, risking collateral value fluctuations that can trigger margin calls or liquidation. Both options require careful management to avoid credit damage and financial loss.

Which Card is Best for Building Credit in 2024?

Secured credit cards remain the most reliable option for building credit in 2024 due to their direct reporting to major credit bureaus and lower risk of volatility. Crypto-backed credit cards offer innovative benefits but carry risks associated with the fluctuating value of digital assets, making them less stable for consistent credit building. Borrowers seeking steady credit improvement should prioritize secured credit cards for their predictable credit reporting and manageable credit limits.

Related Important Terms

Collateralized Card

Collateralized cards require a cash deposit as collateral, directly reducing lender risk and offering a straightforward path to build or rebuild credit by reporting timely payments to credit bureaus. Crypto-backed credit cards leverage cryptocurrency holdings as collateral, providing flexibility and access to credit without liquidating assets, but may involve greater volatility and complexity in credit management.

Stablecoin-Backed Credit

Stablecoin-backed credit cards leverage digital assets pegged to stable currencies like USDC or DAI, providing a low-volatility alternative for building credit while ensuring transparency and faster transaction settlements. Compared to traditional secured credit cards, stablecoin-backed credit cards offer enhanced liquidity and the potential for seamless integration with decentralized finance (DeFi) ecosystems, making them a modern tool for creditworthiness development.

CeFi Credit Vehicles

Secured credit cards require a cash deposit as collateral, offering a traditional and reliable way to build credit by reporting to major credit bureaus under CeFi credit vehicles. Crypto-backed credit cards leverage digital assets as collateral, providing innovative credit-building opportunities while still integrating with centralized financial systems to help establish or improve credit scores.

On-Chain Credit Scoring

Secured credit cards rely on cash deposits to establish credit limits and report to traditional credit bureaus, while crypto-backed credit cards use digital assets as collateral combined with on-chain credit scoring to evaluate creditworthiness based on blockchain transaction history. On-chain credit scoring leverages transparent, immutable data from decentralized finance (DeFi) activity to provide alternative credit profiles, enhancing access to credit for users lacking conventional credit history.

Tokenized Deposit Secured Card

Tokenized Deposit Secured Cards leverage blockchain technology to tokenize deposits, offering enhanced security and transparency compared to traditional secured credit cards, thereby improving credit-building opportunities through real-time reporting and immutable proof of collateral. This innovative approach enables users to build credit efficiently while maintaining control over their assets, distinguishing it from crypto-backed credit cards that typically involve higher volatility and regulatory complexities.

DeFi Credit Builder

Secured credit cards require a cash deposit as collateral, ensuring low risk for lenders and steady credit building through traditional reporting to credit bureaus, while crypto-backed credit cards use cryptocurrency assets on DeFi platforms like DeFi Credit Builder to leverage digital collateral without a credit check, offering innovative routes to establish or improve credit scores. DeFi Credit Builder integrates blockchain transparency and smart contract automation, enabling users to build credit in a decentralized environment that also supports DeFi lending and borrowing activities.

Crypto-Collateralized Utilization Ratio

Crypto-backed credit cards leverage a Crypto-Collateralized Utilization Ratio that dynamically adjusts credit limits based on the value of deposited cryptocurrency, offering potential for flexible credit utilization and rapid credit building. In contrast, secured credit cards rely on fixed cash deposits, providing stable but less responsive credit utilization metrics crucial for traditional credit scoring models.

Hybrid Asset Credit Card

Hybrid asset credit cards leverage both traditional secured credit and crypto-backed collateral to build credit efficiently by combining stable collateral with digital asset flexibility. This innovative approach helps consumers establish or improve credit scores while maintaining access to cryptocurrency value without liquidating assets.

Multi-Asset Security Pledge

A secured credit card requires a cash deposit as collateral, which directly sets the credit limit and helps build credit through traditional reporting to credit bureaus, while a crypto-backed credit card uses a Multi-Asset Security Pledge, allowing multiple cryptocurrencies as collateral to secure the credit line, offering flexibility but with potential volatility risks. Both options enable responsible credit usage to improve credit scores, but the crypto-backed approach integrates blockchain assets, potentially diversifying collateral beyond fiat cash.

Web3 Credit Underwriting

Secured credit cards report traditional payment history to major credit bureaus, enabling gradual credit score improvement through consistent on-time payments. Crypto-backed credit cards leverage Web3 credit underwriting by utilizing blockchain-verified digital assets as collateral, offering innovative credit-building methods that can diversify credit profiles beyond conventional financial data.

Secured credit card vs crypto-backed credit card for building credit. Infographic

moneydiff.com

moneydiff.com