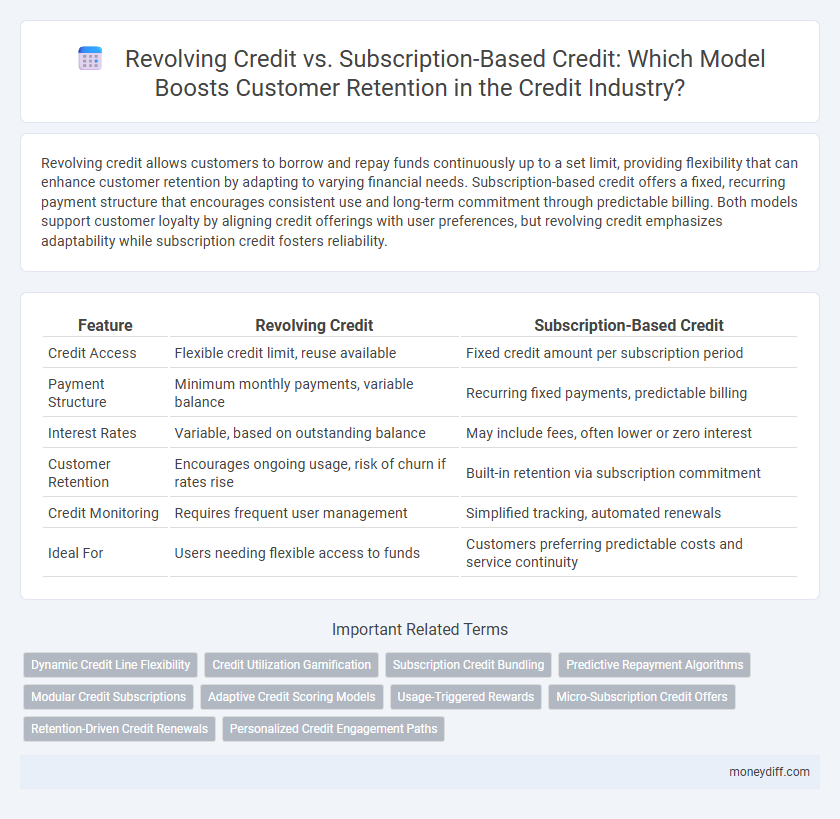

Revolving credit allows customers to borrow and repay funds continuously up to a set limit, providing flexibility that can enhance customer retention by adapting to varying financial needs. Subscription-based credit offers a fixed, recurring payment structure that encourages consistent use and long-term commitment through predictable billing. Both models support customer loyalty by aligning credit offerings with user preferences, but revolving credit emphasizes adaptability while subscription credit fosters reliability.

Table of Comparison

| Feature | Revolving Credit | Subscription-Based Credit |

|---|---|---|

| Credit Access | Flexible credit limit, reuse available | Fixed credit amount per subscription period |

| Payment Structure | Minimum monthly payments, variable balance | Recurring fixed payments, predictable billing |

| Interest Rates | Variable, based on outstanding balance | May include fees, often lower or zero interest |

| Customer Retention | Encourages ongoing usage, risk of churn if rates rise | Built-in retention via subscription commitment |

| Credit Monitoring | Requires frequent user management | Simplified tracking, automated renewals |

| Ideal For | Users needing flexible access to funds | Customers preferring predictable costs and service continuity |

Understanding Revolving Credit and Subscription-Based Credit

Revolving credit allows customers to borrow up to a pre-approved limit and repay over time, providing flexibility and ongoing access to funds that can enhance customer retention through convenience. Subscription-based credit offers a fixed, recurring credit amount tied to a service or product, ensuring predictable usage and consistent engagement, which helps in maintaining long-term customer relationships. Understanding these credit models enables businesses to tailor financial solutions that align with customer spending behavior and loyalty strategies.

Key Differences Between Revolving and Subscription Credit Models

Revolving credit allows customers to borrow up to a set credit limit and repay over time with variable interest, promoting flexibility and usage control. Subscription-based credit offers a fixed periodic payment granting continuous access to services or credit, simplifying budgeting and enhancing predictability. Key differences lie in payment structure, interest application, and impact on customer retention strategies, with revolving credit focusing on credit utilization and subscription credit emphasizing consistent engagement.

Customer Retention Strategies in Revolving Credit

Revolving credit enhances customer retention by offering flexible borrowing limits that adjust based on repayment behavior, encouraging ongoing engagement. Customized credit line increases and tailored repayment plans improve customer satisfaction and loyalty. Data-driven risk assessments enable lenders to proactively manage accounts, reducing churn and fostering long-term relationships.

Subscription-Based Credit: Enhancing Customer Loyalty

Subscription-based credit models foster customer loyalty by offering predictable, flexible financing options that align with recurring expenses. This approach encourages consistent engagement and spending, leading to higher retention rates compared to revolving credit, which often introduces uncertainty due to fluctuating balances and interest. Major retailers leveraging subscription-based credit have reported significant increases in customer lifetime value and repeat purchase frequency.

Flexibility vs Predictability: What Customers Prefer

Revolving credit offers customers flexibility by allowing them to borrow up to a set limit and repay over time, which appeals to those seeking adaptable spending options. Subscription-based credit provides predictability with fixed, regular payments, helping customers manage budgets more effectively. Preferences often depend on individual financial habits, with flexible plans favored by those valuing control and predictable plans preferred by customers prioritizing steady cash flow management.

Impact on Customer Lifetime Value

Revolving credit enhances customer lifetime value by providing flexible access to funds, encouraging repeated usage and higher spending over time. Subscription-based credit fosters consistent engagement and predictable revenue streams, improving retention through ongoing service delivery. Both models increase lifetime value differently: revolving credit drives transactional growth, while subscription credit builds loyalty and stable income.

Personalization Opportunities for Each Credit Model

Revolving credit offers personalized credit limits and spending flexibility that adapt to individual customer behaviors, enhancing tailored reward programs and usage notifications to boost retention. Subscription-based credit enables fixed, predictable billing cycles with customized service tiers and exclusive member benefits, fostering a sense of loyalty through consistent value delivery. Both models leverage data-driven insights for targeted communication and personalized credit solutions, optimizing customer satisfaction and long-term engagement.

Payment Behavior Insights: Revolving vs Subscription Credit

Revolving credit provides flexibility in payment amounts and timing, offering valuable insights into customers' spending habits and credit utilization patterns that help tailor personalized retention strategies. Subscription-based credit, with its fixed periodic payments, enables the tracking of consistent payment behavior, highlighting customer loyalty and the likelihood of longer-term engagement. Analyzing these distinct payment behaviors allows businesses to optimize credit offerings and increase customer retention through targeted financial products.

Minimizing Churn Through Credit Model Optimization

Revolving credit allows customers flexible access to funds with variable repayment schedules, promoting ongoing engagement and reducing churn by accommodating changing financial needs. Subscription-based credit offers predictable, recurring credit limits that foster loyalty through consistent, manageable payments and clear budgeting. Optimizing credit models by blending these approaches enhances customer retention by aligning credit options with diverse spending behaviors and improving satisfaction.

Choosing the Right Credit Approach for Long-Term Retention

Revolving credit offers customers flexibility by allowing them to borrow up to a set limit and repay over time, which can increase satisfaction and retention through continuous access to funds. Subscription-based credit provides predictable, recurring credit limits that simplify budgeting and enhance loyalty by creating a consistent relationship between the customer and provider. Selecting the appropriate credit model hinges on customer behavior analytics and business goals, ensuring tailored credit experiences that drive sustained long-term retention.

Related Important Terms

Dynamic Credit Line Flexibility

Revolving credit offers dynamic credit line flexibility by allowing customers to borrow, repay, and borrow again up to a set limit, enhancing retention through adaptable spending power. Subscription-based credit typically provides fixed monthly limits with less flexibility, which may limit customer engagement and long-term loyalty.

Credit Utilization Gamification

Revolving credit enhances customer retention by leveraging credit utilization gamification, encouraging users to manage their credit lines actively to unlock rewards and maintain favorable credit scores. Subscription-based credit models promote consistent engagement through recurring payments, motivating customers to optimize credit usage patterns within set limits, fostering loyalty through gamified milestones and benefits.

Subscription Credit Bundling

Subscription credit bundling enhances customer retention by offering predictable, recurring billing combined with flexible credit limits tailored to usage patterns. This approach fosters loyalty by simplifying payment management and providing value-added incentives, contrasting with the fluctuating balances and interest rates of traditional revolving credit.

Predictive Repayment Algorithms

Revolving credit leverages predictive repayment algorithms to analyze customer spending patterns and repayment behaviors in real time, enabling personalized credit limits that enhance retention by reducing default risks. Subscription-based credit models utilize machine learning to forecast customer cash flow and optimize payment schedules, fostering loyalty through tailored, manageable repayment plans.

Modular Credit Subscriptions

Modular credit subscriptions enhance customer retention by offering flexible, scalable access to credit that adapts to individual usage patterns, unlike revolving credit which often imposes rigid credit limits and less personalized repayment options. This subscription-based credit model leverages data-driven insights to customize credit modules, fostering increased engagement, loyalty, and long-term customer value.

Adaptive Credit Scoring Models

Adaptive credit scoring models enhance customer retention by personalizing revolving credit limits based on real-time spending patterns and payment behaviors, enabling flexible credit access tailored to individual financial habits. Subscription-based credit systems leverage these models to adjust credit availability dynamically, improving user satisfaction and reducing default rates through predictive analytics and risk-informed decision-making.

Usage-Triggered Rewards

Usage-triggered rewards in revolving credit programs incentivize customers to maintain higher spending levels by offering benefits tied directly to their credit utilization patterns. Subscription-based credit models leverage consistent monthly fees to provide predictable rewards, enhancing customer retention through steady engagement and perceived value continuity.

Micro-Subscription Credit Offers

Micro-subscription credit offers provide flexible, low-commitment financing that enhances customer retention by allowing smaller, recurring credit access tailored to individual spending patterns. Unlike traditional revolving credit, these micro-subscriptions foster consistent engagement and improve cash flow predictability for both consumers and lenders.

Retention-Driven Credit Renewals

Revolving credit offers flexible borrowing limits that encourage ongoing customer engagement through continuous credit availability, enhancing retention-driven credit renewals by adapting to fluctuating financial needs. Subscription-based credit provides predictable, periodic billing cycles and consistent credit access, fostering steady customer commitment and simplifying the renewal process to boost long-term retention.

Personalized Credit Engagement Paths

Revolving credit offers flexible borrowing limits that adjust based on customer payment behavior, enabling tailored repayment plans that enhance long-term retention. Subscription-based credit models provide predictable, recurring credit access with personalized engagement strategies, fostering consistent usage and strengthening customer loyalty.

Revolving Credit vs Subscription-Based Credit for customer retention. Infographic

moneydiff.com

moneydiff.com