Secured credit loans use traditional assets like real estate or vehicles as collateral, offering stable and widely accepted security for lenders. Crypto-backed credit leverages digital assets such as Bitcoin or Ethereum, providing faster approval and access to liquidity without selling holdings. Both options carry risks: secured credit often requires thorough asset valuation, while crypto-backed loans face volatility and regulatory uncertainties.

Table of Comparison

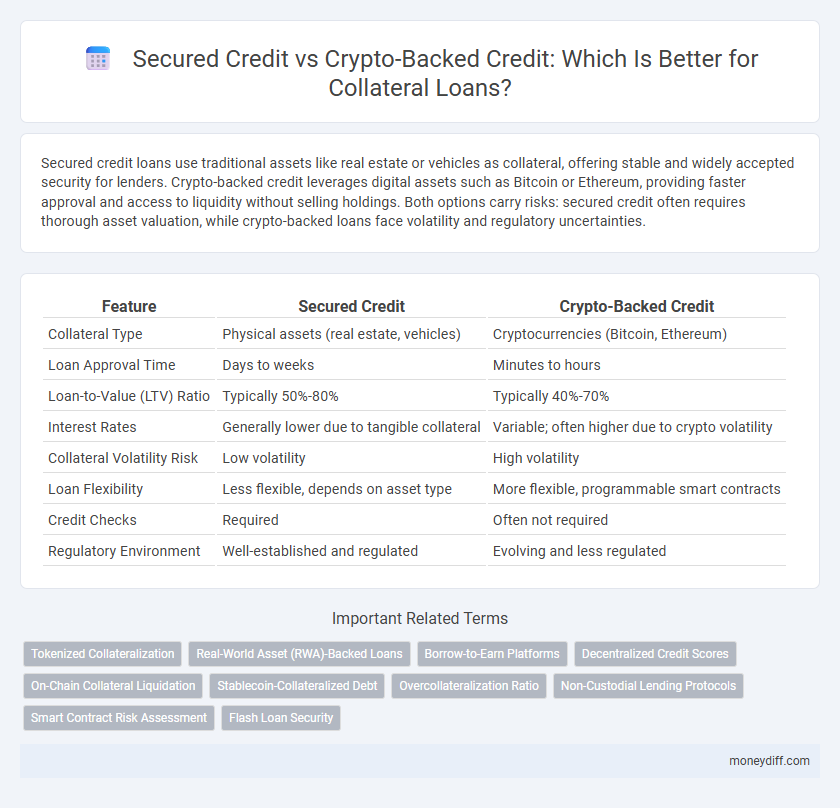

| Feature | Secured Credit | Crypto-Backed Credit |

|---|---|---|

| Collateral Type | Physical assets (real estate, vehicles) | Cryptocurrencies (Bitcoin, Ethereum) |

| Loan Approval Time | Days to weeks | Minutes to hours |

| Loan-to-Value (LTV) Ratio | Typically 50%-80% | Typically 40%-70% |

| Interest Rates | Generally lower due to tangible collateral | Variable; often higher due to crypto volatility |

| Collateral Volatility Risk | Low volatility | High volatility |

| Loan Flexibility | Less flexible, depends on asset type | More flexible, programmable smart contracts |

| Credit Checks | Required | Often not required |

| Regulatory Environment | Well-established and regulated | Evolving and less regulated |

Understanding Secured Credit: Traditional Collateral Explained

Secured credit involves using tangible assets like real estate, vehicles, or savings accounts as collateral to reduce lender risk and secure favorable loan terms. Traditional collateral ensures predictable valuation and legal frameworks, offering borrowers higher credit limits and lower interest rates. Unlike crypto-backed credit, secured credit benefits from established financial systems with less volatility and clearer regulatory protections.

What Are Crypto-Backed Credit Loans?

Crypto-backed credit loans are secured loans that use cryptocurrency assets like Bitcoin or Ethereum as collateral, allowing borrowers to access funds without liquidating their holdings. These loans leverage blockchain technology for transparent, fast transactions and typically offer lower interest rates compared to unsecured credit options. Unlike traditional secured credit loans backed by physical assets or credit histories, crypto-backed loans rely on the volatility and value of digital assets, posing unique risks and opportunities for both lenders and borrowers.

Key Differences Between Secured and Crypto-Backed Credit

Secured credit typically involves traditional assets like real estate or vehicles as collateral, providing lenders with tangible security and established valuation methods. Crypto-backed credit uses digital assets such as Bitcoin or Ethereum as collateral, introducing volatility and requiring specialized platforms to assess and manage risk. Key differences include asset liquidity, regulatory frameworks, and the speed of loan approval, with crypto-backed loans often offering faster access but higher risk due to market fluctuations.

Risk Assessment: Traditional Assets vs Cryptocurrency Collateral

Secured credit using traditional assets such as real estate or vehicles offers a more stable risk assessment due to established valuation methods and lower volatility. Crypto-backed credit loans face higher risk exposure because of cryptocurrency price fluctuations and less predictable market behavior. Lenders require more stringent risk management strategies when dealing with digital collateral to mitigate potential losses.

Loan Approval Process: Conventional vs Crypto-Based Lending

The loan approval process in secured credit typically involves thorough credit checks, income verification, and property appraisal to assess risk and collateral value. In contrast, crypto-backed credit relies on the real-time valuation of digital assets like Bitcoin or Ethereum, enabling faster approvals with reduced traditional financial scrutiny. This streamlined process leverages blockchain transparency, minimizing counterparty risk while providing liquidity without liquidating underlying crypto collateral.

Interest Rates and Fees: A Comparative Analysis

Secured credit loans typically offer lower interest rates compared to crypto-backed credit due to the reduced risk associated with traditional collateral like real estate or vehicles. Crypto-backed loans often come with higher fees and variable interest rates driven by the volatile nature of digital assets used as collateral. Lenders in the crypto space may also charge additional maintenance or liquidation fees, reflecting the unique challenges in securing and managing crypto-backed collateral.

Impact on Credit Score: Borrowing with Secured vs Crypto Collateral

Secured credit loans, backed by traditional assets such as real estate or vehicles, typically have a direct and positive impact on credit scores when payments are made on time, as they are reported to major credit bureaus. Crypto-backed credit loans, while offering innovation and flexibility, often do not influence credit scores since many lenders do not report these transactions to credit bureaus, limiting their effectiveness in building credit history. Borrowers relying on crypto collateral should be aware that missed payments can result in asset liquidation without impacting their credit score, whereas secured credit defaults usually lead to negative credit reporting and damage to the borrower's credit profile.

Accessibility: Who Can Qualify for Each Loan Type?

Secured credit loans typically require borrowers to have tangible assets like real estate or vehicles to qualify, making them accessible primarily to individuals with substantial physical collateral. Crypto-backed credit loans allow borrowers to use digital assets such as Bitcoin or Ethereum as collateral, expanding eligibility to those holding cryptocurrencies regardless of traditional credit history. This flexibility in collateral type enhances accessibility for tech-savvy borrowers seeking faster approval without conventional asset requirements.

Security and Custody of Collateral Assets

Secured credit relies on traditional collateral such as real estate or vehicles, offering well-established legal protections and custody through regulated financial institutions. Crypto-backed credit uses digital assets as collateral, with security dependent on blockchain technology and the custodial solutions chosen, such as hardware wallets or third-party custodians. The custody of crypto assets introduces unique risks like hacking or loss of private keys, while secured credit benefits from more mature regulatory frameworks and asset recovery options.

Future Trends: The Evolution of Collateral Loans in Finance

Secured credit traditionally relies on tangible assets like real estate or vehicles as collateral, offering stability and regulated protection for lenders and borrowers. Crypto-backed credit is emerging as a fast-growing alternative, leveraging blockchain assets to provide flexible, transparent collateral options with faster approval processes. Future trends indicate increased integration of decentralized finance (DeFi) platforms, enhanced regulatory frameworks, and hybrid models combining traditional secured credit with crypto-backed collateral to optimize risk management and accessibility.

Related Important Terms

Tokenized Collateralization

Tokenized collateralization in crypto-backed credit enables seamless digital representation of assets, improving liquidity and transparency compared to traditional secured credit that relies on physical collateral. This innovation enhances loan accessibility by reducing processing times and enabling fractional ownership of collateralized tokens.

Real-World Asset (RWA)-Backed Loans

Real-World Asset (RWA)-Backed loans leverage tangible collateral like real estate or vehicles, offering lower risk and more stable valuations compared to volatile crypto-backed credit, which depends on digital asset price fluctuations. Secured credit with RWAs enhances borrower reliability and lender confidence, whereas crypto-backed loans risk rapid collateral depreciation impacting loan stability.

Borrow-to-Earn Platforms

Borrow-to-earn platforms leverage crypto-backed credit by allowing users to secure loans with digital assets, providing faster collateral verification and higher liquidity compared to traditional secured credit involving physical or financial assets. This innovation enhances borrowing efficiency and opens new earning opportunities through decentralized finance (DeFi) ecosystems.

Decentralized Credit Scores

Secured credit relies on traditional collateral like property or vehicles, offering predictable risk assessment through centralized credit scores, whereas crypto-backed credit leverages blockchain assets and decentralized credit scores for transparent, immutable evaluation. Decentralized credit scores utilize on-chain transaction history and financial behavior, enabling more inclusive lending opportunities without relying on conventional credit bureaus.

On-Chain Collateral Liquidation

Secured credit typically relies on traditional assets like real estate or vehicles for collateral, offering predictable liquidation processes through established legal channels. In contrast, crypto-backed credit uses digital assets on-chain, enabling automatic, transparent collateral liquidation via smart contracts that reduce counterparty risk and enhance loan efficiency.

Stablecoin-Collateralized Debt

Secured credit typically involves tangible assets like real estate or vehicles as collateral, providing a stable and familiar risk profile, while crypto-backed credit, particularly stablecoin-collateralized debt, leverages algorithmic or fiat-pegged digital assets such as USDC or DAI to minimize volatility and enhance loan stability. Stablecoin-collateralized loans enable borrowers to access liquidity without asset liquidation, optimizing collateral efficiency and supporting decentralized finance ecosystems with programmable, transparent credit terms.

Overcollateralization Ratio

Secured credit typically requires an overcollateralization ratio of 100% or higher, ensuring that the collateral value surpasses the loan amount to mitigate default risk. Crypto-backed credit often demands significantly higher overcollateralization ratios, sometimes exceeding 150%, due to the volatility and market fluctuations inherent in digital assets.

Non-Custodial Lending Protocols

Secured credit involves using tangible assets like real estate or vehicles as collateral to secure loans, while crypto-backed credit leverages digital assets such as cryptocurrencies in non-custodial lending protocols to maintain borrower control and reduce counterparty risk. Non-custodial lending platforms like Aave and Compound enable borrowers to lock crypto as collateral without centralized intermediaries, enhancing transparency and security in decentralized finance (DeFi) ecosystems.

Smart Contract Risk Assessment

Secured credit loans typically involve traditional assets such as real estate or vehicles as collateral, with valuation and risk assessments conducted through established financial institutions, ensuring regulatory oversight and reduced default risks. In contrast, crypto-backed credit utilizes blockchain-based smart contracts to automate collateral management and loan disbursement but faces unique challenges in risk assessment due to volatility, code vulnerabilities, and potential oracle manipulation.

Flash Loan Security

Secured credit typically involves tangible collateral like property or vehicles, offering more stable asset valuation and reduced flash loan attack risks. Crypto-backed credit relies on volatile digital assets, making flash loan security more challenging due to rapid price fluctuations and potential for exploit via decentralized finance protocols.

Secured Credit vs Crypto-Backed Credit for collateral loans. Infographic

moneydiff.com

moneydiff.com