Credit reports provide a historical overview of an individual's borrowing and repayment behavior, offering lenders a traditional measure of creditworthiness based on past financial activity. Open banking data, however, gives real-time access to a broader spectrum of financial information, including current income, spending patterns, and account balances, enabling a more dynamic and comprehensive assessment. Integrating open banking data with credit reports enhances the accuracy of financial assessments by combining historical trends with up-to-date financial behavior.

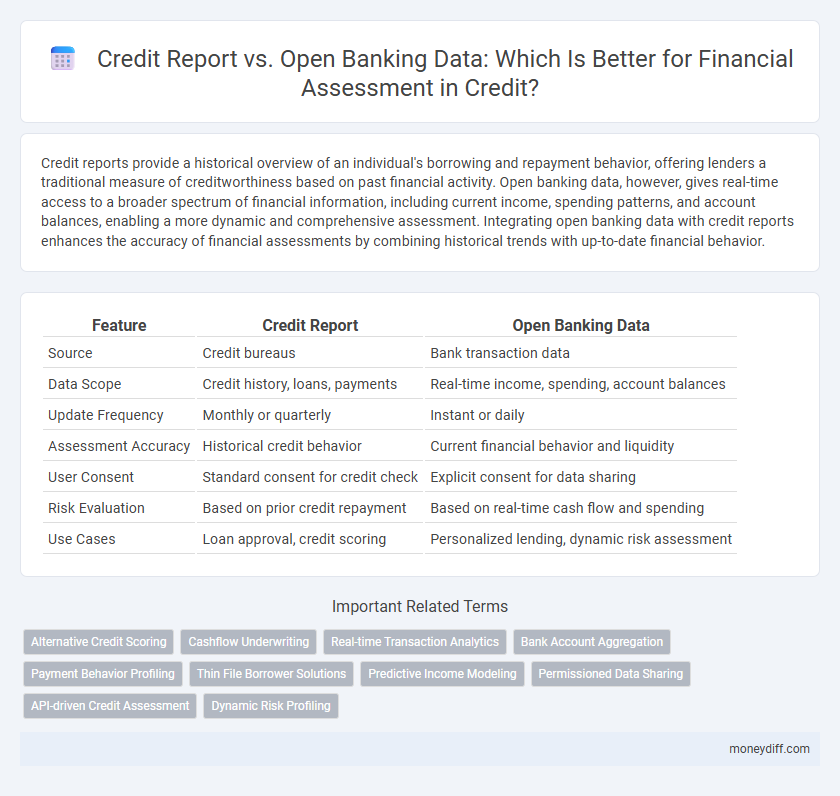

Table of Comparison

| Feature | Credit Report | Open Banking Data |

|---|---|---|

| Source | Credit bureaus | Bank transaction data |

| Data Scope | Credit history, loans, payments | Real-time income, spending, account balances |

| Update Frequency | Monthly or quarterly | Instant or daily |

| Assessment Accuracy | Historical credit behavior | Current financial behavior and liquidity |

| User Consent | Standard consent for credit check | Explicit consent for data sharing |

| Risk Evaluation | Based on prior credit repayment | Based on real-time cash flow and spending |

| Use Cases | Loan approval, credit scoring | Personalized lending, dynamic risk assessment |

Understanding Credit Reports: Traditional Financial Assessment

Credit reports compile detailed credit histories, including payment behavior, outstanding debts, and credit inquiries, serving as the backbone of traditional financial assessments. Lenders rely on credit scores derived from these reports to evaluate creditworthiness and predict the likelihood of loan repayment. This standardized data offers a consistent framework but may omit real-time financial activity and alternative credit factors.

What Is Open Banking Data? A New Approach to Financial Insights

Open Banking data provides real-time access to a consumer's financial transactions and account information directly from bank accounts via secure APIs, offering a more dynamic and comprehensive view than traditional credit reports. Unlike credit reports, which rely on historical credit behavior and reported data from credit bureaus, Open Banking data enables lenders to assess current financial health, cash flow patterns, and spending habits with greater accuracy. This new approach to financial insights enhances credit risk evaluation, allowing for personalized lending decisions and improved financial inclusion, especially for individuals with limited credit histories.

Key Differences: Credit Reports vs Open Banking Data

Credit reports provide a historical record of an individual's borrowing and repayment behavior, including credit accounts, payment history, and public records, while open banking data offers real-time access to bank transaction information, income, and spending patterns. Credit reports are primarily built from third-party financial institutions' reported data, emphasizing creditworthiness and loan repayment risk, whereas open banking data delivers granular insights into cash flow and financial habits directly from the consumer's bank accounts. Financial assessments using credit reports focus on credit scores and debt levels, whereas those leveraging open banking data can evaluate financial stability and affordability through dynamic, up-to-date transaction analysis.

Data Sources: How Credit Reports and Open Banking Data Are Collected

Credit reports compile data primarily from financial institutions, credit card companies, and public records, reflecting historical credit behavior and payment history. Open banking data is gathered directly from consumers' bank accounts through secure APIs, providing real-time insights into income, spending patterns, and cash flow. These differing data sources influence the timeliness and scope of financial assessments used by lenders.

Accuracy and Timeliness: Which Provides Better Financial Snapshots?

Credit reports compile historical borrowing and repayment data from multiple lenders, offering a comprehensive but sometimes outdated view of an individual's financial behavior. Open banking data delivers real-time access to transaction-level information directly from bank accounts, enhancing the accuracy and timeliness of financial assessments. For lenders prioritizing up-to-date financial snapshots, open banking data provides a more dynamic and precise tool compared to traditional credit reports.

Assessing Creditworthiness: Methods and Metrics Compared

Credit reports provide a comprehensive history of an individual's borrowing and repayment behaviors, including credit scores, outstanding debt, and payment timeliness, which are traditional metrics used to assess creditworthiness. Open banking data offers real-time access to detailed financial transactions, income patterns, and cash flow insights, enabling a dynamic and holistic view of a borrower's financial stability. Combining these methods allows lenders to enhance risk assessment accuracy by integrating historical credit behavior with current financial health indicators.

Privacy and Consent: Data Security in Credit Reports vs Open Banking

Credit reports compile historical financial data from multiple sources, governed by strict regulations like the FCRA to ensure user privacy and secure data handling. Open Banking data leverages real-time transactional information, accessed only with explicit user consent and protected under PSD2 in Europe, enhancing transparency and control over personal financial information. The key difference in privacy lies in the dynamic consent model of Open Banking versus the traditional, centralized data collection in credit reports.

The Role of Open Banking in Modern Lending Decisions

Open Banking data enhances financial assessment by providing real-time insights into a borrower's transaction history, income patterns, and spending behavior, offering a dynamic complement to traditional credit reports. Unlike credit reports that rely on historical credit usage and payment records, Open Banking delivers a comprehensive view of financial health through direct access to bank account information. This expanded data scope enables lenders to make more accurate, personalized lending decisions and better assess risk for underserved or thin-file customers.

Combining Credit Reports and Open Banking for Holistic Assessments

Combining credit reports with open banking data enhances financial assessments by providing a comprehensive view of an individual's creditworthiness and real-time financial behavior. Credit reports offer historical data on borrowing and repayment patterns, while open banking delivers insights into cash flow, spending habits, and income stability. This integrated approach enables lenders to make more accurate risk evaluations and personalized lending decisions, improving access to credit for underserved consumers.

Future Trends: The Evolution of Financial Assessment Tools

Credit reports continue to serve as a foundational element in financial assessments, providing historical credit behavior and risk profiles. Open banking data offers real-time insights into spending patterns, income streams, and financial habits, enabling a more dynamic and comprehensive evaluation. Future trends indicate a hybrid approach where AI-driven analysis of both credit reports and open banking data will enhance predictive accuracy and personalized lending decisions.

Related Important Terms

Alternative Credit Scoring

Alternative credit scoring leverages open banking data to provide a more dynamic and comprehensive financial assessment beyond traditional credit reports, capturing real-time transaction patterns and spending behavior. Utilizing this data enables lenders to evaluate creditworthiness for individuals with limited or no credit history, enhancing inclusion and reducing reliance on outdated credit bureau information.

Cashflow Underwriting

Cashflow underwriting leverages open banking data to provide real-time insights into income and expenditure patterns, enabling a more dynamic financial assessment compared to traditional credit reports that rely on historical credit behavior and static snapshots. By integrating open banking data, lenders can assess borrowers' true repayment capacity with greater accuracy, reducing risk and improving credit access for individuals with limited credit history.

Real-time Transaction Analytics

Real-time transaction analytics from open banking data offers lenders dynamic insights into spending patterns, enabling more accurate financial assessments compared to traditional credit reports. This approach enhances risk evaluation by providing continuous updates on account activity, improving decision-making speed and precision.

Bank Account Aggregation

Bank account aggregation in open banking data offers a real-time, comprehensive view of an individual's financial behavior by consolidating transaction histories across multiple accounts, enhancing the accuracy and timeliness of financial assessments. Unlike traditional credit reports, which rely on historical credit activity and may omit current cash flow details, aggregated bank data provides deeper insights into income stability and spending patterns crucial for personalized lending decisions.

Payment Behavior Profiling

Credit reports compile historical payment data from lenders to provide a comprehensive view of an individual's creditworthiness, while open banking data offers real-time insights into transaction patterns and cash flow dynamics. Payment behavior profiling benefits from integrating credit report data with open banking analytics to deliver a more accurate and dynamic assessment of financial reliability.

Thin File Borrower Solutions

Open Banking data enhances financial assessments for thin-file borrowers by providing real-time transaction insights and cash flow patterns unavailable in traditional credit reports. This dynamic financial information enables lenders to evaluate creditworthiness more accurately, expanding access to credit for individuals with limited credit history.

Predictive Income Modeling

Credit reports provide historical credit behavior but often lack real-time cash flow insights necessary for accurate predictive income modeling. Open Banking data offers granular transaction-level information, enabling more precise and dynamic assessments of income stability and financial health for lenders.

Permissioned Data Sharing

Permissioned data sharing in financial assessment leverages both credit reports and open banking data to provide a comprehensive view of an individual's financial behavior. While credit reports offer historical credit performance, open banking data enables real-time access to transactional information, enhancing accuracy and timeliness in risk evaluation.

API-driven Credit Assessment

API-driven credit assessment leverages real-time open banking data to provide a more comprehensive and dynamic financial profile compared to traditional credit reports, which rely on static historical data. Integrating open banking APIs enables lenders to access transaction-level details, improving risk accuracy and enabling personalized credit decisions.

Dynamic Risk Profiling

Credit reports provide static snapshots of an individual's financial history, often limiting the accuracy of risk assessments. Open banking data enables dynamic risk profiling by continuously analyzing real-time transactional information, allowing lenders to make more precise and responsive credit decisions.

Credit Report vs Open Banking Data for Financial Assessment Infographic

moneydiff.com

moneydiff.com