A credit freeze restricts access to your credit report, preventing new accounts from being opened without your permission, and is regulated by federal law. A credit lock offers similar protection but is often more flexible, allowing you to lock and unlock your credit instantly through a mobile app. For security, a credit freeze provides stronger legal protections, while a credit lock offers convenience with comparable safeguards against identity theft.

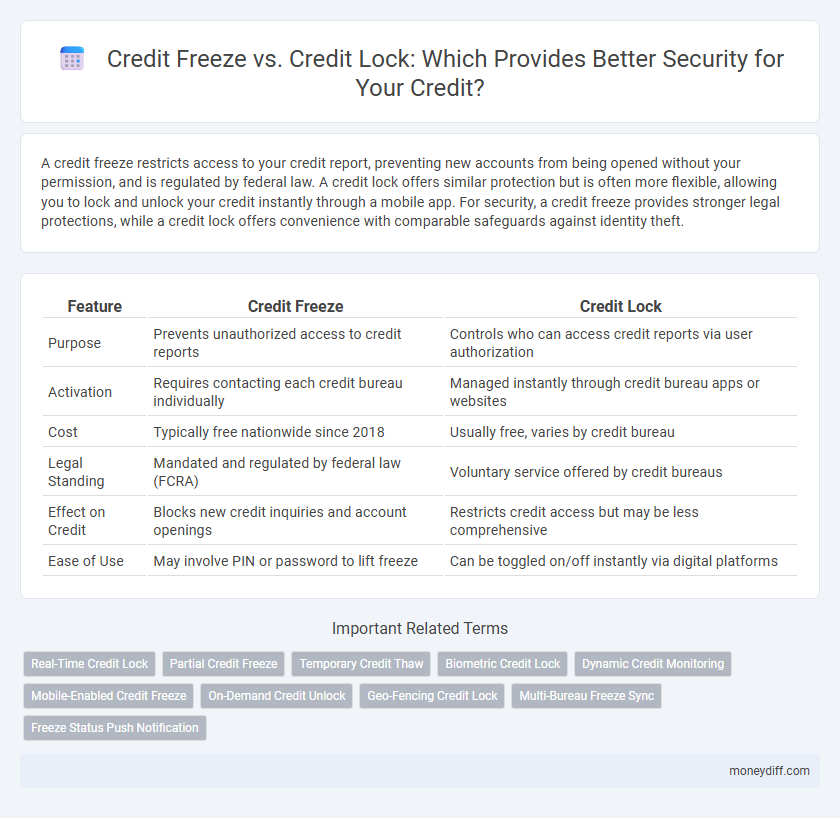

Table of Comparison

| Feature | Credit Freeze | Credit Lock |

|---|---|---|

| Purpose | Prevents unauthorized access to credit reports | Controls who can access credit reports via user authorization |

| Activation | Requires contacting each credit bureau individually | Managed instantly through credit bureau apps or websites |

| Cost | Typically free nationwide since 2018 | Usually free, varies by credit bureau |

| Legal Standing | Mandated and regulated by federal law (FCRA) | Voluntary service offered by credit bureaus |

| Effect on Credit | Blocks new credit inquiries and account openings | Restricts credit access but may be less comprehensive |

| Ease of Use | May involve PIN or password to lift freeze | Can be toggled on/off instantly via digital platforms |

Understanding Credit Freeze and Credit Lock

A credit freeze restricts access to your credit report, preventing new creditors from viewing it without your authorization, making it highly effective against identity theft and unauthorized credit inquiries. A credit lock offers similar protection but is typically easier to toggle on and off via apps or online portals provided by credit bureaus, providing more convenience but sometimes less legal protection than a freeze. Understanding these differences helps consumers choose the best option to safeguard their credit data based on security needs and access flexibility.

Key Differences Between Credit Freeze and Credit Lock

Credit freeze and credit lock both restrict access to your credit report to prevent unauthorized credit checks, but a credit freeze is regulated by federal law and typically free, requiring a PIN to lift, while credit locks are offered by credit bureaus with flexible, instant access control via apps or websites. Credit freezes apply uniformly across all three major credit reporting agencies--Equifax, Experian, and TransUnion--whereas credit locks may vary in availability and terms between bureaus. The key distinction lies in control and cost: freezes provide a robust, long-term security measure mandated by law, while locks offer more convenience with potentially monthly fees.

How Credit Freeze Works

A credit freeze restricts access to your credit reports by lenders and creditors, making it difficult for identity thieves to open new accounts in your name. When a credit freeze is in place, potential creditors cannot view your credit file unless you temporarily lift the freeze using a PIN or password. This security measure is regulated by the major credit bureaus--Equifax, Experian, and TransUnion--and is a free service mandated by federal law to protect consumers from fraud.

How Credit Lock Works

A credit lock instantly restricts access to your credit report, preventing lenders and creditors from viewing your information without your permission, which helps reduce the risk of identity theft and fraud. Unlike a credit freeze, a credit lock can be quickly toggled on or off via an app or website, offering more flexibility and convenience for consumers managing their credit security. Both options serve to protect your credit, but a credit lock provides immediate control and ease of use to guard against unauthorized credit inquiries.

Security Benefits: Freeze vs Lock

A credit freeze provides stronger legal protection by restricting access to your credit report entirely, making it harder for identity thieves to open new accounts. A credit lock offers more convenience with instant on-and-off access but may lack the same federal protections as a freeze. Both methods enhance security by preventing unauthorized credit inquiries, but a freeze is generally recommended for maximum identity theft prevention.

Costs and Accessibility: Freeze vs Lock

Credit freezes are typically free to place and lift at all three major credit bureaus--Equifax, Experian, and TransUnion--offering strong security by restricting all access to credit reports. Credit locks often require a monthly fee and provide more convenient, on-demand control via mobile apps but may not offer the same legal protections as freezes. Consumers should evaluate whether cost savings from free freezes outweigh the accessibility and flexibility benefits of paid credit locks.

Pros and Cons of Freezing Your Credit

Freezing your credit with major bureaus like Equifax, Experian, and TransUnion restricts access to your credit report, preventing unauthorized creditors from opening new accounts in your name. A credit freeze is free, federally regulated, and requires a PIN or password to lift, providing strong protection against identity theft but may delay legitimate credit applications. Unlike credit locks, which may have fees and varying policies, credit freezes offer consistent, long-term security control but require proactive management for timely unfreezing during credit checks.

Pros and Cons of Locking Your Credit

Locking your credit prevents creditors from accessing your credit report, offering immediate protection against identity theft and fraudulent accounts, but may restrict your ability to quickly apply for new credit. Unlike a credit freeze, locks can usually be managed and lifted instantly via an app or website, providing more convenience but sometimes lacking the same legal protections. The main drawback is that if the lock service experiences technical issues, you might face delayed access to your credit information when needed.

When to Use a Credit Freeze or Credit Lock

A credit freeze is ideal when you want to prevent unauthorized access to your credit report and reduce the risk of identity theft by blocking all new credit inquiries, especially during long-term financial uncertainty or after a data breach. A credit lock offers more flexibility with instant on-and-off control but may not have the same legal protections as a freeze, making it suitable for temporary security needs or frequent monitoring. Understanding the differences in cost, duration, and impact on credit applications helps consumers choose the best option to safeguard their credit information effectively.

Steps to Activate and Manage Credit Security

To activate a credit freeze, contact each of the three major credit bureaus--Equifax, Experian, and TransUnion--via their websites, phone lines, or mobile apps, providing personal identification details like Social Security number and date of birth. Managing a credit lock typically involves downloading the credit bureau's dedicated app or accessing their online portal, where users can toggle the lock status instantly without formal verification each time. Both credit freezes and locks restrict access to credit reports, but credit freezes require separate activation and removal with each bureau, while credit locks offer faster, more flexible control through digital platforms.

Related Important Terms

Real-Time Credit Lock

Real-time credit lock provides immediate control over your credit report by allowing you to lock and unlock it instantly through an app or online portal, enhancing security against unauthorized credit inquiries. Unlike a credit freeze, which often requires a lengthy process to lift, real-time credit locks offer convenience and rapid response to potential identity theft threats.

Partial Credit Freeze

A partial credit freeze restricts specific types of credit inquiries, allowing consumers to maintain some credit activities while protecting against unauthorized accounts, contrasting with a full credit freeze that blocks all new credit applications. Unlike a credit lock, which is managed through credit bureaus' apps and can be toggled instantly, a partial freeze combines targeted security with controlled access, enhancing fraud prevention without fully limiting credit use.

Temporary Credit Thaw

A credit freeze restricts access to your credit report, preventing new credit accounts from being opened without your authorization, and requires a PIN or password to temporarily lift, known as a Temporary Credit Thaw. A credit lock offers more flexibility with instant unlocking via an app or online, allowing consumers to quickly enable or disable access without PINs, but both methods protect against identity theft and unauthorized credit inquiries.

Biometric Credit Lock

A credit freeze restricts access to your credit report by requiring a PIN or password, while a biometric credit lock enhances security by allowing instant, fingerprint- or facial-recognition-based control over credit file access. Biometric credit locks offer superior protection against identity theft by eliminating the need for traditional passwords and enabling seamless, real-time management of credit permissions.

Dynamic Credit Monitoring

Dynamic Credit Monitoring enhances security by continuously tracking credit activity and alerting consumers to suspicious changes, offering greater real-time protection than a static credit freeze, which restricts access to credit reports until lifted. While a credit freeze prevents unauthorized credit inquiries, dynamic monitoring provides ongoing surveillance and rapid response options to combat identity theft and fraud.

Mobile-Enabled Credit Freeze

Mobile-enabled credit freeze offers real-time control and instant activation through smartphone apps, providing a seamless way to protect against identity theft without affecting credit scores. Unlike credit locks, which are managed by private companies with varying terms, credit freezes are federally regulated, ensuring consistent security standards and legal protections for consumers.

On-Demand Credit Unlock

Credit freeze restricts access to your credit report by requiring a PIN or password to unlock, offering strong protection against identity theft but with a slower, manual lift process; credit lock provides a more convenient, on-demand unlock option via mobile apps or websites, allowing instant control over credit access for enhanced security and flexibility. On-demand credit unlock features empower users to manage their credit exposure in real time, minimizing the risk of unauthorized credit inquiries while maintaining quick access for legitimate credit activities.

Geo-Fencing Credit Lock

Geo-Fencing Credit Lock enhances security by automatically locking your credit reports when you move outside a predefined geographic area, preventing unauthorized access from suspicious locations. Unlike a traditional credit freeze, which requires manual unlocking, this technology offers dynamic, location-based control that reduces fraud risk while maintaining convenience.

Multi-Bureau Freeze Sync

Multi-bureau credit freeze synchronizes security measures across all major credit reporting agencies, preventing unauthorized access to credit reports simultaneously and offering stronger protection against identity theft. Credit locks provide similar control but often require managing separate contracts and may not offer consistent multi-bureau synchronization, making freeze syncing more reliable for comprehensive credit security.

Freeze Status Push Notification

A credit freeze restricts access to your credit report, preventing creditors from viewing it and reducing identity theft risks, while a credit lock offers similar protection but can be toggled more easily through an app or website. Freeze status push notifications provide immediate alerts when a freeze is placed or lifted, enhancing real-time control and security over your credit monitoring.

Credit freeze vs credit lock for security Infographic

moneydiff.com

moneydiff.com