Secured credit leverages tangible assets like property or vehicles as collateral, providing lenders with lower risk and borrowers with typically lower interest rates. Crypto-backed credit uses cryptocurrency holdings as collateral, offering faster approval and greater liquidity but introducing volatility risks due to price fluctuations. Both options enable access to funds while protecting lenders, yet the choice depends on the borrower's asset preferences and risk tolerance.

Table of Comparison

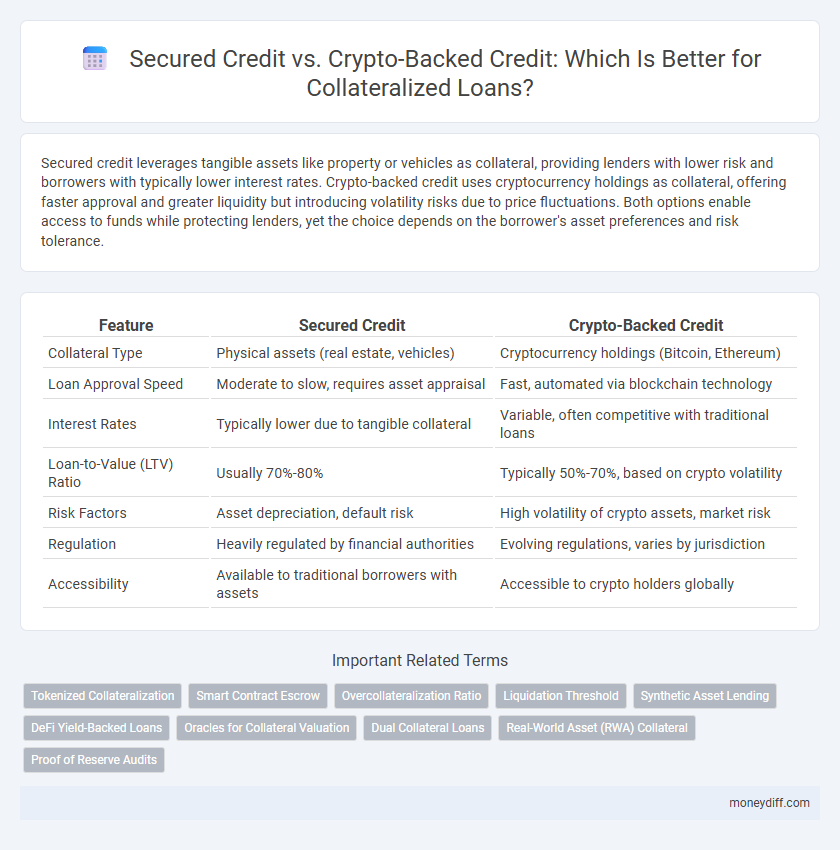

| Feature | Secured Credit | Crypto-Backed Credit |

|---|---|---|

| Collateral Type | Physical assets (real estate, vehicles) | Cryptocurrency holdings (Bitcoin, Ethereum) |

| Loan Approval Speed | Moderate to slow, requires asset appraisal | Fast, automated via blockchain technology |

| Interest Rates | Typically lower due to tangible collateral | Variable, often competitive with traditional loans |

| Loan-to-Value (LTV) Ratio | Usually 70%-80% | Typically 50%-70%, based on crypto volatility |

| Risk Factors | Asset depreciation, default risk | High volatility of crypto assets, market risk |

| Regulation | Heavily regulated by financial authorities | Evolving regulations, varies by jurisdiction |

| Accessibility | Available to traditional borrowers with assets | Accessible to crypto holders globally |

Understanding Collateralized Loans: An Overview

Collateralized loans use assets like real estate or cryptocurrency as collateral to reduce lender risk and secure lower interest rates. Secured credit typically involves tangible assets such as homes or vehicles, while crypto-backed credit leverages digital currencies like Bitcoin or Ethereum, often offering faster approval and increased accessibility. Understanding the differences in asset volatility, liquidity, and regulatory environment is crucial when comparing secured credit options with crypto-backed loans.

What Is Secured Credit? Definition and Key Features

Secured credit is a type of loan backed by collateral, such as real estate, vehicles, or other valuable assets, which reduces the lender's risk and often results in lower interest rates. Key features include the requirement of an asset to secure the loan, higher borrowing limits compared to unsecured credit, and the risk of asset forfeiture if repayment terms are not met. This form of credit provides borrowers with access to larger loan amounts while offering lenders a safety net through tangible collateral.

Crypto-Backed Credit Explained: How It Works

Crypto-backed credit leverages digital assets like Bitcoin or Ethereum as collateral to secure loans, enabling borrowers to access liquidity without selling their holdings. The value of the crypto collateral is monitored in real-time to manage loan-to-value ratios and minimize liquidation risks. This method offers faster approval processes and fewer credit checks compared to traditional secured credit, attracting users who prefer decentralized finance solutions.

Types of Accepted Collateral in Secured Loans

Secured credit typically accepts tangible collateral such as real estate, vehicles, and savings accounts, providing lenders with lower risk and borrowers with potentially lower interest rates. Crypto-backed credit uses digital assets like Bitcoin, Ethereum, or other cryptocurrencies as collateral, offering faster loan approval and increased liquidity. The choice of collateral influences loan terms, risk assessment, and regulatory requirements for both lenders and borrowers.

Risk Assessment: Traditional Assets vs Cryptocurrency Collateral

Secured credit using traditional assets such as real estate or vehicles benefits from established valuation methods and regulatory frameworks, resulting in more predictable risk assessments. Crypto-backed credit relies on volatile digital assets that can experience rapid price fluctuations, increasing the potential for collateral value instability. Lenders face higher risk in crypto-backed loans due to market unpredictability, requiring dynamic monitoring and often higher collateralization ratios to mitigate default risks.

Loan Approval Process: Banks vs Crypto Lenders

Banks require extensive credit history, income verification, and asset evaluation, resulting in a lengthier loan approval process for secured credit. Crypto lenders leverage blockchain technology and digital asset valuation, enabling faster loan approvals with minimal paperwork for crypto-backed credit. The decentralized nature of crypto lending reduces reliance on traditional credit scores, expediting collateralized loan disbursement times compared to traditional banking institutions.

Interest Rates: Secured Credit vs Crypto-Backed Credit

Secured credit typically offers lower interest rates compared to crypto-backed credit due to the stable value of traditional collateral like real estate or vehicles. Crypto-backed loans face higher interest rates reflecting the volatility and risk associated with digital assets such as Bitcoin or Ethereum. Lenders mitigate potential losses by charging premium rates on crypto-backed credit to compensate for price fluctuations and liquidity challenges.

Investor Protections and Regulatory Considerations

Secured credit offers investor protections through established legal frameworks and clear collateral repossession procedures, minimizing risk in collateralized loans. Crypto-backed credit introduces challenges due to market volatility and evolving regulatory standards, which may impact asset valuation and enforceability. Regulatory considerations favor traditional secured credit with comprehensive oversight, whereas crypto-backed loans require adaptive compliance to address decentralized asset risks and investor safeguards.

Pros and Cons: Traditional Secured Loans vs Crypto-Backed Loans

Secured credit loans use tangible assets like real estate or vehicles as collateral, providing predictable valuation and lower interest rates but often involve lengthy approval processes and limited flexibility. Crypto-backed credit leverages digital assets such as Bitcoin or Ethereum, offering faster loan disbursement and increased accessibility, yet faces high volatility risks and regulatory uncertainties that can affect loan stability. Understanding these trade-offs is crucial for borrowers seeking collateralized loans tailored to their financial profile and risk tolerance.

Which Is Right for You? Choosing the Best Collateralized Loan Option

Secured credit typically involves traditional collateral like property or vehicles, offering lower interest rates and established lender protections, making it ideal for borrowers seeking stability. Crypto-backed credit uses digital assets as collateral, providing faster access to funds and potentially higher loan-to-value ratios but with increased volatility and risk. Evaluating your risk tolerance, asset liquidity, and loan purpose helps determine whether secured credit or crypto-backed credit suits your financial needs.

Related Important Terms

Tokenized Collateralization

Tokenized collateralization in crypto-backed credit enables fractional ownership of digital assets, enhancing liquidity and accessibility compared to traditional secured credit which relies on physical collateral. This innovative approach reduces valuation challenges and accelerates loan processing by leveraging blockchain transparency and security features.

Smart Contract Escrow

Smart contract escrow enables automated and transparent management of collateral in crypto-backed credit, reducing counterparty risk compared to traditional secured credit where assets are held by third-party intermediaries. This technology ensures real-time enforcement of loan terms and immediate collateral liquidation upon default, enhancing security and efficiency for borrowers and lenders alike.

Overcollateralization Ratio

Secured credit typically requires an overcollateralization ratio of 110-150% to mitigate lender risk, while crypto-backed credit often demands higher ratios, ranging from 150-200% due to cryptocurrency volatility. This elevated overcollateralization ratio in crypto-backed loans ensures sufficient coverage against rapid asset value fluctuations, maintaining loan stability and reducing default risk.

Liquidation Threshold

Secured credit loans typically have a fixed liquidation threshold based on the collateral's market value, often ranging between 70% to 90%, ensuring lenders minimize risk exposure. Crypto-backed credit features dynamic liquidation thresholds influenced by market volatility, frequently set around 50% to 70%, requiring borrowers to monitor collateral ratios closely to avoid forced liquidation during price swings.

Synthetic Asset Lending

Synthetic asset lending leverages crypto-backed credit by using tokenized derivatives as collateral, offering greater liquidity and flexibility compared to traditional secured credit tied to physical assets. This approach enables borrowers to access loans without relinquishing underlying assets, optimizing capital efficiency and reducing liquidation risks in volatile markets.

DeFi Yield-Backed Loans

Secured credit relies on traditional collateral such as real estate or vehicles, whereas crypto-backed credit in DeFi yield-backed loans uses digital assets staked in decentralized finance protocols to generate interest while securing the loan. This approach leverages blockchain transparency and composability, offering enhanced liquidity and real-time valuation compared to conventional collateralized loans.

Oracles for Collateral Valuation

Oracles play a crucial role in collateralized loans by providing real-time, accurate asset valuations essential for both secured credit and crypto-backed credit. While secured credit relies on traditional asset appraisals, crypto-backed credit depends on decentralized oracles to deliver dynamic, tamper-proof price feeds for volatile crypto collateral, ensuring precise risk assessment and loan-to-value ratios.

Dual Collateral Loans

Dual collateral loans combine traditional secured credit with crypto-backed credit, enabling borrowers to use both physical assets and digital currencies as collateral for increased loan flexibility and potentially lower interest rates. This hybrid approach mitigates volatility risks inherent in crypto by balancing them with stable, tangible collateral, enhancing creditworthiness and loan accessibility.

Real-World Asset (RWA) Collateral

Secured credit utilizes traditional real-world asset (RWA) collateral such as real estate, vehicles, or equipment to mitigate lender risk and often offers lower interest rates due to asset stability. In contrast, crypto-backed credit relies on volatile digital assets like Bitcoin or Ethereum as collateral, which can lead to higher loan-to-value (LTV) ratios but increased liquidation risk during market fluctuations.

Proof of Reserve Audits

Proof of Reserve Audits in secured credit involve traditional financial institutions verifying collateral through regulated asset holdings, ensuring transparency and trustworthiness. In contrast, crypto-backed credit relies on blockchain-based proof of reserves, enabling real-time, cryptographically verifiable audits that enhance security and reduce counterparty risk for collateralized loans.

Secured Credit vs Crypto-Backed Credit for collateralized loans. Infographic

moneydiff.com

moneydiff.com