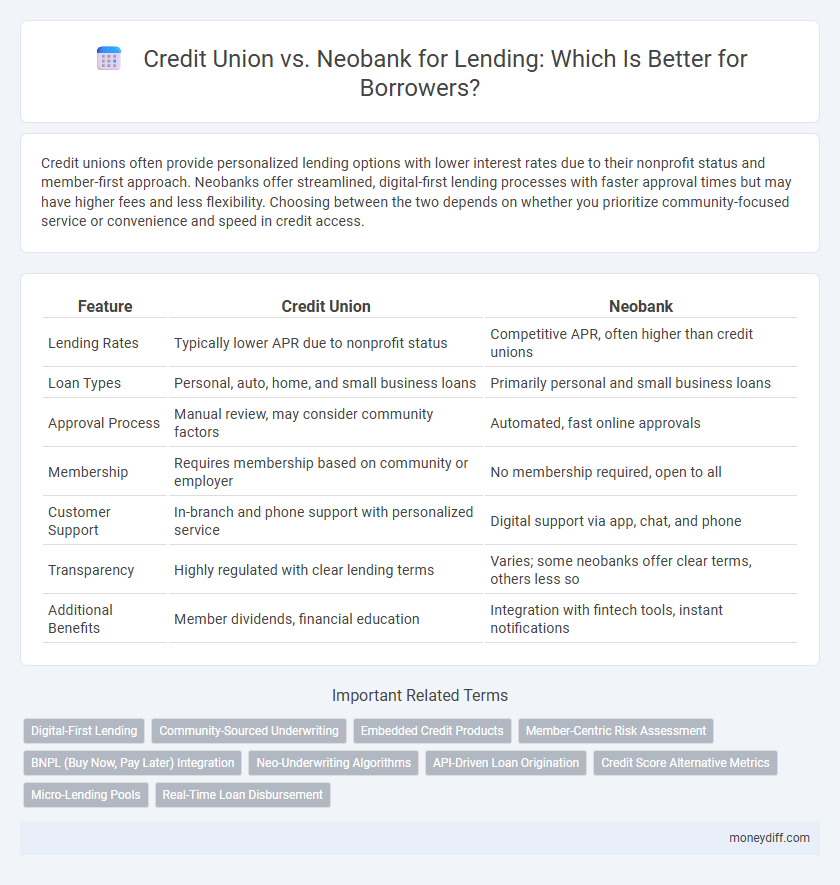

Credit unions often provide personalized lending options with lower interest rates due to their nonprofit status and member-first approach. Neobanks offer streamlined, digital-first lending processes with faster approval times but may have higher fees and less flexibility. Choosing between the two depends on whether you prioritize community-focused service or convenience and speed in credit access.

Table of Comparison

| Feature | Credit Union | Neobank |

|---|---|---|

| Lending Rates | Typically lower APR due to nonprofit status | Competitive APR, often higher than credit unions |

| Loan Types | Personal, auto, home, and small business loans | Primarily personal and small business loans |

| Approval Process | Manual review, may consider community factors | Automated, fast online approvals |

| Membership | Requires membership based on community or employer | No membership required, open to all |

| Customer Support | In-branch and phone support with personalized service | Digital support via app, chat, and phone |

| Transparency | Highly regulated with clear lending terms | Varies; some neobanks offer clear terms, others less so |

| Additional Benefits | Member dividends, financial education | Integration with fintech tools, instant notifications |

Understanding Credit Unions and Neobanks

Credit unions are member-owned financial institutions offering personalized lending options with competitive interest rates, typically focusing on community-oriented service and financial education. Neobanks operate entirely online, leveraging technology to provide streamlined lending processes often with faster approvals and innovative digital tools but may lack the personalized support found in credit unions. Understanding these differences helps borrowers choose between the traditional stability and member benefits of credit unions versus the convenience and tech-driven solutions of neobanks.

Lending Products Offered: A Comparison

Credit unions typically offer personalized lending products such as auto loans, mortgages, personal loans, and credit-builder loans with competitive interest rates and flexible terms due to their member-focused structure. Neobanks primarily provide streamlined personal loans and credit products with quick digital approval processes but may have limited loan variety compared to credit unions. Evaluating factors like interest rates, loan terms, and eligibility criteria helps borrowers choose between traditional credit union lending and the innovative, tech-driven approach of neobanks.

Interest Rates and Fees: Credit Union vs Neobank

Credit unions typically offer lower interest rates and fewer fees on loans compared to neobanks due to their nonprofit structure and member-focused approach. Neobanks, as digital-only financial institutions, may provide competitive rates but often include higher fees or stricter lending criteria to offset operational costs. Borrowers seeking affordable lending options with transparent fees generally benefit more from credit union services.

Membership Requirements and Eligibility

Credit unions require membership often based on geographic location, employer, or association affiliation, restricting lending services to eligible members only. Neobanks offer broader accessibility with minimal eligibility criteria, usually requiring only basic personal identification and bank account setup. This difference affects lending availability, with credit unions providing personalized terms for members and neobanks emphasizing convenience and speed for a wider audience.

Loan Approval Processes: Speed and Simplicity

Credit unions often provide a personalized loan approval process with moderate speed, leveraging member relationships to simplify verification steps. Neobanks utilize fully digital platforms and automated algorithms, enabling faster loan approvals often within minutes. The streamlined technology of neobanks typically outpaces traditional credit unions in terms of processing speed and user convenience.

Customer Service: Human Touch vs Digital Experience

Credit unions prioritize personalized customer service with in-branch support and direct access to loan officers, fostering trust and tailored financial advice. Neobanks offer a seamless digital experience with instant loan approvals and 24/7 online support, leveraging AI-driven tools for convenience and efficiency. The choice between a credit union and neobank depends on whether borrowers value human interaction or prefer a fast, technology-based lending process.

Technology and Accessibility in Lending

Credit unions leverage community-based relationships and member trust to offer personalized lending, often integrating legacy systems with emerging financial technologies to improve accessibility. Neobanks utilize advanced digital platforms and AI-driven analytics to provide seamless, 24/7 lending experiences with instant approvals and competitive rates. The integration of cloud computing and mobile technology in neobanks enhances borrower accessibility, while credit unions increasingly adopt fintech partnerships to modernize their lending operations and expand outreach.

Security and Regulatory Protections

Credit unions offer robust security measures backed by federal insurance through the National Credit Union Administration (NCUA), providing members with deposit protection up to $250,000. Neobanks, while innovative and convenient, often lack direct federal insurance as many operate through partner banks, which may expose users to varying levels of regulatory oversight. Regulatory protections for credit unions are typically stronger, ensuring stricter compliance protocols and member safeguards compared to the evolving frameworks governing neobanks.

Flexibility and Customization of Loan Terms

Credit unions offer greater flexibility and customization in loan terms by providing personalized service tailored to members' unique financial situations. Neobanks utilize advanced technology and data analytics to streamline lending but often have standardized loan products with less room for negotiation. Borrowers seeking adaptable repayment schedules and interest rates may find credit unions better suited to their needs.

Which Lender Suits Your Financial Needs?

Credit unions offer personalized lending with lower interest rates and member-focused services, making them ideal for borrowers seeking community-oriented support and favorable loan terms. Neobanks provide swift, technology-driven lending solutions with easy online access and digital tools, appealing to tech-savvy individuals who prioritize convenience and speed. Evaluating your preferences for interest rates, customer service, and application process helps determine whether a traditional credit union or a modern neobank best suits your financial needs.

Related Important Terms

Digital-First Lending

Credit unions leverage member-focused service and local community knowledge to offer personalized lending solutions, while neobanks utilize advanced digital-first platforms to provide swift, seamless loan approvals and flexible credit products. Digital-first lending in neobanks emphasizes automation, real-time credit assessments, and user-friendly mobile interfaces, enabling faster access to funds compared to traditional credit union processes.

Community-Sourced Underwriting

Credit unions leverage community-sourced underwriting by utilizing local member relationships and shared financial histories to assess loan risk more accurately than neobanks, which primarily rely on automated algorithms and broader data sets. This community-based approach allows credit unions to offer personalized lending terms and increased approval rates for borrowers within their networks compared to the standardized, technology-driven models of neobanks.

Embedded Credit Products

Credit unions often integrate embedded credit products within their community-focused platforms, offering personalized loans with competitive rates and strong member protections. Neobanks leverage advanced technology to embed credit solutions seamlessly into digital services, providing instant lending options with flexible terms and streamlined application processes.

Member-Centric Risk Assessment

Credit unions prioritize member-centric risk assessment by leveraging personalized financial histories and community ties to offer tailored lending solutions, often resulting in lower interest rates and flexible repayment terms. Neobanks utilize advanced algorithms and real-time data analytics to evaluate creditworthiness rapidly, enabling efficient lending but typically lacking the personalized, relationship-driven approach characteristic of credit unions.

BNPL (Buy Now, Pay Later) Integration

Credit unions often provide personalized BNPL integration with competitive rates through member-focused lending programs, leveraging established trust and regulatory compliance. Neobanks deliver seamless, tech-driven BNPL solutions offering rapid approval and integration, capitalizing on digital agility and advanced data analytics for optimized credit risk management.

Neo-Underwriting Algorithms

Neobanks utilize advanced neo-underwriting algorithms that analyze alternative data points such as social media activity, transaction history, and real-time financial behavior to assess creditworthiness more dynamically than traditional credit unions. This technology enables faster loan approvals and personalized lending decisions, often reaching underserved borrowers with limited credit histories.

API-Driven Loan Origination

Credit unions leverage API-driven loan origination systems to enhance member-specific risk assessment and streamline personalized lending experiences through secure, integrated financial data sharing. Neobanks utilize advanced APIs to automate underwriting processes, offering faster loan approvals and competitive rates by integrating real-time credit scoring and banking data from multiple fintech platforms.

Credit Score Alternative Metrics

Credit unions leverage alternative credit score metrics such as payment history on utility bills, rental payments, and employment stability to assess lending risk beyond traditional FICO scores, providing access to credit for underserved borrowers. Neobanks increasingly integrate AI-driven data analytics and non-traditional financial behaviors like cash flow patterns and social media activities to evaluate creditworthiness, enabling faster but often higher-risk lending decisions.

Micro-Lending Pools

Credit unions offer micro-lending pools with personalized service, lower interest rates, and community-focused underwriting models tailored to local members. Neobanks leverage advanced algorithms and digital platforms to provide faster access to micro-loans, often with flexible repayment options targeting underserved, tech-savvy borrowers.

Real-Time Loan Disbursement

Credit unions offer personalized lending services with competitive rates, but their loan disbursement can take several days due to manual processing and regulatory checks. Neobanks leverage advanced technology to enable real-time loan disbursement, providing instant access to funds through automated underwriting and digital workflows.

Credit union vs neobank for lending. Infographic

moneydiff.com

moneydiff.com