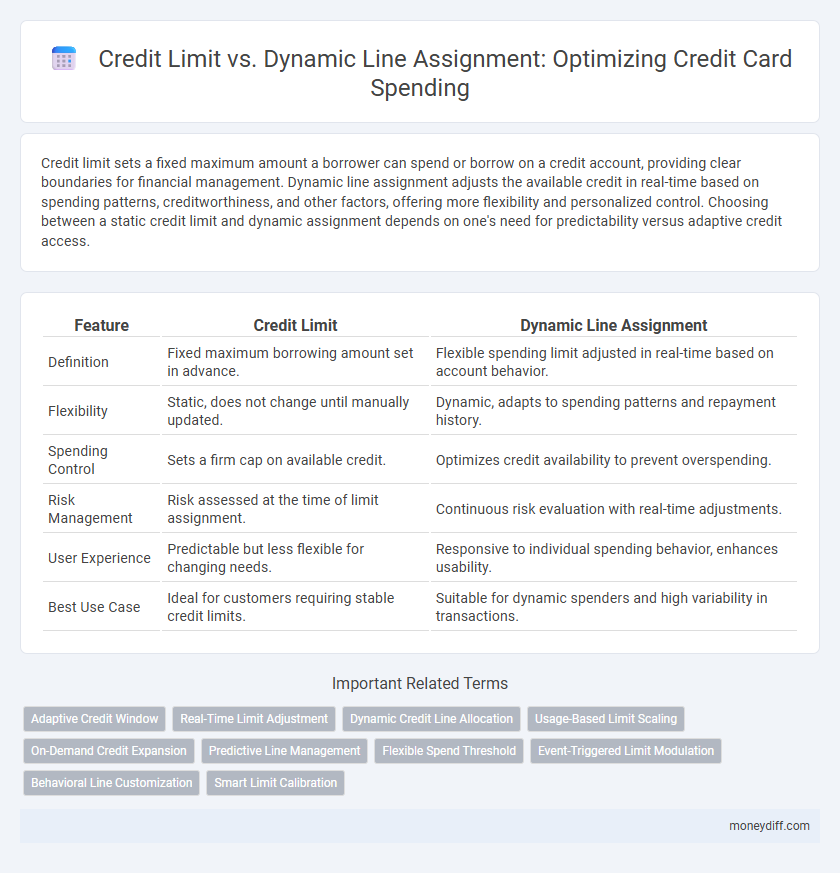

Credit limit sets a fixed maximum amount a borrower can spend or borrow on a credit account, providing clear boundaries for financial management. Dynamic line assignment adjusts the available credit in real-time based on spending patterns, creditworthiness, and other factors, offering more flexibility and personalized control. Choosing between a static credit limit and dynamic assignment depends on one's need for predictability versus adaptive credit access.

Table of Comparison

| Feature | Credit Limit | Dynamic Line Assignment |

|---|---|---|

| Definition | Fixed maximum borrowing amount set in advance. | Flexible spending limit adjusted in real-time based on account behavior. |

| Flexibility | Static, does not change until manually updated. | Dynamic, adapts to spending patterns and repayment history. |

| Spending Control | Sets a firm cap on available credit. | Optimizes credit availability to prevent overspending. |

| Risk Management | Risk assessed at the time of limit assignment. | Continuous risk evaluation with real-time adjustments. |

| User Experience | Predictable but less flexible for changing needs. | Responsive to individual spending behavior, enhances usability. |

| Best Use Case | Ideal for customers requiring stable credit limits. | Suitable for dynamic spenders and high variability in transactions. |

Understanding Credit Limits: Definition and Purpose

Credit limits define the maximum amount of credit a lender extends to a borrower, establishing a controlled spending boundary to manage financial risk. Understanding credit limits helps consumers maintain responsible borrowing habits and avoid exceeding their authorized credit capacity, which can impact credit scores. Dynamic line assignment adjusts credit limits based on real-time spending behavior and creditworthiness, offering flexibility compared to static credit limits.

What is Dynamic Line Assignment in Credit Management?

Dynamic Line Assignment in credit management refers to an adaptive system that adjusts a borrower's credit limit based on real-time analysis of spending patterns, payment behavior, and credit risk. Unlike static credit limits, this approach enables lenders to optimize credit exposure and offer personalized spending capacity, improving both customer satisfaction and risk control. By leveraging data-driven algorithms, dynamic line assignment enhances the flexibility and responsiveness of credit allocation.

Key Differences Between Credit Limit and Dynamic Line Assignment

Credit limit refers to a fixed maximum amount a borrower can spend on a credit account, established by the lender based on creditworthiness. Dynamic line assignment adjusts the available credit in real-time, allocating funds based on current spending patterns, payment history, and account activity. Key differences include the static nature of credit limits versus the flexible, responsive adjustment of dynamic line assignments to optimize credit utilization and risk management.

Pros and Cons of Fixed Credit Limits

Fixed credit limits provide clear spending boundaries, helping users control debt and avoid overspending. However, they lack flexibility, potentially restricting purchasing power during fluctuating financial needs. Unlike dynamic line assignment, fixed limits can lead to unused credit capacity or insufficient access when urgent expenses arise.

Advantages of Dynamic Line Assignment for Cardholders

Dynamic Line Assignment offers cardholders enhanced spending flexibility by automatically adjusting credit limits based on real-time transaction behavior and repayment history. This approach reduces the risk of declined transactions and optimizes available credit without manual intervention. Cardholders benefit from improved purchasing power and personalized credit management tailored to their financial habits.

How Lenders Set Credit Limits vs Dynamic Lines

Lenders set credit limits based on fixed evaluations of factors such as credit score, income, and repayment history, establishing a maximum borrowing threshold that remains constant unless manually adjusted. In contrast, dynamic line assignment adjusts spending capacity in real-time using algorithms that analyze recent spending behavior, payment patterns, and external economic indicators, allowing for flexible credit limits tailored to current risk profiles. This adaptive approach helps lenders better manage risk and optimize credit availability by aligning limits with ongoing financial activity and market conditions.

Impact on Credit Scores: Fixed Limits vs Dynamic Assignment

Fixed credit limits provide a clear, predetermined borrowing cap that helps maintain consistent credit utilization ratios, positively influencing credit scores by promoting responsible spending habits. Dynamic line assignment adjusts available credit based on real-time factors and spending behavior, which can rapidly alter utilization rates and potentially cause fluctuations in credit scores. Understanding the stability offered by fixed limits versus the flexibility of dynamic lines is crucial in managing credit impact effectively.

Spending Flexibility: Which Approach Works Best?

Credit limit sets a fixed maximum amount a borrower can spend on a credit account, providing clear boundaries but limited adaptability. Dynamic line assignment adjusts the available credit based on real-time spending patterns, offering enhanced spending flexibility to accommodate varying financial needs. For users requiring adaptable access to funds without constant manual adjustments, dynamic line assignment presents a more responsive and personalized spending solution.

Risk Management for Lenders: Credit Limit vs Dynamic Line Assignment

Credit limit provides a fixed cap on borrower spending, enabling lenders to control risk exposure through consistent monitoring and predefined thresholds. Dynamic line assignment adjusts credit availability based on real-time borrower behavior and creditworthiness, enhancing risk management by aligning credit with evolving financial conditions. Effective risk strategies often combine static credit limits with dynamic adjustments to optimize credit utilization while minimizing default probabilities.

Choosing the Right Credit Option for Your Financial Needs

Choosing the right credit option involves understanding the difference between a fixed credit limit and dynamic line assignment. A fixed credit limit offers a predetermined maximum spending capacity, ideal for maintaining strict budget controls, while dynamic line assignment adjusts your spending power based on real-time financial behavior and creditworthiness. Evaluating your spending patterns and financial goals helps determine whether a stable credit limit or a flexible, adaptive credit line best suits your financial needs.

Related Important Terms

Adaptive Credit Window

Adaptive Credit Window enhances spending flexibility by dynamically adjusting credit limits based on real-time transaction patterns and risk assessment, ensuring optimal credit utilization. This approach contrasts with static credit limits by providing personalized credit line assignments that adapt to changing financial behaviors and creditworthiness.

Real-Time Limit Adjustment

Real-time limit adjustment enhances credit management by allowing dynamic line assignment to respond instantly to spending behaviors and risk assessments, optimizing customer credit utilization. Unlike static credit limits, this approach leverages data analytics to continuously update credit availability, improving fraud prevention and personalized credit experiences.

Dynamic Credit Line Allocation

Dynamic credit line allocation adjusts spending limits in real-time based on transactional behavior, risk assessment, and payment history, optimizing credit availability while minimizing default risk. Unlike fixed credit limits, this adaptive approach enhances financial flexibility and supports more personalized credit management for users.

Usage-Based Limit Scaling

Usage-based limit scaling adjusts credit limits dynamically based on real-time spending patterns and credit utilization, enhancing personalized credit management. Unlike static credit limits, dynamic line assignment optimizes available credit by analyzing transactional behavior and risk factors, improving both user experience and credit risk control.

On-Demand Credit Expansion

Credit limit represents a fixed maximum amount a borrower can spend, while dynamic line assignment allows for real-time on-demand credit expansion based on spending behavior and risk assessment. On-demand credit expansion enhances financial flexibility by automatically adjusting credit availability to meet immediate spending needs without manual intervention.

Predictive Line Management

Credit limit establishes a fixed maximum spending threshold, while dynamic line assignment leverages predictive line management algorithms to adjust credit availability in real-time based on user behavior and risk assessment. Predictive line management enhances credit utilization efficiency by forecasting spending patterns and proactively reallocating credit lines to optimize financial flexibility and minimize default risk.

Flexible Spend Threshold

Flexible Spend Threshold enhances credit management by adjusting credit limits in real-time based on spending patterns, unlike static Credit Limits that remain fixed regardless of usage. Dynamic Line Assignment optimizes available credit by reallocating funds across multiple accounts or categories, enabling more adaptive and efficient spending control.

Event-Triggered Limit Modulation

Event-triggered limit modulation dynamically adjusts credit limits based on real-time spending patterns, enhancing risk management and customer flexibility compared to static credit limits. This approach uses behavioral data and transaction triggers to increase or decrease credit availability, optimizing credit utilization and reducing default probability.

Behavioral Line Customization

Behavioral line customization leverages dynamic line assignment to adjust credit limits based on real-time spending patterns, enhancing risk management and customer satisfaction. Unlike static credit limits, this approach provides personalized credit flexibility by analyzing transaction behavior, payment history, and usage frequency.

Smart Limit Calibration

Smart Limit Calibration enhances credit management by dynamically adjusting credit limits based on real-time spending patterns and risk assessment, outperforming static credit limits. This approach optimizes borrowing capacity, reduces default risk, and aligns credit availability with individual financial behavior.

Credit Limit vs Dynamic Line Assignment for Spending Infographic

moneydiff.com

moneydiff.com