Credit builder loans establish a proven payment history by requiring borrowers to make fixed monthly payments, which are reported to credit bureaus and help improve credit scores over time. Experiential credit leverages alternative data, such as utility and rental payments, to enhance credit profiles, offering a more inclusive approach for those with limited traditional credit histories. Combining both strategies can effectively strengthen creditworthiness by providing a balanced mix of verified payments and diverse credit data.

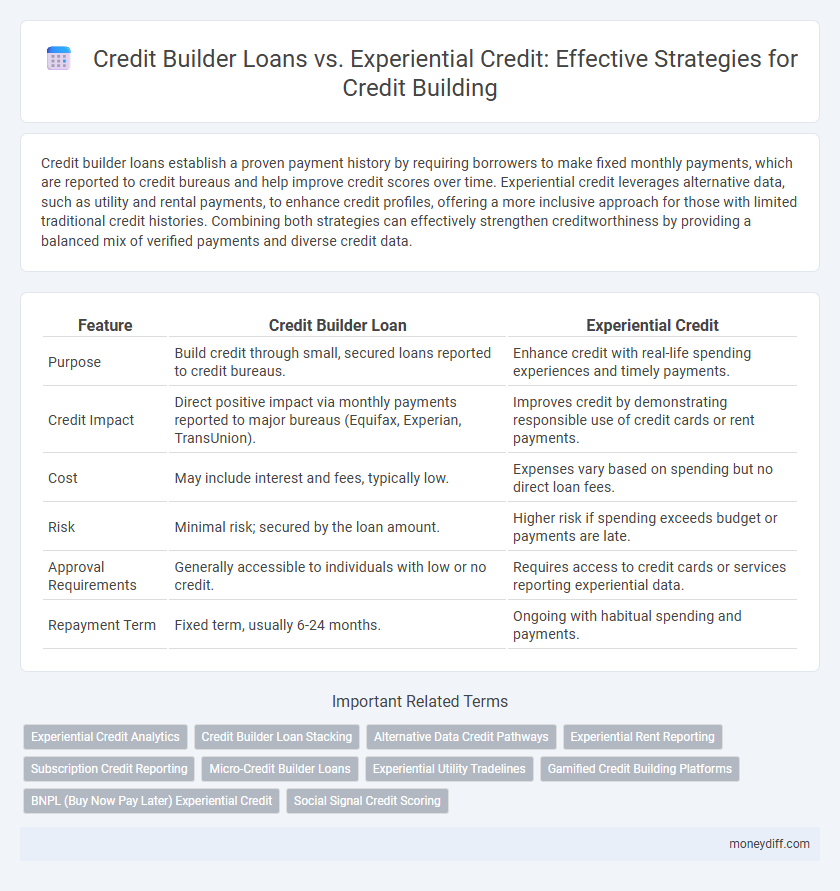

Table of Comparison

| Feature | Credit Builder Loan | Experiential Credit |

|---|---|---|

| Purpose | Build credit through small, secured loans reported to credit bureaus. | Enhance credit with real-life spending experiences and timely payments. |

| Credit Impact | Direct positive impact via monthly payments reported to major bureaus (Equifax, Experian, TransUnion). | Improves credit by demonstrating responsible use of credit cards or rent payments. |

| Cost | May include interest and fees, typically low. | Expenses vary based on spending but no direct loan fees. |

| Risk | Minimal risk; secured by the loan amount. | Higher risk if spending exceeds budget or payments are late. |

| Approval Requirements | Generally accessible to individuals with low or no credit. | Requires access to credit cards or services reporting experiential data. |

| Repayment Term | Fixed term, usually 6-24 months. | Ongoing with habitual spending and payments. |

Understanding Credit Builder Loans: A Primer

Credit builder loans are designed to improve credit scores by reporting regular, on-time payments to credit bureaus, making them a reliable tool for those with limited or poor credit history. Unlike experiential credit, which relies on alternative data such as rental and utility payments, credit builder loans offer structured repayment terms that directly enhance credit profiles. Financial institutions often use credit builder loans as a foundational strategy for consumers seeking to establish or repair credit efficiently.

What is Experiential Credit in Modern Credit Building?

Experiential credit refers to the use of non-traditional financial behaviors and data, such as timely payments on utilities, rent, and subscription services, to build and improve credit scores in modern credit building strategies. Unlike credit builder loans, which are installment loans specifically designed to establish credit history, experiential credit leverages everyday financial activities that reflect responsible money management. This innovative approach broadens access to credit for individuals with limited or no traditional credit history by incorporating alternative data into credit evaluations.

Credit Builder Loan vs Experiential Credit: Key Differences

Credit builder loans involve small, fixed payments reported to credit bureaus, designed specifically to establish or improve credit history, while experiential credit leverages everyday financial behaviors like rent or utility payments to build credit profiles through alternative data reporting. Credit builder loans typically require an initial deposit held in a secured account until the loan is paid off, whereas experiential credit relies on timely payment of recurring expenses without additional borrowing. The main differences lie in payment structure, credit reporting methods, and the financial commitment required to enhance credit scores effectively.

Pros and Cons of Credit Builder Loans

Credit builder loans offer a structured way to build credit by requiring monthly payments that are reported to credit bureaus, helping to establish a positive payment history. Pros include predictable payment schedules, low risk since funds are often secured or held in a savings account, and accessibility for individuals with limited credit. Cons involve potentially higher interest rates compared to other credit types, slower credit score improvement due to smaller loan amounts, and limited funds until the loan is fully repaid.

Benefits and Limitations of Experiential Credit Reporting

Experiential credit reporting enhances credit profiles by incorporating non-traditional payment data such as rent, utilities, and subscriptions, widening access for individuals with limited credit history. This method improves credit scores by demonstrating consistent financial behavior but may face limitations due to inconsistent reporting standards and lesser acceptance by all lenders. Unlike credit builder loans, experiential credit relies on real-time payment activity without additional borrowing, reducing debt risk but potentially offering slower credit score improvements.

Who Should Choose Credit Builder Loans?

Credit builder loans are ideal for individuals with limited or poor credit history who need a structured repayment plan to establish or improve their credit score. These loans typically require fixed monthly payments reported to credit bureaus, making them effective for disciplined borrowers seeking to demonstrate reliable credit behavior. Consumers without access to traditional credit products or those aiming to build credit from scratch benefit most from credit builder loans over experiential credit options.

When is Experiential Credit Reporting More Effective?

Experiential credit reporting proves more effective when individuals have limited or no traditional credit history, as it incorporates alternative data like rent, utilities, and subscription payments to establish creditworthiness. This method provides a more comprehensive view of financial behavior, benefiting those who are self-employed or lack credit card usage. Experiential credit reporting accelerates credit building by reflecting consistent, real-time payment patterns that traditional credit builder loans may not capture.

Combining Credit Builder Loans and Experiential Credit for Maximum Impact

Combining credit builder loans and experiential credit maximizes credit building by leveraging the structured repayment history of credit builder loans with the dynamic usage patterns of experiential credit such as retail and service transactions. Credit builder loans demonstrate consistent on-time payments to credit bureaus, directly boosting payment history, while experiential credit enhances credit mix and utilization ratios through diverse spending activities. Together, these strategies optimize credit scores by balancing installment and revolving credit types, fostering a comprehensive credit profile favorable to lenders.

How to Monitor Your Credit Progress with Both Strategies

Monitoring your credit progress with credit builder loans involves regularly reviewing your credit reports from major bureaus like Experian, TransUnion, and Equifax to ensure timely payments are reported accurately. For experiential credit strategies, track your spending patterns and on-time repayments through mobile apps and financial tools that sync with your credit accounts. Consistent analysis of FICO scores and credit utilization ratios helps optimize both methods for faster credit improvement.

Tips for Responsible Credit Building with Loans and Experiential Data

Using a credit builder loan responsibly involves making consistent, on-time payments to establish a positive credit history, while keeping the loan amount manageable relative to your income. Incorporating experiential credit data like utility and rent payments can enhance credit profiles by demonstrating reliability beyond traditional credit accounts. Monitoring credit reports regularly and avoiding overextending credit limits helps maintain healthy credit utilization and improves credit scores sustainably.

Related Important Terms

Experiential Credit Analytics

Experiential Credit Analytics leverages real-time spending behavior and alternative data sources to provide a more accurate and dynamic assessment of creditworthiness compared to traditional Credit Builder Loans, which rely on fixed loan repayment schedules to build credit history. This innovative approach enhances credit building strategies by incorporating a broader range of financial activities, enabling tailored credit solutions and faster credit score improvements.

Credit Builder Loan Stacking

Credit builder loan stacking involves taking multiple small installment loans simultaneously, enhancing credit mix and payment history faster than traditional experiential credit methods like timely utility or rent payments. This strategy accelerates credit score improvement by increasing active accounts and demonstrating consistent repayment behavior across diverse loan types.

Alternative Data Credit Pathways

Credit builder loans leverage traditional installment payments to establish credit history, while experiential credit incorporates alternative data such as rental payments, utility bills, and subscription services to reflect real-life financial behavior. Utilizing experiential credit with alternative data pathways enhances credit scoring models by including non-traditional financial activities, broadening access to credit for underbanked individuals.

Experiential Rent Reporting

Experiential rent reporting enhances credit building strategies by leveraging consistent rent payments to boost credit scores, providing an alternative to traditional credit builder loans that often require additional debt. This method utilizes actual rental payment data reported to credit bureaus, enabling renters without extensive credit history to establish or improve credit profiles effectively.

Subscription Credit Reporting

Subscription credit reporting enhances credit builder loans by consistently reporting timely payments to major credit bureaus, accelerating credit profile development. Experiential credit leverages alternative data, such as rent and utility payments, to supplement traditional credit history, broadening credit-building opportunities for consumers with limited or no credit history.

Micro-Credit Builder Loans

Micro-credit builder loans offer targeted, small-dollar borrowing options designed specifically to establish or improve credit scores through consistent, on-time payments reported to major bureaus. Unlike experiential credit, which relies on varied non-traditional data points, micro-credit builder loans provide a more straightforward, data-driven approach to credit enhancement with predictable repayment terms.

Experiential Utility Tradelines

Experiential Utility Tradelines leverage recurring utility payments to boost credit scores by reporting consistent, on-time payments to credit bureaus, providing a practical alternative to traditional credit builder loans that require upfront deposits and fixed monthly payments. This strategy enhances credit profiles by incorporating everyday expenses without increasing debt burden, fostering improved creditworthiness through real-life financial behavior.

Gamified Credit Building Platforms

Gamified credit building platforms combine experiential credit strategies with credit builder loans by engaging users through interactive challenges that promote responsible financial habits, enhancing credit scores over time. These platforms leverage behavioral psychology and real-time feedback to motivate timely payments and credit usage, making credit improvement more accessible and effective.

BNPL (Buy Now Pay Later) Experiential Credit

BNPL (Buy Now Pay Later) experiential credit leverages everyday purchase experiences to build credit history by reporting timely payments to credit bureaus, offering a more seamless and flexible alternative to traditional credit builder loans that require fixed monthly installments. This strategy enhances credit profiles through frequent micro-payments and real-time credit activity, accelerating credit score improvement compared to conventional credit builder loans.

Social Signal Credit Scoring

Credit builder loans and experiential credit both leverage social signal credit scoring to enhance credit profiles by incorporating alternative data like community engagement and payment behavior. Social signal credit scoring evaluates real-world interactions and digital footprints, providing lenders with a more comprehensive assessment beyond traditional credit metrics, which can accelerate credit building for individuals with limited or no credit history.

Credit builder loan vs Experiential credit for credit building strategies. Infographic

moneydiff.com

moneydiff.com