Manual underwriting relies on human judgment to evaluate creditworthiness through detailed document review and personal interaction, offering nuanced insights but often resulting in slower decision-making. AI-powered underwriting leverages machine learning algorithms to analyze vast datasets instantaneously, improving accuracy and consistency while minimizing biases. Combining human expertise with AI efficiency enhances credit approval processes by balancing analytical precision with contextual understanding.

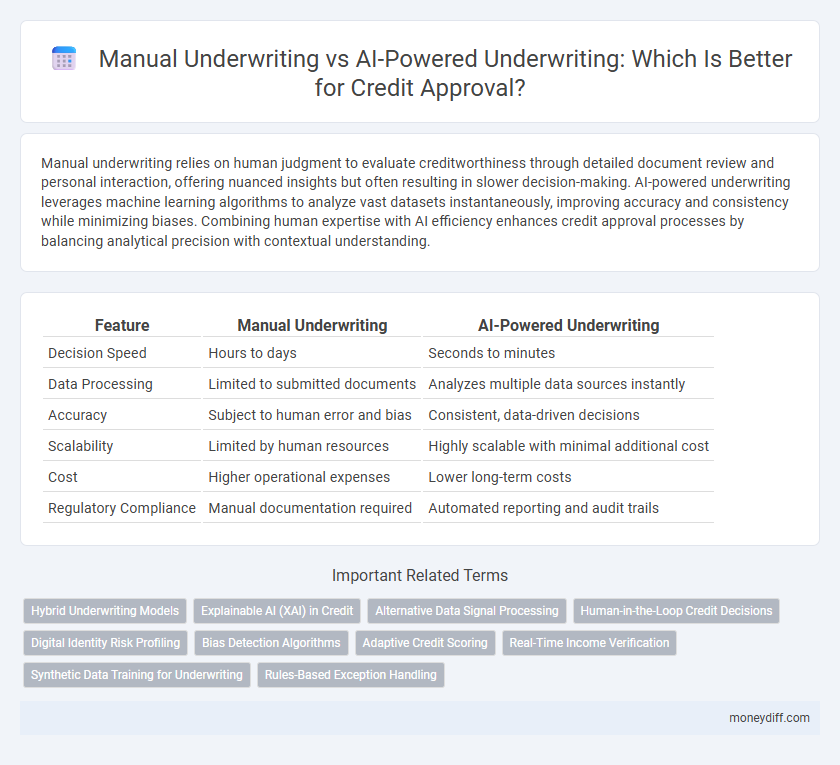

Table of Comparison

| Feature | Manual Underwriting | AI-Powered Underwriting |

|---|---|---|

| Decision Speed | Hours to days | Seconds to minutes |

| Data Processing | Limited to submitted documents | Analyzes multiple data sources instantly |

| Accuracy | Subject to human error and bias | Consistent, data-driven decisions |

| Scalability | Limited by human resources | Highly scalable with minimal additional cost |

| Cost | Higher operational expenses | Lower long-term costs |

| Regulatory Compliance | Manual documentation required | Automated reporting and audit trails |

Understanding Manual Underwriting in Credit Approval

Manual underwriting in credit approval involves a thorough, human-led analysis of an applicant's financial documents, credit history, income stability, and debt-to-income ratios to assess creditworthiness. This process allows underwriters to apply nuanced judgment in cases where automated systems might flag inconsistencies or require contextual interpretation, ensuring personalized evaluation for risk management. Despite being time-intensive, manual underwriting excels in handling complex credit profiles that often involve non-traditional income sources or irregular financial patterns.

What Is AI-Powered Underwriting?

AI-powered underwriting leverages advanced algorithms and machine learning models to analyze vast datasets, including credit history, transaction patterns, and alternative data sources, for accurate credit risk assessment. This technology enhances credit approval efficiency by providing consistent, data-driven decisions while minimizing human bias and errors. By integrating AI, lenders can process applications faster and better predict borrower default probability, improving overall portfolio quality.

Key Differences Between Manual and AI Underwriting

Manual underwriting involves human judgment to assess credit risk, relying on qualitative data and traditional credit reports, which can result in slower decision-making and potential biases. AI-powered underwriting leverages machine learning algorithms and big data analytics to evaluate creditworthiness instantly, improving accuracy by examining diverse data points beyond standard reports. Key differences include speed, scalability, consistency, and the ability to analyze non-traditional data sources, making AI underwriting more efficient for large-scale credit approvals.

Efficiency: Traditional Manual vs AI-Driven Processes

Manual underwriting relies on human expertise to evaluate credit applications, often leading to slower processing times and increased potential for subjective errors. AI-powered underwriting harnesses machine learning algorithms and vast datasets to analyze credit risk swiftly and accurately, significantly reducing approval times. This automation enhances efficiency by enabling real-time decision-making and consistent application of credit policies.

Accuracy and Risk Assessment in Credit Decisions

Manual underwriting relies on human judgment to evaluate creditworthiness, often leading to subjective decisions and potential inconsistencies in risk assessment. AI-powered underwriting utilizes advanced algorithms and machine learning to analyze vast datasets, enhancing accuracy by identifying subtle patterns and predictive indicators that traditional methods might overlook. This technological approach reduces default risk and improves credit decision precision by providing data-driven insights that adapt to evolving market conditions.

Impact on Borrower Experience: Manual vs Automated

Manual underwriting often results in slower credit approval processes, causing delays and potential frustration for borrowers. AI-powered underwriting accelerates decision-making by quickly analyzing vast data sets, enhancing borrower experience with faster responses and more personalized credit offers. Automated systems reduce human bias and inconsistency, leading to fairer evaluations and improved satisfaction for credit applicants.

Bias and Fairness in Credit Underwriting Methods

Manual underwriting in credit decisions often incorporates human judgment, which can introduce implicit biases impacting fairness and consistency across applicants. AI-powered underwriting leverages machine learning algorithms trained on extensive datasets, aiming to reduce subjective bias and promote equitable credit approval by analyzing diverse credit factors. Despite advancements, AI systems require continuous monitoring and refinement to prevent algorithmic bias and ensure unbiased, fair credit evaluations.

Data Security and Privacy Concerns

Manual underwriting relies heavily on human judgment, increasing risks of inconsistent data handling and potential privacy breaches due to limited oversight and manual processes. AI-powered underwriting employs advanced encryption, real-time monitoring, and automated compliance checks to safeguard sensitive financial information throughout the credit approval process. Enhanced data security protocols in AI systems minimize unauthorized access, ensuring strict adherence to privacy regulations such as GDPR and CCPA.

Cost Implications for Lenders

Manual underwriting requires significant labor costs due to the need for skilled credit analysts to review applications individually, leading to slower processing times and higher operational expenses. AI-powered underwriting reduces these costs by automating risk assessment through machine learning algorithms, enabling faster decision-making and minimizing human error. Implementing AI systems involves initial investment but results in long-term savings by lowering administrative overhead and improving credit approval efficiency.

The Future of Credit Underwriting: Integrating AI and Human Insights

The future of credit underwriting lies in a hybrid approach that combines AI-powered algorithms with manual underwriting expertise to enhance accuracy and fairness in credit decisions. AI enables faster data analysis and risk assessment by processing vast datasets and identifying complex patterns, while human underwriters contribute contextual judgment and the ability to interpret nuanced information beyond algorithmic capabilities. Integrating these methods optimizes credit approval processes, reducing bias and improving borrower inclusion across diverse credit profiles.

Related Important Terms

Hybrid Underwriting Models

Hybrid underwriting models combine the expertise of manual underwriting with the efficiency and data analysis capabilities of AI-powered systems to optimize credit approval decisions. These models leverage machine learning algorithms alongside human judgment to enhance risk assessment accuracy, reduce biases, and improve approval turnaround times in credit evaluation processes.

Explainable AI (XAI) in Credit

Explainable AI (XAI) in credit underwriting enhances transparency by providing clear, interpretable insights into AI-driven decisions, enabling lenders to justify approvals or denials while ensuring regulatory compliance. Unlike manual underwriting, XAI combines data-driven efficiency with explainability, reducing bias and increasing trust among borrowers and financial institutions.

Alternative Data Signal Processing

Manual underwriting relies on human judgment to evaluate traditional credit data, which can limit the assessment of an applicant's creditworthiness. AI-powered underwriting leverages advanced algorithms to analyze alternative data signals, such as social media behavior and transaction patterns, improving accuracy and inclusivity in credit approval decisions.

Human-in-the-Loop Credit Decisions

Human-in-the-loop credit decisions combine manual underwriting expertise with AI-powered underwriting algorithms to enhance the accuracy and fairness of credit approvals, leveraging human judgment to interpret complex financial nuances that automated systems may overlook. This hybrid approach reduces the risk of bias and errors, ensuring that credit risk assessments consider both quantitative data and qualitative insights for optimal decision-making.

Digital Identity Risk Profiling

Manual underwriting relies on human judgment to assess creditworthiness, often leading to subjective evaluations and slower decision-making, while AI-powered underwriting leverages advanced algorithms and digital identity risk profiling to analyze vast datasets for more accurate, consistent, and rapid credit approvals. Incorporating digital identity risk profiling enables AI models to detect fraud, verify applicant information, and predict default risks with higher precision compared to traditional manual processes.

Bias Detection Algorithms

Bias detection algorithms integrated into AI-powered underwriting systems analyze vast datasets to identify and mitigate discriminatory patterns, enhancing fairness in credit approval decisions. Manual underwriting lacks such systematic bias detection capabilities, often relying on subjective judgment that can inadvertently perpetuate biases.

Adaptive Credit Scoring

Adaptive credit scoring in AI-powered underwriting leverages machine learning algorithms to analyze vast datasets and continuously refine risk assessments, resulting in more accurate and personalized credit approvals. Manual underwriting relies on static criteria and human judgment, which may overlook subtle patterns in borrower behavior that adaptive systems can detect for better credit decision-making.

Real-Time Income Verification

Manual underwriting often relies on slower, document-based income verification methods, which can delay credit approval decisions, while AI-powered underwriting leverages real-time income data through secure integrations with payroll systems and financial accounts to enhance accuracy and speed. This technology reduces human error, enhances fraud detection, and enables lenders to make more informed credit decisions instantly.

Synthetic Data Training for Underwriting

Synthetic data training enhances AI-powered underwriting by providing diverse, privacy-compliant datasets that improve model accuracy and reduce bias compared to manual underwriting processes. Leveraging synthetic data enables the development of robust credit approval algorithms capable of identifying nuanced risk patterns without exposing sensitive customer information.

Rules-Based Exception Handling

Rules-based exception handling in manual underwriting relies on human judgment to evaluate deviations from standard credit criteria, which can lead to inconsistent decisions and delays. AI-powered underwriting leverages advanced algorithms to swiftly analyze exceptions, improving accuracy and efficiency in credit approval processes.

Manual Underwriting vs AI-Powered Underwriting for credit approval. Infographic

moneydiff.com

moneydiff.com