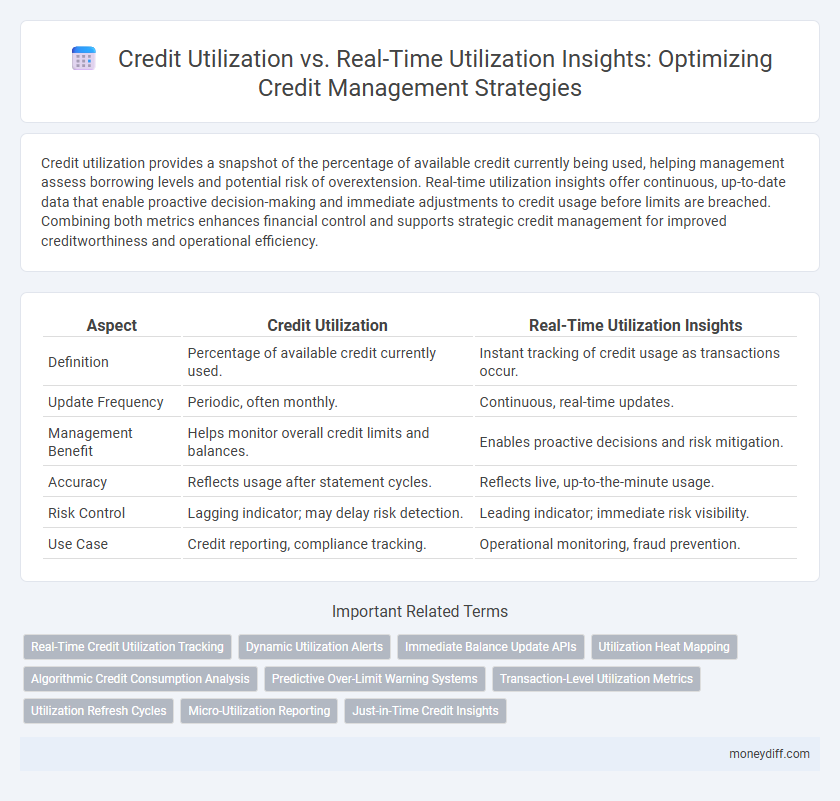

Credit utilization provides a snapshot of the percentage of available credit currently being used, helping management assess borrowing levels and potential risk of overextension. Real-time utilization insights offer continuous, up-to-date data that enable proactive decision-making and immediate adjustments to credit usage before limits are breached. Combining both metrics enhances financial control and supports strategic credit management for improved creditworthiness and operational efficiency.

Table of Comparison

| Aspect | Credit Utilization | Real-Time Utilization Insights |

|---|---|---|

| Definition | Percentage of available credit currently used. | Instant tracking of credit usage as transactions occur. |

| Update Frequency | Periodic, often monthly. | Continuous, real-time updates. |

| Management Benefit | Helps monitor overall credit limits and balances. | Enables proactive decisions and risk mitigation. |

| Accuracy | Reflects usage after statement cycles. | Reflects live, up-to-the-minute usage. |

| Risk Control | Lagging indicator; may delay risk detection. | Leading indicator; immediate risk visibility. |

| Use Case | Credit reporting, compliance tracking. | Operational monitoring, fraud prevention. |

Understanding Credit Utilization: Key Concepts

Credit utilization refers to the ratio of current credit card balances to total available credit limits, serving as a critical metric for assessing financial health and creditworthiness. Real-time utilization insights provide dynamic, up-to-date data that enable management to make proactive decisions and optimize credit risk strategies effectively. Monitoring credit utilization in real time enhances accuracy in evaluating liquidity and helps prevent overextension before it negatively impacts credit scores or cash flow.

Real-Time Utilization Insights: The Next Frontier

Real-time credit utilization insights empower management to monitor borrowing behavior instantaneously, enabling proactive risk assessment and decision-making. Unlike traditional monthly reports, real-time data captures dynamic fluctuations in credit usage, highlighting emerging patterns before they escalate into financial issues. Integrating advanced analytics with real-time utilization metrics enhances portfolio management by optimizing credit limits and improving customer creditworthiness evaluation.

Credit Utilization Metrics: How They Impact Scores

Credit utilization metrics measure the ratio of outstanding credit balances to total available credit, directly influencing credit scores by indicating borrowing behavior and repayment risk. Real-time utilization insights provide management with up-to-date data, enabling proactive decisions to optimize credit utilization rates and maintain healthy credit profiles. Accurate monitoring of credit utilization through timely insights helps prevent score drops due to high balances, ensuring improved creditworthiness and financial stability.

The Value of Real-Time Data in Credit Management

Real-time utilization insights provide credit management with immediate visibility into borrowing behavior, enabling more accurate risk assessment and dynamic credit limit adjustments. Unlike traditional credit utilization metrics, which often rely on delayed data, real-time data reduces the likelihood of overextension and potential defaults by capturing up-to-the-minute credit activity. Leveraging this instantaneous information enhances decision-making, improves cash flow forecasting, and optimizes credit strategies to align with current financial realities.

Comparing Traditional vs. Real-Time Utilization Tracking

Traditional credit utilization tracking relies on periodic statements, often resulting in lagging insights that can obscure true borrowing capacity. Real-time utilization insights offer dynamic monitoring, enabling management to respond swiftly to fluctuating credit availability and optimize cash flow more effectively. Employing real-time tracking enhances decision-making accuracy by providing up-to-date data on credit consumption and risk exposure.

Optimizing Credit Health with Real-Time Monitoring

Real-time utilization insights enable management to optimize credit health by providing instantaneous data on credit usage, preventing overextension and improving borrowing capacity. Monitoring credit utilization dynamically allows businesses to adjust spending patterns proactively, maintaining ideal credit ratios that enhance credit scores and financial stability. Leveraging advanced analytics for real-time credit monitoring supports strategic decision-making, reduces risk, and maximizes access to favorable credit terms.

Leveraging Technology for Real-Time Utilization Insights

Leveraging advanced technology enables management to gain real-time credit utilization insights, improving decision-making accuracy by monitoring spending patterns and credit limits dynamically. Real-time utilization data minimizes risk exposure and enhances credit management efficiency compared to traditional periodic reports. Integrating artificial intelligence and machine learning tools helps predict credit behavior, optimize credit usage, and prevent potential credit overuse in fast-paced financial environments.

Pitfalls of Delayed Credit Utilization Reporting

Delayed credit utilization reporting often leads to inaccurate risk assessments and missed opportunities for proactive credit management. Real-time utilization insights enable management to monitor credit exposure continuously, reducing the likelihood of exceeding credit limits and improving cash flow forecasting. Relying on outdated data increases the risk of financial penalties and impairs strategic decision-making in dynamic credit environments.

Strategic Credit Decisions with Up-to-Date Utilization Data

Real-time credit utilization insights empower management to make strategic credit decisions based on the most current data, enhancing risk assessment and capital allocation precision. Accurate utilization tracking helps identify borrowing patterns and prevent over-leverage, supporting optimal credit limits and improving portfolio health. Integrating up-to-date utilization metrics into credit management systems drives proactive adjustments, ensuring financial stability and competitive advantage.

Future Trends: Real-Time Credit Utilization in Money Management

Real-time credit utilization provides dynamic insights into spending patterns, enabling management to optimize credit limits and reduce the risk of overextension. Emerging technologies leverage AI and machine learning to analyze real-time data, improving accuracy in credit risk assessment and personalized financial recommendations. Future trends indicate a significant shift towards integrating real-time utilization metrics within digital wallets and financial dashboards, enhancing proactive money management strategies.

Related Important Terms

Real-Time Credit Utilization Tracking

Real-time credit utilization tracking offers management precise, up-to-the-minute insights into spending patterns, enabling proactive decision-making to avoid credit limit breaches and optimize financial health. Unlike traditional credit utilization reports that update monthly, real-time systems provide dynamic data integration from multiple accounts, enhancing risk management and improving credit score forecasts.

Dynamic Utilization Alerts

Dynamic Utilization Alerts provide real-time insights into credit utilization, enabling management to monitor and adjust credit usage proactively to avoid overextension. These alerts optimize financial decision-making by highlighting fluctuating credit demands instantly, ensuring better control over credit risk.

Immediate Balance Update APIs

Immediate Balance Update APIs provide real-time utilization insights by instantly reflecting credit usage, enabling management to monitor credit utilization ratios accurately. This eliminates delays inherent in batch processing systems, ensuring timely decision-making and optimized credit risk management.

Utilization Heat Mapping

Utilization Heat Mapping provides management with detailed real-time insights into credit usage patterns, highlighting areas of high and low credit consumption to optimize allocation strategies effectively. This approach enables precise monitoring of credit utilization trends, reducing the risk of overextension and improving overall financial control.

Algorithmic Credit Consumption Analysis

Algorithmic Credit Consumption Analysis enables real-time insights into credit utilization, providing management with precise data to optimize credit limits and prevent overextension. This method leverages advanced algorithms to monitor and predict credit consumption patterns, enhancing risk management and strategic decision-making.

Predictive Over-Limit Warning Systems

Predictive Over-Limit Warning Systems leverage real-time credit utilization insights to proactively alert management before accounts exceed predefined credit limits, reducing default risks and optimizing credit line management. By integrating historical usage data with predictive analytics, businesses can enhance decision-making accuracy and improve financial stability through timely interventions.

Transaction-Level Utilization Metrics

Transaction-level utilization metrics provide granular insights into credit usage, enabling management to monitor real-time credit utilization with precision. Leveraging these detailed metrics allows for more accurate risk assessment and optimized credit limits, improving overall portfolio performance and decision-making.

Utilization Refresh Cycles

Credit utilization refresh cycles directly impact real-time utilization insights, enabling management to monitor borrowing levels with higher accuracy and timeliness. Frequent refresh intervals reduce latency in data updates, allowing for more proactive credit risk assessment and optimized credit line management.

Micro-Utilization Reporting

Micro-Utilization Reporting provides granular insights into credit utilization patterns, enabling management to monitor real-time credit usage against predefined limits with greater accuracy. This methodology enhances decision-making by identifying underutilized or overextended credit segments, optimizing credit allocation and risk management strategies.

Just-in-Time Credit Insights

Just-in-Time Credit Insights empower management with real-time utilization data, enabling precise monitoring of credit limits and immediate adjustments to optimize borrowing costs and risk exposure. Leveraging advanced analytics, these insights surpass traditional credit utilization metrics by providing dynamic, moment-to-moment visibility into credit usage patterns and liquidity status.

Credit utilization vs real-time utilization insights for management Infographic

moneydiff.com

moneydiff.com