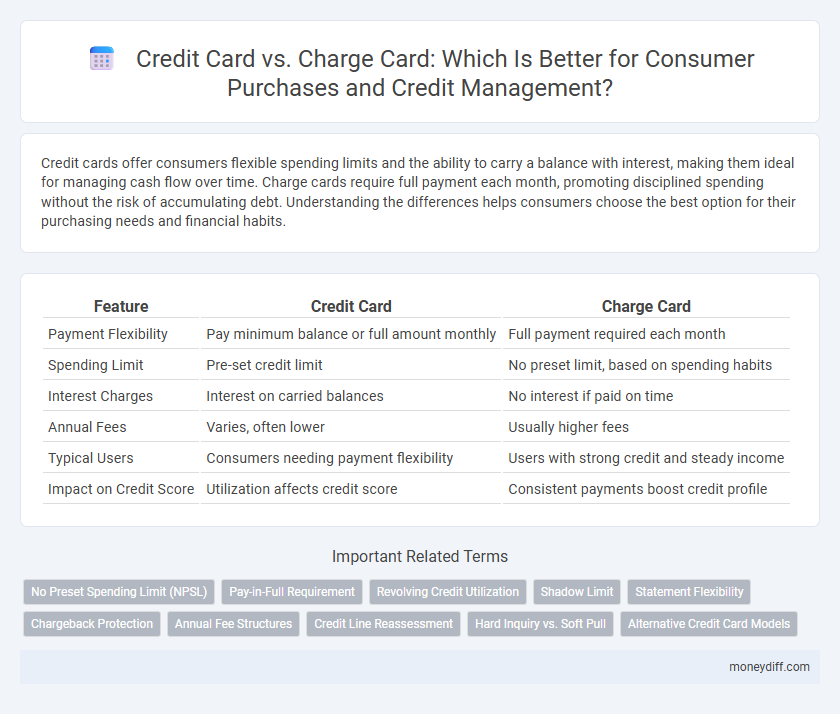

Credit cards offer consumers flexible spending limits and the ability to carry a balance with interest, making them ideal for managing cash flow over time. Charge cards require full payment each month, promoting disciplined spending without the risk of accumulating debt. Understanding the differences helps consumers choose the best option for their purchasing needs and financial habits.

Table of Comparison

| Feature | Credit Card | Charge Card |

|---|---|---|

| Payment Flexibility | Pay minimum balance or full amount monthly | Full payment required each month |

| Spending Limit | Pre-set credit limit | No preset limit, based on spending habits |

| Interest Charges | Interest on carried balances | No interest if paid on time |

| Annual Fees | Varies, often lower | Usually higher fees |

| Typical Users | Consumers needing payment flexibility | Users with strong credit and steady income |

| Impact on Credit Score | Utilization affects credit score | Consistent payments boost credit profile |

Understanding Credit Cards and Charge Cards

Credit cards allow consumers to borrow funds up to a preset limit and repay over time with interest, offering flexibility for purchases and balance management. Charge cards require full payment of the balance each month, promoting disciplined spending without accruing interest but often include no preset spending limit. Understanding these differences helps consumers choose a payment method aligned with their financial habits and purchasing needs.

Key Differences Between Credit and Charge Cards

Credit cards allow consumers to carry a balance and make minimum monthly payments, offering revolving credit with interest charges on unpaid balances. Charge cards require full payment of the balance each billing cycle without the option to carry debt, often with no preset spending limit but potential penalties for late payments. Key differences include payment flexibility, interest fees, spending controls, and typical usage patterns in consumer purchasing.

Fees and Interest Rates: What to Expect

Credit cards typically involve variable interest rates and may charge annual fees depending on the issuer and card type, affecting the overall cost of consumer purchases if balances are carried. Charge cards usually do not have preset spending limits and require full payment each month, often with higher annual fees but no interest charges since balances are not carried over. Understanding these fee structures and interest policies helps consumers select the best payment option for managing costs and credit usage effectively.

Credit Limits vs No Pre-set Spending Limits

Credit cards feature a fixed credit limit determined by the issuer, allowing consumers to manage spending within a predetermined borrowing capacity. Charge cards do not have a pre-set spending limit, offering greater purchasing flexibility, but require full payment of the balance each billing cycle. Understanding the difference between credit limits and no pre-set limits is essential for optimizing consumer purchasing power and managing financial obligations effectively.

Payment Flexibility and Requirements

Credit cards offer flexible payment options allowing consumers to carry a balance and make minimum monthly payments, which helps manage cash flow but may incur interest charges. Charge cards require full payment each billing cycle, eliminating interest but demanding disciplined budgeting to avoid penalties. Understanding these differences is crucial for consumers seeking either adjustable repayment terms or strict spending limits in their purchasing decisions.

Rewards, Perks, and Consumer Benefits

Credit cards offer flexible spending limits with the ability to carry balances, often providing cashback, travel rewards, and promotional financing options that enhance consumer purchasing power. Charge cards require full payment each month, typically featuring premium perks such as exclusive travel benefits, concierge services, and higher reward point multipliers for frequent users. Consumers benefit from credit cards through ongoing interest-free periods and diverse reward programs, while charge cards cater to those prioritizing elevated service and superior rewards without revolving debt.

Impact on Credit Score and Credit History

Credit cards impact credit scores by utilizing revolving credit, with payment history and credit utilization ratio playing crucial roles in score calculation. Charge cards require full payment each month, typically reporting to credit bureaus as paid in full, which can boost payment history without revolving balance utilization. Both types of cards contribute positively to credit history length and diversity, but credit cards offer flexibility that may affect credit utilization ratios more significantly.

Security Features and Fraud Protection

Credit cards offer robust security features such as EMV chip technology, real-time transaction alerts, and zero liability policies that protect consumers against unauthorized purchases. Charge cards provide similar fraud protection but often include enhanced customer service support and stricter spending controls, reducing the risk of overspending and potential fraud. Both card types employ advanced encryption and fraud detection algorithms to safeguard consumer data during transactions.

Choosing the Right Card for Your Spending Habits

Choosing the right card depends on your spending habits and payment preferences. Credit cards allow you to carry a balance with interest, offering flexibility for larger purchases or occasional cash flow needs. Charge cards require full payment each month, encouraging disciplined spending and often providing higher reward thresholds and exclusive perks for frequent buyers.

Which Card is Best for Your Financial Goals?

Credit cards offer revolving credit with flexible repayment options and interest charges on balances, making them ideal for consumers seeking to build credit scores and manage cash flow. Charge cards require full monthly payment without interest but typically provide higher spending limits and premium rewards, suiting users aiming for disciplined spending and maximizing benefits. Evaluating your financial goals, spending habits, and ability to pay in full determines whether a credit card or charge card best fits your purchasing strategy.

Related Important Terms

No Preset Spending Limit (NPSL)

Credit cards with No Preset Spending Limit (NPSL) offer flexible purchasing power based on factors like creditworthiness and payment history, allowing consumers to spend beyond traditional credit limits while managing balances over time. Charge cards, featuring NPSL as well, require full payment each billing cycle, emphasizing disciplined spending without carrying a revolving balance.

Pay-in-Full Requirement

Charge cards require consumers to pay the full balance each month, eliminating interest charges but limiting flexible payment options. Credit cards allow users to carry a balance with minimum payments, incurring interest on unpaid amounts, which offers greater spending flexibility but potential debt accumulation.

Revolving Credit Utilization

Credit cards offer revolving credit utilization, allowing consumers to carry a balance and make minimum payments over time, which impacts credit scores based on utilization ratios; charge cards require full payment each month, eliminating revolving balances but providing less flexibility in purchasing power. Managing credit card utilization below 30% is crucial for maintaining healthy credit, while charge cards help avoid interest fees by enforcing full payment, making them suitable for disciplined spenders.

Shadow Limit

Charge cards typically have no preset spending limit, allowing consumers flexible purchasing power without a fixed cap, whereas credit cards impose a defined credit limit based on creditworthiness and income. The shadow limit on charge cards represents an informal, dynamic threshold that, while not explicitly stated, can restrict spending based on account history and payment behavior.

Statement Flexibility

Credit cards offer flexible payment options by allowing consumers to carry a balance and make minimum monthly payments, enhancing spending convenience and cash flow management. Charge cards require full payment each billing cycle, limiting statement flexibility but avoiding interest charges and encouraging disciplined financial habits.

Chargeback Protection

Charge cards typically offer stronger chargeback protection compared to credit cards, allowing consumers to dispute fraudulent or unauthorized purchases more effectively. This enhanced protection helps reduce financial liability and provides greater security during consumer transactions.

Annual Fee Structures

Credit cards typically offer variable annual fees based on card type and rewards programs, often ranging from $0 to $550, while charge cards usually have higher, fixed annual fees averaging between $95 and $550, reflecting their premium services and lack of preset spending limits. Consumers should evaluate fee structures in relation to spending habits and benefits like cashback, travel rewards, or exclusive access to optimize their purchasing power.

Credit Line Reassessment

Credit cardholders benefit from periodic credit line reassessments that allow for increased purchasing power and improved credit utilization, while charge cards typically require full balance payment each cycle, limiting credit line adjustments but enhancing spending discipline. Continuous credit line evaluation in credit cards supports flexible consumer purchasing options and better financial management tailored to spending behavior.

Hard Inquiry vs. Soft Pull

A credit card typically involves a hard inquiry on your credit report during application, which can temporarily lower your credit score, while a charge card may require only a soft pull, causing no impact on your credit score. Understanding the difference between hard inquiries and soft pulls is essential for consumers prioritizing credit score management when choosing between credit card and charge card options.

Alternative Credit Card Models

Charge cards require full payment each billing cycle, eliminating interest charges, while credit cards allow consumers to carry a balance with interest applied on unpaid amounts. Alternative credit card models, such as hybrid cards, combine features of both by offering a grace period for payments before interest accrues, providing flexible options for consumer purchasing.

Credit Card vs Charge Card for consumer purchasing. Infographic

moneydiff.com

moneydiff.com