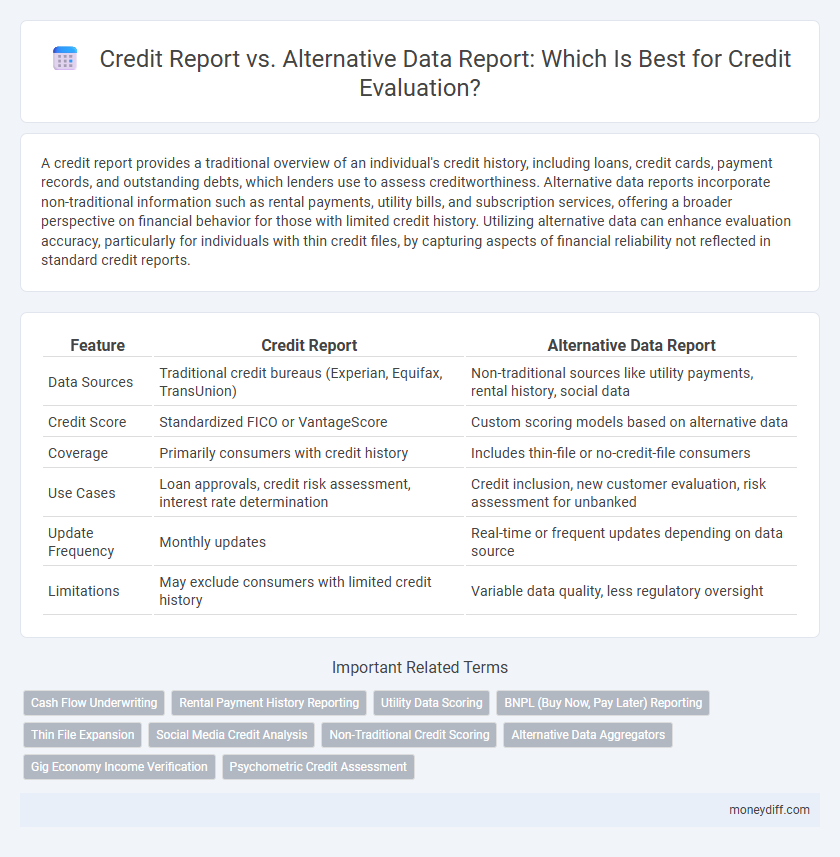

A credit report provides a traditional overview of an individual's credit history, including loans, credit cards, payment records, and outstanding debts, which lenders use to assess creditworthiness. Alternative data reports incorporate non-traditional information such as rental payments, utility bills, and subscription services, offering a broader perspective on financial behavior for those with limited credit history. Utilizing alternative data can enhance evaluation accuracy, particularly for individuals with thin credit files, by capturing aspects of financial reliability not reflected in standard credit reports.

Table of Comparison

| Feature | Credit Report | Alternative Data Report |

|---|---|---|

| Data Sources | Traditional credit bureaus (Experian, Equifax, TransUnion) | Non-traditional sources like utility payments, rental history, social data |

| Credit Score | Standardized FICO or VantageScore | Custom scoring models based on alternative data |

| Coverage | Primarily consumers with credit history | Includes thin-file or no-credit-file consumers |

| Use Cases | Loan approvals, credit risk assessment, interest rate determination | Credit inclusion, new customer evaluation, risk assessment for unbanked |

| Update Frequency | Monthly updates | Real-time or frequent updates depending on data source |

| Limitations | May exclude consumers with limited credit history | Variable data quality, less regulatory oversight |

Understanding Credit Reports: Traditional Evaluation Methods

Traditional credit reports rely on data from major credit bureaus, incorporating information such as payment history, outstanding debt, and credit inquiries to evaluate an individual's creditworthiness. These reports provide a standardized view widely used by lenders to assess risk, but may exclude alternative financial behaviors, limiting insights for individuals with thin credit files. Understanding the scope and limitations of traditional credit reports is essential for accurate credit evaluation and risk management.

What Is Alternative Data in Credit Assessment?

Alternative data in credit assessment refers to non-traditional information sources such as utility payments, rental history, phone bills, and bank transaction data used to evaluate a borrower's creditworthiness. This data provides a broader and more inclusive financial profile for individuals with limited or no credit history, improving access to credit. Unlike traditional credit reports, alternative data captures real-time financial behaviors, enabling more accurate risk assessment for lenders.

Key Differences Between Credit Reports and Alternative Data Reports

Credit reports primarily compile traditional financial information such as loan repayment history, credit card usage, and public records, enabling lenders to assess creditworthiness based on well-established scoring models. Alternative data reports incorporate non-traditional information like utility payments, rental history, and phone bills, providing insights into individuals with limited or no formal credit history. The key difference lies in the scope of data sources and the potential to expand credit access for underserved populations through alternative data.

How Lenders Use Credit Reports

Lenders use credit reports to assess borrowers' creditworthiness by analyzing payment history, outstanding debt, and credit utilization. Credit reports provide standardized, verified financial data that helps predict the risk of default. Alternative data reports incorporate non-traditional information like utility payments and rental history, offering a broader evaluation but are less commonly used by mainstream lenders.

Role of Alternative Data in Credit Decision-Making

Alternative data enhances credit decision-making by providing insights into financial behaviors not captured by traditional credit reports, such as rent, utility payments, and phone bills. Incorporating alternative data broadens credit access for thin-file or no-credit consumers, improving predictive accuracy and reducing default risks. Lenders leverage this expanded dataset to make more inclusive, data-driven credit evaluations, fostering financial inclusion and risk mitigation.

Pros and Cons of Traditional Credit Reports

Traditional credit reports provide a comprehensive overview of an individual's credit history, including payment records, credit utilization, and outstanding debts, offering lenders reliable data for risk assessment. However, these reports often exclude alternative credit behaviors such as rental payments, utilities, or phone bills, potentially disadvantaging individuals with limited credit histories. Additionally, traditional reports may contain outdated or inaccurate information, which can negatively impact credit evaluations and access to financial products.

Advantages and Drawbacks of Alternative Data Reports

Alternative data reports incorporate non-traditional information such as utility payments, rental history, and social media activity, providing a broader credit evaluation for those with limited or no conventional credit history. This approach enhances credit accessibility and offers lenders a more comprehensive risk assessment, though it may raise privacy concerns and lack standardized reporting formats. Consequently, while alternative data can improve financial inclusion, inconsistencies and potential data inaccuracies remain significant drawbacks.

Impact on Financial Inclusion: Alternative Data vs. Credit Reports

Alternative data reports enhance financial inclusion by incorporating non-traditional data sources such as utility payments, rental history, and social media activity, providing credit access to individuals with limited or no credit history. Traditional credit reports primarily rely on established credit accounts and payment history, often excluding underserved populations from financial opportunities. Utilizing alternative data enables lenders to better assess creditworthiness, reducing biases and expanding access to credit for marginalized and underbanked consumers.

Regulatory Considerations for Credit and Alternative Data Reports

Regulatory considerations for credit reports primarily involve compliance with the Fair Credit Reporting Act (FCRA), ensuring accuracy, privacy, and consumer consent in data usage. Alternative data reports, while increasingly used for credit evaluations, lack comprehensive regulatory frameworks, raising concerns over transparency and potential biases. Financial institutions must navigate these regulations carefully to maintain fairness and legal compliance when integrating alternative data into credit assessments.

Future Trends in Credit Evaluation: Merging Traditional and Alternative Data

Future trends in credit evaluation emphasize the integration of traditional credit reports with alternative data sources such as utility payments, rental history, and social behavior analytics. Combining these datasets enhances predictive accuracy by providing a more comprehensive view of borrower reliability, especially for thin-file or credit-invisible consumers. This hybrid approach leverages machine learning algorithms to identify creditworthiness beyond conventional metrics, fostering financial inclusion and risk mitigation.

Related Important Terms

Cash Flow Underwriting

Credit reports primarily rely on historical credit accounts and payment history, whereas alternative data reports integrate non-traditional information such as utility payments and rent to enhance cash flow underwriting accuracy. Incorporating alternative data provides a more comprehensive view of an applicant's financial behavior, reducing risk and improving credit decision-making models.

Rental Payment History Reporting

Credit reports primarily rely on credit card, loan, and mortgage data to evaluate creditworthiness, while alternative data reports incorporate non-traditional metrics such as rental payment history to provide a more comprehensive financial profile. Including rental payment history in evaluation models enhances credit accessibility for individuals with limited credit files by demonstrating consistent monthly payment behavior.

Utility Data Scoring

Utility data scoring leverages payment histories from electricity, water, and gas services to supplement traditional credit reports, offering a more inclusive evaluation of creditworthiness for individuals with limited credit histories. This alternative data approach enhances predictive accuracy by incorporating consistent utility payment behavior, which is often overlooked in conventional credit reporting systems.

BNPL (Buy Now, Pay Later) Reporting

BNPL reporting increasingly supplements traditional credit reports by incorporating alternative data such as payment history on installment purchases, improving credit evaluation for users with limited credit history. This alternative data enhances lenders' ability to assess risk and extend credit responsibly by capturing real-time transactional behaviors beyond conventional credit bureau metrics.

Thin File Expansion

Credit reports primarily rely on traditional financial data such as loan repayments and credit card usage, which often exclude thin-file consumers with limited credit history. Alternative data reports incorporate non-traditional information like utility payments, rental history, and phone bills, enabling expanded evaluation and improved credit access for thin-file individuals.

Social Media Credit Analysis

Social Media Credit Analysis leverages alternative data such as online behavior, social interactions, and digital footprints to supplement traditional credit reports, providing a more comprehensive evaluation of creditworthiness for individuals with limited credit history. This innovative approach enhances risk assessment accuracy by incorporating real-time social indicators alongside conventional financial data.

Non-Traditional Credit Scoring

Non-traditional credit scoring leverages alternative data such as utility payments, rental history, and mobile phone bills to provide a more holistic evaluation than traditional credit reports, which primarily rely on bank loans and credit card performance. Incorporating alternative data enhances credit accessibility for individuals with limited or no conventional credit history, improving risk assessment accuracy and financial inclusion.

Alternative Data Aggregators

Alternative data aggregators enhance credit evaluation by incorporating non-traditional sources such as utility payments, rental history, and mobile phone bills, providing a more comprehensive financial profile for consumers with limited credit history. These aggregators use machine learning algorithms to analyze diverse datasets, improving risk assessment accuracy and enabling lenders to make informed decisions beyond standard credit reports.

Gig Economy Income Verification

Credit reports primarily assess traditional financial history, while alternative data reports incorporate non-traditional metrics such as gig economy income verification, offering a more comprehensive evaluation for individuals with irregular earnings. Utilizing alternative data enables lenders to better understand gig workers' cash flow stability and creditworthiness beyond conventional credit scores.

Psychometric Credit Assessment

Psychometric credit assessments leverage behavioral and personality data to supplement traditional credit reports, providing lenders with deeper insights into borrower reliability beyond conventional financial data. This alternative data report enhances evaluation accuracy by analyzing traits such as risk tolerance and decision-making processes, enabling more inclusive credit scoring for individuals lacking extensive credit histories.

Credit report vs alternative data report for evaluation. Infographic

moneydiff.com

moneydiff.com