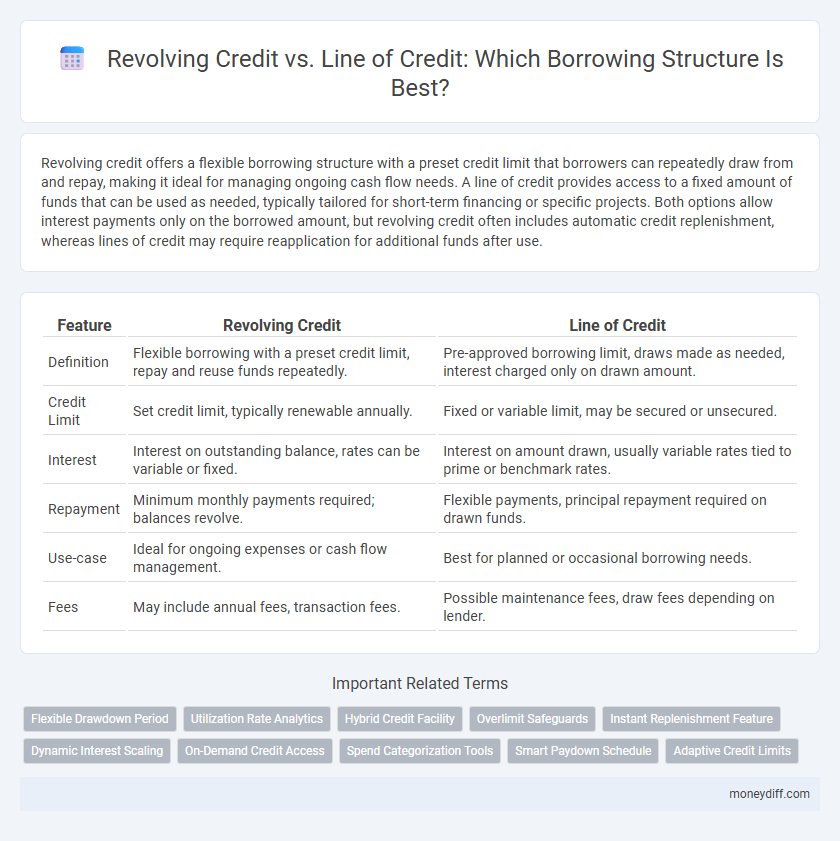

Revolving credit offers a flexible borrowing structure with a preset credit limit that borrowers can repeatedly draw from and repay, making it ideal for managing ongoing cash flow needs. A line of credit provides access to a fixed amount of funds that can be used as needed, typically tailored for short-term financing or specific projects. Both options allow interest payments only on the borrowed amount, but revolving credit often includes automatic credit replenishment, whereas lines of credit may require reapplication for additional funds after use.

Table of Comparison

| Feature | Revolving Credit | Line of Credit |

|---|---|---|

| Definition | Flexible borrowing with a preset credit limit, repay and reuse funds repeatedly. | Pre-approved borrowing limit, draws made as needed, interest charged only on drawn amount. |

| Credit Limit | Set credit limit, typically renewable annually. | Fixed or variable limit, may be secured or unsecured. |

| Interest | Interest on outstanding balance, rates can be variable or fixed. | Interest on amount drawn, usually variable rates tied to prime or benchmark rates. |

| Repayment | Minimum monthly payments required; balances revolve. | Flexible payments, principal repayment required on drawn funds. |

| Use-case | Ideal for ongoing expenses or cash flow management. | Best for planned or occasional borrowing needs. |

| Fees | May include annual fees, transaction fees. | Possible maintenance fees, draw fees depending on lender. |

Understanding Revolving Credit and Line of Credit

Revolving credit allows borrowers to access funds up to a set limit, repay, and borrow again without reapplying, making it ideal for ongoing cash flow needs. A line of credit provides a flexible borrowing option with predetermined credit limits, often secured or unsecured, suitable for managing short-term expenses or unexpected costs. Both structures offer adaptable financing but differ in terms of interest calculation, repayment schedules, and access frequency.

Key Differences Between Revolving Credit and Line of Credit

Revolving credit allows borrowers to repeatedly draw, repay, and redraw funds up to a set credit limit, offering flexible access to capital without reapplying. A line of credit typically refers to a preset borrowing limit from which funds can be drawn, often secured by assets and used for specific purposes like home equity or business expenses. Key differences include interest calculation methods, repayment terms, and collateral requirements, with revolving credit usually unsecured and revolving, while lines of credit may have fixed terms and require collateral security.

Eligibility Criteria for Each Borrowing Structure

Revolving credit eligibility typically requires a strong credit score, steady income, and low debt-to-income ratio, making it accessible to individuals with well-established credit histories. Line of credit eligibility often involves collateral requirements, detailed financial statements, and comprehensive credit evaluations, particularly for business borrowers seeking larger sums. Both borrowing structures demand thorough credit assessments, but lines of credit generally impose stricter documentation and asset verification standards.

Ease of Access: Which Offers More Flexibility?

Revolving credit offers greater ease of access and flexibility by allowing borrowers to repeatedly draw, repay, and redraw funds up to a set credit limit without reapplying. Lines of credit provide a fixed amount that can be drawn upon as needed, but may have more stringent approval processes for increases or renewals. Revolving credit is typically more suitable for ongoing expenses due to its continuous access feature, while lines of credit suit planned borrowing with periodic access.

Interest Rate Comparison: Revolving vs Line of Credit

Revolving credit typically features higher interest rates compared to a traditional line of credit due to its flexible repayment terms and continual borrowing capability. Lines of credit often offer lower, fixed interest rates, making them more cost-effective for planned, larger financing needs. Understanding the interest rate structure is crucial for borrowers to choose the most economical borrowing option tailored to their financial requirements.

Repayment Terms and Borrower Responsibilities

Revolving credit offers flexible repayment terms where borrowers can repay and re-borrow up to a credit limit, with interest charged only on the outstanding balance. Lines of credit provide structured repayment schedules with fixed or variable terms, requiring timely payments to avoid penalties and maintain access. Borrowers are responsible for managing balances and understanding interest computations to optimize borrowing costs in both credit types.

Impact on Credit Score: What to Expect

Revolving credit, such as credit cards, can significantly impact your credit score by influencing your credit utilization ratio, which ideally should remain below 30% to maintain a positive score. Lines of credit typically offer more flexibility and often do not affect credit utilization in the same way, but timely payments remain critical for preserving credit health. Monitoring both credit types for utilization and payment history is essential to avoid negative effects and improve creditworthiness over time.

Top Use Cases for Revolving Credit and Line of Credit

Revolving credit is ideal for managing ongoing cash flow needs and unexpected expenses, supporting businesses with fluctuating working capital requirements. Lines of credit are well-suited for large, planned expenses such as equipment purchases or expansion projects, offering flexible access to capital on demand. Both credit types enhance borrowing structures by providing tailored financial solutions for short-term operational funding and strategic investments.

Risks and Limitations of Each Credit Option

Revolving credit carries higher risks due to fluctuating interest rates and potential over-utilization, which can lead to increased debt and credit score damage. Lines of credit often have draw limits and require collateral, limiting accessibility and exposing borrowers to asset forfeiture if payments are missed. Both options can impose fees, penalties, and financial strain if not managed carefully within the borrowing structure.

Choosing the Right Borrowing Structure for Your Needs

Revolving credit offers flexible borrowing up to a set limit with variable interest rates, ideal for managing fluctuating cash flow and short-term expenses. A line of credit provides a lump sum accessible as needed, often with fixed repayment terms, suitable for planned projects or larger purchases. Evaluating your financial goals, repayment ability, and borrowing frequency helps determine the optimal structure between revolving credit and a line of credit.

Related Important Terms

Flexible Drawdown Period

Revolving credit offers a flexible drawdown period allowing borrowers to access funds repeatedly up to a set limit as needed, making it ideal for managing fluctuating cash flow requirements. In contrast, a line of credit typically provides a predetermined amount with more structured drawdown terms, which may limit flexibility but offer clearer repayment schedules.

Utilization Rate Analytics

Revolving credit utilization rate measures the percentage of available credit currently being used, directly impacting credit scores and borrowing capacity, while lines of credit often allow more flexible borrowing limits without immediate utilization penalties. Analyzing utilization rates between revolving credit and lines of credit enables borrowers to optimize borrowing structures by minimizing interest costs and maximizing credit efficiency.

Hybrid Credit Facility

A hybrid credit facility combines features of revolving credit and a traditional line of credit, allowing borrowers flexible access to funds up to a predetermined limit while enabling periodic repayments and reborrowings without reapplying. This structure optimizes cash flow management by providing revolving availability with the stability of a committed line, often used by businesses to balance short-term liquidity needs and long-term financing strategies.

Overlimit Safeguards

Revolving credit typically includes built-in overlimit safeguards that prevent borrowing beyond preset limits, ensuring stricter control over credit utilization. Lines of credit often offer more flexible access but may lack automatic overlimit protections, risking potential overspending without explicit monitoring.

Instant Replenishment Feature

Revolving credit features instant replenishment, allowing borrowers to reuse available credit immediately after repayments, enhancing cash flow flexibility and financial agility. Lines of credit may lack this automatic reset, requiring formal reapproval or delays before funds become accessible again.

Dynamic Interest Scaling

Revolving credit features dynamic interest scaling based on outstanding balances, allowing borrowers to manage payments flexibly while interest adjusts with usage fluctuations. In contrast, a line of credit typically offers fixed interest rates up to a credit limit, providing predictable borrowing costs but less adaptability to changing financial needs.

On-Demand Credit Access

Revolving credit offers on-demand credit access with a preset limit, allowing borrowers to withdraw, repay, and reuse funds repeatedly, ideal for managing fluctuating cash flow. Lines of credit provide flexible financing with similar access but may include fixed terms or conditions affecting immediate availability.

Spend Categorization Tools

Revolving credit and lines of credit both offer flexible borrowing options, but spend categorization tools are more commonly integrated with lines of credit, enabling users to track and categorize expenses for better financial management. These tools enhance visibility into spending patterns, facilitating precise budgeting and optimized credit utilization within a line of credit framework.

Smart Paydown Schedule

A smart paydown schedule for revolving credit leverages flexible repayment amounts based on available cash flow, minimizing interest expenses and optimizing borrowing capacity. In contrast, a line of credit often requires a structured repayment plan with fixed minimum payments, which can limit flexibility but provide predictable cash outflows for budgeting.

Adaptive Credit Limits

Revolving credit offers flexible borrowing with automatic credit limit replenishment as balances are repaid, allowing continuous access to funds within a set limit. Lines of credit provide predetermined credit limits tailored to borrower needs, with adaptive credit adjustments based on creditworthiness and repayment behavior to optimize borrowing capacity.

Revolving Credit vs Line of Credit for borrowing structure. Infographic

moneydiff.com

moneydiff.com