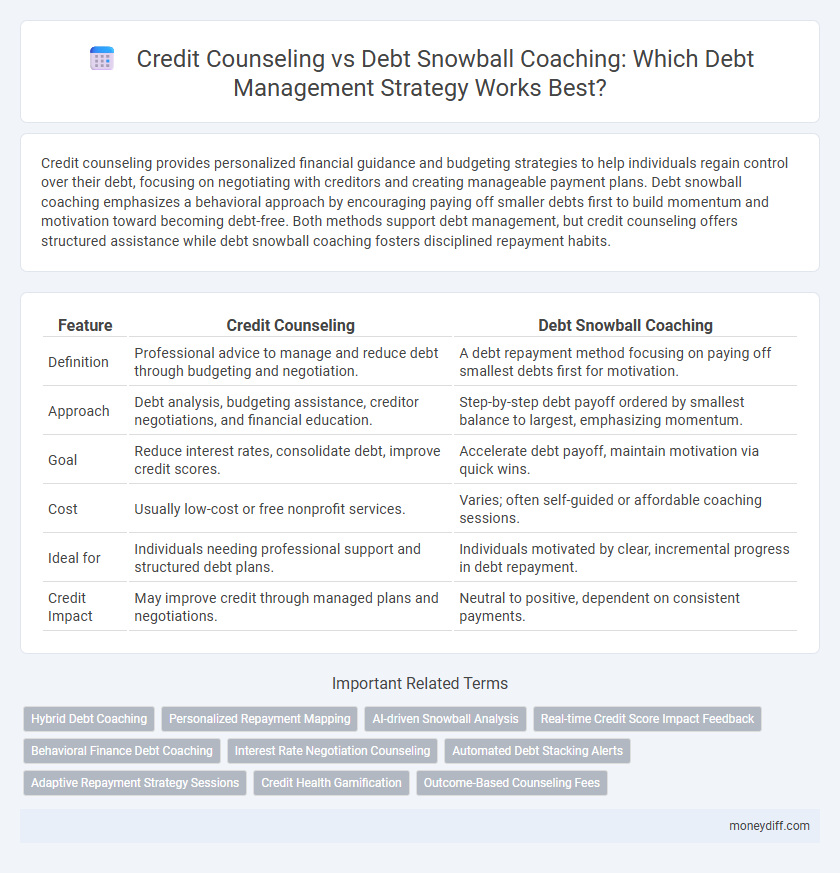

Credit counseling provides personalized financial guidance and budgeting strategies to help individuals regain control over their debt, focusing on negotiating with creditors and creating manageable payment plans. Debt snowball coaching emphasizes a behavioral approach by encouraging paying off smaller debts first to build momentum and motivation toward becoming debt-free. Both methods support debt management, but credit counseling offers structured assistance while debt snowball coaching fosters disciplined repayment habits.

Table of Comparison

| Feature | Credit Counseling | Debt Snowball Coaching |

|---|---|---|

| Definition | Professional advice to manage and reduce debt through budgeting and negotiation. | A debt repayment method focusing on paying off smallest debts first for motivation. |

| Approach | Debt analysis, budgeting assistance, creditor negotiations, and financial education. | Step-by-step debt payoff ordered by smallest balance to largest, emphasizing momentum. |

| Goal | Reduce interest rates, consolidate debt, improve credit scores. | Accelerate debt payoff, maintain motivation via quick wins. |

| Cost | Usually low-cost or free nonprofit services. | Varies; often self-guided or affordable coaching sessions. |

| Ideal for | Individuals needing professional support and structured debt plans. | Individuals motivated by clear, incremental progress in debt repayment. |

| Credit Impact | May improve credit through managed plans and negotiations. | Neutral to positive, dependent on consistent payments. |

Understanding Credit Counseling: An Overview

Credit counseling provides personalized guidance from certified counselors to help individuals develop realistic budgets and manage debt effectively. This service often includes analyzing credit reports, negotiating with creditors, and offering education on financial literacy to improve credit scores. Compared to debt snowball coaching, credit counseling takes a comprehensive approach addressing overall financial health rather than focusing solely on rapid debt repayment strategies.

What Is Debt Snowball Coaching?

Debt Snowball Coaching is a debt management strategy focusing on paying off the smallest debts first to build momentum and motivation. This method encourages disciplined budgeting and prioritizing debts by size rather than interest rate, enhancing psychological commitment to becoming debt-free. Credit counselors often incorporate this technique to help clients systematically reduce debt while fostering financial accountability.

Key Differences Between Credit Counseling and Debt Snowball Coaching

Credit counseling provides holistic debt management strategies, including negotiating with creditors and creating personalized budgets, while debt snowball coaching focuses specifically on paying off debts from smallest to largest to build momentum. Credit counselors often work through non-profit agencies offering long-term financial education, whereas debt snowball coaches typically guide clients through self-managed repayment plans emphasizing psychological motivation. The key difference lies in credit counseling's comprehensive approach versus debt snowball coaching's targeted focus on accelerating debt elimination through behavioral techniques.

Pros and Cons of Credit Counseling

Credit counseling offers personalized financial assessments, budgeting advice, and debt management plans, helping individuals regain control over their finances and negotiate with creditors for lower interest rates. However, it may involve fees and requires consistent participation, which some clients find restrictive or time-consuming. Unlike debt snowball coaching that emphasizes psychological motivation through paying off smaller debts first, credit counseling focuses more on structured repayment strategies and creditor negotiation.

Advantages and Disadvantages of Debt Snowball Coaching

Debt Snowball Coaching offers a structured approach by focusing on paying off the smallest debts first, which boosts motivation through quick wins and improves financial discipline. This method can lead to faster psychological debt relief but may result in higher overall interest costs compared to other strategies like the debt avalanche method. However, Debt Snowball Coaching may lack personalized financial advice and fail to address underlying spending habits that credit counseling typically covers.

Which Method Suits Different Debt Situations?

Credit counseling suits individuals needing structured financial guidance to manage various debts by creating realistic budgets and negotiating with creditors, ideal for those overwhelmed by multiple accounts. Debt snowball coaching benefits borrowers with smaller debts who prefer motivational momentum by paying off debts from smallest to largest, encouraging discipline and progress. Evaluating debt size, complexity, and personal discipline determines which method aligns best with individual financial recovery goals.

Cost Comparison: Credit Counseling vs Debt Snowball Coaching

Credit counseling typically involves a one-time or short-term fee ranging from $50 to $100, with some agencies offering free initial sessions, while debt snowball coaching may cost between $200 and $500 depending on the coach's experience and program length. Credit counseling agencies often provide structured repayment plans that can reduce interest rates and fees, potentially lowering overall costs compared to self-managed debt snowball methods. Choosing credit counseling can result in negotiated debt settlements and lower creditor fees, whereas debt snowball coaching mainly focuses on behavioral strategies without creditor negotiation, impacting cost-effectiveness over time.

Impact on Credit Score: Counseling vs Snowball Approach

Credit counseling offers personalized guidance to improve financial habits, often leading to gradual credit score recovery through structured debt management plans. The debt snowball coaching method prioritizes paying off smaller debts first, which can boost credit scores quickly by reducing the number of outstanding accounts and improving payment history. Both approaches positively impact credit scores but vary in speed and focus, with counseling emphasizing long-term financial health and the snowball approach targeting rapid psychological wins.

Success Rates: Credit Counseling vs Debt Snowball Method

Credit counseling boasts average success rates of 70-80% by offering personalized financial assessments and tailored repayment plans, helping clients reduce debt systematically. The debt snowball method, emphasizing rapid payoff of smallest debts first, shows success rates near 60-70%, driven by increased motivation and behavioral commitment. Combining credit counseling with the debt snowball approach can enhance overall debt management outcomes by addressing both financial strategy and psychological factors.

How to Choose the Right Debt Management Strategy

Choosing the right debt management strategy depends on your financial goals and discipline level. Credit counseling offers personalized budgeting and negotiation with creditors to reduce interest rates, ideal for those needing professional guidance. Debt snowball coaching emphasizes paying off smaller debts first to build momentum, best suited for individuals motivated by quick wins and a structured payoff plan.

Related Important Terms

Hybrid Debt Coaching

Hybrid Debt Coaching integrates the personalized strategies of Credit Counseling with the structured approach of Debt Snowball Coaching, offering tailored debt management plans that enhance repayment efficiency while maintaining credit health. This method leverages credit analysis and behavioral coaching to optimize debt reduction, balancing immediate financial relief with long-term credit improvement.

Personalized Repayment Mapping

Credit counseling offers personalized repayment mapping by evaluating individual financial situations and creating tailored budgets and debt management plans, while debt snowball coaching emphasizes systematic repayment of smaller debts first to build momentum and motivation. Both methods prioritize structured guidance, but credit counseling provides a comprehensive approach with creditor negotiations and customized strategies for long-term debt resolution.

AI-driven Snowball Analysis

AI-driven Snowball Analysis enhances debt snowball coaching by providing precise, personalized payment strategies that maximize debt reduction efficiency. Credit counseling typically offers generic advice, while AI-powered tools enable dynamic adjustments based on real-time financial data, accelerating debt payoff and improving overall debt management outcomes.

Real-time Credit Score Impact Feedback

Credit counseling provides personalized debt management plans with real-time credit score impact feedback to help individuals understand how payment strategies affect their credit health. Debt snowball coaching emphasizes rapid debt payoff order but often lacks immediate insights into credit score changes during the repayment process.

Behavioral Finance Debt Coaching

Behavioral finance debt coaching emphasizes understanding psychological biases and spending habits to create sustainable debt repayment plans, often integrated within credit counseling for holistic financial health. Debt snowball coaching focuses on accelerating debt payoff by prioritizing smaller balances to build motivation, aligning behavioral strategies with tangible progress metrics.

Interest Rate Negotiation Counseling

Interest rate negotiation counseling within credit counseling helps reduce overall debt costs by securing lower interest rates, directly impacting the debt payoff timeline. Unlike debt snowball coaching, which emphasizes paying off smaller balances first, this approach targets reducing financial burdens through strategic lender negotiations.

Automated Debt Stacking Alerts

Automated debt stacking alerts use algorithms to prioritize debt payments by interest rates and balances, enhancing the efficiency of credit counseling strategies. Unlike traditional debt snowball coaching that emphasizes paying off the smallest debts first, these alerts optimize debt repayment order to reduce overall interest costs and speed up debt elimination.

Adaptive Repayment Strategy Sessions

Adaptive Repayment Strategy Sessions in credit counseling tailor personalized plans that adjust based on your financial changes and debt behavior, optimizing your ability to manage repayments efficiently. Debt Snowball Coaching emphasizes accelerating payments on smaller balances first to build momentum, but credit counseling's adaptive approach offers dynamic adjustments to prevent setbacks and enhance long-term debt elimination.

Credit Health Gamification

Credit Health Gamification leverages interactive tools to enhance Credit Counseling by making repayment progress visually engaging, boosting motivation and adherence to credit management plans. Debt Snowball Coaching integrates gamified milestones that reward early debt eliminations, encouraging consistent payments and reinforcing positive financial behaviors for sustainable credit improvement.

Outcome-Based Counseling Fees

Credit counseling often charges fees based on personalized debt management plans that prioritize sustainable financial outcomes, while debt snowball coaching typically offers outcome-based fees linked to achieving incremental debt reduction milestones, promoting motivation and accountability. Both approaches emphasize measurable progress, but debt snowball coaching aligns fees more directly with client success in eliminating debts step-by-step.

Credit Counseling vs Debt Snowball Coaching for debt management. Infographic

moneydiff.com

moneydiff.com