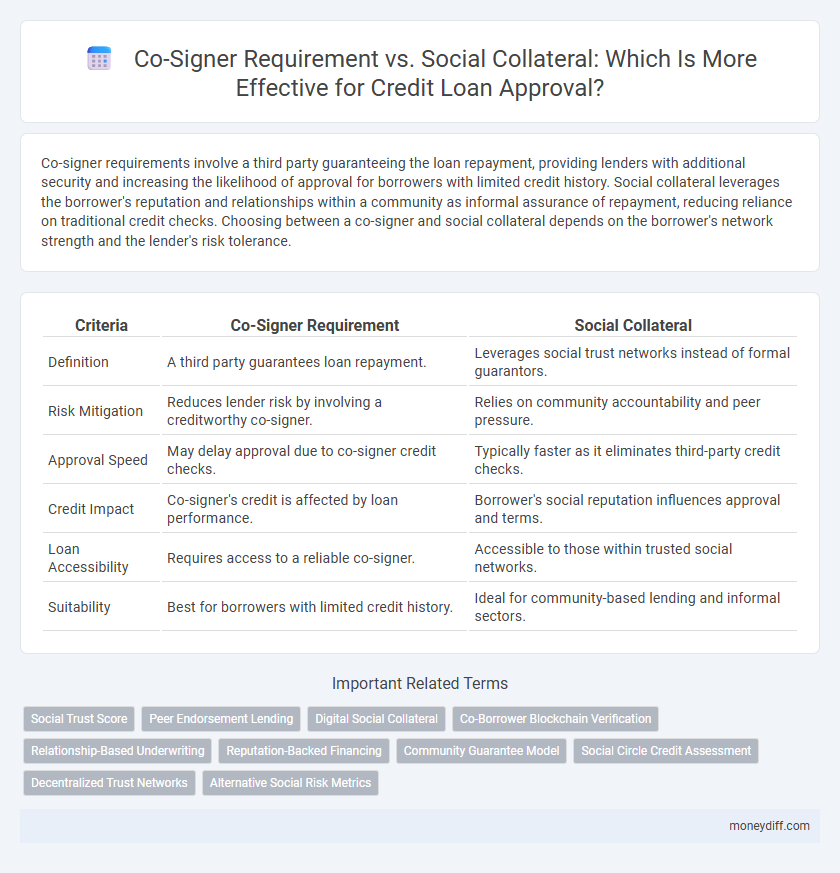

Co-signer requirements involve a third party guaranteeing the loan repayment, providing lenders with additional security and increasing the likelihood of approval for borrowers with limited credit history. Social collateral leverages the borrower's reputation and relationships within a community as informal assurance of repayment, reducing reliance on traditional credit checks. Choosing between a co-signer and social collateral depends on the borrower's network strength and the lender's risk tolerance.

Table of Comparison

| Criteria | Co-Signer Requirement | Social Collateral |

|---|---|---|

| Definition | A third party guarantees loan repayment. | Leverages social trust networks instead of formal guarantors. |

| Risk Mitigation | Reduces lender risk by involving a creditworthy co-signer. | Relies on community accountability and peer pressure. |

| Approval Speed | May delay approval due to co-signer credit checks. | Typically faster as it eliminates third-party credit checks. |

| Credit Impact | Co-signer's credit is affected by loan performance. | Borrower's social reputation influences approval and terms. |

| Loan Accessibility | Requires access to a reliable co-signer. | Accessible to those within trusted social networks. |

| Suitability | Best for borrowers with limited credit history. | Ideal for community-based lending and informal sectors. |

Understanding Co-Signer Requirements in Loan Approval

Co-signer requirements in loan approval involve a secondary party agreeing to take responsibility for the debt if the primary borrower defaults, enhancing the lender's confidence in repayment. Lenders typically require a co-signer when the primary applicant has a low credit score, limited credit history, or insufficient income to meet loan criteria independently. Understanding co-signer obligations and their impact on credit risk assessment helps borrowers navigate approval processes more effectively.

Defining Social Collateral in Modern Lending

Social collateral in modern lending refers to the use of a borrower's social reputation, community standing, and network connections as non-traditional assurance for loan approval. Unlike a co-signer requirement, which relies on a specific individual's financial backing, social collateral leverages collective trust and social capital to mitigate lending risks. This innovative approach is gaining traction in peer-to-peer lending platforms and microfinance institutions, expanding access to credit for borrowers without formal credit history.

Key Differences: Co-Signer vs. Social Collateral

A co-signer is a legally responsible individual who guarantees loan repayment if the primary borrower defaults, providing lenders with a credit safety net, while social collateral leverages a borrower's social ties and reputation within a community to assure repayment without formal legal obligations. Co-signers typically have verifiable credit histories and income, directly impacting loan approval decisions, whereas social collateral relies on trust, social pressure, and communal enforcement mechanisms. The key difference lies in the formal legal liability of co-signers versus the informal, reputation-based assurance in social collateral frameworks.

Pros and Cons of Using a Co-Signer

Using a co-signer can significantly enhance loan approval chances by leveraging the co-signer's creditworthiness to offset the primary borrower's risk, often resulting in lower interest rates and better loan terms. However, this arrangement carries the risk of damaging the co-signer's credit if the borrower defaults, and it may strain personal relationships due to shared financial responsibility. Unlike social collateral, which relies on community reputation and informal trust, a co-signer provides a formal and legally binding guarantee that directly influences credit evaluation.

Advantages and Risks of Social Collateral

Social collateral leverages relationships and trust within a community to enhance loan approval chances without the need for a formal co-signer, potentially reducing strict credit requirements and fostering financial inclusion. Advantages include increased access to credit for individuals lacking traditional credit history and the empowerment of community bonds as a form of informal guarantee. Risks involve the possibility of social pressure, strained relationships if repayment issues arise, and the absence of legal enforcement mechanisms compared to co-signer agreements.

Impact on Credit Scores: Co-Signer vs. Social Collateral

A co-signer directly links their credit profile to the loan, making their credit score vulnerable to payment history and defaults, which can significantly affect their creditworthiness. Social collateral leverages trust and community ties instead of credit bureaus, minimizing immediate impact on formal credit scores but risking social reputation if payments fail. Choosing between these options depends on balancing traditional credit impact with informal social accountability in securing loan approval.

Eligibility Criteria for Co-Signers and Social Collateral

Eligibility criteria for co-signers typically include a strong credit score, stable income, and low debt-to-income ratio to assure lenders of repayment ability. Social collateral leverages community trust and relationships, often requiring proof of social standing, peer endorsements, or participation in trusted networks instead of traditional financial metrics. Lenders assessing loans with social collateral prioritize social reliability and community reputation over formal credit qualifications.

Borrower Responsibility and Loan Repayment Assurance

Borrower responsibility is crucial in loan approval, where co-signers provide a legal guarantee to repay the loan if the primary borrower defaults, enhancing lender confidence. Social collateral, based on the borrower's community reputation and relationships, offers a less formal but culturally significant assurance without legal binding. Both methods influence loan repayment assurance, but co-signers directly increase accountability through shared financial obligation, while social collateral fosters trust and social pressure to fulfill repayment commitments.

Trends in Alternative Credit Assessment Methods

Emerging trends in alternative credit assessment prioritize social collateral over traditional co-signer requirements, leveraging social networks and community trust as indicators of creditworthiness. Innovative platforms analyze social behavior, peer endorsements, and digital footprints to mitigate risk and broaden access to loans, especially for underserved populations. This shift reduces reliance on co-signers, streamlining approval processes while maintaining lender confidence through more holistic and data-driven evaluations.

Choosing Between Co-Signer and Social Collateral for Loans

Choosing between a co-signer and social collateral for loan approval depends on creditworthiness and relationship dynamics. A co-signer with strong credit provides a traditional guarantee, reducing lender risk and potentially securing better loan terms. Social collateral leverages community trust and reputation but may pose challenges in quantifying risk, making lender acceptance less consistent.

Related Important Terms

Social Trust Score

Lenders increasingly consider Social Trust Scores as an alternative to traditional co-signer requirements, using social trust data derived from community interactions, payment behaviors, and reputation metrics to assess creditworthiness. This shift enables individuals with limited credit history to access loans by leveraging their social collateral, reducing dependency on co-signers and enhancing inclusive credit approval processes.

Peer Endorsement Lending

Peer endorsement lending leverages social collateral through trusted co-signers or community networks to enhance loan approval chances by validating creditworthiness beyond traditional credit scores. Unlike standard co-signer requirements, this approach reduces reliance on individual credit history by emphasizing collective reputation and mutual accountability within peer groups.

Digital Social Collateral

Digital social collateral leverages social media data, online behavior, and network credibility to supplement traditional co-signer requirements in loan approval, enhancing lender confidence without the need for a guarantor. Utilizing AI-driven algorithms, lenders analyze digital footprints such as transaction history, peer endorsements, and reputation metrics to assess creditworthiness, enabling more inclusive and efficient lending processes.

Co-Borrower Blockchain Verification

Co-borrower blockchain verification enhances loan approval accuracy by securely validating co-signers' credit histories and identities, reducing fraud risks compared to traditional co-signer requirements. Social collateral leverages personal networks and reputational data but lacks the immutable verification strength provided by blockchain technology in co-borrower assessments.

Relationship-Based Underwriting

Relationship-based underwriting leverages social collateral by evaluating a borrower's network and interpersonal trust, reducing the reliance on a traditional co-signer for loan approval. This approach enhances credit access by incorporating qualitative factors like social reputation and community standing alongside financial metrics.

Reputation-Backed Financing

Reputation-backed financing leverages social collateral, where a borrower's trustworthiness and relationships serve as alternatives to traditional co-signer requirements in loan approval. This approach reduces reliance on credit scores by emphasizing community endorsement and personal reputation to secure credit access.

Community Guarantee Model

The Community Guarantee Model leverages social collateral through trusted community networks to reduce or eliminate the need for a formal co-signer, enhancing loan approval rates for individuals lacking traditional credit history. This model emphasizes collective responsibility and social ties as key factors in credit risk assessment, providing an alternative to conventional co-signer requirements.

Social Circle Credit Assessment

Social Circle Credit Assessment evaluates loan approval by analyzing the trustworthiness and financial behavior within a borrower's network, reducing reliance on traditional co-signer requirements. This method leverages social collateral, using peer credibility and community reputation to enhance creditworthiness and secure favorable loan terms.

Decentralized Trust Networks

Decentralized trust networks reduce the necessity for traditional co-signer requirements by utilizing social collateral derived from verified peer interactions and reputation data, enhancing loan approval accessibility and risk assessment. These networks leverage blockchain technology and smart contracts to validate social collateral, ensuring transparent and secure creditworthiness evaluation without relying on centralized credit bureaus.

Alternative Social Risk Metrics

Alternative social risk metrics evaluate a borrower's creditworthiness by analyzing behavioral data, community reputation, and social network activity, providing lenders with more dynamic insights than traditional co-signer requirements. These metrics reduce reliance on co-signers by quantifying social collateral, enabling broader access to loans for individuals lacking conventional credit histories.

Co-Signer Requirement vs Social Collateral for loan approval. Infographic

moneydiff.com

moneydiff.com