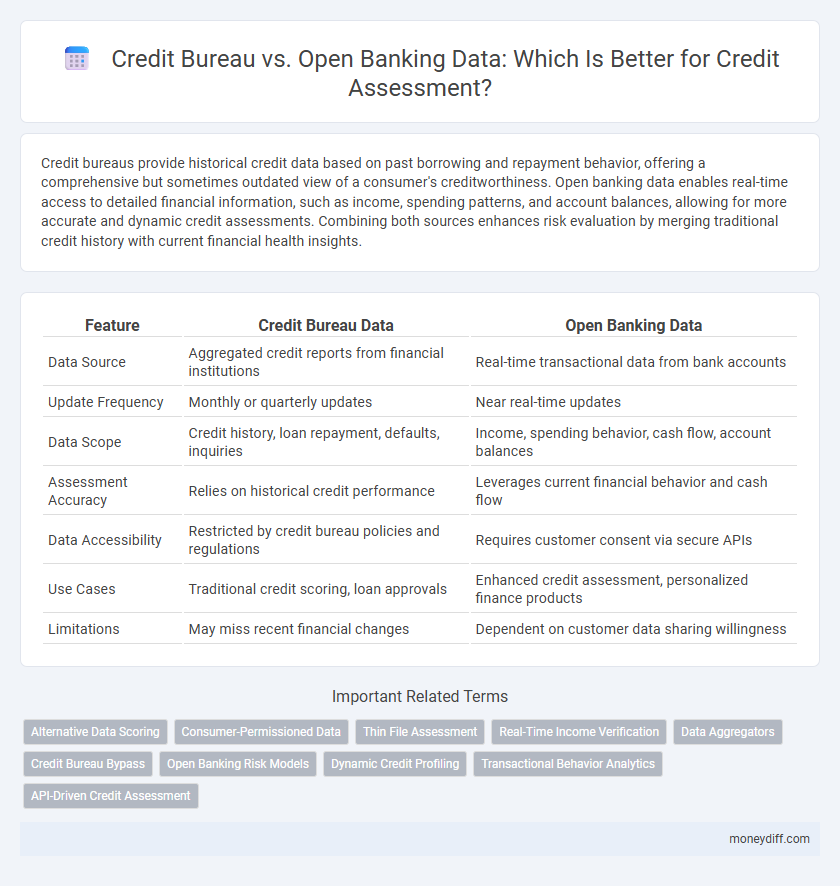

Credit bureaus provide historical credit data based on past borrowing and repayment behavior, offering a comprehensive but sometimes outdated view of a consumer's creditworthiness. Open banking data enables real-time access to detailed financial information, such as income, spending patterns, and account balances, allowing for more accurate and dynamic credit assessments. Combining both sources enhances risk evaluation by merging traditional credit history with current financial health insights.

Table of Comparison

| Feature | Credit Bureau Data | Open Banking Data |

|---|---|---|

| Data Source | Aggregated credit reports from financial institutions | Real-time transactional data from bank accounts |

| Update Frequency | Monthly or quarterly updates | Near real-time updates |

| Data Scope | Credit history, loan repayment, defaults, inquiries | Income, spending behavior, cash flow, account balances |

| Assessment Accuracy | Relies on historical credit performance | Leverages current financial behavior and cash flow |

| Data Accessibility | Restricted by credit bureau policies and regulations | Requires customer consent via secure APIs |

| Use Cases | Traditional credit scoring, loan approvals | Enhanced credit assessment, personalized finance products |

| Limitations | May miss recent financial changes | Dependent on customer data sharing willingness |

Understanding Credit Bureau Data

Credit Bureau data provides a comprehensive historical record of a borrower's credit behavior, including loan repayments, credit inquiries, and outstanding debts, which enables lenders to assess creditworthiness based on past financial conduct. This data is standardized and regulated, offering reliability and consistency for risk evaluation in credit assessment models. Understanding Credit Bureau information helps lenders predict default risk by analyzing patterns like payment punctuality and credit utilization ratios.

What is Open Banking Data?

Open Banking Data refers to financial information securely shared by consumers through authorized third-party providers, offering detailed insights into transaction history, income patterns, and spending behavior. Unlike traditional Credit Bureau data, which primarily includes credit scores, repayment history, and public records, Open Banking allows lenders to access real-time, granular banking data for more accurate credit assessments. This enhances credit decision accuracy by incorporating dynamic financial behavior beyond static credit reports.

Key Differences Between Credit Bureau and Open Banking Data

Credit bureaus compile historical credit information such as loan repayment history, credit card usage, and public records to generate credit scores primarily based on past financial behavior. Open banking data provides real-time access to banking transactions, income, and cash flow patterns, enabling a more dynamic and comprehensive view of an individual's current financial health. Unlike credit bureaus, open banking offers granular, up-to-date financial activity that can enhance credit assessment accuracy, especially for thin-file or underbanked consumers.

Data Sources and Collection Methods

Credit bureaus collect data primarily from traditional financial institutions, including banks, credit card companies, and lenders, aggregating historical credit behavior and payment records. Open banking data sources involve real-time access to consumer banking transactions, income flows, and spending patterns via API integrations with financial service providers. The collection methods differ as credit bureaus rely on periodic reporting and credit histories, while open banking utilizes direct, dynamic data retrieval from customers' bank accounts for enhanced accuracy and timeliness in credit assessment.

Accuracy and Timeliness of Credit Information

Credit bureaus provide comprehensive historical credit information that offers reliable accuracy but may experience delays in updating recent financial activities. Open banking data delivers real-time transaction insights, enhancing timeliness and improving the precision of creditworthiness assessments. Combining traditional credit bureau data with open banking information creates a more dynamic and accurate credit evaluation model.

Impact on Credit Scoring Models

Credit bureaus provide historical credit data that enhances the accuracy of traditional credit scoring models by incorporating extensive payment histories and delinquencies. Open banking data offers real-time financial behavior insights such as income flows and spending patterns, enabling dynamic risk assessment beyond static credit reports. Integrating both credit bureau and open banking data improves predictive power and reduces default risk by delivering a more comprehensive borrower profile.

Consumer Privacy and Data Security

Credit bureaus provide historical credit data accumulated from multiple financial institutions, raising concerns about centralized data breaches impacting consumer privacy. Open banking data offers real-time transactional insights directly from consumers' bank accounts, enhancing data accuracy while necessitating stringent consent and encryption protocols to secure sensitive financial information. Leveraging open banking for credit assessment promotes transparent data sharing with enhanced consumer control, reducing the risks associated with traditional credit bureau databases.

Accessibility for Lenders and Borrowers

Credit bureaus provide lenders with extensive historical credit data aggregated from multiple sources, enabling comprehensive risk assessment but often requiring fees and formal access permissions. Open banking data offers real-time financial information directly from consumers' bank accounts, enhancing accessibility for lenders through API integrations and empowering borrowers with greater control over their data sharing. While credit bureaus might limit access due to regulatory or cost barriers, open banking fosters a more inclusive and transparent credit evaluation process for both lenders and borrowers.

Regulatory Considerations in Credit Assessment

Regulatory considerations in credit assessment mandate strict compliance with data privacy laws such as GDPR and CCPA when utilizing Credit Bureau versus Open Banking Data. Credit Bureaus operate under well-established regulatory frameworks ensuring data accuracy and consumer rights, while Open Banking requires adherence to PSD2 regulations promoting secure and consent-based access to real-time financial data. Financial institutions must balance transparency, data protection, and the right to explanation when integrating these data sources to enhance credit decision-making processes.

Future Trends: Integrating Credit Bureau and Open Banking Data

Future credit assessment trends emphasize the integration of traditional Credit Bureau data with real-time Open Banking data to enhance accuracy and predictive power. Combining these data sources enables lenders to gain a more comprehensive view of a borrower's financial behavior, including transaction patterns and credit history. This integration supports more inclusive credit decisions, reduces default risk, and drives innovation in personalized lending solutions.

Related Important Terms

Alternative Data Scoring

Credit bureaus provide traditional credit scores based on historical repayment data, while open banking data offers alternative data scoring by analyzing real-time financial transactions, income patterns, and account balances for a more comprehensive credit assessment. Alternative data scoring enhances predictive accuracy by incorporating diverse financial behaviors not captured in conventional credit reports, improving credit access for thin-file or credit-invisible consumers.

Consumer-Permissioned Data

Consumer-permissioned data from open banking provides real-time, granular financial insights directly authorized by the consumer, offering a dynamic alternative to traditional credit bureau data that often relies on historical credit reports and delayed updates. This type of data enhances credit assessment accuracy by incorporating comprehensive transaction-level information, enabling lenders to better evaluate creditworthiness and reduce risk.

Thin File Assessment

Credit bureaus provide extensive historical credit data essential for traditional credit assessments, but often struggle with thin file borrowers who have limited credit history. Open banking data, leveraging real-time financial transaction insights, enhances thin file assessments by offering a holistic view of income, spending patterns, and financial behavior, improving credit decision accuracy for underbanked consumers.

Real-Time Income Verification

Credit bureaus provide historical credit data but often lack real-time income verification, limiting the accuracy of credit assessments. Open banking data delivers instant access to verified income information from bank accounts, enabling more precise and up-to-date credit evaluations.

Data Aggregators

Data aggregators play a critical role in credit assessment by consolidating information from both Credit Bureaus and Open Banking sources, enhancing the accuracy of risk evaluation. Leveraging Open Banking data through aggregators provides real-time insights into consumer financial behaviors, complementing traditional Credit Bureau reports for a more comprehensive credit profile.

Credit Bureau Bypass

Credit Bureau Bypass leverages Open Banking data to access real-time, granular financial information, enabling more accurate credit assessments without relying solely on traditional credit bureau reports. This approach enhances credit inclusivity by incorporating alternative data such as transaction history, account balances, and spending patterns, reducing dependency on credit bureau limitations.

Open Banking Risk Models

Open Banking risk models leverage real-time financial transaction data, offering a dynamic and granular view of a consumer's credit behavior compared to traditional Credit Bureau reports, which rely on historical credit data and static credit scores. By integrating bank account activity, income consistency, and spending patterns, Open Banking enables more accurate risk assessments and inclusive lending decisions.

Dynamic Credit Profiling

Credit bureaus aggregate historical financial data such as payment history, outstanding debts, and credit inquiries to create a static credit profile that may not fully capture real-time financial behavior. Open banking data enables dynamic credit profiling by providing up-to-date insights into cash flow, spending patterns, and income variability, allowing for more accurate and responsive credit assessments.

Transactional Behavior Analytics

Credit bureaus rely on historical credit reports and payment patterns, while open banking data provides real-time transactional behavior analytics, offering a more dynamic and precise evaluation of borrower creditworthiness. Integrating open banking transaction insights with traditional credit bureau data enhances predictive accuracy in credit risk assessments and enables personalized lending decisions.

API-Driven Credit Assessment

API-driven credit assessment leverages both Credit Bureau data and Open Banking Data to enhance accuracy and speed in evaluating creditworthiness. Integrating Credit Bureau's historical credit records with real-time financial data from Open Banking APIs enables lenders to make more informed, personalized credit decisions.

Credit Bureau vs Open Banking Data for credit assessment. Infographic

moneydiff.com

moneydiff.com