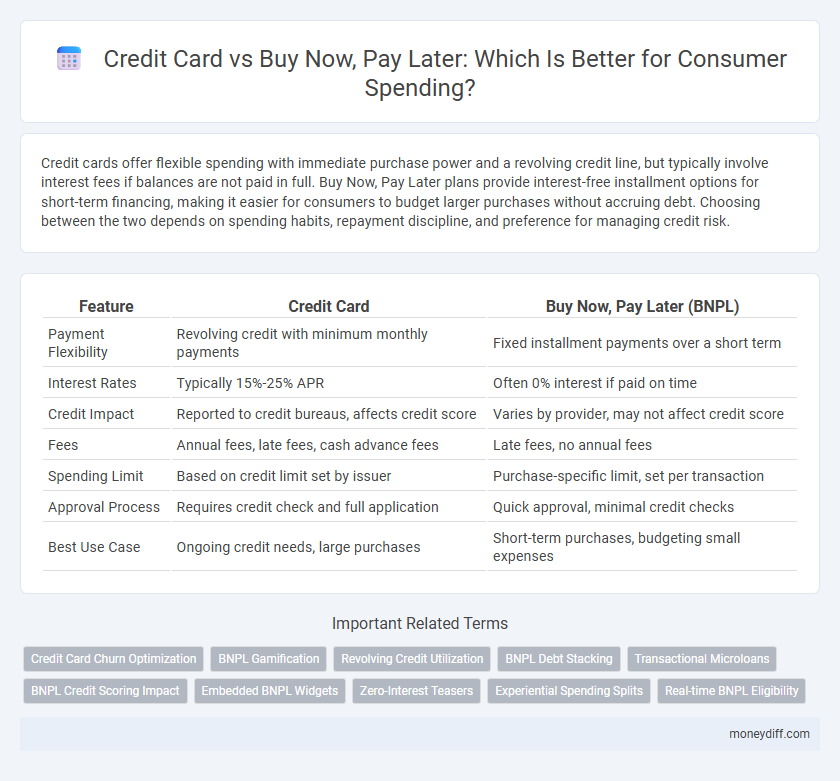

Credit cards offer flexible spending with immediate purchase power and a revolving credit line, but typically involve interest fees if balances are not paid in full. Buy Now, Pay Later plans provide interest-free installment options for short-term financing, making it easier for consumers to budget larger purchases without accruing debt. Choosing between the two depends on spending habits, repayment discipline, and preference for managing credit risk.

Table of Comparison

| Feature | Credit Card | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Payment Flexibility | Revolving credit with minimum monthly payments | Fixed installment payments over a short term |

| Interest Rates | Typically 15%-25% APR | Often 0% interest if paid on time |

| Credit Impact | Reported to credit bureaus, affects credit score | Varies by provider, may not affect credit score |

| Fees | Annual fees, late fees, cash advance fees | Late fees, no annual fees |

| Spending Limit | Based on credit limit set by issuer | Purchase-specific limit, set per transaction |

| Approval Process | Requires credit check and full application | Quick approval, minimal credit checks |

| Best Use Case | Ongoing credit needs, large purchases | Short-term purchases, budgeting small expenses |

Understanding Credit Cards: Key Features and Benefits

Credit cards offer revolving credit with flexible repayment options, including minimum monthly payments and the ability to carry a balance while accruing interest. They provide consumer protections such as fraud liability coverage, rewards programs, and credit-building opportunities essential for improving credit scores. Compared to Buy Now, Pay Later plans, credit cards often have higher spending limits and more extensive acceptance, making them a versatile tool for managing consumer expenses.

What is Buy Now, Pay Later? An Overview

Buy Now, Pay Later (BNPL) is a financing option allowing consumers to split purchases into interest-free installments over a set period, typically ranging from weeks to months. Unlike traditional credit cards, BNPL services often require no credit check and feature transparent payment schedules without revolving debt. This method appeals to budget-conscious shoppers seeking flexibility and immediate payment without incurring interest charges common with credit card balances.

Comparing Interest Rates: Credit Cards vs BNPL

Credit cards typically charge interest rates ranging from 15% to 25% APR on unpaid balances, significantly higher than Buy Now, Pay Later (BNPL) services, which often offer interest-free periods or minimal fees if payments are made on time. BNPL providers may impose late fees or interest rates between 20% to 30% APR only after the interest-free installment period lapses, making them more cost-effective for short-term consumer spending. Consumers should carefully evaluate the effective interest rates and repayment terms to avoid high credit costs and potential debt accumulation.

Fees and Hidden Costs: Which is More Expensive?

Credit cards often incur interest charges and late fees if balances are not paid in full, with APRs ranging from 15% to 25%, resulting in potentially high costs over time. Buy Now, Pay Later (BNPL) services usually offer interest-free installments but may include late fees or penalty charges that vary by provider, sometimes leading to unexpected expenses. Careful review of terms reveals credit cards tend to accumulate higher overall fees, while BNPL can become costly through missed payments and strict repayment schedules.

Impact on Credit Score: Credit Card vs BNPL

Credit cards typically impact credit scores by reporting payment history, credit utilization, and account age to major credit bureaus, which can improve or harm scores based on responsible use. Buy Now, Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, resulting in minimal effect on credit scores if paid on time. Consumers should understand that credit cards can build credit over time, while BNPL offers short-term flexibility with limited credit score benefits.

Flexibility and Repayment Terms: A Side-by-Side Comparison

Credit cards offer revolving credit with flexible repayment options, allowing consumers to make minimum monthly payments or pay balances in full, typically with variable interest rates. Buy Now, Pay Later (BNPL) services provide fixed installment plans over short periods, often interest-free if paid on time, but with less flexibility for partial payments. The choice hinges on consumer preference for managing cash flow versus avoiding interest fees and potential late charges.

Security and Consumer Protections: Which Option is Safer?

Credit cards offer robust consumer protections, including fraud liability limits, chargeback rights, and encryption technologies that safeguard against unauthorized transactions. Buy Now, Pay Later (BNPL) services often lack comprehensive security measures and regulatory oversight, potentially exposing consumers to higher risks of data breaches and limited recourse in fraudulent cases. For securing consumer spending and minimizing fraud risks, credit cards remain the safer choice due to established legal protections and advanced security protocols.

Convenience and Accessibility for Consumers

Credit cards offer widespread acceptance and immediate purchasing power, allowing consumers to access funds instantly at millions of locations worldwide. Buy Now, Pay Later (BNPL) services provide simplified approval processes and often require no credit check, making them accessible to a broader range of consumers, including those with limited credit history. Both options enhance convenience, but BNPL's segmented payments and digital-first approach appeal to younger, tech-savvy shoppers seeking flexible budgeting solutions without revolving credit.

Risks of Overspending: Credit Card vs Buy Now, Pay Later

Credit cards often encourage overspending through high credit limits and revolving balances, leading to accumulating interest and potential debt cycles. Buy Now, Pay Later (BNPL) services may seem convenient but risk fostering impulsive purchases by delaying immediate payment, often without interest but with penalties for missed installments. Both options require careful budgeting to avoid financial strain and long-term credit damage.

Choosing the Right Payment Method for Your Financial Health

Choosing the right payment method impacts your financial health by influencing interest rates, fees, and repayment flexibility. Credit cards offer rewards and build credit history but may incur high interest if balances are not paid in full, whereas Buy Now, Pay Later (BNPL) services provide interest-free installments but can encourage overspending and affect credit if payments are missed. Evaluating your spending habits and ability to manage payments ensures you select a method that supports long-term financial stability.

Related Important Terms

Credit Card Churn Optimization

Credit card churn optimization enhances consumer retention by leveraging data analytics to personalize rewards and reduce attrition, outperforming Buy Now, Pay Later alternatives that often lack loyalty incentives. Implementing dynamic credit line adjustments and targeted engagement strategies increases cardholder satisfaction and spending frequency, driving sustained profitability in competitive consumer credit markets.

BNPL Gamification

Buy Now, Pay Later (BNPL) services integrate gamification elements such as rewards, progress tracking, and exclusive offers to enhance consumer engagement and spending frequency, contrasting traditional credit cards that rely primarily on interest and reward points. This gamified approach in BNPL not only drives impulse purchases but also encourages responsible repayment behavior through interactive incentives, reshaping consumer credit dynamics.

Revolving Credit Utilization

Credit card users must carefully monitor revolving credit utilization as high balances relative to credit limits can negatively impact credit scores, whereas Buy Now, Pay Later (BNPL) plans often operate outside traditional credit reporting, offering less influence on credit utilization metrics but limited credit-building opportunities. Managing credit card utilization below 30% is crucial for maintaining healthy credit standing, while excessive reliance on BNPL may lead to overspending without the credit score benefits tied to revolving credit use.

BNPL Debt Stacking

Buy Now, Pay Later (BNPL) services often lead to debt stacking as consumers accumulate multiple short-term debts without centralized tracking, increasing the risk of missed payments and credit score damage. In contrast, credit cards offer consolidated monthly statements and credit limits, enabling easier management of revolving credit but potentially higher interest costs if balances are not paid in full.

Transactional Microloans

Transactional microloans offered through Buy Now, Pay Later services provide consumers with short-term, interest-free payment options, enhancing budget flexibility compared to traditional credit cards which typically accrue interest and fees on outstanding balances. These microloans enable precise control over consumer spending by breaking transactions into manageable installments, reducing the risk of debt accumulation common in credit card use.

BNPL Credit Scoring Impact

Buy Now, Pay Later (BNPL) services often bypass traditional credit scoring metrics, leading to potential underreporting of consumer debt and affecting long-term creditworthiness assessments. In contrast, credit card usage directly impacts credit scores through regular reporting of payment history and credit utilization, providing a clearer picture of consumer financial behavior to lenders.

Embedded BNPL Widgets

Embedded BNPL widgets in e-commerce platforms provide consumers with seamless installment payment options that enhance spending flexibility compared to traditional credit cards. These widgets increase conversion rates by offering transparent, interest-free periods and real-time credit approvals, reducing reliance on revolving credit balances and improving user financial control.

Zero-Interest Teasers

Zero-interest teaser offers on credit cards provide short-term interest-free periods that encourage immediate spending but may result in high deferred interest if balances are not paid in full. Buy Now, Pay Later services offer interest-free installment plans without traditional credit checks, making them attractive for budget-conscious consumers seeking flexibility without accruing interest.

Experiential Spending Splits

Credit cards typically offer more flexible spending limits and rewards programs for experiential purchases such as travel and dining, while Buy Now, Pay Later (BNPL) services encourage smaller, interest-free installments that can make splitting the cost of experiences more manageable. Consumers tend to use credit cards for larger, high-reward experiential spending, whereas BNPL appeals to budget-conscious users seeking immediate access without high upfront costs.

Real-time BNPL Eligibility

Real-time BNPL eligibility enables consumers to instantly access flexible payment options at checkout, enhancing purchasing power without impacting credit card limits or increasing immediate debt. Unlike traditional credit cards, BNPL approval often relies on alternative data and soft credit checks, allowing faster, more inclusive decisions that improve consumer spending experiences.

Credit Card vs Buy Now, Pay Later for consumer spending. Infographic

moneydiff.com

moneydiff.com