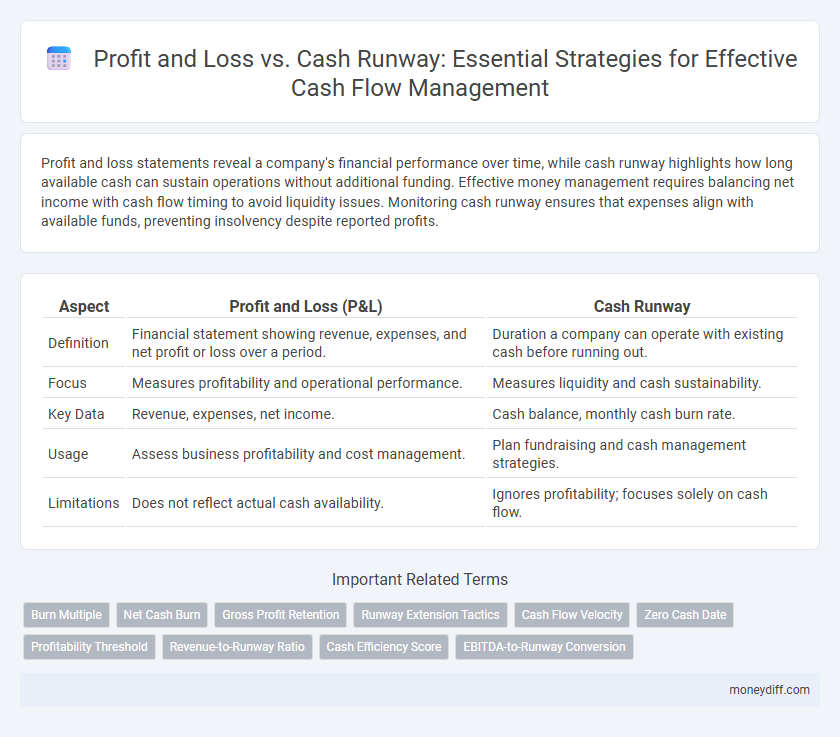

Profit and loss statements reveal a company's financial performance over time, while cash runway highlights how long available cash can sustain operations without additional funding. Effective money management requires balancing net income with cash flow timing to avoid liquidity issues. Monitoring cash runway ensures that expenses align with available funds, preventing insolvency despite reported profits.

Table of Comparison

| Aspect | Profit and Loss (P&L) | Cash Runway |

|---|---|---|

| Definition | Financial statement showing revenue, expenses, and net profit or loss over a period. | Duration a company can operate with existing cash before running out. |

| Focus | Measures profitability and operational performance. | Measures liquidity and cash sustainability. |

| Key Data | Revenue, expenses, net income. | Cash balance, monthly cash burn rate. |

| Usage | Assess business profitability and cost management. | Plan fundraising and cash management strategies. |

| Limitations | Does not reflect actual cash availability. | Ignores profitability; focuses solely on cash flow. |

Understanding Profit and Loss Statements

Profit and loss statements provide a snapshot of a company's revenue, expenses, and net income over a specific period, revealing profitability but not actual cash availability. Cash runway calculations, based on current cash reserves and burn rate, measure how long a company can sustain operations before needing new funds. Understanding the distinction between accounting profits and cash flow is crucial for effective money management and ensuring liquidity.

What Is Cash Runway?

Cash runway measures how long a company can continue operating with its current cash reserves before exhausting funds, making it crucial for effective money management. Unlike profit and loss statements, which reflect accounting earnings, cash runway focuses on actual liquidity and cash flow timing. Monitoring cash runway ensures businesses maintain solvency and avoid unexpected cash shortages during growth or downturns.

Key Differences: Profit and Loss vs Cash Runway

Profit and loss statements capture revenue, expenses, and net income over a specific period, reflecting business profitability but not actual cash availability. Cash runway measures how long a company can sustain operations with its current cash reserves, highlighting liquidity and burn rate critical for money management. Understanding the key difference between profit and loss and cash runway ensures accurate cash flow forecasting and financial stability.

Why P&L Doesn’t Tell the Full Cash Story

Profit and loss statements reflect a company's revenues and expenses over a specific period but do not capture the timing of cash inflows and outflows, which is crucial for assessing liquidity. Cash runway measures how long a business can sustain operations with its current cash balance, highlighting potential cash shortages that P&L statements might overlook. Reliance solely on P&L can mislead money management decisions since profitable businesses may still face cash crises due to delayed receivables or accelerated payables.

How to Calculate Your Cash Runway

Cash runway is calculated by dividing your current cash balance by your average monthly cash burn rate, which represents the net cash outflow each month. Unlike profit and loss statements that reflect accrual accounting, cash runway focuses solely on actual cash available and spent, providing a clearer picture of how long your business can operate before needing additional funding. Accurately monitoring cash runway assists businesses in making informed decisions about budgeting, fundraising, and expense management to avoid insolvency.

Managing Expenses: Profitability vs Liquidity

Managing expenses requires balancing profitability metrics from the profit and loss statement with liquidity insights from the cash runway. Profit and loss reports reveal operational efficiency and net income, while cash runway measures how long available cash can sustain expenses without additional revenue. Prioritizing liquidity ensures timely obligations are met, preventing cash shortages despite positive profit figures, supporting sustainable money management.

The Role of Revenue Timing in Cash Flow

Revenue timing significantly impacts cash flow by influencing when cash inflows occur relative to expenses, thereby affecting the cash runway available for operational sustainability. Profit and loss statements may show profitability, but delayed revenue recognition can limit actual cash on hand, creating challenges in meeting short-term obligations. Managing cash flow effectively requires aligning revenue collection schedules with payment cycles to maintain sufficient liquidity and extend the cash runway.

Common Pitfalls: Confusing Profits with Cash

Confusing profits with cash flow is a common pitfall that can jeopardize effective money management, as profit on the income statement does not reflect the actual cash availability. Businesses may appear profitable while facing liquidity shortages due to delayed receivables, inventory buildup, or non-cash expenses like depreciation. Monitoring cash runway alongside profit and loss ensures accurate assessment of financial health and sustainability, preventing unexpected cash crunches.

Strategies to Extend Your Cash Runway

Analyzing profit and loss provides insight into business performance, but focusing on cash runway management ensures liquidity sustainability. Strategies to extend cash runway include optimizing operational expenses, accelerating receivables, and deferring non-essential capital expenditures. Maintaining a detailed cash flow forecast helps anticipate shortfalls and enables proactive financial adjustments for prolonged business viability.

Integrating P&L and Cash Runway for Smart Money Management

Integrating Profit and Loss (P&L) statements with cash runway analysis enables precise money management by linking profitability metrics to actual cash availability. This approach helps businesses forecast operational sustainability, identify cash flow gaps, and optimize spending decisions based on real-time financial health. Utilizing both P&L data and cash runway insights ensures strategic alignment between earning performance and liquidity management.

Related Important Terms

Burn Multiple

Burn Multiple measures cash efficiency by comparing net cash burned to revenue growth, highlighting how quickly a company spends capital relative to its revenue gains. Unlike profit and loss statements that reflect accounting earnings, cash runway focuses on liquidity duration, making Burn Multiple a critical metric for sustainable money management and extending operational lifespan.

Net Cash Burn

Net Cash Burn measures the actual cash outflow rate by subtracting operating cash inflows from outflows, reflecting liquidity more accurately than profit and loss statements that include non-cash expenses. Monitoring Net Cash Burn is crucial for assessing the cash runway, ensuring a company manages its cash reserves efficiently to avoid insolvency.

Gross Profit Retention

Gross Profit Retention measures the percentage of recurring revenue retained from existing customers, directly impacting cash runway by ensuring steady cash inflows despite fluctuations in profit and loss statements. Effective money management relies on maintaining high Gross Profit Retention to extend cash runway and sustain operational liquidity.

Runway Extension Tactics

Profit and loss statements reflect business performance but do not capture actual liquidity, making cash runway critical for survival analysis. Extending runway relies on tactics like reducing burn rate, deferring expenses, accelerating receivables, and securing short-term financing to maintain operational continuity.

Cash Flow Velocity

Cash Flow Velocity measures the speed at which cash moves through a business, influencing how quickly profits translate into available funds, unlike traditional profit and loss statements that reflect accrued revenue and expenses without timing considerations. Monitoring Cash Flow Velocity enhances cash runway projections by highlighting the liquidity pace, enabling more accurate money management decisions and preventing premature funding shortages.

Zero Cash Date

Profit and loss statements reflect net income but do not capture cash availability, making the zero cash date--when cash reserves deplete--a critical metric for cash runway analysis in effective money management. Monitoring the zero cash date helps businesses anticipate liquidity challenges and adjust spending before insolvency occurs.

Profitability Threshold

The profitability threshold marks the point at which a business's revenues consistently exceed expenses, distinguishing profit and loss statements from cash runway calculations that measure actual liquidity over time. Monitoring this threshold ensures effective money management by aligning operational profitability with sustainable cash flow to avoid liquidity shortfalls.

Revenue-to-Runway Ratio

Profit and loss statements reflect a company's financial performance, while cash runway measures how long the available cash will sustain operations without additional financing. The Revenue-to-Runway Ratio, calculated by dividing total revenue by monthly cash burn, provides a critical metric for assessing financial health and guiding strategic money management decisions.

Cash Efficiency Score

Cash Efficiency Score measures how effectively a company converts its profit and loss into sustainable cash runway, highlighting the gap between accounting profitability and actual cash availability. Tracking this metric allows businesses to optimize money management by identifying cash flow inefficiencies and improving liquidity planning.

EBITDA-to-Runway Conversion

EBITDA-to-runway conversion provides a critical metric for cash flow analysis by translating earnings before interest, taxes, depreciation, and amortization into a realistic timeline for financial sustainability. Unlike profit and loss statements that show net income over a period, this conversion emphasizes actual cash availability, offering investors and managers a precise runway estimate essential for strategic money management and operational decision-making.

Profit and loss vs cash runway for money management. Infographic

moneydiff.com

moneydiff.com