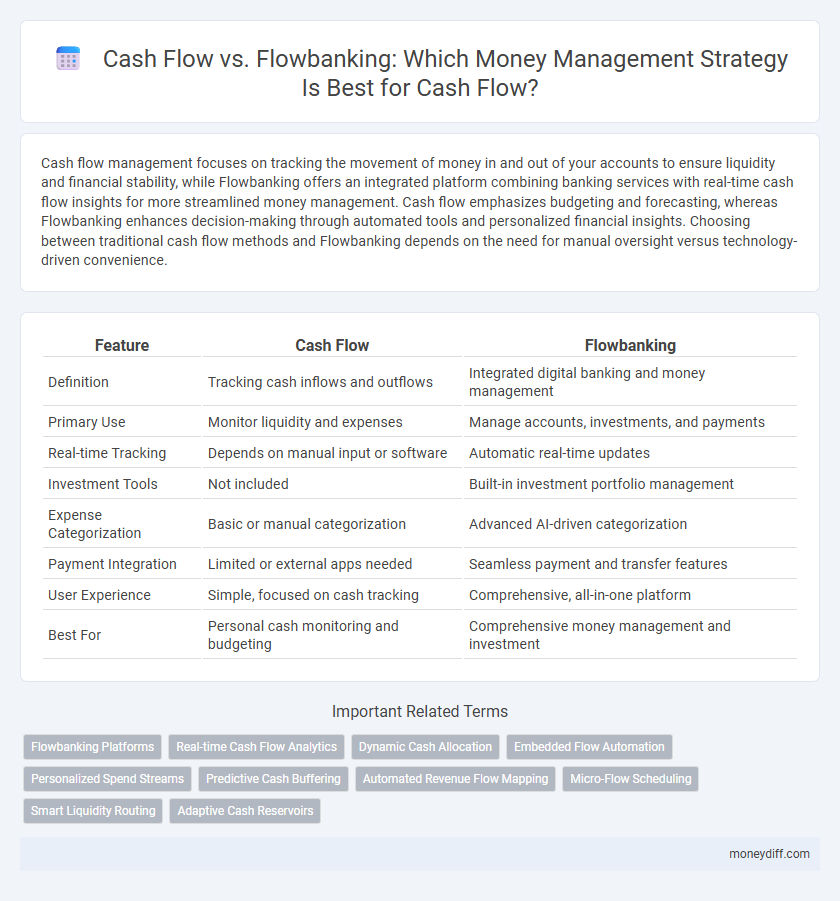

Cash flow management focuses on tracking the movement of money in and out of your accounts to ensure liquidity and financial stability, while Flowbanking offers an integrated platform combining banking services with real-time cash flow insights for more streamlined money management. Cash flow emphasizes budgeting and forecasting, whereas Flowbanking enhances decision-making through automated tools and personalized financial insights. Choosing between traditional cash flow methods and Flowbanking depends on the need for manual oversight versus technology-driven convenience.

Table of Comparison

| Feature | Cash Flow | Flowbanking |

|---|---|---|

| Definition | Tracking cash inflows and outflows | Integrated digital banking and money management |

| Primary Use | Monitor liquidity and expenses | Manage accounts, investments, and payments |

| Real-time Tracking | Depends on manual input or software | Automatic real-time updates |

| Investment Tools | Not included | Built-in investment portfolio management |

| Expense Categorization | Basic or manual categorization | Advanced AI-driven categorization |

| Payment Integration | Limited or external apps needed | Seamless payment and transfer features |

| User Experience | Simple, focused on cash tracking | Comprehensive, all-in-one platform |

| Best For | Personal cash monitoring and budgeting | Comprehensive money management and investment |

Understanding Cash Flow in Personal Finance

Cash flow in personal finance represents the net amount of money moving in and out of an individual's accounts, encompassing income streams and expenses. Flowbanking, a modern digital banking solution, offers real-time tracking and categorization of cash flow, enhancing transparency and control over financial habits. Comparing traditional cash flow monitoring with Flowbanking highlights the benefits of automation and data-driven insights for effective money management.

What Is Flowbanking?

Flowbanking is a comprehensive money management system designed to optimize cash flow by categorizing income and expenses into distinct "flows." Unlike traditional cash flow analysis, Flowbanking enables precise allocation of funds, enhancing budgeting accuracy and financial control. This method improves liquidity management and financial planning by automating fund distribution across various financial goals.

Key Differences: Cash Flow vs Flowbanking

Cash flow refers to the real-time movement of money in and out of an individual or business, emphasizing liquidity and operational financial health. Flowbanking combines traditional banking services with advanced cash flow management tools, offering automated tracking, budgeting, and forecasting features to optimize financial decisions. The key differences lie in cash flow being a financial metric, while Flowbanking is a comprehensive platform designed to enhance money management through data-driven insights and integration with banking products.

Benefits of Managing Cash Flow

Effective cash flow management ensures businesses maintain adequate liquidity to meet obligations, invest in growth, and avoid costly debt. Flowbanking platforms enhance cash flow control by offering real-time tracking, automated forecasting, and seamless integration with payment systems, reducing the risk of cash shortfalls. Optimizing cash flow through these tools improves financial stability, operational efficiency, and strategic decision-making.

How Flowbanking Optimizes Money Management

Flowbanking enhances money management by offering real-time tracking of cash flow, enabling users to monitor income and expenses with precision. Its automated categorization and predictive analytics help anticipate future financial needs, reducing the risk of overdrafts. Integrating multiple accounts into a single platform, Flowbanking streamlines budgeting and ensures optimal allocation of funds for improved financial stability.

Pros and Cons: Cash Flow vs Flowbanking

Cash flow provides immediate visibility into the timing and amount of cash entering and leaving a business, essential for short-term liquidity management but often lacks integrated digital tools. Flowbanking offers automated money management features, including real-time tracking and AI-driven financial insights, enhancing efficiency but may involve subscription costs and require digital literacy. Choosing between cash flow tracking and Flowbanking depends on the user's preference for manual control versus automated convenience and the complexity of their financial operations.

Cash Flow Strategies for Better Financial Health

Cash flow strategies prioritize managing incoming and outgoing cash to ensure liquidity and avoid shortfalls, which is critical for maintaining financial health. Unlike FlowBanking, which integrates digital banking services for transactions and investments, cash flow management focuses on budgeting, forecasting, and optimizing expenses. Effective cash flow strategies empower individuals and businesses to prioritize essential payments, allocate funds efficiently, and build reserves for financial stability.

Flowbanking Techniques for Achieving Financial Goals

Flowbanking techniques streamline cash flow management by integrating automated budgeting, real-time transaction tracking, and personalized financial insights, enhancing decision-making efficiency. This approach optimizes income and expenses alignment, ensuring consistent liquidity and targeted savings for specific financial goals. Leveraging advanced analytics within Flowbanking enables proactive adjustments to spending habits and investment strategies, driving sustainable wealth accumulation.

Choosing the Right System: Cash Flow or Flowbanking?

Choosing the right system between Cash Flow and Flowbanking depends on the complexity of your money management needs and real-time tracking preferences. Cash Flow offers intuitive budgeting tools and straightforward expense categorization, ideal for individuals seeking clarity in daily transactions. Flowbanking integrates advanced analytics and investment features, making it suitable for users who require comprehensive financial oversight and growth opportunities.

Practical Tips to Maximize Cash Flow and Flowbanking

Maximize cash flow by tracking income and expenses daily, setting realistic budget limits, and prioritizing payments to avoid overdraft fees. Flowbanking enhances money management with real-time transaction monitoring, automatic savings features, and personalized financial insights through AI-driven analytics. Leveraging Flowbanking tools alongside disciplined cash flow practices ensures optimized liquidity and smarter financial decisions.

Related Important Terms

Flowbanking Platforms

Flowbanking platforms enhance money management by providing real-time cash flow tracking, automated transaction categorization, and integrated financial analytics, enabling users to optimize liquidity and forecast expenses accurately. These platforms offer seamless connectivity with multiple accounts and investment tools, streamlining cash flow monitoring and improving overall financial decision-making.

Real-time Cash Flow Analytics

Real-time cash flow analytics provide instantaneous insights into inflows and outflows, enabling precise financial decision-making and proactive liquidity management. Flowbanking integrates advanced real-time tracking and forecasting tools that surpass traditional cash flow methods, optimizing money management with automated transaction categorization and predictive analysis.

Dynamic Cash Allocation

Dynamic Cash Allocation optimizes cash flow by automatically adjusting liquidity across multiple accounts to maximize interest earnings and minimize idle funds, whereas Flowbanking provides a streamlined platform for real-time money movement and account oversight. Leveraging AI-driven algorithms, Dynamic Cash Allocation ensures efficient use of available cash, enhancing financial flexibility beyond traditional Flowbanking methods.

Embedded Flow Automation

Embedded Flow Automation streamlines cash flow management by integrating real-time transaction monitoring, automated categorization, and predictive analytics directly within Flowbanking platforms. This seamless automation enhances liquidity forecasting and optimizes fund allocation, reducing manual errors and improving overall financial control.

Personalized Spend Streams

Cash flow management emphasizes tracking and optimizing income and expenses to maintain financial stability, while Flowbanking innovates with Personalized Spend Streams that categorize and automate money flows based on individual behavioral patterns. This tailored approach enhances budgeting precision and cash flow forecasting by dynamically aligning spending with personal financial goals.

Predictive Cash Buffering

Predictive cash buffering in cash flow management uses historical data and real-time analytics to forecast liquidity needs, reducing the risk of overdrafts and missed payments. Flowbanking enhances this process by integrating AI-driven algorithms that automate cash buffer adjustments, optimizing fund allocation and improving overall financial stability.

Automated Revenue Flow Mapping

Automated Revenue Flow Mapping in cash flow management enables precise tracking and forecasting of income sources, enhancing financial visibility and decision-making accuracy. Flowbanking integrates this technology to streamline money management by automatically categorizing and optimizing revenue streams for improved liquidity control.

Micro-Flow Scheduling

Micro-flow scheduling in cash flow management enables precise allocation of funds to meet short-term obligations and optimize liquidity, enhancing real-time financial control. Flowbanking integrates micro-flow scheduling with automated transaction categorization and predictive analytics, providing a comprehensive solution for efficient money management and proactive cash flow forecasting.

Smart Liquidity Routing

Smart Liquidity Routing in Flowbank enhances cash flow management by automatically optimizing fund allocation across multiple accounts and investment opportunities, ensuring maximum returns and liquidity. This advanced technology outperforms traditional cash flow methods by minimizing idle cash and improving real-time cash availability for seamless financial operations.

Adaptive Cash Reservoirs

Adaptive Cash Reservoirs in cash flow management dynamically allocate funds to optimize liquidity, unlike traditional Flowbanking methods that rely on fixed account structures. This approach enhances real-time cash availability and financial flexibility, ensuring businesses can swiftly respond to fluctuating expenses and revenue cycles.

Cash flow vs Flowbanking for money management. Infographic

moneydiff.com

moneydiff.com