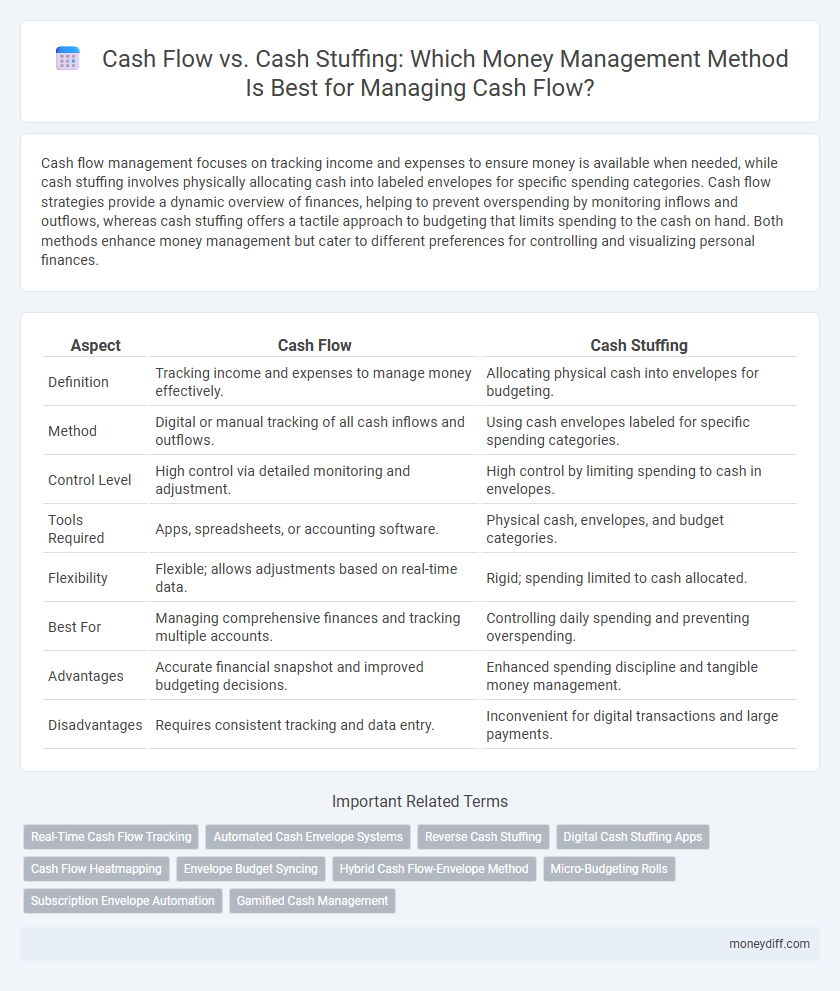

Cash flow management focuses on tracking income and expenses to ensure money is available when needed, while cash stuffing involves physically allocating cash into labeled envelopes for specific spending categories. Cash flow strategies provide a dynamic overview of finances, helping to prevent overspending by monitoring inflows and outflows, whereas cash stuffing offers a tactile approach to budgeting that limits spending to the cash on hand. Both methods enhance money management but cater to different preferences for controlling and visualizing personal finances.

Table of Comparison

| Aspect | Cash Flow | Cash Stuffing |

|---|---|---|

| Definition | Tracking income and expenses to manage money effectively. | Allocating physical cash into envelopes for budgeting. |

| Method | Digital or manual tracking of all cash inflows and outflows. | Using cash envelopes labeled for specific spending categories. |

| Control Level | High control via detailed monitoring and adjustment. | High control by limiting spending to cash in envelopes. |

| Tools Required | Apps, spreadsheets, or accounting software. | Physical cash, envelopes, and budget categories. |

| Flexibility | Flexible; allows adjustments based on real-time data. | Rigid; spending limited to cash allocated. |

| Best For | Managing comprehensive finances and tracking multiple accounts. | Controlling daily spending and preventing overspending. |

| Advantages | Accurate financial snapshot and improved budgeting decisions. | Enhanced spending discipline and tangible money management. |

| Disadvantages | Requires consistent tracking and data entry. | Inconvenient for digital transactions and large payments. |

Introduction to Cash Flow and Cash Stuffing

Cash flow refers to the movement of money into and out of a business or personal account, encompassing income, expenses, and overall liquidity management. Cash stuffing is a budgeting method that involves physically dividing cash into labeled envelopes to control spending and enhance financial discipline. Understanding cash flow provides a broad view of financial health, while cash stuffing offers a tangible approach for managing expenses and avoiding overspending.

Understanding Cash Flow Management

Cash flow management involves monitoring, analyzing, and optimizing the inflow and outflow of cash to ensure sufficient liquidity for business operations and financial stability. Unlike cash stuffing, which allocates fixed cash amounts into envelopes for budgeting, cash flow management utilizes real-time tracking and forecasting to adapt to financial changes dynamically. Effective cash flow management enhances decision-making by providing accurate insights into cash availability, improving working capital efficiency, and minimizing the risk of insolvency.

What is Cash Stuffing?

Cash Stuffing is a money management technique where physical cash is allocated into separate envelopes or categories based on a budget plan to control spending and improve financial discipline. Unlike traditional cash flow management that tracks income and expenses digitally, Cash Stuffing emphasizes using tangible money to limit overspending and increase budgeting accuracy. This hands-on approach helps individuals visually manage their finances and avoid debt by ensuring funds are only spent from predetermined cash reserves.

Key Differences: Cash Flow vs Cash Stuffing

Cash flow tracks the movement of money in and out of accounts, providing a comprehensive overview of income, expenses, and financial health over time. Cash stuffing is a budgeting technique that allocates physical cash into labeled envelopes for specific expenses, emphasizing direct control and discipline in spending. Unlike cash flow analysis, which relies on monitoring digital transactions, cash stuffing enforces tangible limits to prevent overspending and enhance money management.

Pros and Cons of Cash Flow Management

Cash flow management provides real-time visibility into income and expenses, enabling better financial planning and timely debt repayment, though it requires consistent tracking and may involve complex budgeting tools. In contrast, cash stuffing offers a simple, tangible approach by allocating physical cash to budget categories, reducing overspending but lacking flexibility and detailed insight for long-term financial strategy. Effective cash flow management supports business growth and creditworthiness but demands discipline and can be challenging during irregular income periods.

Pros and Cons of Cash Stuffing

Cash stuffing offers a tangible method to control spending by allocating physical cash into labeled envelopes, enhancing budgeting discipline and reducing reliance on digital transactions. However, drawbacks include limited security since cash can be lost or stolen, and it lacks automation, making tracking expenses less efficient compared to cash flow management systems. While cash stuffing promotes mindful spending, cash flow analysis provides a comprehensive overview of income and expenses, supporting long-term financial planning.

Impact on Budgeting and Saving

Cash flow management provides a dynamic overview of income and expenses, enabling precise budgeting and proactive saving strategies. Cash stuffing, a physical cash allocation method, limits spending by compartmentalizing funds into specific envelopes, which can enhance discipline but may restrict flexibility in adjusting budgets. Both approaches impact saving habits differently; cash flow management supports long-term financial planning while cash stuffing encourages tangible control over daily expenditures.

Cash Flow Strategies for Effective Money Management

Effective cash flow strategies prioritize maintaining a positive inflow-to-outflow ratio by accurately forecasting income and expenses to avoid liquidity shortages. Implementing real-time cash tracking systems and automating payments enhances visibility and control over financial movements, ensuring funds are allocated efficiently. Comparing cash flow management to cash stuffing reveals that dynamic cash flow analysis offers greater flexibility and responsiveness for optimizing expenditure and savings plans.

When to Use Cash Stuffing Techniques

Cash stuffing techniques are best used when individuals seek to control discretionary spending by allocating fixed cash amounts into designated envelopes for specific expenses. This method enhances budgeting discipline and prevents overspending compared to standard cash flow management, which tracks income and expenses more broadly. Cash stuffing is particularly effective during periods of irregular income or when building savings, as it enforces a tangible spending limit.

Choosing the Best Method for Your Financial Goals

Cash flow management involves tracking income and expenses to ensure sufficient liquidity for ongoing obligations, while cash stuffing allocates physical cash into envelopes for specific spending categories, promoting disciplined budgeting. Choosing the best method depends on your financial goals; cash flow suits those seeking detailed tracking and flexibility, whereas cash stuffing benefits individuals aiming to control spending and avoid overspending. Evaluate your spending habits, financial objectives, and preference for digital versus tangible budgeting tools to determine the most effective approach for managing your money.

Related Important Terms

Real-Time Cash Flow Tracking

Real-time cash flow tracking provides up-to-the-minute visibility into income and expenses, enabling more precise budgeting compared to the traditional cash stuffing method, which relies on pre-allocated physical cash envelopes. Digital tools enhance immediate financial decision-making by automatically updating cash flow data, reducing reliance on manual cash handling and improving overall money management efficiency.

Automated Cash Envelope Systems

Automated Cash Envelope Systems streamline cash flow management by digitally allocating funds into specific spending categories, reducing the need for physical cash stuffing and enhancing budgeting accuracy. This technology optimizes financial planning by providing real-time tracking and automated expense categorization, improving overall money management efficiency.

Reverse Cash Stuffing

Reverse cash stuffing optimizes money management by prioritizing automated cash inflows and allocating funds toward specific expenses before discretionary spending, enhancing financial discipline. This approach contrasts with traditional cash stuffing, which involves physically dividing money into envelopes, by leveraging digital tracking to improve cash flow visibility and budgeting accuracy.

Digital Cash Stuffing Apps

Digital cash stuffing apps enhance cash flow management by allowing users to allocate funds into virtual envelopes, improving budgeting accuracy and expense tracking. These apps streamline money management by combining cash flow principles with the traditional cash stuffing method, promoting disciplined spending and real-time financial awareness.

Cash Flow Heatmapping

Cash flow heatmapping provides a visual analysis of income and expenses, helping to identify patterns and optimize budgeting strategies more effectively than the cash stuffing method. By tracking real-time cash movements and highlighting high-spending categories, cash flow heatmapping enhances financial decision-making and ensures better money management.

Envelope Budget Syncing

Cash flow management ensures regular tracking and allocation of income versus expenses, while cash stuffing physically separates cash into envelopes for designated categories, promoting disciplined spending. Synchronizing envelope budgeting with digital cash flow tools enhances accuracy and real-time financial insights, combining the tactile control of cash stuffing with the analytical power of cash flow monitoring.

Hybrid Cash Flow-Envelope Method

The Hybrid Cash Flow-Envelope Method combines the systematic tracking of cash inflows and outflows with the tactile budgeting approach of cash stuffing, allowing precise allocation of funds into designated envelopes based on spending categories to enhance financial discipline. This method optimizes liquidity management by ensuring essential expenditures are covered from cash flow projections while physically limiting discretionary spending through envelope constraints.

Micro-Budgeting Rolls

Cash flow management tracks income and expenses to maintain liquidity, while cash stuffing allocates physical cash into labeled envelopes for disciplined spending within micro-budgeting rolls. Micro-budgeting rolls break down monthly expenses into smaller, manageable amounts, enhancing control over discretionary spending and preventing overspending by using cash flow insights to optimize each category.

Subscription Envelope Automation

Subscription Envelope Automation streamlines cash flow management by categorizing recurring expenses into designated envelopes, enabling precise allocation of funds for subscriptions without disrupting overall liquidity. This method reduces the risk of overspending compared to traditional cash stuffing by automating payments and maintaining real-time budget visibility.

Gamified Cash Management

Gamified cash management enhances traditional cash flow techniques by integrating cash stuffing methods with interactive budgeting tools to improve user engagement and financial discipline. This approach leverages behavioral psychology to encourage consistent saving and expense tracking, resulting in optimized cash flow control and reduced financial stress.

Cash flow vs Cash stuffing for money management. Infographic

moneydiff.com

moneydiff.com