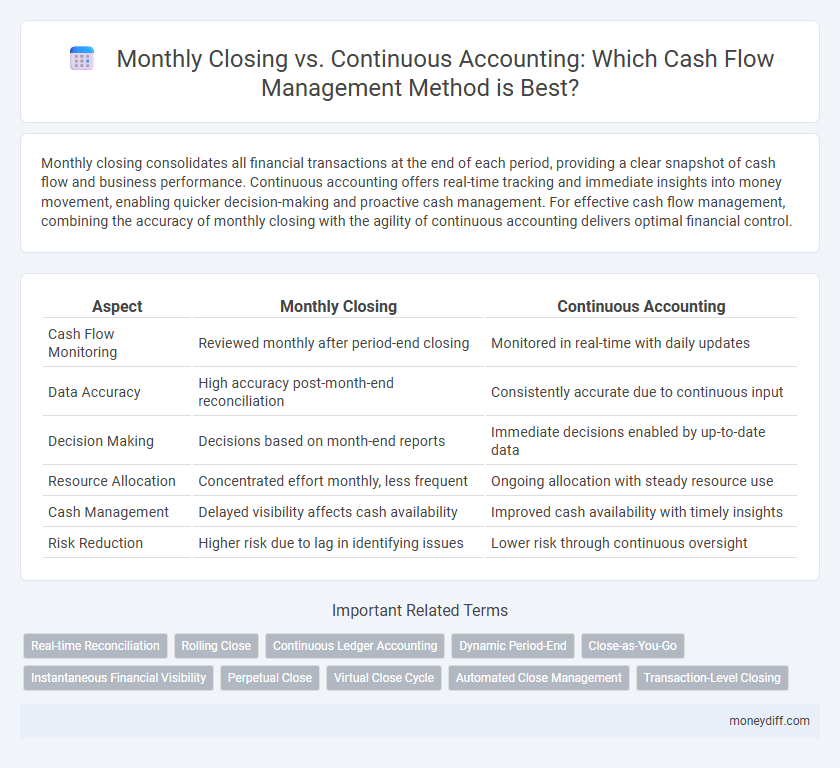

Monthly closing consolidates all financial transactions at the end of each period, providing a clear snapshot of cash flow and business performance. Continuous accounting offers real-time tracking and immediate insights into money movement, enabling quicker decision-making and proactive cash management. For effective cash flow management, combining the accuracy of monthly closing with the agility of continuous accounting delivers optimal financial control.

Table of Comparison

| Aspect | Monthly Closing | Continuous Accounting |

|---|---|---|

| Cash Flow Monitoring | Reviewed monthly after period-end closing | Monitored in real-time with daily updates |

| Data Accuracy | High accuracy post-month-end reconciliation | Consistently accurate due to continuous input |

| Decision Making | Decisions based on month-end reports | Immediate decisions enabled by up-to-date data |

| Resource Allocation | Concentrated effort monthly, less frequent | Ongoing allocation with steady resource use |

| Cash Management | Delayed visibility affects cash availability | Improved cash availability with timely insights |

| Risk Reduction | Higher risk due to lag in identifying issues | Lower risk through continuous oversight |

Understanding Monthly Closing in Cash Flow Management

Monthly closing in cash flow management consolidates all financial transactions within a specific period to provide an accurate snapshot of liquidity and expenditures. This process enables businesses to identify cash surpluses and deficits, ensuring timely adjustments in budgeting and forecasting. Comparing monthly closing with continuous accounting highlights the structured reconciliation benefits that enhance financial accuracy and strategic decision-making.

What Is Continuous Accounting?

Continuous accounting is a modern financial management approach that integrates real-time transaction recording and analysis into daily operations, contrasting with the traditional monthly closing process which consolidates financial data at period-end. This method leverages automation and cloud-based platforms to provide up-to-date cash flow visibility, enabling faster decision-making and improved liquidity management. By maintaining an ongoing reconciliation of accounts, businesses can detect discrepancies early, optimize working capital, and reduce the time-intensive closing cycle.

Key Differences: Monthly Closing vs Continuous Accounting

Monthly closing consolidates financial transactions at the end of each month to provide a snapshot of cash flow, focusing on accuracy and compliance, while continuous accounting updates cash flow data in real-time, enhancing responsiveness and liquidity management. Monthly closing supports traditional reporting cycles and financial statement preparation, whereas continuous accounting leverages automation and integrated systems to maintain up-to-date cash positions. Businesses prioritizing timely decision-making and operational agility benefit from continuous accounting, whereas those emphasizing regulatory adherence and thorough monthly analysis rely on monthly closing.

Impact on Cash Flow Visibility

Monthly closing limits cash flow visibility by providing cash position snapshots only at period-end, which can delay the detection of liquidity issues. Continuous accounting enhances real-time cash flow tracking by recording transactions as they occur, enabling more proactive money management. Improved cash flow visibility through continuous methods supports timely decision-making and better financial stability.

Efficiency in Financial Reporting

Monthly closing consolidates financial data at the month's end, enabling comprehensive reporting but often delaying actionable insights. Continuous accounting automates real-time transaction recording, enhancing efficiency by providing up-to-date cash flow visibility. This approach reduces time-consuming reconciliations and accelerates decision-making in money management.

Real-Time Decision-Making with Continuous Accounting

Continuous accounting enables real-time cash flow monitoring by integrating transaction data instantly, improving accuracy over monthly closing methods that delay financial insights. This approach facilitates proactive money management, allowing businesses to respond immediately to liquidity changes and optimize operational decisions. Real-time decision-making supported by continuous accounting enhances cash flow visibility, reducing risks and improving financial agility.

Risk Management: Periodic vs Ongoing Controls

Monthly closing limits risk identification to fixed intervals, potentially allowing errors or fraud to go undetected between periods. Continuous accounting enables real-time monitoring and immediate detection of anomalies, reducing the likelihood of financial discrepancies. Ongoing controls enhance cash flow accuracy and strengthen overall risk management by ensuring timely intervention.

Cost Implications for Money Management

Monthly closing concentrates costs into a fixed period, requiring intensive labor and resources at month-end, which may lead to cash flow distortions and delayed decision-making. Continuous accounting spreads expenses evenly over time, reducing month-end bottlenecks and providing real-time financial insights that improve liquidity management. Adopting continuous accounting can lower operational costs by minimizing manual interventions and enhancing timely cash flow forecasting.

Technology's Role in Automating Cash Flow Processes

Technology streamlines monthly closing and continuous accounting by automating transaction recording, reconciliation, and reporting in real-time, reducing manual errors and accelerating cash flow insights. Cloud-based financial platforms use AI-driven analytics to provide instant visibility into cash positions, enabling proactive management of working capital. Integration of accounting software with banking systems ensures seamless updates and accurate cash flow forecasting, enhancing decision-making efficiency.

Choosing the Best Approach for Sustainable Cash Flow

Monthly closing provides a structured snapshot of cash flow, allowing businesses to review financial health at set intervals and identify trends crucial for long-term planning. Continuous accounting offers real-time cash flow insights, enhancing responsiveness to fluctuations and enabling proactive money management. Choosing the best approach depends on the organization's size, complexity, and need for real-time data, balancing accuracy with timely decision-making for sustainable cash flow.

Related Important Terms

Real-time Reconciliation

Real-time reconciliation in continuous accounting enhances cash flow management by providing immediate visibility into transactions, enabling businesses to identify discrepancies and optimize liquidity without waiting for monthly closing. This approach reduces errors and improves financial accuracy, supporting proactive decision-making and efficient money management.

Rolling Close

Rolling close in cash flow management allows businesses to maintain up-to-date financial data by continuously recording transactions, reducing the risk of errors and improving decision-making compared to traditional monthly closing. This dynamic approach enhances liquidity monitoring and cash forecasting by providing real-time insights into operational cash movements.

Continuous Ledger Accounting

Continuous ledger accounting provides real-time updating of financial transactions, enhancing accuracy in cash flow management by reflecting immediate changes in account balances. This method enables businesses to monitor liquidity continuously, facilitating proactive decision-making and reducing risks associated with delayed monthly closing processes.

Dynamic Period-End

Dynamic Period-End in cash flow management enables continuous accounting to provide real-time financial insights, eliminating the delays associated with traditional monthly closing. This approach enhances liquidity forecasting and decision-making by continuously updating cash positions and transaction data throughout the accounting period.

Close-as-You-Go

Close-as-You-Go accounting enhances cash flow management by recording transactions in real time, ensuring up-to-date financial visibility and reducing month-end closing delays. This continuous approach enables more accurate forecasting and quicker decision-making compared to traditional monthly closing cycles.

Instantaneous Financial Visibility

Monthly closing processes delay critical cash flow insights, hindering real-time financial decision-making, whereas continuous accounting offers instantaneous financial visibility by updating transactions and balances in real-time. This enables businesses to manage liquidity more effectively, optimize working capital, and respond promptly to cash flow fluctuations.

Perpetual Close

Perpetual close enables real-time financial visibility by continuously updating cash flow records, eliminating the delays and inaccuracies associated with monthly closing cycles. This approach enhances money management efficiency by providing up-to-date data for prompt decision-making and improved liquidity control.

Virtual Close Cycle

Virtual Close Cycle enhances cash flow accuracy by streamlining monthly closing processes with real-time transaction updates, reducing delays and errors in financial reporting. This continuous accounting approach improves liquidity management and decision-making by providing timely insights into cash position and operational expenses.

Automated Close Management

Automated close management streamlines monthly closing by reducing manual interventions, enhancing accuracy, and accelerating reconciliation processes to ensure timely cash flow visibility. Continuous accounting supports real-time money management by integrating ongoing transaction updates, enabling proactive financial decision-making and improved liquidity monitoring.

Transaction-Level Closing

Transaction-level closing in continuous accounting provides real-time cash flow insights by recording and reconciling each transaction immediately, enhancing accuracy and timeliness compared to traditional monthly closing cycles. This method enables dynamic money management, reduces end-of-period adjustments, and improves liquidity forecasting for businesses.

Monthly closing vs continuous accounting for money management. Infographic

moneydiff.com

moneydiff.com