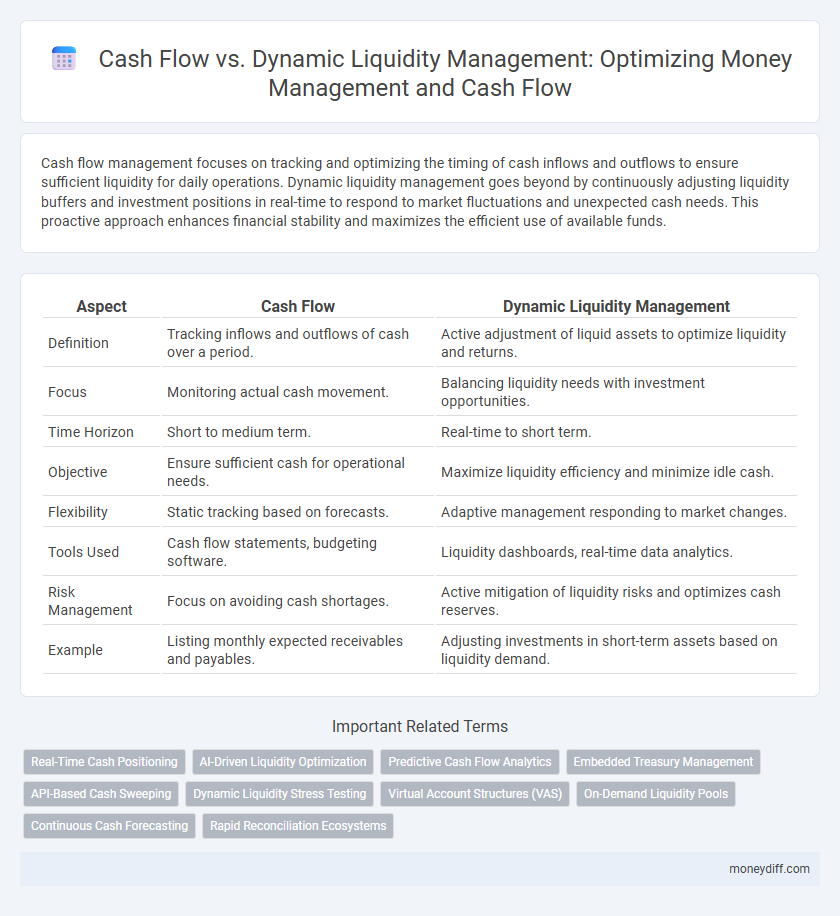

Cash flow management focuses on tracking and optimizing the timing of cash inflows and outflows to ensure sufficient liquidity for daily operations. Dynamic liquidity management goes beyond by continuously adjusting liquidity buffers and investment positions in real-time to respond to market fluctuations and unexpected cash needs. This proactive approach enhances financial stability and maximizes the efficient use of available funds.

Table of Comparison

| Aspect | Cash Flow | Dynamic Liquidity Management |

|---|---|---|

| Definition | Tracking inflows and outflows of cash over a period. | Active adjustment of liquid assets to optimize liquidity and returns. |

| Focus | Monitoring actual cash movement. | Balancing liquidity needs with investment opportunities. |

| Time Horizon | Short to medium term. | Real-time to short term. |

| Objective | Ensure sufficient cash for operational needs. | Maximize liquidity efficiency and minimize idle cash. |

| Flexibility | Static tracking based on forecasts. | Adaptive management responding to market changes. |

| Tools Used | Cash flow statements, budgeting software. | Liquidity dashboards, real-time data analytics. |

| Risk Management | Focus on avoiding cash shortages. | Active mitigation of liquidity risks and optimizes cash reserves. |

| Example | Listing monthly expected receivables and payables. | Adjusting investments in short-term assets based on liquidity demand. |

Understanding Cash Flow in Money Management

Cash flow represents the inflow and outflow of cash within a business, serving as a critical indicator of financial health and operational efficiency. Dynamic liquidity management involves actively adjusting cash reserves and short-term assets to ensure sufficient liquidity for obligations while optimizing returns. Understanding cash flow enables better forecasting and strategic allocation of resources, enhancing overall money management and financial stability.

Introduction to Dynamic Liquidity Management

Dynamic liquidity management optimizes cash flow by continuously monitoring and adjusting liquidity positions in real time to meet short-term obligations and investment opportunities. Unlike static cash flow models, it integrates advanced forecasting and automated funding decisions, enhancing financial flexibility and minimizing idle cash. This approach leverages technology and data analytics to align liquidity with evolving market conditions and organizational needs.

Key Differences: Cash Flow vs Dynamic Liquidity Management

Cash flow represents the actual inflow and outflow of cash within a business over a specific period, reflecting its ability to meet immediate financial obligations. Dynamic liquidity management involves actively optimizing and reallocating liquid assets to ensure liquidity and operational flexibility under varying market conditions. Key differences include cash flow's focus on historical and projected cash transactions, whereas dynamic liquidity management emphasizes real-time adjustment of liquidity positions to proactively mitigate risks and enhance financial agility.

Importance of Predicting Cash Flow for Financial Health

Accurately predicting cash flow is essential for maintaining financial health, enabling businesses to anticipate liquidity needs and avoid insolvency. Dynamic liquidity management relies on these forecasts to allocate resources efficiently and optimize short-term cash positions. By integrating precise cash flow predictions, companies can enhance decision-making, ensuring operational stability and strategic growth.

The Role of Dynamic Liquidity in Risk Mitigation

Dynamic liquidity management enhances cash flow oversight by continuously adjusting available liquidity to meet fluctuating financial obligations, thereby reducing the risk of insolvency. It enables real-time monitoring and reallocation of cash resources, which improves the firm's ability to respond swiftly to unexpected market changes or payment demands. Effective dynamic liquidity strategies minimize liquidity risk and ensure sustained operational stability, surpassing traditional static cash flow approaches in adaptive risk mitigation.

Tools for Effective Cash Flow Management

Cash flow management tools such as cash flow forecasting software, automated invoicing systems, and real-time transaction tracking enhance accuracy and liquidity visibility. Dynamic liquidity management leverages advanced analytics and AI-driven platforms to optimize cash reserves, ensuring funds are allocated efficiently across operational needs and investment opportunities. Integrating these tools supports proactive decision-making, reduces liquidity risks, and maximizes financial agility.

Technologies Advancing Dynamic Liquidity Management

Technologies advancing dynamic liquidity management integrate real-time data analytics and AI-driven forecasting to optimize cash flow visibility and decision-making. Cloud-based platforms and blockchain enhance transparency and accuracy, enabling firms to respond swiftly to liquidity demands across multiple accounts and currencies. Advanced automation streamlines cash positioning and cash concentration, reducing operational risks while maximizing investment yields.

Strategic Benefits of Integrating Cash Flow and Liquidity Management

Integrating cash flow and dynamic liquidity management enhances real-time visibility into financial positions, enabling more accurate forecasting and optimized allocation of capital. This strategic approach reduces funding costs and mitigates risks associated with liquidity shortages or excesses, ensuring operational stability. Companies benefit from improved decision-making capabilities, balancing short-term obligations with long-term investment opportunities.

Common Challenges in Cash Flow and Liquidity Management

Common challenges in cash flow and dynamic liquidity management include accurately forecasting inflows and outflows amidst market volatility and operational unpredictability. Businesses often struggle with maintaining optimal liquidity levels to meet short-term obligations while maximizing investment opportunities. Inefficient monitoring systems and delayed data integration exacerbate risks of cash shortages or excess idle funds, hindering effective money management.

Best Practices for Optimizing Money Management with Dynamic Solutions

Dynamic liquidity management enhances traditional cash flow analysis by providing real-time insights into available funds across multiple accounts, enabling more accurate forecasting and optimized allocation of resources. Integrating advanced technologies like AI-driven analytics and automation platforms allows organizations to proactively manage liquidity, reduce idle cash, and improve working capital efficiency. Best practices include continuous monitoring of cash positions, leveraging predictive cash flow models, and aligning liquidity strategies with business cycles to ensure flexibility and responsiveness in money management.

Related Important Terms

Real-Time Cash Positioning

Real-time cash positioning enhances dynamic liquidity management by continuously monitoring inflows and outflows to optimize fund allocation and reduce idle cash. This approach ensures accurate forecasting and immediate response to liquidity needs, surpassing traditional cash flow analysis that relies on periodic reporting.

AI-Driven Liquidity Optimization

AI-driven liquidity optimization enhances cash flow management by leveraging real-time data analytics and machine learning algorithms to predict liquidity needs and allocate resources dynamically. This advanced approach surpasses traditional cash flow forecasting by enabling proactive, precise adjustments that improve financial agility and reduce liquidity risks.

Predictive Cash Flow Analytics

Predictive cash flow analytics enhances dynamic liquidity management by leveraging historical data and real-time indicators to forecast future cash positions accurately. This enables businesses to optimize working capital, proactively manage liquidity risks, and ensure sufficient funds for operational needs and strategic investments.

Embedded Treasury Management

Embedded Treasury Management enhances cash flow optimization by integrating real-time dynamic liquidity management within financial operations, enabling precise allocation and forecasting of funds across various accounts and entities. This seamless approach supports proactive decision-making, reduces idle cash, and improves working capital efficiency through automated cash positioning and comprehensive visibility.

API-Based Cash Sweeping

API-based cash sweeping enhances dynamic liquidity management by automating the real-time transfer of surplus funds between accounts, optimizing cash flow efficiency and reducing idle balances. This technology enables seamless integration with banking systems, improving visibility and control over liquidity positions while minimizing manual intervention.

Dynamic Liquidity Stress Testing

Dynamic liquidity stress testing enhances cash flow management by simulating multiple adverse scenarios to identify potential liquidity shortfalls in real time. This approach provides a proactive framework for optimizing liquidity buffers and improving financial resilience beyond traditional static cash flow analysis.

Virtual Account Structures (VAS)

Virtual Account Structures (VAS) enhance cash flow visibility by segmenting and tracking funds within a master account, enabling precise allocation and real-time liquidity monitoring across multiple business units or geographies. This dynamic liquidity management approach optimizes working capital efficiency and reduces the need for external borrowing by facilitating instant internal fund transfers and improved forecasting accuracy.

On-Demand Liquidity Pools

On-demand liquidity pools enhance cash flow efficiency by providing immediate access to funds, reducing reliance on traditional credit lines and mitigating liquidity risks. Integrating dynamic liquidity management with these pools allows businesses to optimize cash reserves, ensuring seamless transaction settlements and improved financial agility.

Continuous Cash Forecasting

Continuous cash forecasting enhances dynamic liquidity management by providing real-time visibility into cash positions, enabling more precise money management decisions. Unlike static cash flow analysis, this approach integrates ongoing inflows and outflows to optimize liquidity and minimize funding costs.

Rapid Reconciliation Ecosystems

Cash flow management focuses on tracking income and expenses to maintain solvency, while dynamic liquidity management leverages real-time data and rapid reconciliation ecosystems to optimize cash availability and reduce idle funds. Rapid reconciliation ecosystems enhance money management by automating transaction matching and providing instant visibility into cash positions across multiple accounts, enabling more agile liquidity decisions.

Cash flow vs Dynamic liquidity management for money management. Infographic

moneydiff.com

moneydiff.com