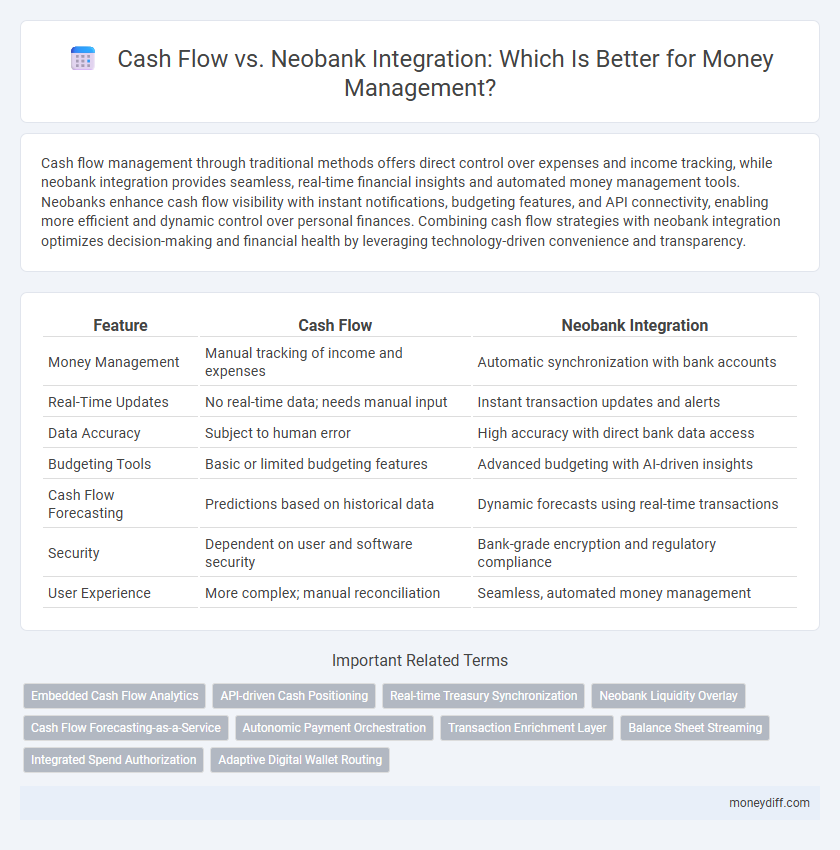

Cash flow management through traditional methods offers direct control over expenses and income tracking, while neobank integration provides seamless, real-time financial insights and automated money management tools. Neobanks enhance cash flow visibility with instant notifications, budgeting features, and API connectivity, enabling more efficient and dynamic control over personal finances. Combining cash flow strategies with neobank integration optimizes decision-making and financial health by leveraging technology-driven convenience and transparency.

Table of Comparison

| Feature | Cash Flow | Neobank Integration |

|---|---|---|

| Money Management | Manual tracking of income and expenses | Automatic synchronization with bank accounts |

| Real-Time Updates | No real-time data; needs manual input | Instant transaction updates and alerts |

| Data Accuracy | Subject to human error | High accuracy with direct bank data access |

| Budgeting Tools | Basic or limited budgeting features | Advanced budgeting with AI-driven insights |

| Cash Flow Forecasting | Predictions based on historical data | Dynamic forecasts using real-time transactions |

| Security | Dependent on user and software security | Bank-grade encryption and regulatory compliance |

| User Experience | More complex; manual reconciliation | Seamless, automated money management |

Understanding Cash Flow in Modern Money Management

Cash flow analysis is crucial for effective money management, particularly when integrating with neobank platforms that offer real-time transaction tracking and automated budgeting tools. Neobanks enhance cash flow visibility by providing seamless access to income, expenses, and savings goals, enabling users to optimize financial decisions. Advanced integration between cash flow management software and neobanks promotes accurate forecasting and smarter allocation of funds.

The Rise of Neobanks: Revolutionizing Financial Services

Neobank integration significantly enhances cash flow management by offering real-time transaction tracking and instant payment notifications, which traditional cash flow systems often lack. These digital-only banks leverage advanced APIs to seamlessly connect with budgeting tools, providing users with comprehensive insights and automated expense categorization. The rise of neobanks is revolutionizing financial services by delivering greater transparency, faster access to funds, and personalized money management features that optimize cash flow efficiency.

Key Differences Between Traditional Cash Flow Methods and Neobank Integration

Traditional cash flow methods rely on manual tracking and periodic reconciliation, often leading to delays and errors in money management. Neobank integration offers real-time transaction updates, automated categorization, and seamless synchronization with financial tools, enhancing accuracy and efficiency. This digital approach enables improved cash flow forecasting and instant access to financial insights compared to conventional processes.

How Neobank Features Enhance Cash Flow Tracking

Neobank integration streamlines cash flow tracking by providing real-time transaction updates and automated expense categorization, enabling precise monitoring of income and expenditures. Advanced features such as instant notifications and customizable budgeting tools allow users to anticipate cash flow fluctuations and optimize liquidity management. Enhanced visibility through intuitive dashboards ensures proactive financial planning and improved cash flow forecasting.

Real-Time Financial Insights: The Power of Neobank Integration

Neobank integration offers real-time financial insights by synchronizing cash flow data across accounts instantly, enabling proactive money management and improved liquidity control. This continuous data exchange allows for immediate detection of spending patterns, helping users optimize expenses and predict future cash flow needs accurately. Access to real-time updates enhances decision-making efficiency, reducing risks associated with delayed financial information compared to traditional cash flow tracking methods.

Automating Budgeting and Savings with Neobank Tools

Neobank integration with cash flow management enhances automating budgeting and savings by leveraging real-time transaction data to create dynamic spending categories and personalized savings goals. Advanced algorithms track income and expenses, enabling seamless allocation of funds into separate savings accounts without manual intervention. This automation boosts financial discipline and improves overall money management efficiency for users.

Security and Privacy: Cash Flow Management in the Digital Age

Cash flow management in the digital age requires robust security and privacy protocols to protect sensitive financial information. Neobank integration offers advanced encryption standards and biometric authentication that enhance data protection compared to traditional cash flow systems. These innovations reduce fraud risks and ensure compliance with regulations like GDPR and CCPA, providing users with greater control over their financial data.

Case Studies: Improved Cash Flow with Neobank Solutions

Case studies reveal that neobank integration significantly enhances cash flow management by providing real-time transaction tracking, automated expense categorization, and instant fund transfers. Companies leveraging neobank platforms report accelerated cash conversion cycles and improved liquidity management, reducing operational downtime. Enhanced visibility into cash movements enables more accurate forecasting and strategic financial planning, driving sustained business growth.

Common Challenges: Cash Flow Management Without Neobanks

Managing cash flow without neobank integration often results in delayed transaction processing and limited real-time visibility into account balances. Traditional financial systems struggle with manual reconciliation, increasing the likelihood of errors and inefficient cash forecasting. These common challenges hinder timely decision-making and restrict seamless automation crucial for effective money management.

Future Trends: The Evolution of Neobank Integration in Money Management

Future trends in cash flow management highlight increased integration with neobanks, enabling seamless real-time transaction monitoring and automatic budget adjustments. Advanced APIs link cash flow analytics directly to neobank platforms, enhancing personalized financial insights and predictive cash forecasting. These innovations drive more efficient liquidity management and empower businesses to optimize working capital through automated, data-driven decision-making.

Related Important Terms

Embedded Cash Flow Analytics

Embedded Cash Flow Analytics in neobank integration enhances real-time financial insights by automatically categorizing transactions and predicting cash flow trends, facilitating smarter money management. This seamless integration empowers users with actionable data, improving budget control and liquidity forecasting compared to traditional cash flow methods.

API-driven Cash Positioning

API-driven cash positioning enables real-time visibility of cash flow, enhancing Neobank integration for seamless money management by automating liquidity tracking and forecasting. This approach optimizes financial decision-making through precise, data-driven insights, reducing risks associated with cash shortfalls and improving operational efficiency.

Real-time Treasury Synchronization

Real-time treasury synchronization between cash flow systems and neobank integration enhances money management by providing instant visibility into account balances and transaction statuses. This seamless connectivity ensures accurate liquidity forecasting and optimizes fund allocation across multiple accounts, reducing manual reconciliation errors.

Neobank Liquidity Overlay

Neobank liquidity overlay enhances cash flow management by providing real-time visibility into account balances and transaction flows across multiple financial platforms, enabling efficient allocation of funds. Integrating this feature within neobanks optimizes liquidity management, reduces overdraft risks, and streamlines cash position forecasting for businesses.

Cash Flow Forecasting-as-a-Service

Cash Flow Forecasting-as-a-Service enhances money management by providing real-time, predictive analytics that integrate seamlessly with neobank platforms, enabling businesses to anticipate liquidity needs and optimize financial decisions. This service leverages advanced AI algorithms to deliver accurate cash flow projections, reducing risks associated with cash shortages and improving operational efficiency.

Autonomic Payment Orchestration

Autonomic payment orchestration enhances cash flow efficiency by automating transaction routing and optimizing liquidity management within neobank integrations. This seamless synchronization of payment processes reduces delays and improves real-time cash visibility, enabling superior money management.

Transaction Enrichment Layer

The Transaction Enrichment Layer in cash flow management enhances raw transaction data by categorizing expenses, identifying merchant details, and providing actionable insights, which neobanks integrate to deliver personalized financial services. This integration streamlines money management by transforming complex cash flow data into intuitive, context-rich information that improves budgeting, forecasting, and financial decision-making for users.

Balance Sheet Streaming

Balance Sheet Streaming enables real-time synchronization of cash flow data with neobank platforms, enhancing visibility and accuracy in money management. This integration reduces reconciliation times and empowers businesses to make informed financial decisions based on up-to-date balance sheet insights.

Integrated Spend Authorization

Integrated spend authorization within neobanks enhances cash flow management by enabling real-time control over transactions, reducing unauthorized expenditures, and streamlining budget adherence. This integration provides dynamic spend limits and instant approval workflows, optimizing liquidity and financial transparency for businesses.

Adaptive Digital Wallet Routing

Adaptive Digital Wallet Routing in neobank integration optimizes cash flow by dynamically directing transactions to the most cost-effective funding sources, reducing fees and improving liquidity management. This technology enhances real-time money management by automating payment pathways based on user behavior and account status, maximizing financial efficiency and control.

Cash flow vs Neobank integration for money management. Infographic

moneydiff.com

moneydiff.com