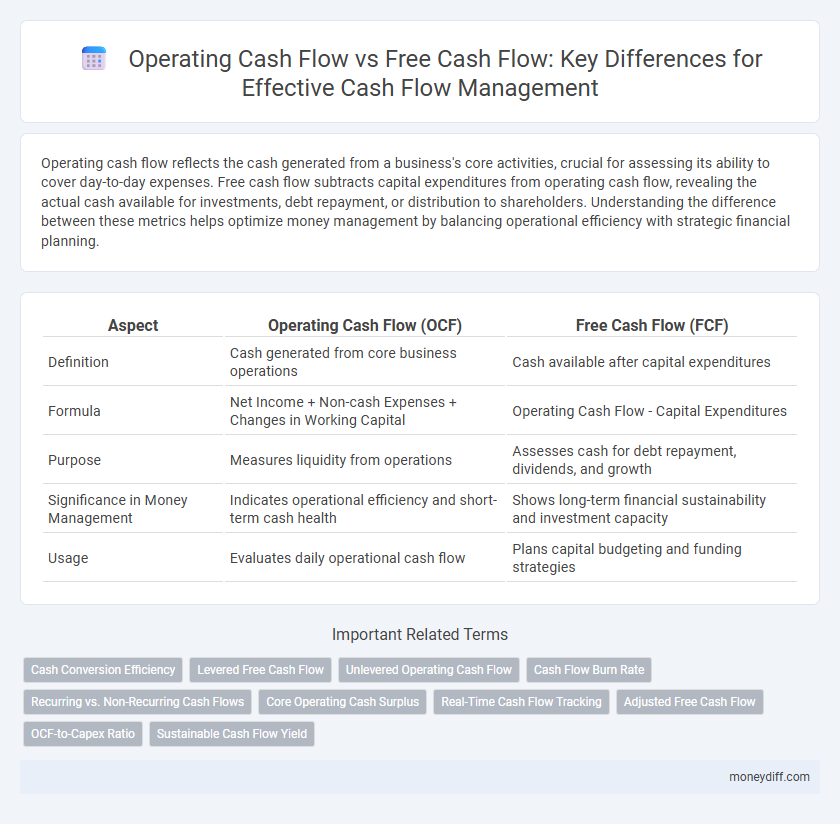

Operating cash flow reflects the cash generated from a business's core activities, crucial for assessing its ability to cover day-to-day expenses. Free cash flow subtracts capital expenditures from operating cash flow, revealing the actual cash available for investments, debt repayment, or distribution to shareholders. Understanding the difference between these metrics helps optimize money management by balancing operational efficiency with strategic financial planning.

Table of Comparison

| Aspect | Operating Cash Flow (OCF) | Free Cash Flow (FCF) |

|---|---|---|

| Definition | Cash generated from core business operations | Cash available after capital expenditures |

| Formula | Net Income + Non-cash Expenses + Changes in Working Capital | Operating Cash Flow - Capital Expenditures |

| Purpose | Measures liquidity from operations | Assesses cash for debt repayment, dividends, and growth |

| Significance in Money Management | Indicates operational efficiency and short-term cash health | Shows long-term financial sustainability and investment capacity |

| Usage | Evaluates daily operational cash flow | Plans capital budgeting and funding strategies |

Understanding Operating Cash Flow: The Basics

Operating cash flow represents the cash generated from core business activities, reflecting a company's ability to generate sufficient revenue to maintain and grow operations. It excludes financing and investing cash flows, providing a clear view of operational efficiency and liquidity. Understanding operating cash flow is essential for money management as it indicates the cash available to cover expenses, reinvest in the business, and support sustainable growth.

What is Free Cash Flow? A Clear Definition

Free cash flow (FCF) represents the cash a company generates after accounting for capital expenditures necessary to maintain or expand its asset base, crucial for assessing true financial flexibility. Unlike operating cash flow, which includes all cash generated from core business operations, free cash flow specifically shows the amount of cash available for distribution to investors, debt repayment, or reinvestment. Understanding free cash flow helps investors and managers evaluate the company's ability to generate sustainable profits and fund growth without external financing.

Key Differences Between Operating and Free Cash Flow

Operating cash flow measures the cash generated from a company's core business operations, reflecting its ability to sustain and grow day-to-day activities. Free cash flow, calculated by subtracting capital expenditures from operating cash flow, indicates the actual cash available for debt repayment, dividends, and expansion projects. Key differences include operating cash flow's focus on liquidity from operations versus free cash flow's emphasis on cash availability after maintaining or expanding asset bases.

Why Operating Cash Flow Matters in Money Management

Operating cash flow highlights the cash generated from a company's core business operations, providing a clear indicator of its ability to sustain and grow daily activities. It reflects real liquidity available for paying bills, salaries, and reinvesting without relying on external financing. Understanding operating cash flow is essential for effective money management, ensuring businesses maintain solvency and fund critical operational needs consistently.

The Role of Free Cash Flow in Investment Decisions

Free cash flow plays a crucial role in investment decisions by providing a clear picture of the cash available after capital expenditures, unlike operating cash flow which only measures cash generated from core business operations. Investors prioritize free cash flow as it indicates the company's ability to generate surplus cash for dividends, debt repayment, and growth opportunities. Managing free cash flow effectively ensures sustainable investment strategies and long-term financial health.

Cash Flow Analysis: Interpreting Financial Health

Operating cash flow reveals the cash generated from core business activities, highlighting a company's ability to sustain day-to-day operations and meet short-term liabilities. Free cash flow subtracts capital expenditures from operating cash flow, indicating the actual cash available for expansion, debt repayment, or dividends. Analyzing both metrics provides a comprehensive view of financial health, enabling better money management and investment decisions.

Benefits and Limitations of Operating Cash Flow

Operating cash flow provides crucial insights into a company's core business performance by measuring cash generated from regular operations, offering a clear view of liquidity and operational efficiency. It helps assess the ability to cover short-term liabilities and reinvest in growth but excludes capital expenditures, leading to potential overestimation of available cash. Limitations include ignoring non-operational income and expenses, which can result in incomplete cash flow analysis for comprehensive money management.

Free Cash Flow: Unlocking Value for Investors

Free cash flow represents the actual cash available after capital expenditures, providing a clearer picture of a company's financial health and its ability to generate shareholder value. Investors prioritize free cash flow because it indicates the funds available for dividends, debt repayment, and reinvestment, unlike operating cash flow which excludes capital spending. Understanding free cash flow enables more strategic money management by highlighting sustainable cash generation beyond operational performance.

Practical Applications: Cash Flow Metrics in Budgeting

Operating cash flow provides a clear picture of cash generated from core business operations, essential for assessing liquidity and day-to-day expense management in budgeting. Free cash flow accounts for capital expenditures deducted from operating cash flow, offering a more comprehensive view of available funds for investments, debt repayment, or discretionary spending. Using both metrics enables more accurate financial planning and allocation of resources to maintain solvency and support growth initiatives.

Choosing the Right Cash Flow Metric for Money Management

Operating cash flow measures the cash generated from a company's core business operations, providing insight into ongoing liquidity and operational efficiency. Free cash flow accounts for capital expenditures, reflecting the actual cash available for debt repayment, dividends, or reinvestment, making it critical for long-term financial planning. Selecting the appropriate cash flow metric depends on whether the focus is short-term operational health or long-term financial flexibility in money management.

Related Important Terms

Cash Conversion Efficiency

Operating cash flow measures the cash generated from core business activities, essential for assessing short-term liquidity and operational efficiency, while free cash flow accounts for capital expenditures, providing a clearer picture of available cash for investments and debt repayment. Higher cash conversion efficiency indicates effective management of receivables, payables, and inventory, directly improving both operating and free cash flow for sustainable money management.

Levered Free Cash Flow

Operating cash flow measures the cash generated from core business operations, excluding capital expenditures, while levered free cash flow represents the actual cash available after covering both operating expenses and debt obligations, making it critical for money management decisions. Prioritizing levered free cash flow provides a more accurate insight into a company's liquidity and ability to finance growth or repay debt, ensuring sustainable financial health.

Unlevered Operating Cash Flow

Unlevered operating cash flow represents the cash generated by a company's core operations before accounting for interest and financing activities, providing a clear picture of operational efficiency and profit sustainability. Comparing unlevered operating cash flow to free cash flow helps money managers assess the firm's ability to generate liquidity without the impact of capital expenditures and debt payments, crucial for strategic investment and debt management decisions.

Cash Flow Burn Rate

Operating cash flow measures the cash generated from core business operations, essential for covering daily expenses, while free cash flow indicates the remaining cash after capital expenditures, crucial for evaluating financial flexibility. Monitoring the cash flow burn rate helps businesses assess how quickly they use cash reserves, guiding effective money management and ensuring sustainable operations.

Recurring vs. Non-Recurring Cash Flows

Operating cash flow reflects the recurring cash inflows and outflows generated from core business operations, providing a reliable indicator of ongoing money management capacity. Free cash flow accounts for both recurring operating cash flow and non-recurring investments like capital expenditures, offering a comprehensive view of available cash for debt repayment, dividends, or expansion.

Core Operating Cash Surplus

Core Operating Cash Surplus represents the net cash generated from primary business operations, excluding non-operating income and expenses, serving as a critical indicator of a company's financial health. It differs from Free Cash Flow, which accounts for capital expenditures and reflects the actual cash available for debt repayment, dividends, and growth investments.

Real-Time Cash Flow Tracking

Operating cash flow measures the cash generated from core business operations, reflecting liquidity available for day-to-day expenses, while free cash flow accounts for capital expenditures, showing the cash available for expansion or debt repayment. Real-time cash flow tracking enables businesses to monitor both metrics instantaneously, optimizing money management by providing up-to-date insights on operational efficiency and investment capacity.

Adjusted Free Cash Flow

Adjusted Free Cash Flow provides a refined measure of liquidity by excluding one-time expenses and non-recurring earnings from Free Cash Flow, offering a clearer picture of sustainable cash available for reinvestment and debt management. Unlike Operating Cash Flow, which captures cash generated from core business operations, Adjusted Free Cash Flow better reflects the true cash surplus after all capital expenditures and adjustments, crucial for effective money management strategies.

OCF-to-Capex Ratio

The Operating Cash Flow (OCF)-to-Capex ratio measures a company's ability to cover capital expenditures with cash generated from operations, providing insight into financial sustainability and investment capacity. A higher OCF-to-Capex ratio indicates stronger cash flow management, ensuring that operating cash flow sufficiently funds asset growth without relying on external financing.

Sustainable Cash Flow Yield

Operating cash flow measures the cash generated from core business operations, crucial for assessing a company's ability to sustain day-to-day activities, while free cash flow subtracts capital expenditures, indicating the cash available for growth, debt repayment, and dividends. Sustainable Cash Flow Yield evaluates the efficiency and reliability of these cash flows relative to market value, providing a key metric for effective money management and long-term financial health.

Operating cash flow vs free cash flow for money management. Infographic

moneydiff.com

moneydiff.com