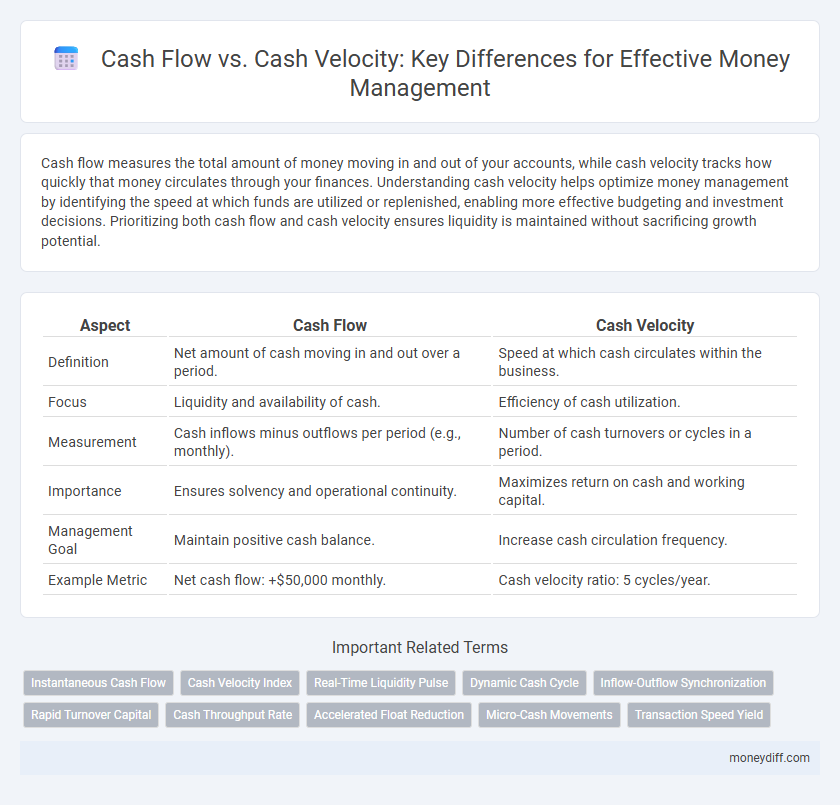

Cash flow measures the total amount of money moving in and out of your accounts, while cash velocity tracks how quickly that money circulates through your finances. Understanding cash velocity helps optimize money management by identifying the speed at which funds are utilized or replenished, enabling more effective budgeting and investment decisions. Prioritizing both cash flow and cash velocity ensures liquidity is maintained without sacrificing growth potential.

Table of Comparison

| Aspect | Cash Flow | Cash Velocity |

|---|---|---|

| Definition | Net amount of cash moving in and out over a period. | Speed at which cash circulates within the business. |

| Focus | Liquidity and availability of cash. | Efficiency of cash utilization. |

| Measurement | Cash inflows minus outflows per period (e.g., monthly). | Number of cash turnovers or cycles in a period. |

| Importance | Ensures solvency and operational continuity. | Maximizes return on cash and working capital. |

| Management Goal | Maintain positive cash balance. | Increase cash circulation frequency. |

| Example Metric | Net cash flow: +$50,000 monthly. | Cash velocity ratio: 5 cycles/year. |

Understanding Cash Flow: The Money Movement Lifeline

Cash flow represents the total amount of money moving in and out of a business over a specific period, crucial for maintaining liquidity and operational stability. Cash velocity measures the speed at which cash circulates within the company, impacting how quickly resources can be reinvested or obligations met. Understanding both cash flow and cash velocity provides a comprehensive view of financial health, enabling more effective money management and strategic planning.

What Is Cash Velocity? Speeding Up Your Finances

Cash velocity measures how quickly cash circulates through a business, reflecting the efficiency of money management beyond traditional cash flow analysis. Faster cash velocity indicates quicker turnover of assets into cash, enabling better liquidity and investment opportunities. Speeding up cash velocity optimizes working capital, reduces holding costs, and enhances overall financial agility.

Key Differences: Cash Flow vs Cash Velocity

Cash flow measures the total amount of money moving in and out of a business over a specific period, highlighting liquidity and operational efficiency. Cash velocity focuses on how quickly cash circulates through the business, emphasizing the frequency of transactions and turnover rate. Understanding both cash flow and cash velocity is crucial for effective money management, as cash flow ensures solvency while cash velocity drives profitability through faster capital turnover.

Why Cash Flow Management Matters for Financial Health

Effective cash flow management ensures a business maintains sufficient liquidity to meet operational expenses and invest in growth opportunities, directly influencing financial stability. Monitoring cash velocity, or the speed at which money circulates within the business, complements cash flow analysis by identifying areas to optimize working capital efficiency. Prioritizing both cash flow and cash velocity enhances decision-making, reduces financial risks, and supports sustainable financial health.

The Importance of Cash Velocity in Business Growth

Cash velocity measures how quickly cash circulates within a business, directly impacting liquidity and operational efficiency. Faster cash velocity enables companies to reinvest earnings rapidly, seize growth opportunities, and reduce reliance on external financing. Prioritizing cash velocity alongside cash flow ensures sustained business expansion and improved financial stability.

Measuring and Monitoring Cash Flow Effectively

Measuring and monitoring cash flow effectively involves tracking the timing and amounts of cash inflows and outflows to maintain liquidity and operational stability. Cash velocity, the speed at which money circulates through a business, complements cash flow by revealing how quickly cash is converted from sales into cash available for use. Employing real-time cash flow forecasting tools and key performance indicators (KPIs) like cash conversion cycle enhances decision-making and ensures optimal money management.

Strategies to Enhance Cash Velocity

Improving cash velocity involves accelerating the movement of money through efficient receivables collection, streamlined inventory management, and prompt payables processing. Implementing electronic invoicing and payment systems can reduce transaction times, while closely monitoring cash conversion cycles helps identify bottlenecks in cash flow. Businesses that optimize cash velocity enhance liquidity, enabling faster reinvestment and improved operational agility.

Common Cash Flow Problems and Solutions

Common cash flow problems include delayed receivables, unexpected expenses, and inaccurate forecasting, which disrupt money management and hinder cash velocity. Implementing streamlined invoicing processes, maintaining a cash reserve, and utilizing real-time financial tracking tools help improve cash inflows and optimize cash velocity. Enhancing cash flow visibility enables better liquidity management and supports timely decision-making to sustain operational efficiency.

Integrating Cash Flow and Cash Velocity for Optimal Money Management

Integrating cash flow and cash velocity enhances money management by balancing the timing of cash inflows and outflows with the speed at which cash circulates through the business. Optimizing cash velocity ensures funds are quickly reinvested or used productively, reducing idle cash and increasing operational efficiency. This synergy supports sustainable liquidity, improved working capital management, and maximized return on cash assets.

Practical Tips to Boost Your Cash Flow and Cash Velocity

Improving cash flow and cash velocity requires efficient invoicing and prompt payment collection to accelerate money turnover. Implementing real-time cash flow monitoring tools and optimizing inventory management can free up capital and increase liquidity. Prioritizing quick expense approvals and negotiating better payment terms with suppliers also enhances overall cash velocity for stronger financial health.

Related Important Terms

Instantaneous Cash Flow

Instantaneous cash flow measures the exact moment cash enters or leaves a business, providing real-time insights into liquidity compared to traditional cash flow, which tracks changes over a period. Cash velocity assesses how quickly money circulates within the business, emphasizing the speed of cash turnover crucial for optimizing working capital and enhancing money management strategies.

Cash Velocity Index

The Cash Velocity Index measures the speed at which cash circulates within a business, offering critical insights beyond traditional cash flow analysis by highlighting operational efficiency and liquidity turnover. Monitoring the Cash Velocity Index enables more precise money management decisions, optimizing working capital and enhancing overall financial performance.

Real-Time Liquidity Pulse

Cash flow measures the total inflow and outflow of money over a period, while cash velocity tracks the speed at which cash circulates within the business, offering a dynamic view of liquidity. Real-Time Liquidity Pulse leverages cash velocity data to provide immediate insights into available cash, enhancing money management and optimizing operational efficiency.

Dynamic Cash Cycle

Dynamic Cash Cycle enhances money management by optimizing both cash flow and cash velocity, ensuring faster turnover rates and improved liquidity. Efficient synchronization of cash inflows and outflows accelerates the recycling of funds, maximizing operational efficiency and financial stability.

Inflow-Outflow Synchronization

In money management, synchronizing cash inflow and outflow enhances cash velocity by ensuring funds are available precisely when needed, minimizing idle cash and reducing reliance on external financing. Effective alignment of receivables and payables accelerates liquidity turnover, optimizing operational efficiency and supporting sustained business growth.

Rapid Turnover Capital

Cash flow measures the net amount of cash moving in and out of a business, while cash velocity emphasizes the speed at which money circulates through operations, directly impacting liquidity and operational efficiency. Rapid turnover capital enhances cash velocity by quickly converting assets into usable cash, enabling faster reinvestment and improved financial agility for money management.

Cash Throughput Rate

Cash throughput rate measures the velocity at which cash moves through a business, highlighting the efficiency of converting cash inflows into outflows without delay. Optimizing cash throughput rate enhances liquidity management by accelerating cash circulation, ensuring timely payments, and reducing holding costs, which directly influences overall cash flow stability.

Accelerated Float Reduction

Accelerated float reduction increases cash velocity by minimizing the time cash is tied up in transit, thereby optimizing liquidity and enhancing operational efficiency. Efficient management of both cash flow and cash velocity ensures better working capital utilization and strengthens overall financial stability.

Micro-Cash Movements

Cash flow measures the total inflow and outflow of cash over a period, while cash velocity quantifies the speed at which money circulates within a business, highlighting the efficiency of micro-cash movements. Optimizing micro-cash velocity enhances liquidity management by ensuring rapid turnover of cash assets, thereby improving short-term financial stability.

Transaction Speed Yield

Cash flow measures the total amount of money moving in and out of a business over a period, while cash velocity quantifies the speed at which cash circulates within operations, directly impacting Transaction Speed Yield. Maximizing cash velocity enhances Transaction Speed Yield by accelerating the turnover of cash, improving liquidity and operational efficiency for optimized money management.

Cash flow vs Cash velocity for money management. Infographic

moneydiff.com

moneydiff.com