Cash flow management ensures a steady inflow and outflow of money, allowing pet owners to cover essential expenses without financial stress. Conscious spending emphasizes intentional choices, prioritizing needs over wants to maximize the value of every dollar spent. Balancing cash flow with mindful spending creates a sustainable approach to managing pet-related costs effectively.

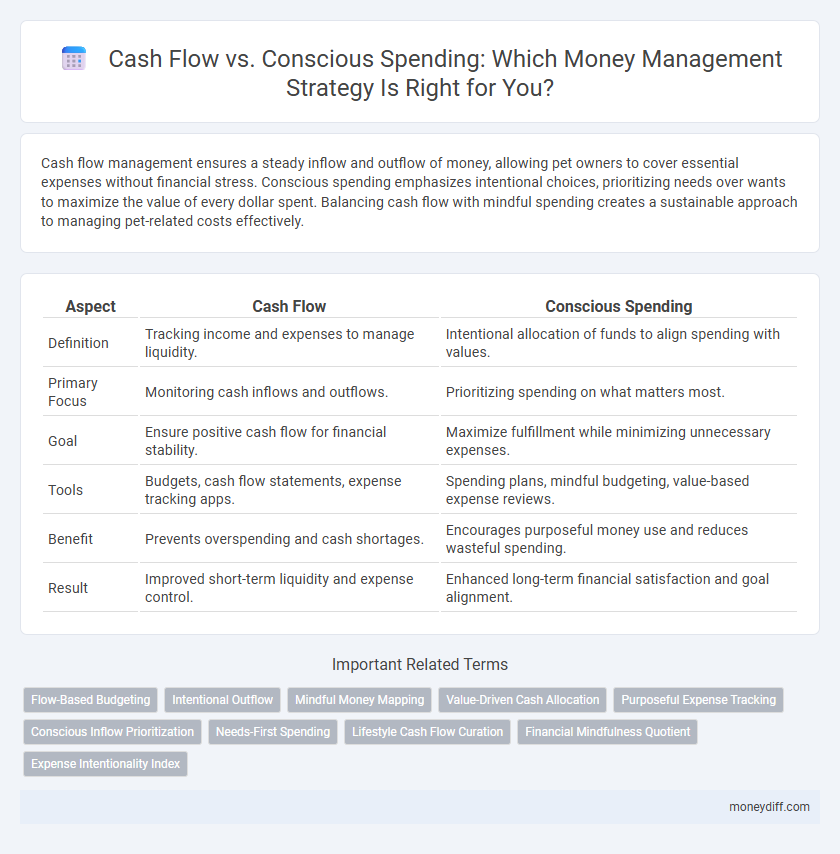

Table of Comparison

| Aspect | Cash Flow | Conscious Spending |

|---|---|---|

| Definition | Tracking income and expenses to manage liquidity. | Intentional allocation of funds to align spending with values. |

| Primary Focus | Monitoring cash inflows and outflows. | Prioritizing spending on what matters most. |

| Goal | Ensure positive cash flow for financial stability. | Maximize fulfillment while minimizing unnecessary expenses. |

| Tools | Budgets, cash flow statements, expense tracking apps. | Spending plans, mindful budgeting, value-based expense reviews. |

| Benefit | Prevents overspending and cash shortages. | Encourages purposeful money use and reduces wasteful spending. |

| Result | Improved short-term liquidity and expense control. | Enhanced long-term financial satisfaction and goal alignment. |

Understanding Cash Flow: The Foundation of Money Management

Understanding cash flow is essential for effective money management, as it tracks the actual movement of money in and out of your accounts, providing a clear picture of financial health. Conscious spending complements cash flow by ensuring that expenditures align with priorities and available resources, preventing overspending and encouraging savings. Mastering cash flow enables individuals to make informed decisions and maintain financial stability by balancing income, expenses, and intentional spending habits.

Defining Conscious Spending: Mindful Choices with Your Money

Conscious spending involves making mindful choices by aligning expenditures with personal values and financial goals, ensuring cash flow supports long-term priorities. Effective money management balances inflows and outflows to maintain liquidity while avoiding impulsive purchases. Prioritizing intentional purchases over habitual spending enhances financial stability and maximizes the utility of available cash flow.

Key Differences Between Cash Flow and Conscious Spending

Cash flow represents the total amount of money moving in and out of your accounts over a specific period, emphasizing income versus expenses to maintain liquidity. Conscious spending centers on intentional decision-making about how money is used, prioritizing value and mindful allocation to maximize financial satisfaction. Key differences include cash flow's focus on tracking cash movement and maintaining balance, while conscious spending prioritizes purposeful budgeting and aligning expenditures with personal values.

How Cash Flow Impacts Your Financial Health

Cash flow directly influences your financial health by determining the availability of funds to cover expenses and invest in growth opportunities. Positive cash flow ensures that bills are paid on time, debts are managed effectively, and savings are increased, reducing financial stress. Poor cash flow management, even with conscious spending, can lead to liquidity issues and hinder long-term wealth accumulation.

The Role of Conscious Spending in Achieving Financial Goals

Conscious spending plays a pivotal role in managing cash flow by ensuring that expenses align with financial goals and prioritize value. By deliberately tracking and categorizing expenditures, individuals can optimize their cash flow to maximize savings and investments. This strategic approach reduces impulsive spending, enhances budgeting accuracy, and accelerates the achievement of long-term financial objectives.

Benefits of Prioritizing Cash Flow Management

Prioritizing cash flow management ensures liquidity to cover essential expenses and prevents debt accumulation by maintaining a steady inflow and outflow balance. It provides real-time insights into available funds, enabling informed financial decisions and reducing reliance on credit. Effective cash flow oversight enhances financial stability and supports long-term wealth growth by aligning spending habits with actual income streams.

Advantages of Adopting a Conscious Spending Approach

Conscious spending enhances cash flow management by prioritizing meaningful expenses and reducing impulsive purchases, leading to improved financial stability. This approach aligns spending with personal values, which increases satisfaction and reduces financial stress. By consciously allocating funds, individuals can build savings more effectively and avoid debt accumulation.

Integrating Cash Flow Analysis and Conscious Spending

Integrating cash flow analysis with conscious spending enhances money management by providing a clear picture of income and expenses, enabling informed financial decisions. Monitoring cash flow ensures funds availability while conscious spending prioritizes aligning expenditures with personal values and goals, reducing impulsive purchases. This combined approach promotes financial stability, helping individuals optimize resource allocation and build long-term wealth.

Common Mistakes in Managing Cash Flow vs. Conscious Spending

Mismanaging cash flow often stems from neglecting conscious spending habits, leading to unexpected shortfalls and financial stress. Common mistakes include failing to track expenses meticulously, overspending on non-essential items, and ignoring the timing of cash inflows and outflows. Prioritizing deliberate spending decisions enhances cash flow stability and promotes long-term financial health.

Building a Balanced Money Management Strategy: Best Practices

Effective cash flow management ensures consistent tracking of income and expenses, promoting financial stability. Conscious spending aligns expenditures with priorities and values, preventing unnecessary debt and fostering savings growth. Combining real-time cash flow analysis with intentional budgeting creates a balanced money management strategy that maximizes financial health and long-term wealth.

Related Important Terms

Flow-Based Budgeting

Flow-Based Budgeting prioritizes tracking actual cash flow to allocate funds dynamically, ensuring expenses align with real-time income rather than fixed budgets. This method enhances conscious spending by adapting financial decisions to available resources, reducing overspending and improving money management efficiency.

Intentional Outflow

Intentional outflow in cash flow management involves deliberately planning and controlling expenses to align with financial goals, ensuring money is spent purposefully rather than impulsively. By prioritizing conscious spending, individuals enhance their ability to maintain positive cash flow and build long-term financial stability.

Mindful Money Mapping

Mindful Money Mapping enhances cash flow management by aligning income and expenses with personal values and financial goals, reducing impulsive spending. This approach fosters conscious spending habits that optimize cash flow, ensuring sustainable financial health through intentional allocation and prioritization of resources.

Value-Driven Cash Allocation

Value-driven cash allocation prioritizes directing funds toward expenses and investments that align with personal or business goals, enhancing financial efficiency. Effective cash flow management integrates conscious spending habits to ensure liquidity supports growth and avoids unnecessary debt.

Purposeful Expense Tracking

Purposeful expense tracking enhances cash flow management by aligning spending decisions with financial goals, ensuring money is allocated to priorities rather than discretionary impulses. This strategic approach improves liquidity and supports sustainable budgeting through detailed monitoring of income inflows and expense outflows.

Conscious Inflow Prioritization

Conscious inflow prioritization enhances cash flow management by strategically allocating incoming funds to essential expenses, savings, and investments, ensuring financial stability and growth. This approach reduces impulsive spending and optimizes resource distribution based on prioritized financial goals, improving overall money management effectiveness.

Needs-First Spending

Cash flow management prioritizes allocating funds toward essential expenses before discretionary purchases, ensuring needs-first spending supports financial stability. Conscious spending enhances this approach by encouraging deliberate, value-driven decisions that optimize cash flow and prevent unnecessary debt.

Lifestyle Cash Flow Curation

Lifestyle Cash Flow Curation transforms cash flow management by aligning income and expenses with conscious spending habits, ensuring money is directed toward values-driven choices. This approach enhances financial stability and personal fulfillment by optimizing cash flow to support intentional lifestyle goals rather than impulsive purchases.

Financial Mindfulness Quotient

Cash flow management emphasizes tracking income and expenses to ensure liquidity, while conscious spending prioritizes aligning expenditures with personal values to maximize satisfaction and reduce waste. Enhancing Financial Mindfulness Quotient involves developing awareness of both cash flow patterns and spending habits, fostering disciplined decisions that support sustainable wealth growth and emotional well-being.

Expense Intentionality Index

The Expense Intentionality Index measures the alignment of cash flow with conscious spending habits, highlighting how intentional expenses improve overall money management efficacy. Higher index values correlate with better cash flow optimization and reduced impulsive expenditures, enhancing financial stability.

Cash flow vs Conscious spending for money management. Infographic

moneydiff.com

moneydiff.com