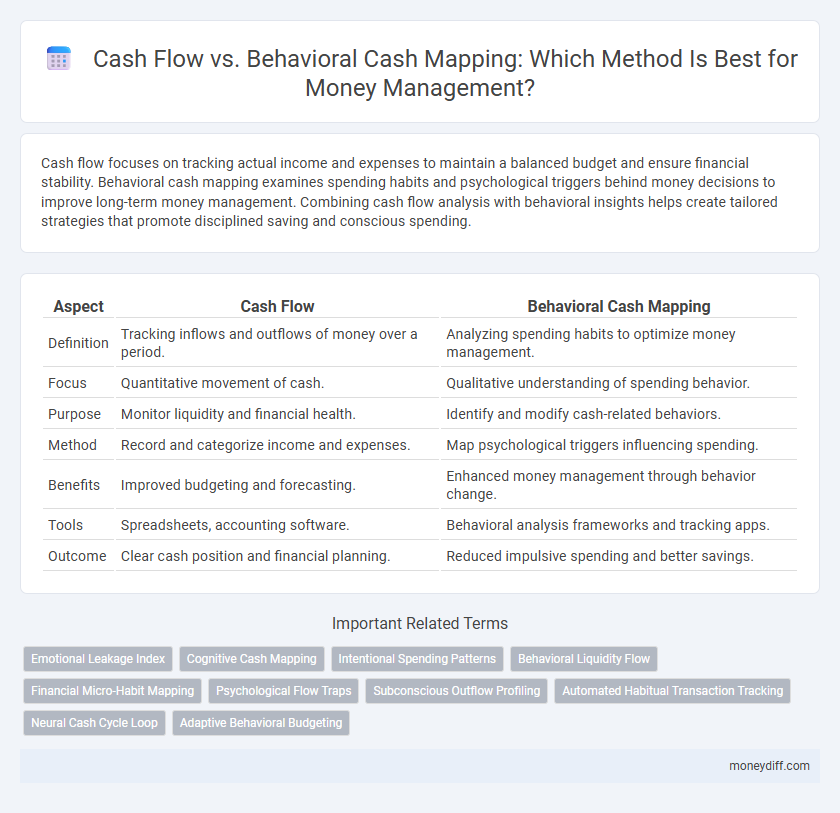

Cash flow focuses on tracking actual income and expenses to maintain a balanced budget and ensure financial stability. Behavioral cash mapping examines spending habits and psychological triggers behind money decisions to improve long-term money management. Combining cash flow analysis with behavioral insights helps create tailored strategies that promote disciplined saving and conscious spending.

Table of Comparison

| Aspect | Cash Flow | Behavioral Cash Mapping |

|---|---|---|

| Definition | Tracking inflows and outflows of money over a period. | Analyzing spending habits to optimize money management. |

| Focus | Quantitative movement of cash. | Qualitative understanding of spending behavior. |

| Purpose | Monitor liquidity and financial health. | Identify and modify cash-related behaviors. |

| Method | Record and categorize income and expenses. | Map psychological triggers influencing spending. |

| Benefits | Improved budgeting and forecasting. | Enhanced money management through behavior change. |

| Tools | Spreadsheets, accounting software. | Behavioral analysis frameworks and tracking apps. |

| Outcome | Clear cash position and financial planning. | Reduced impulsive spending and better savings. |

Understanding Cash Flow: The Foundation of Money Management

Understanding cash flow involves tracking the inflow and outflow of money within a specified period to maintain financial stability and meet obligations. Behavioral cash mapping complements this by analyzing spending patterns and emotional triggers that influence financial decisions, providing deeper insights into money management habits. Together, these methods form the foundation for effective budgeting, saving, and investment strategies.

What Is Behavioral Cash Mapping?

Behavioral Cash Mapping is a money management technique that analyzes an individual's spending habits and psychological triggers to optimize cash flow. Unlike traditional cash flow methods that track income and expenses quantitatively, Behavioral Cash Mapping focuses on the qualitative patterns influencing financial decisions. This approach helps identify emotional spending triggers and aligns cash flow management with personal financial behaviors to improve savings and reduce impulsive expenditures.

Key Differences Between Traditional Cash Flow and Behavioral Cash Mapping

Traditional cash flow analysis centers on tracking income and expenses to determine net cash availability, relying heavily on historical financial data and standardized accounting methods. Behavioral cash mapping incorporates psychological and emotional factors influencing spending habits, offering a more personalized approach to money management by identifying patterns driven by cognitive biases and decision-making processes. The key difference lies in traditional methods focusing on quantitative data, while behavioral mapping emphasizes qualitative insights to optimize cash management strategies.

The Psychology Behind Money Management Decisions

Cash flow analysis provides a quantitative view of a person's income and expenses, while behavioral cash mapping delves into the psychological patterns influencing spending and saving habits. Understanding the emotional triggers and cognitive biases behind money management decisions can reveal why individuals deviate from optimal financial strategies despite positive cash flows. Integrating behavioral insights with cash flow data enables more effective personalized financial planning and improved long-term money management outcomes.

Benefits of Using Behavioral Cash Mapping

Behavioral Cash Mapping enhances traditional cash flow analysis by incorporating psychological spending patterns and financial decision behaviors, leading to more accurate budgeting and expense forecasting. This method helps identify emotional triggers behind spending, empowering individuals to create sustainable money management strategies and improve savings habits. Integrating behavioral insights with cash flow data results in personalized financial plans that better align with one's goals and reduce impulsive expenditures.

Potential Pitfalls in Relying Solely on Cash Flow Analysis

Relying solely on cash flow analysis can obscure underlying behavioral spending patterns essential for effective money management, leading to overlooked impulsive expenditures or irregular income sources. Cash flow reports often fail to capture the emotional triggers and habitual financial decisions that impact long-term financial health. Integrating behavioral cash mapping reveals these subtleties, preventing misinterpretation of cash flow stability and promoting more comprehensive management strategies.

Integrating Behavioral Insights with Cash Flow Tracking

Integrating behavioral insights with cash flow tracking enhances money management by aligning spending patterns with psychological tendencies, leading to more effective budgeting and financial decision-making. Behavioral cash mapping identifies emotional triggers and habitual expenditures, enabling tailored interventions that improve savings and reduce impulsive spending. This combination fosters greater financial discipline and long-term cash flow stability.

Practical Strategies for Implementing Behavioral Cash Mapping

Implement practical strategies for implementing behavioral cash mapping by tracking spending patterns and categorizing cash flow into behavioral segments such as needs, wants, and savings to increase financial awareness. Use digital tools and regular cash flow reviews to identify wasteful expenditures and reinforce positive money habits. Establish clear financial goals aligned with behavioral insights to optimize cash management and improve long-term financial stability.

Which Approach Works Best: Cash Flow or Behavioral Cash Mapping?

Cash flow analysis provides a clear overview of income and expenses, enabling precise budgeting and financial forecasting. Behavioral cash mapping digs deeper into spending habits and psychological triggers, offering insights that help modify financial behavior for long-term stability. Combining cash flow metrics with behavioral insights often yields the most effective money management strategy by balancing numbers with personal spending patterns.

Building Sustainable Financial Habits Through Behavioral Cash Mapping

Behavioral cash mapping identifies spending patterns and emotional triggers influencing cash flow, enabling tailored strategies for efficient money management. This approach enhances financial awareness by linking cash flow data to behavioral insights, fostering sustainable spending habits. Implementing behavioral cash mapping transforms raw cash flow figures into actionable habits that support long-term financial stability.

Related Important Terms

Emotional Leakage Index

The Emotional Leakage Index measures the impact of psychological triggers on cash flow, highlighting discrepancies between actual spending behaviors and planned budgets. Integrating this index into behavioral cash mapping enhances money management by identifying emotional spending patterns that cause financial drains.

Cognitive Cash Mapping

Cognitive Cash Mapping enhances traditional cash flow analysis by incorporating behavioral insights into spending and saving patterns, enabling more precise money management strategies. This method identifies psychological triggers and decision-making habits that affect cash flow, improving financial planning accuracy and long-term wealth accumulation.

Intentional Spending Patterns

Intentional spending patterns focus on aligning cash flow with behavioral cash mapping to optimize money management by identifying habitual expenses and redirecting funds towards financial goals. This approach enhances cash flow predictability and fosters disciplined spending, reducing impulsive outflows and improving overall financial stability.

Behavioral Liquidity Flow

Behavioral Liquidity Flow emphasizes understanding spending habits and psychological triggers influencing cash inflows and outflows, providing deeper insights beyond traditional cash flow analysis. Integrating Behavioral Cash Mapping enables more effective money management by aligning liquidity strategies with individual financial behaviors and decision-making patterns.

Financial Micro-Habit Mapping

Financial Micro-Habit Mapping enhances cash flow management by tracking daily spending behaviors and aligning them with income patterns, enabling precise adjustments to optimize liquidity. Unlike traditional cash flow analysis, this behavioral approach identifies subtle financial habits that impact money management, fostering proactive control over personal finances.

Psychological Flow Traps

Cash flow analysis provides a numerical snapshot of income and expenses, while behavioral cash mapping uncovers psychological flow traps such as spending triggers and emotional biases that disrupt effective money management. Understanding these psychological flow traps enables individuals to create healthier cash habits by aligning their financial behaviors with long-term goals.

Subconscious Outflow Profiling

Subconscious Outflow Profiling identifies hidden spending habits by analyzing behavioral cash mapping patterns to reveal non-conscious cash flow triggers. This approach enhances money management by aligning spending behavior with actual cash flow, preventing unexpected outflows and promoting financial discipline.

Automated Habitual Transaction Tracking

Automated Habitual Transaction Tracking leverages behavioral cash mapping to identify recurring spending patterns, enhancing cash flow analysis by providing real-time insights into habitual expenses. This method improves money management by enabling precise forecasting and tailored budgeting strategies based on actual transaction behaviors.

Neural Cash Cycle Loop

The Neural Cash Cycle Loop integrates behavioral cash mapping with traditional cash flow analysis to optimize money management by aligning subconscious spending patterns with conscious financial goals. This approach enhances the predictability of cash inflows and outflows, enabling more accurate budgeting and improved liquidity management.

Adaptive Behavioral Budgeting

Adaptive Behavioral Budgeting enhances cash flow management by integrating behavioral cash mapping techniques to predict spending patterns and adjust budgets dynamically. This approach improves financial decision-making by aligning cash flow projections with actual behavioral tendencies, promoting more effective money management.

Cash flow vs Behavioral cash mapping for money management. Infographic

moneydiff.com

moneydiff.com