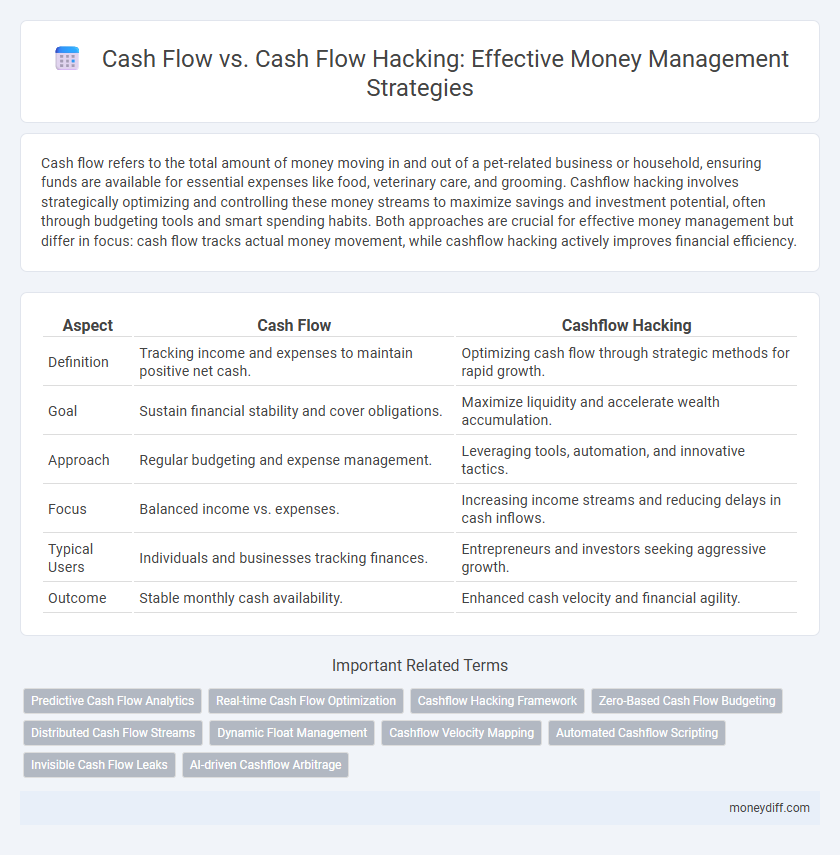

Cash flow refers to the total amount of money moving in and out of a pet-related business or household, ensuring funds are available for essential expenses like food, veterinary care, and grooming. Cashflow hacking involves strategically optimizing and controlling these money streams to maximize savings and investment potential, often through budgeting tools and smart spending habits. Both approaches are crucial for effective money management but differ in focus: cash flow tracks actual money movement, while cashflow hacking actively improves financial efficiency.

Table of Comparison

| Aspect | Cash Flow | Cashflow Hacking |

|---|---|---|

| Definition | Tracking income and expenses to maintain positive net cash. | Optimizing cash flow through strategic methods for rapid growth. |

| Goal | Sustain financial stability and cover obligations. | Maximize liquidity and accelerate wealth accumulation. |

| Approach | Regular budgeting and expense management. | Leveraging tools, automation, and innovative tactics. |

| Focus | Balanced income vs. expenses. | Increasing income streams and reducing delays in cash inflows. |

| Typical Users | Individuals and businesses tracking finances. | Entrepreneurs and investors seeking aggressive growth. |

| Outcome | Stable monthly cash availability. | Enhanced cash velocity and financial agility. |

Understanding Cash Flow in Money Management

Understanding cash flow in money management involves tracking the inflow and outflow of cash to maintain financial stability. Cash flow hacking emphasizes optimizing and accelerating cash movement to maximize liquidity and reduce financial stress. Effective management of cash flow ensures timely payments, improves budgeting accuracy, and supports strategic financial planning.

What is Cashflow Hacking?

Cashflow hacking is a strategic approach to money management that focuses on maximizing cash inflows and minimizing outflows through targeted financial tactics and behavioral adjustments. Unlike traditional cash flow management, which primarily tracks income and expenses, cashflow hacking leverages budgeting tools, automated savings, and investment optimization to accelerate wealth accumulation. This method empowers individuals and businesses to gain greater control over their finances by enhancing liquidity and improving financial agility.

Core Differences: Cash Flow vs Cashflow Hacking

Cash flow represents the total amount of money moving in and out of a business or individual's accounts, focusing on tracking income and expenses to maintain financial stability. Cashflow hacking emphasizes strategically optimizing and accelerating cash inflows while minimizing outflows through techniques like renegotiating payment terms, leveraging discount opportunities, and improving receivables management. The core difference lies in traditional cash flow as a measurement and recording process versus cashflow hacking as an active, tactical approach to maximize liquidity and financial agility.

Cash Flow Fundamentals for Financial Health

Cash flow fundamentals emphasize tracking income and expenses to maintain liquidity and solvency, ensuring consistent financial health. Understanding cash inflows and outflows enables accurate budgeting and prevents overspending, which is crucial for sustaining operations or personal finance stability. Cash flow hacking, often referring to quick tricks or short-term fixes, lacks the strategic discipline of fundamental cash flow management necessary for long-term financial success.

How Cashflow Hacking Boosts Income Streams

Cashflow hacking enhances traditional cash flow management by strategically identifying and optimizing multiple income streams to increase overall cash inflow. This approach leverages techniques such as automating receivables, diversifying revenue sources, and minimizing unnecessary expenses to accelerate liquidity growth. By actively managing and hacking cash flow, individuals and businesses can achieve greater financial flexibility and sustainable income expansion.

Pros and Cons of Conventional Cash Flow

Conventional cash flow management offers clear tracking of income and expenses, providing a reliable foundation for budgeting and financial planning. This method ensures stability and predictability but can limit flexibility and responsiveness to unexpected expenses or opportunities. Rigid adherence to traditional cash flow can hinder dynamic money management strategies like cashflow hacking, which aims to optimize liquidity and accelerate wealth building.

Risks and Rewards of Cashflow Hacking

Cash flow hacking involves aggressive strategies to accelerate income and minimize expenses, increasing liquidity but also exposing individuals to higher financial risks such as debt accumulation and cash shortages. Traditional cash flow management prioritizes steady, predictable income and expenses, offering stability but potentially slower growth. Understanding the balance between the high rewards of rapid financial gains and the risks of cash flow hacking is essential for effective money management.

Integrating Cash Flow and Cashflow Hacking Strategies

Integrating cash flow management with cashflow hacking strategies maximizes liquidity and accelerates wealth accumulation by optimizing income streams and reducing unnecessary expenses. Employing real-time cash flow analysis alongside innovative hacking techniques enhances financial agility and empowers smarter investment decisions. This synergy supports sustained financial health and unlocks new opportunities for business growth and personal wealth optimization.

Tools and Techniques for Monitoring Cash Flow

Effective cash flow management relies on tools like accounting software, cash flow forecasting apps, and real-time analytics platforms that provide detailed insights into income and expenses. Techniques such as rolling forecasts, variance analysis, and automated alerts enable timely adjustments to maintain liquidity and prevent cash shortages. Integrating cashflow hacking strategies with monitoring tools enhances financial agility by identifying hidden cash reserves and optimizing fund allocation.

Choosing the Right Approach for Personal Money Management

Evaluating cash flow involves tracking income and expenses to maintain a clear overview of financial health, while cashflow hacking leverages strategic tweaks and smart automation to accelerate savings and optimize spending habits. Selecting the right approach depends on individual financial goals, such as stability versus rapid wealth growth, and risk tolerance levels. Combining traditional cash flow management with innovative cashflow hacking techniques often maximizes personal money management efficiency.

Related Important Terms

Predictive Cash Flow Analytics

Predictive cash flow analytics enhances traditional cash flow management by using advanced algorithms and real-time data to forecast future cash positions, enabling proactive decision-making and optimized liquidity management. This approach surpasses basic cash flow tracking or cashflow hacking techniques by providing actionable insights that minimize risks and improve financial stability.

Real-time Cash Flow Optimization

Real-time Cash Flow Optimization leverages cashflow hacking techniques to continuously monitor and adjust incoming and outgoing funds, ensuring maximum liquidity and minimized financial risks. This dynamic approach surpasses traditional cash flow methods by providing immediate insights and actionable strategies to enhance money management efficiency and business solvency.

Cashflow Hacking Framework

Cashflow Hacking Framework enhances traditional cash flow management by strategically optimizing income streams and expenses through data-driven methods and automation, enabling more efficient money management. This approach leverages real-time financial insights and smart budgeting techniques to increase liquidity and accelerate wealth building beyond conventional cash flow practices.

Zero-Based Cash Flow Budgeting

Zero-Based Cash Flow Budgeting enhances money management by allocating every dollar of income to specific expenses, savings, or debt repayment, ensuring no cash is unassigned and preventing overspending. Unlike Cashflow hacking, which uses quick adjustments to optimize liquidity, zero-based budgeting provides a structured, comprehensive approach for precise control over financial inflows and outflows.

Distributed Cash Flow Streams

Distributed cash flow streams enhance financial stability by diversifying income sources, reducing dependency on a single revenue channel. Cash flow hacking leverages this strategy to optimize money management, ensuring continuous liquidity and maximizing investment opportunities.

Dynamic Float Management

Dynamic Float Management enhances cash flow by optimizing the timing of cash inflows and outflows, reducing idle balances and improving liquidity. Unlike traditional cash flow methods, cashflow hacking leverages real-time data to strategically manipulate float periods, maximizing working capital efficiency.

Cashflow Velocity Mapping

Cashflow Velocity Mapping accelerates the movement and utilization of cash within financial systems, optimizing liquidity and enhancing cash flow management efficiency compared to traditional cash flow methods. This technique identifies bottlenecks and opportunities in cash flow cycles, enabling faster decision-making and improved money management strategies.

Automated Cashflow Scripting

Automated Cashflow Scripting revolutionizes cash flow management by using algorithm-driven processes to optimize income and expenses in real-time, enhancing liquidity and financial stability. This method surpasses traditional cash flow techniques by systematically identifying and executing money management strategies that increase efficiency and maximize available capital.

Invisible Cash Flow Leaks

Cash flow management identifies and tracks actual inflows and outflows of cash, while cashflow hacking targets invisible cash flow leaks that silently erode financial resources through unnoticed expenses and inefficient processes. Detecting these hidden leaks, such as unmonitored subscriptions or delayed receivables, is crucial for optimizing liquidity and maximizing available working capital.

AI-driven Cashflow Arbitrage

AI-driven Cashflow Arbitrage leverages machine learning algorithms to identify and exploit discrepancies in cash inflows and outflows, optimizing liquidity management for businesses. This approach surpasses traditional cash flow methods by automating real-time analysis and decision-making, enhancing profitability through dynamic allocation of financial resources.

Cash flow vs Cashflow hacking for money management. Infographic

moneydiff.com

moneydiff.com