Manual reconciliation often involves time-consuming processes prone to human error, delaying accurate cash flow insights. Real-time payment reconciliation automates transaction matching instantly, ensuring up-to-date financial records and improved money management. This immediate accuracy enhances decision-making and optimizes cash flow visibility for businesses.

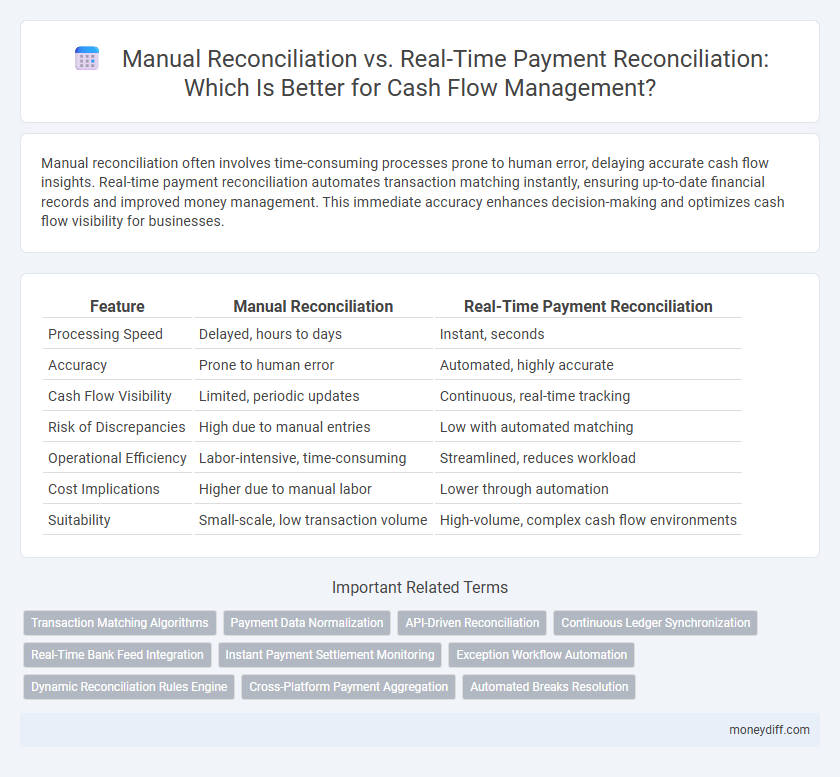

Table of Comparison

| Feature | Manual Reconciliation | Real-Time Payment Reconciliation |

|---|---|---|

| Processing Speed | Delayed, hours to days | Instant, seconds |

| Accuracy | Prone to human error | Automated, highly accurate |

| Cash Flow Visibility | Limited, periodic updates | Continuous, real-time tracking |

| Risk of Discrepancies | High due to manual entries | Low with automated matching |

| Operational Efficiency | Labor-intensive, time-consuming | Streamlined, reduces workload |

| Cost Implications | Higher due to manual labor | Lower through automation |

| Suitability | Small-scale, low transaction volume | High-volume, complex cash flow environments |

Understanding Manual vs. Real-Time Payment Reconciliation

Manual reconciliation involves verifying financial transactions by comparing records line-by-line, which can be time-consuming and prone to human error. Real-time payment reconciliation uses automated systems to instantly match payments with invoices and ledger entries, improving accuracy and cash flow visibility. Businesses leveraging real-time reconciliation streamline money management, reduce discrepancies, and accelerate decision-making processes.

The Importance of Accurate Cash Flow Management

Accurate cash flow management hinges on real-time payment reconciliation, which provides immediate visibility into financial transactions and prevents discrepancies before they escalate. Manual reconciliation, though traditional, often leads to delayed cash flow insights and increased risk of errors that can disrupt liquidity planning. Leveraging automated reconciliation systems enhances precision, supports timely decision-making, and maintains optimal working capital levels.

Manual Reconciliation: Processes and Common Challenges

Manual reconciliation involves matching transactions by manually reviewing bank statements and accounting records, which is time-consuming and prone to human error. Common challenges include delayed identification of discrepancies, increased risk of fraud, and difficulty maintaining accurate cash flow visibility. These issues often lead to inefficiencies in money management and hinder timely financial decision-making.

How Real-Time Payment Reconciliation Works

Real-time payment reconciliation automates the matching of transactions as they occur, significantly reducing errors and delays compared to manual reconciliation. This process uses advanced algorithms to instantly compare payment details against invoices and bank statements, ensuring accurate and up-to-date cash flow records. Businesses gain immediate visibility into their financial status, enabling proactive money management and improved liquidity forecasting.

Impact on Cash Flow Visibility and Accuracy

Manual reconciliation often leads to delayed updates and increased errors, reducing cash flow visibility and accuracy in financial management. Real-time payment reconciliation enhances cash flow monitoring by providing instantaneous transaction verification, allowing businesses to react promptly to discrepancies. Improved accuracy and timely data from real-time systems enable better forecasting and liquidity management, crucial for maintaining optimal cash flow.

Speed and Efficiency: Manual vs. Real-Time Reconciliation

Manual reconciliation often leads to delays and human errors, slowing down cash flow visibility and impacting timely decision-making. Real-time payment reconciliation automates the matching process, providing immediate updates that enhance accuracy and accelerate financial reporting. Faster reconciliation improves liquidity management, reduces operational costs, and supports proactive money management strategies.

Reducing Errors and Fraud Risk in Payment Reconciliation

Manual reconciliation often leads to increased errors and delayed fraud detection due to human oversight and slower processing times. Real-time payment reconciliation utilizes automated systems and advanced algorithms to identify discrepancies instantly, significantly reducing the risk of fraud and improving accuracy. Integrating real-time reconciliation enhances cash flow management by ensuring timely and precise validation of financial transactions.

Cost Implications: Manual Methods vs. Automation

Manual reconciliation incurs higher labor costs due to time-consuming data entry and error correction processes, increasing operational expenses. Real-time payment reconciliation reduces costs by automating transaction matching and minimizing discrepancies, which decreases the need for extensive human intervention. Automation enhances cash flow accuracy and efficiency, resulting in significant cost savings over manual methods.

Integrating Real-Time Reconciliation into Financial Systems

Real-time payment reconciliation improves cash flow visibility by instantly matching transactions within financial systems, reducing errors and accelerating decision-making. Integrating automated reconciliation tools streamlines money management processes, enhancing accuracy and operational efficiency compared to manual methods. This seamless integration supports timely cash flow forecasting and strengthens financial control for businesses.

Choosing the Right Reconciliation Approach for Your Business

Manual reconciliation often involves labor-intensive processes prone to human error, delaying accurate cash flow visibility and impacting timely decision-making. Real-time payment reconciliation leverages automation and integration with financial systems to provide instantaneous updates, enhancing accuracy and enabling proactive money management. Select the reconciliation method that aligns with your business size, transaction volume, and need for speed to optimize cash flow control and reduce operational risks.

Related Important Terms

Transaction Matching Algorithms

Transaction matching algorithms in real-time payment reconciliation optimize cash flow management by instantly pairing incoming payments with corresponding invoices, reducing errors and improving liquidity visibility. Manual reconciliation relies on slower, often error-prone processes that can delay financial closing and obscure accurate cash position insights.

Payment Data Normalization

Manual reconciliation often delays cash flow visibility due to inconsistent payment data formats, increasing the risk of errors and inefficiencies in money management. Real-time payment reconciliation utilizes automated payment data normalization, standardizing diverse transaction inputs instantly to enhance accuracy, accelerate financial reporting, and optimize cash flow control.

API-Driven Reconciliation

API-driven reconciliation enables real-time payment matching by automatically integrating transaction data from multiple sources, significantly reducing manual errors and improving cash flow accuracy. This automated approach streamlines money management by providing instant visibility into payment statuses, eliminating the delays inherent in manual reconciliation processes.

Continuous Ledger Synchronization

Manual reconciliation often leads to delays and errors in cash flow management, causing discrepancies that hinder accurate financial reporting. Real-time payment reconciliation ensures continuous ledger synchronization, providing instant updates and enhancing the accuracy and efficiency of money management processes.

Real-Time Bank Feed Integration

Real-time bank feed integration streamlines cash flow management by providing instant transaction updates, reducing errors and eliminating the delays inherent in manual reconciliation processes. This automation enhances financial accuracy and enables proactive decision-making through up-to-the-minute payment reconciliation data.

Instant Payment Settlement Monitoring

Manual reconciliation involves time-consuming cross-checking of transactions that can delay cash flow visibility and hinder timely decision-making, while real-time payment reconciliation enables instant payment settlement monitoring to provide up-to-the-minute accuracy in tracking fund movements. Instant payment settlement monitoring enhances money management by automatically updating cash positions and detecting discrepancies immediately, reducing operational risks and improving liquidity management.

Exception Workflow Automation

Manual reconciliation often leads to delayed identification of discrepancies, increasing the risk of cash flow inaccuracies and time-consuming exception handling. Real-time payment reconciliation leverages exception workflow automation to instantly detect and resolve anomalies, streamlining cash management and improving financial accuracy.

Dynamic Reconciliation Rules Engine

Manual reconciliation relies on time-consuming, error-prone processes that delay cash flow visibility, while real-time payment reconciliation powered by a dynamic reconciliation rules engine automates transaction matching with high accuracy, accelerating financial close cycles and enhancing liquidity management. Dynamic reconciliation rules engines use customizable algorithms to adapt instantly to diverse transaction patterns, reduce discrepancies, and provide actionable insights for optimized cash flow control.

Cross-Platform Payment Aggregation

Manual reconciliation often leads to delays and increased errors in cash flow management due to fragmented data across multiple platforms. Real-time payment reconciliation with cross-platform payment aggregation streamlines financial tracking by consolidating transactions instantly, enhancing accuracy and accelerating liquidity insights.

Automated Breaks Resolution

Automated breaks resolution in real-time payment reconciliation significantly enhances cash flow accuracy by instantly identifying and correcting discrepancies, reducing manual errors and processing delays. Manual reconciliation, in contrast, often leads to prolonged cash flow disruptions due to time-consuming investigations and delayed adjustments.

Manual reconciliation vs real-time payment reconciliation for money management. Infographic

moneydiff.com

moneydiff.com