Cash flow management tracks and controls the actual movement of money, ensuring expenses never exceed income, which helps maintain financial stability. Reverse budgeting prioritizes savings first by setting aside a fixed amount before allocating funds for expenses, promoting disciplined spending and long-term financial goals. Both methods improve money management but cater to different financial habits and objectives, with cash flow offering flexibility and reverse budgeting enforcing strict savings.

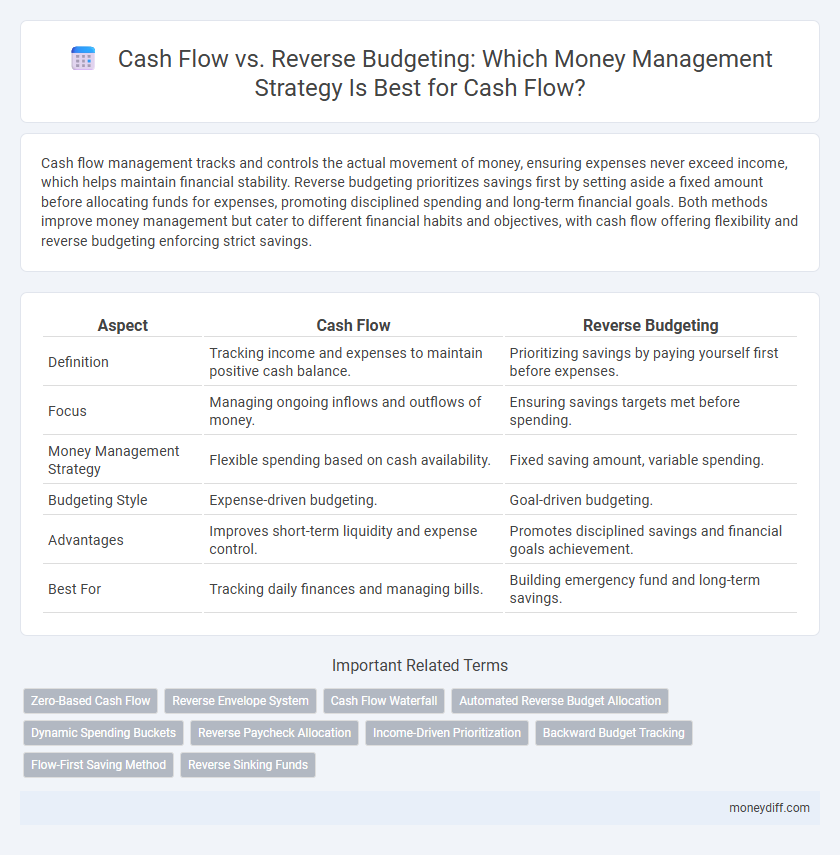

Table of Comparison

| Aspect | Cash Flow | Reverse Budgeting |

|---|---|---|

| Definition | Tracking income and expenses to maintain positive cash balance. | Prioritizing savings by paying yourself first before expenses. |

| Focus | Managing ongoing inflows and outflows of money. | Ensuring savings targets met before spending. |

| Money Management Strategy | Flexible spending based on cash availability. | Fixed saving amount, variable spending. |

| Budgeting Style | Expense-driven budgeting. | Goal-driven budgeting. |

| Advantages | Improves short-term liquidity and expense control. | Promotes disciplined savings and financial goals achievement. |

| Best For | Tracking daily finances and managing bills. | Building emergency fund and long-term savings. |

Understanding Cash Flow: The Foundation of Money Management

Cash flow represents the movement of money in and out of your accounts, serving as the foundation for effective money management by ensuring expenses do not exceed income. Reverse budgeting starts with setting savings goals first, then allocating the remaining funds for spending, relying on a clear understanding of cash flow to prioritize financial objectives. Mastering cash flow allows individuals to create realistic budgets that support long-term financial stability and avoid debt.

What Is Reverse Budgeting? A Modern Approach Explained

Reverse budgeting is a money management strategy that prioritizes savings and investments by allocating funds to financial goals before covering expenses. Unlike traditional budgeting, which tracks spending after expenses, reverse budgeting ensures essential financial targets are met first, promoting disciplined cash flow management. This modern approach helps individuals build wealth efficiently by focusing on what remains after securing key financial priorities.

Key Differences: Cash Flow Management vs Reverse Budgeting

Cash flow management tracks actual income and expenses to ensure sufficient liquidity for daily needs, emphasizing real-time cash availability and control over spending patterns. Reverse budgeting prioritizes saving and investing first by allocating funds to goals before covering expenses, fostering disciplined financial planning and debt reduction. The primary difference lies in cash flow's responsiveness to current finances versus reverse budgeting's proactive allocation to financial priorities.

Pros and Cons of Managing Cash Flow

Managing cash flow provides real-time insight into income and expenses, allowing precise control over financial stability and timely bill payments. However, it requires constant monitoring and can become overwhelming without disciplined tracking systems. Reverse budgeting encourages savings by prioritizing financial goals first, but may lead to cash shortages if variable expenses are underestimated or unexpected costs occur.

Advantages and Drawbacks of Reverse Budgeting

Reverse budgeting prioritizes savings and essential expenses first, ensuring financial goals are met before discretionary spending, which enhances disciplined money management. Its advantage lies in promoting proactive savings and reducing impulse purchases, but the drawback includes limited flexibility and potential stress if unexpected expenses arise. This method suits individuals with stable incomes but may challenge those with variable cash flows or irregular financial obligations.

How to Track Your Cash Flow Effectively

Tracking cash flow effectively requires categorizing all income and expenses with precision, enabling accurate monitoring of money movement over time. Utilizing digital tools or budgeting apps that automatically sync bank transactions provides real-time visibility and detailed reports for immediate adjustments. Regularly reviewing cash flow patterns uncovers spending habits and income fluctuations, facilitating informed financial decisions and improved money management strategies.

Steps to Implement Reverse Budgeting in Daily Life

Start by tracking all income sources and fixed expenses to establish a clear cash flow baseline. Prioritize saving or investing a set amount first each month before allocating funds to variable expenses. Regularly review and adjust spending habits to ensure that savings goals are met consistently, promoting financial discipline and stability.

Which Method Suits Different Financial Goals?

Cash flow management centers on tracking income and expenses to maintain financial stability, making it ideal for individuals aiming to optimize daily spending and avoid debt. Reverse budgeting prioritizes saving goals first by allocating funds to savings before other expenses, supporting long-term objectives like retirement or large purchases. Choosing between cash flow and reverse budgeting depends on whether the focus is on immediate expense control or disciplined saving for future financial milestones.

Integrating Cash Flow Analysis With Reverse Budgeting

Integrating cash flow analysis with reverse budgeting enhances money management by aligning spending limits with actual income and obligations, ensuring expenses do not exceed available resources. This method prioritizes tracking inflows and outflows to identify surplus or deficits before allocating funds, promoting disciplined saving and strategic spending. Utilizing real-time cash flow data within reverse budgeting frameworks increases financial clarity and adaptability, empowering individuals to optimize their budget based on dynamic income patterns.

Choosing the Best Money Management Strategy: Cash Flow or Reverse Budgeting

Cash flow management emphasizes tracking income and expenses in real-time to maintain positive liquidity, while reverse budgeting prioritizes saving first and spending what remains, promoting disciplined financial goals. Choosing between cash flow and reverse budgeting depends on individual financial habits, with cash flow ideal for those needing flexibility and reverse budgeting suited for savers aiming for targeted reserves. Effective money management often combines both strategies to optimize spending control and savings growth.

Related Important Terms

Zero-Based Cash Flow

Zero-Based Cash Flow allocates every dollar of income toward specific expenses, savings, or debt repayment, ensuring no money is left unassigned. In contrast to reverse budgeting, which prioritizes savings then adjusts spending, zero-based cash flow provides precise control over cash allocation, promoting disciplined money management and avoiding overspending.

Reverse Envelope System

Reverse Envelope System in money management prioritizes saving and expense allocation by setting aside funds for future goals before handling daily cash flow, contrasting with traditional cash flow methods that track income and expenses retrospectively. This proactive approach enhances financial discipline and aligns spending with long-term objectives, improving overall cash flow control and reducing the risk of overspending.

Cash Flow Waterfall

The Cash Flow Waterfall prioritizes allocating income to essential expenses, savings, and debt payments in a structured sequence, ensuring financial obligations are met before discretionary spending. This method contrasts with Reverse Budgeting, which begins with savings goals and works backward to manage expenses, emphasizing proactive wealth building over reactive expense tracking.

Automated Reverse Budget Allocation

Automated reverse budget allocation enhances cash flow management by prioritizing savings and essential expenses before discretionary spending, ensuring consistent financial stability. This method leverages automation to allocate funds efficiently, reducing overspending and improving long-term financial health.

Dynamic Spending Buckets

Dynamic Spending Buckets in cash flow management allow for flexible allocation of funds based on real-time income and expenses, enhancing control over financial priorities. Unlike reverse budgeting, which fixes savings goals before expenses, this method adapts spending categories dynamically to optimize cash flow and increase financial agility.

Reverse Paycheck Allocation

Reverse Paycheck Allocation in reverse budgeting prioritizes directing income toward essential expenses and financial goals before discretionary spending, optimizing cash flow management by ensuring obligations and savings are met first. This method contrasts traditional cash flow tracking by proactively allocating funds, enhancing financial discipline and reducing the risk of overspending.

Income-Driven Prioritization

Cash flow management focuses on tracking actual income and expenses to maintain financial stability, while reverse budgeting prioritizes expenses based on income by assigning funds to savings and necessities before discretionary spending. Income-driven prioritization ensures essential financial goals are met first, promoting disciplined saving and optimized allocation of resources.

Backward Budget Tracking

Backward budget tracking emphasizes analyzing cash flow by starting with expenses and working backward to income, enabling precise control over spending limits. This reverse budgeting method improves money management by aligning actual cash outflows with financial goals, reducing overspending and enhancing savings potential.

Flow-First Saving Method

The Flow-First Saving Method prioritizes managing cash flow by allocating funds toward savings immediately upon income receipt, contrasting reverse budgeting which starts with expenses and adjusts savings as a residual. This proactive approach ensures consistent saving habits and improves financial stability by treating savings as a non-negotiable cash outflow within the overall money management strategy.

Reverse Sinking Funds

Reverse sinking funds enhance cash flow management by allocating money for future expenses in advance, creating a structured savings plan that prevents cash shortfalls. This method contrasts with traditional cash flow tracking by proactively setting aside funds, improving financial stability and expense predictability.

Cash flow vs Reverse budgeting for money management. Infographic

moneydiff.com

moneydiff.com