Cash flow represents the total amount of cash generated by a company's operations, while free cash flow deducts capital expenditures from operating cash flow to reveal the cash available for activities like debt repayment and investments. Free cash flow offers a clearer picture of liquidity because it accounts for the essential reinvestment needed to maintain or grow asset bases. Analyzing both cash flow and free cash flow supports more accurate assessments of a company's true liquidity and financial health.

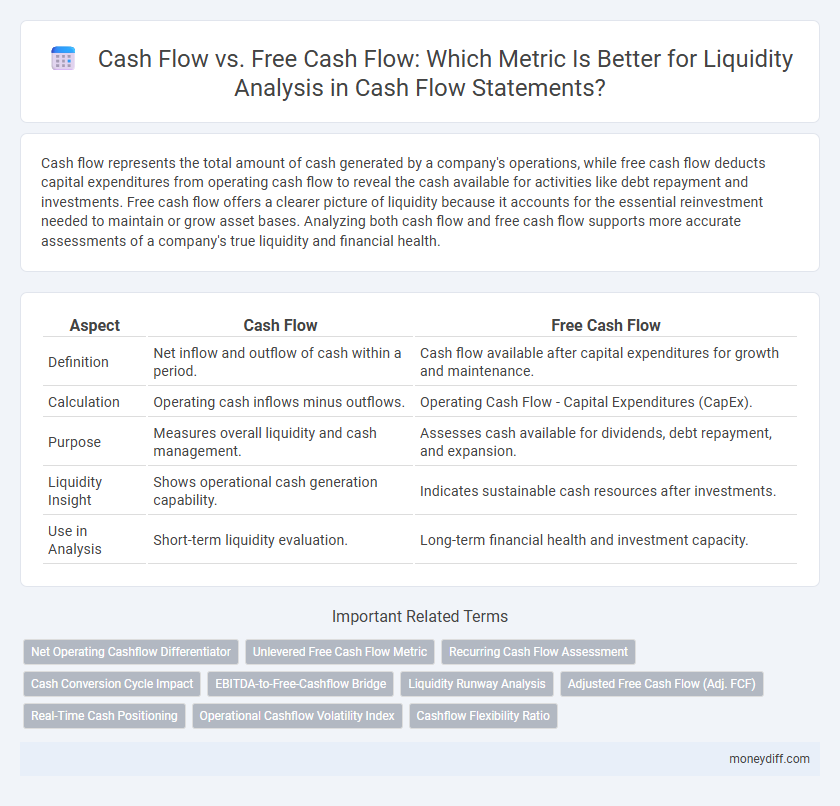

Table of Comparison

| Aspect | Cash Flow | Free Cash Flow |

|---|---|---|

| Definition | Net inflow and outflow of cash within a period. | Cash flow available after capital expenditures for growth and maintenance. |

| Calculation | Operating cash inflows minus outflows. | Operating Cash Flow - Capital Expenditures (CapEx). |

| Purpose | Measures overall liquidity and cash management. | Assesses cash available for dividends, debt repayment, and expansion. |

| Liquidity Insight | Shows operational cash generation capability. | Indicates sustainable cash resources after investments. |

| Use in Analysis | Short-term liquidity evaluation. | Long-term financial health and investment capacity. |

Understanding Cash Flow: The Basics

Cash flow represents the total amount of money moving in and out of a business, essential for assessing its operational liquidity and short-term financial health. Free cash flow is the cash remaining after capital expenditures, reflecting the company's ability to generate surplus funds for expansion, debt repayment, or dividends. Analyzing both cash flow and free cash flow provides a comprehensive view of liquidity and sustainable financial flexibility.

What Is Free Cash Flow?

Free cash flow (FCF) represents the cash generated by a company after accounting for capital expenditures required to maintain or expand its asset base. It is a critical measure for assessing a firm's financial health and liquidity because it shows the actual cash available to pay dividends, reduce debt, or pursue growth opportunities. Unlike operating cash flow, free cash flow provides a clearer view of the firm's ability to generate cash sustainably after reinvestment in the business.

Key Differences Between Cash Flow and Free Cash Flow

Cash flow represents the total amount of cash generated or used by a company in operating, investing, and financing activities, providing a broad view of liquidity. Free cash flow specifically measures cash remaining after capital expenditures, highlighting the actual liquidity available for expansion, debt reduction, or dividends. The key difference lies in free cash flow's exclusion of capital expenditures, making it a more precise indicator of financial health and operational flexibility.

How Cash Flow Reflects Liquidity

Cash flow represents the total amount of cash generated and used by a company during a specific period, highlighting its ability to meet short-term obligations and maintain day-to-day operations. Free cash flow, calculated by subtracting capital expenditures from operating cash flow, provides a clearer picture of the cash available for expansion, debt repayment, or dividends, reflecting long-term financial flexibility. Analyzing cash flow alongside free cash flow enables more accurate liquidity assessment by distinguishing operational cash generation from cash availability after essential investments.

The Role of Free Cash Flow in Financial Health

Free cash flow is a critical indicator of a company's financial health, as it represents the cash generated after capital expenditures, highlighting the firm's ability to maintain operations and invest in growth. Unlike basic cash flow, free cash flow provides a clearer picture of liquidity by showing surplus cash available for debt repayment, dividends, or reinvestment. Analysts use free cash flow metrics to assess sustainable liquidity and long-term financial stability beyond operational cash inflows.

Liquidity Analysis Using Cash Flow

Cash flow measures the total amount of cash generated by a company's operations, providing a clear snapshot of liquidity available for immediate obligations. Free cash flow refines this by subtracting capital expenditures, indicating how much cash remains for debt repayment, dividends, or reinvestment without compromising operational capacity. Analyzing both cash flow and free cash flow offers a comprehensive view of financial health, highlighting the company's ability to meet short-term liabilities while sustaining long-term growth.

Liquidity Analysis Using Free Cash Flow

Free cash flow provides a more accurate measure of a company's liquidity by accounting for capital expenditures, which are subtracted from operating cash flow to show the actual cash available for debt repayment and investments. Unlike net cash flow, free cash flow highlights the firm's capacity to generate surplus cash after maintaining asset base, offering clearer insights into financial flexibility. Analysts prioritize free cash flow for liquidity analysis as it reflects cash that can be freely distributed or reinvested without compromising operational efficiency.

Which Metric Matters More for Investors?

Free cash flow is often considered a more critical metric for investors analyzing liquidity because it represents the actual cash available after capital expenditures, highlighting the company's ability to generate cash that can be used for expansion, dividends, or debt repayment. While cash flow from operations provides insight into the company's core business profitability, free cash flow offers a clearer picture of financial health and long-term sustainability. Investors prioritize free cash flow when assessing liquidity since it reflects true cash availability beyond mere operational inflows.

Common Pitfalls in Analyzing Cash Flow and Free Cash Flow

Common pitfalls in analyzing cash flow versus free cash flow for liquidity include misinterpreting operating cash flow as true liquidity without accounting for capital expenditures that free cash flow deducts. Ignoring timing differences and non-recurring items can distort the assessment of ongoing cash generation capacity. Overlooking the impact of working capital changes also leads to inaccurate conclusions about a company's short-term financial health.

Practical Tips for Using Cash Flow Metrics in Liquidity Assessment

Cash flow provides a broad view of a company's liquidity by tracking all cash inflows and outflows, while free cash flow offers a more focused metric by subtracting capital expenditures, highlighting cash available for expansion or debt repayment. Practical tips for liquidity assessment include prioritizing free cash flow to evaluate financial flexibility and using cash flow trends over multiple periods to identify consistency or volatility. Incorporate cash flow ratios such as operating cash flow to current liabilities to gain deeper insight into short-term liquidity health.

Related Important Terms

Net Operating Cashflow Differentiator

Net Operating Cash Flow represents the cash generated from core business operations, serving as a crucial indicator of liquidity by showing the company's ability to cover short-term obligations without external financing. Free Cash Flow subtracts capital expenditures from Net Operating Cash Flow, highlighting the actual cash available for expansion, debt repayment, or dividends, but Net Operating Cash Flow remains the primary liquidity differentiator by focusing solely on operational cash inflows and outflows.

Unlevered Free Cash Flow Metric

Unlevered Free Cash Flow (UFCF) provides a clear view of a company's cash generation from core operations, excluding debt-related interest payments, making it a vital metric for assessing liquidity independent of capital structure. Unlike traditional cash flow, UFCF enables investors to evaluate a firm's ability to cover operational expenses and reinvest in growth without the distortion of leverage effects.

Recurring Cash Flow Assessment

Recurring cash flow assessment focuses on the consistent inflow of cash from core operational activities, excluding irregular or non-operational cash sources. Free cash flow provides a deeper liquidity analysis by subtracting capital expenditures from operating cash flow, highlighting the actual cash available for debt repayment, dividends, and reinvestment.

Cash Conversion Cycle Impact

Cash flow reflects the total inflows and outflows of cash, while free cash flow measures the cash available after capital expenditures, directly impacting liquidity analysis by indicating operational efficiency and financial flexibility. The Cash Conversion Cycle (CCC) influences cash flow by determining the time taken to convert inventory and receivables into cash, thereby affecting both cash flow and free cash flow levels crucial for assessing liquidity.

EBITDA-to-Free-Cashflow Bridge

EBITDA-to-Free-Cashflow bridge illustrates the transition from operating profitability to cash liquidity by adjusting for changes in working capital, capital expenditures, and non-cash expenses. This analysis highlights the difference between cash generated from core operations and the actual free cash flow available for debt repayment, dividends, or reinvestment, providing a clearer view of liquidity strength.

Liquidity Runway Analysis

Cash flow measures total cash inflows and outflows, providing a snapshot of a company's liquidity position, while free cash flow deducts capital expenditures from operating cash flow, offering a more precise indicator of available liquidity for growth or debt repayment. In liquidity runway analysis, free cash flow is crucial for assessing how long a company can sustain operations without external financing, reflecting true operational cash health beyond net cash movement.

Adjusted Free Cash Flow (Adj. FCF)

Adjusted Free Cash Flow (Adj. FCF) provides a more precise measure of a company's liquidity by factoring in non-recurring expenses and capital expenditures, offering clearer insight than basic cash flow figures. This refined metric helps analysts evaluate sustainable cash generation available for debt repayment, dividends, and growth investments, enhancing liquidity analysis accuracy.

Real-Time Cash Positioning

Real-time cash positioning emphasizes monitoring actual cash inflows and outflows to provide an accurate snapshot of liquidity, while free cash flow accounts for operational cash remaining after capital expenditures, offering a long-term view of financial flexibility. Evaluating both cash flow and free cash flow enables businesses to optimize liquidity management by balancing immediate needs with strategic investment capacity.

Operational Cashflow Volatility Index

Operational Cashflow Volatility Index measures fluctuations in cash generated from core business operations, providing a more precise indicator of liquidity stability compared to Free Cash Flow, which includes capital expenditures and financing activities. This index helps analysts isolate operational liquidity risks, as it excludes investment cash flows that can distort a company's true liquidity position.

Cashflow Flexibility Ratio

Cash flow measures the total cash generated by operations, while free cash flow accounts for capital expenditures, providing a realistic view of liquidity available for expansion or debt reduction. The Cashflow Flexibility Ratio evaluates a company's ability to adjust cash flow under financial stress, highlighting operational resilience and short-term liquidity management.

Cash flow vs Free cash flow for liquidity analysis. Infographic

moneydiff.com

moneydiff.com