Cash flow forecasting provides a fixed, detailed estimate of future cash inflows and outflows over a specific period, helping businesses plan expenses and investments with greater certainty. Rolling cash flow projections continuously update these estimates, extending the forecast horizon as new data becomes available, which enhances adaptability to changing financial conditions. Combining both methods improves money management by offering a clear short-term outlook alongside a dynamic, long-term financial perspective.

Table of Comparison

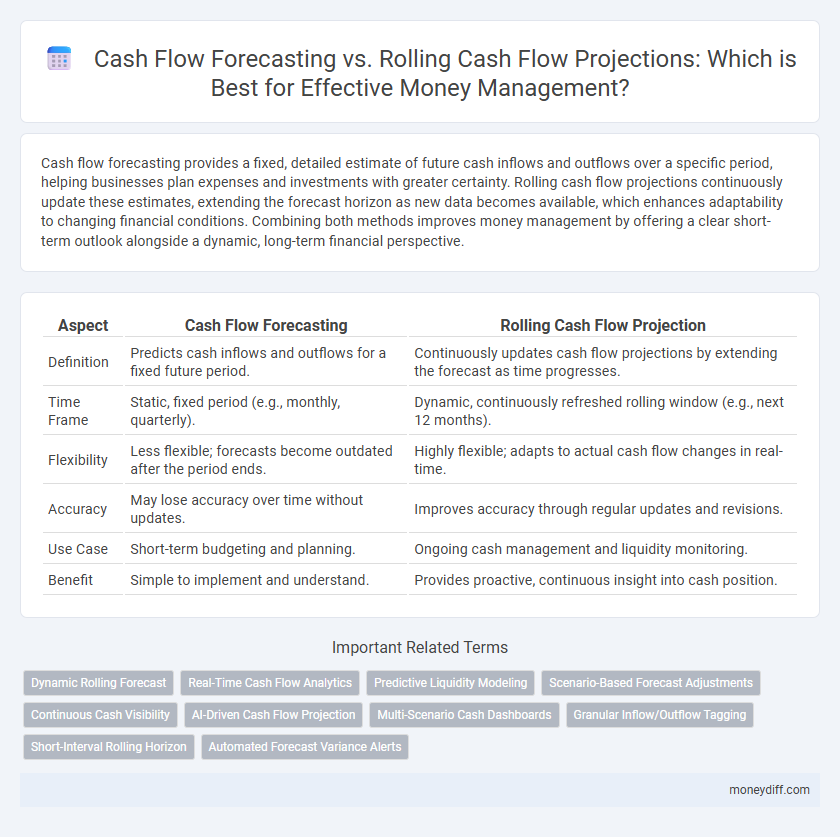

| Aspect | Cash Flow Forecasting | Rolling Cash Flow Projection |

|---|---|---|

| Definition | Predicts cash inflows and outflows for a fixed future period. | Continuously updates cash flow projections by extending the forecast as time progresses. |

| Time Frame | Static, fixed period (e.g., monthly, quarterly). | Dynamic, continuously refreshed rolling window (e.g., next 12 months). |

| Flexibility | Less flexible; forecasts become outdated after the period ends. | Highly flexible; adapts to actual cash flow changes in real-time. |

| Accuracy | May lose accuracy over time without updates. | Improves accuracy through regular updates and revisions. |

| Use Case | Short-term budgeting and planning. | Ongoing cash management and liquidity monitoring. |

| Benefit | Simple to implement and understand. | Provides proactive, continuous insight into cash position. |

Understanding Cash Flow Forecasting

Cash flow forecasting involves predicting future cash inflows and outflows over a specific period to ensure sufficient liquidity for business operations and financial obligations. This method provides a fixed, time-bound view, offering precise short-term financial planning insights. In contrast, rolling cash flow projections continuously update forecasts by adding new periods as time progresses, allowing for more flexible and dynamic money management strategies.

What Is Rolling Cash Flow Projection?

Rolling cash flow projection is a dynamic financial tool that continuously updates cash flow forecasts by adding a new period as the current period concludes, ensuring an ongoing view of liquidity. Unlike static cash flow forecasting, which predicts cash flows for a fixed horizon, rolling projections adapt to real-time data, enhancing accuracy in money management and decision-making. This method improves cash flow visibility, allowing businesses to proactively manage working capital and funding needs.

Key Differences Between Cash Flow Forecasting and Rolling Projections

Cash flow forecasting provides a fixed, short-term estimate of inflows and outflows based on historical data and planned transactions, offering a snapshot for immediate money management decisions. Rolling cash flow projections continuously update future cash estimates by adding new data and extending the forecast period, enhancing accuracy and enabling dynamic response to changing financial conditions. Key differences include the static nature of forecasting versus the adaptive, ongoing revision process in rolling projections, which supports proactive liquidity planning and risk mitigation.

Importance of Accurate Cash Flow Management

Accurate cash flow management hinges on reliable forecasting methods, where cash flow forecasting provides a fixed, short-term view based on historical data and expected receipts and payments. Rolling cash flow projections offer dynamic, continuous updates extending beyond fixed periods, enhancing the ability to anticipate liquidity gaps and adjust strategies proactively. Prioritizing precise cash flow forecasts and projections enables businesses to optimize working capital, maintain solvency, and strategically plan investments.

Short-Term vs Long-Term Cash Flow Planning

Cash flow forecasting provides a short-term snapshot, helping businesses anticipate immediate inflows and outflows within days or weeks to maintain liquidity. Rolling cash flow projections extend this insight by continuously updating forecasts over longer periods, such as months or quarters, facilitating strategic long-term money management. Integrating both methods ensures accurate short-term decision-making while aligning with long-term financial goals and risk mitigation.

Benefits of Cash Flow Forecasting in Money Management

Cash flow forecasting provides a detailed projection of expected inflows and outflows over a fixed period, enabling businesses to anticipate liquidity needs and avoid cash shortages. This precise financial insight supports strategic decision-making, improves budgeting accuracy, and enhances the ability to secure funding or manage debt proactively. By forecasting cash flow, organizations can optimize operational efficiency, maintain financial stability, and maximize investment opportunities.

Advantages of Rolling Cash Flow Projections

Rolling cash flow projections provide continuous updates by incorporating the latest financial data, enabling more accurate short- and long-term liquidity management. This method enhances the ability to anticipate cash shortages or surpluses, improving decision-making for investments and expense planning. Compared to static cash flow forecasts, rolling projections offer greater flexibility and responsiveness to changing business conditions.

Common Mistakes in Cash Flow Forecasting

Common mistakes in cash flow forecasting include relying on static assumptions that fail to reflect changing market conditions, leading to inaccurate projections. Overlooking cash inflows and outflows timing can create misleading short-term liquidity pictures, risking cash shortages. Rolling cash flow projections mitigate these errors by continuously updating forecasts with actual data, improving accuracy and enabling better money management decisions.

Integrating Forecasting and Rolling Projections for Optimal Management

Integrating cash flow forecasting with rolling cash flow projections enhances money management by providing both short-term accuracy and long-term adaptability. Forecasting uses historical data and market trends to predict cash inflows and outflows, while rolling projections continuously update these estimates based on real-time financial performance. This integration enables businesses to optimize liquidity, anticipate funding needs, and adjust strategies proactively to maintain financial stability.

Choosing the Right Cash Flow Strategy for Your Business

Cash flow forecasting estimates future cash inflows and outflows based on historical data and known transactions, offering short-term visibility for budgeting and operational decisions. Rolling cash flow projections continuously update forecasts by extending the forecast period as time progresses, enabling dynamic adjustments to changing business conditions and improved liquidity management. Selecting the right strategy depends on business size, volatility of cash flows, and the need for flexibility in financial planning to optimize working capital and avoid cash shortages.

Related Important Terms

Dynamic Rolling Forecast

Dynamic rolling cash flow forecasts provide continuous updates based on real-time financial data, enhancing accuracy and enabling proactive money management compared to static cash flow forecasting. This method adjusts projections regularly, incorporating changes in revenue and expenses to optimize liquidity planning and reduce cash shortfalls.

Real-Time Cash Flow Analytics

Real-time cash flow analytics enhance cash flow forecasting by providing up-to-the-minute visibility into cash movements, enabling more accurate and dynamic projections compared to traditional rolling cash flow projections. This immediate insight supports proactive money management decisions, optimizing liquidity and reducing the risk of shortfalls.

Predictive Liquidity Modeling

Cash flow forecasting relies on fixed, period-based predictions to estimate future liquidity, whereas rolling cash flow projections continuously update assumptions based on real-time data, enhancing accuracy in Predictive Liquidity Modeling. Rolling projections enable dynamic adjustment of cash inflows and outflows, providing a more responsive framework for effective money management and minimizing liquidity risks.

Scenario-Based Forecast Adjustments

Scenario-based forecast adjustments in cash flow forecasting enable precise anticipation of financial outcomes by incorporating various market conditions and operational changes, enhancing liquidity management accuracy. Rolling cash flow projections continuously update assumptions and incorporate recent data, allowing dynamic recalibration of forecasts to reflect real-time business scenarios and uncertainties effectively.

Continuous Cash Visibility

Cash flow forecasting provides a fixed snapshot of projected inflows and outflows over a set period, while rolling cash flow projection continuously updates forecasts by integrating real-time financial data, enhancing accuracy in money management. Continuous cash visibility through rolling projections enables proactive decision-making, minimizes liquidity risks, and optimizes working capital utilization.

AI-Driven Cash Flow Projection

AI-driven cash flow projection enhances accuracy by continuously analyzing real-time data, outperforming traditional cash flow forecasting methods that rely on static assumptions. Rolling cash flow projections powered by AI provide dynamic insights for proactive money management, enabling businesses to adapt swiftly to changing financial conditions and optimize liquidity.

Multi-Scenario Cash Dashboards

Multi-scenario cash dashboards enhance cash flow forecasting by integrating rolling cash flow projections, enabling businesses to evaluate various financial outcomes under different assumptions. This dynamic approach supports more accurate money management by providing real-time insights into liquidity positions across multiple scenarios.

Granular Inflow/Outflow Tagging

Cash flow forecasting provides periodic estimates based on fixed intervals, whereas rolling cash flow projection continuously updates inflow and outflow data to reflect real-time financial changes. Granular inflow/outflow tagging enhances accuracy by categorizing transactions at a detailed level, enabling precise tracking and improved decision-making in money management.

Short-Interval Rolling Horizon

Short-interval rolling horizon cash flow projections enable businesses to continuously update their cash forecasts based on recent financial data, improving accuracy and responsiveness in money management. Unlike static cash flow forecasting, this dynamic approach helps firms maintain liquidity by adapting quickly to fluctuations in receivables, payables, and operational expenses.

Automated Forecast Variance Alerts

Automated forecast variance alerts enhance cash flow forecasting by instantly highlighting deviations between predicted and actual cash flows, enabling timely adjustments for better money management. Rolling cash flow projections benefit from these alerts by continuously updating forecasts based on real-time data, improving accuracy and responsiveness in financial planning.

Cash flow forecasting vs rolling cash flow projection for money management. Infographic

moneydiff.com

moneydiff.com